Fleet Card Market Research, 2034

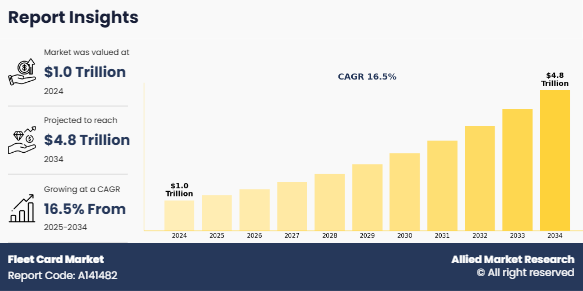

The fleet card market was valued at $1 trillion in 2024 and is estimated to reach $4.8 trillion by 2034, exhibiting a CAGR of 16.5% from 2025 to 2034. A fleet card is a special type of fleet payment card used by businesses to manage fuel and vehicle-related expenses for their company vehicles. It works like a credit or debit card but is only used for things like buying fuel, paying for repairs, or maintaining vehicles.

Companies give fleet cards to their drivers, so they don’t have to carry cash. Every purchase made with the card is tracked, which helps the company monitor fuel usage, prevent misuse, and control spending. Fleet cards often come with online tools that provide detailed reports on each transaction. This helps businesses save money, manage their fleet better, and make smart decisions about their vehicles. They are widely used in logistics, transportation, and delivery services.

Key Takeaways:

- By type, the closed-loop segment held the largest share in the fleet card market for 2024.

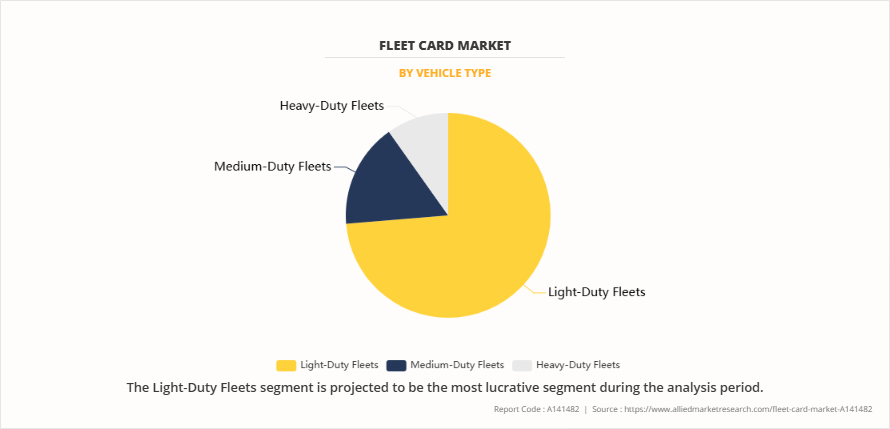

- By vehicle type, the light-duty fleets segment held the largest share in the fleet card market for 2024.

- By industry, the Transportation and Logistics segment held the largest share in the fleet card market for 2024.

- By enterprise size, the SMEs segment held the largest share in the fleet card market for 2024.

- Region-wise, North America held the largest market share in 2024. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

The fleet card market is witnessing growth due to rise in fuel costs, which are pushing businesses to look for smarter ways to manage and control fuel expenses. Fuel is one of the biggest operating costs for companies with vehicle fleets, and frequent price hikes can affect overall profitability. To handle this, businesses are turning to fleet cards that offer fuel tracking and optimization solutions. These cards help companies monitor where, when, and how much fuel is being used, giving them better control over their spending. With detailed reports and spending limits, fleet managers can reduce fuel misuse and improve efficiency. Some cards also offer discounts or rewards on fuel purchases, helping companies save more. As fuel prices remain unpredictable, the need for cost-effective and transparent fuel management tools continues to rise. This is increasing the demand for fleet cards, making fuel cost management one of the key drivers of the fleet card market.

Furthermore, the growth in e-commerce sector is driving the growth of the fleet card market. As more people shop online, businesses need larger delivery fleets to meet rising customer demand and ensure fast, timely deliveries. This increase in delivery operations has created a greater need for efficient logistics and fleet management. Fleet cards help e-commerce companies monitor fuel usage, track vehicle movements, and manage driver expenses in real time. They offer detailed spending reports and allow companies to set limits on fuel and maintenance purchases, thus improving cost control. With more online orders and expanding delivery networks, companies need tools to manage their fleets more efficiently and reduce operational costs. Fleet cards make this possible by offering easy and secure payment solutions. As the e-commerce industry continues to grow rapidly, the need for smart fleet management solutions is rising, thus fueling the demand for fleet cards in the market.

Segment Review

The fleet card market is segmented on the basis of type, vehicle type, industry, enterprise size, and region. By type, it is segmented into open loop, closed loop, and dual network cards. By vehicle type, it is classified into light-duty fleets, medium-duty fleets, and heavy-duty fleets. By industry, it is segmented into transportation and logistics, construction and mining, public transport, and others. By enterprise size, it is categorized into large enterprises and SMEs. By region, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of type, the closed loop dominated the fleet card market in 2024 and is expected to maintain its dominance in the upcoming years. This is attributed to their strong integration with specific fuel station networks, which allows for enhanced control over fuel purchases, reduced chances of misuse, and simplified expense tracking for fleet operators. Moreover, closed loop cards often come with discounts and loyalty benefits, making them a preferred choice for businesses. However, the dual network cards segment is expected to register the highest CAGR during the forecast period owing to the increased flexibility they offer by combining the benefits of both open and closed loop systems. This enables fleet managers to control spending while allowing drivers to access a broader merchant network.

On the basis of vehicle type, the light-duty fleets segment dominated the fleet card market in 2024 and is expected to maintain its dominance in the upcoming years owing to its widespread use across various industries such as delivery services, maintenance, and small business operations. These vehicles are cost-effective, fuel-efficient, and ideal for urban transportation, making them a preferred choice for fleet operations. Their high volume of daily transactions further supports the demand for efficient fleet card solutions. However, the medium-duty fleets are expected to register the highest CAGR during the forecast period. This is attributed to growing need for regional transportation, increasing logistics operations, and rising adoption by service providers. Moreover, their balance between capacity and efficiency makes them ideal for expanding mid-range delivery networks.

Competition Analysis

The report analyzes the profiles of key players operating in the fleet card market, such as Shell International B.V., ExxonMobil Fleet Services, Visa Inc., Corpay, Inc., Mastercard International Incorporated, Chevron Corporation, Thomas Silvey Ltd, WEX Inc., Circle K Stores, Inc., Arval UK Limited, and Parkland Corporation. These players have adopted various strategies to increase their market penetration and strengthen their position in the fleet card market.

Recent Key Developments in the Fleet card market

- In May 2024, WEX Inc. signed an agreement with Shell to manage a portfolio of commercial fleet fuel cards in North America, thereby strengthening its long-standing partnership. Under this deal, WEX will provide Shell with advanced payment processing and account management services for its fleet card programs. The collaboration aims to enhance customer experience by offering improved digital tools, expanded acceptance networks, and integrated solutions for fuel and mobility management. This move reflects both companies’ commitment to innovation and efficiency in the fleet card market.

Top Impacting Factors

Driver

Rising Demand for Electric Vehicles

The rising demand for electric vehicles (evs) is fueling the growth of the fleet card market. As more businesses and governments shift toward sustainable transportation, the adoption of evs in commercial fleets is increasing. This change is creating the need for advanced fleet card solutions that can support electric vehicle charging, in addition to traditional fuel purchases. Companies are now looking for fleet cards that work at ev charging stations, making it easier to track and manage charging expenses across multiple vehicles. Moreover, evs come with new tracking and maintenance requirements. Fleet card providers are offering customized features that help businesses monitor ev-specific data such as battery usage, charging times, and cost per charge. These smart tools are becoming essential for fleet managers to control costs and ensure smooth operations. In addition, government support for ev adoption through subsidies and policy changes is encouraging more businesses to go electric. This growing ev fleet size is directly boosting the demand for flexible and digital payment systems like fleet cards. Furthermore, many providers are now partnering with ev charging networks to expand card usability, thus offering more convenience to users. As highlighted in the fleet card market forecast, the ev trend will remain a key driver of long-term adoption. With rising sustainability goals, the fleet card market outlook indicates steady growth, driven by the need for efficient, digital, and eco-friendly fleet management solutions.

Restraints

Connectivity Issues in Remote Areas

One of the key restraints affecting the growth of the fleet card market is the issue of poor connectivity in remote and rural areas. Fleet cards often rely on digital systems and real-time communication to track fuel purchases, monitor vehicle movements, and send transaction alerts. However, in many remote regions, internet and mobile network coverage can be unreliable or even unavailable. This lack of stable connectivity makes it difficult for fleet card systems to function smoothly, leading to delayed transaction processing, lack of real-time data, and reduced efficiency in managing fleet expenses. Moreover, drivers operating in such areas may face challenges in accessing authorized fuel stations that accept fleet cards, further reducing the usability of these cards. In addition, limited access to technical support in remote regions can delay problem resolution, causing frustration for fleet operators and reducing trust in the system. This can make companies hesitant to fully shift to digital fleet card systems, especially in industries like mining, construction, or agriculture, where operations often take place in remote locations. Furthermore, the lack of infrastructure development and low awareness of digital payment systems in such regions continue to act as major barriers. While fleet cards offer many benefits, overcoming these connectivity challenges is essential for expanding their adoption and fueling the growth of the fleet card market across all regions.

Opportunity

Expansion into Emerging Markets

Expansion into emerging markets is creating a major fleet card market opportunity. Many developing countries are witnessing rapid growth in transportation, logistics, and infrastructure development. As businesses in these regions expand their vehicle fleets, there is a growing need for efficient and secure fuel payment systems. Fleet cards offer a reliable solution by helping companies control expenses, track fuel usage, and reduce misuse. Moreover, the rise of e-commerce and delivery services in countries like India, Brazil, and southeast asian nations is fueling the demand for fleet management tools, including fuel cards. In addition, many emerging markets are seeing increased digitalization and adoption of cashless payment methods. Governments in these regions are also encouraging transparency and digital payment systems, which supports the growth of fleet cards and further boosts the overall fleet card market size. Furthermore, global fleet card providers are entering these markets by forming partnerships with local banks, fuel providers, and payment networks to expand their reach and offer localized solutions. The lower penetration of fleet card services in emerging countries also presents a strong growth potential for companies looking to increase their fleet card market share. As more businesses realize the benefits of cost control, fraud prevention, and operational efficiency, the adoption of fleet cards is expected to rise. This growing awareness and expanding market reach are strongly driving the growth of the fleet card market in emerging economies.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the fleet card industry segments, current trends, estimations, and dynamics of the fleet card market analysis from 2024 to 2034 to identify the prevailing fleet card market opportunities.

- The fleet card industry research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the fleet card market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global fleet card market trends, key players, market segments, application areas, and fleet card market growth strategies.

Fleet Card Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 4.8 trillion |

| Growth Rate | CAGR of 16.5% |

| Forecast period | 2024 - 2034 |

| Report Pages | 354 |

| By Industry |

|

| By Enterprise Size |

|

| By Type |

|

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | Arval UK Limited, Corpay, Inc., WEX Inc., Mastercard International Incorporated, Thomas Silvey Ltd., Parkland Corporation, Chevron Corporation, Shell International B.V., Circle K Stores, Inc., ExxonMobil Fleet Services, Visa Inc. |

Analyst Review

According to the CXOs, the fleet card market is experiencing strong growth, driven by increasing demand from businesses seeking both cost efficiency and operational control. As companies manage growing vehicle fleets and face rising fuel prices and compliance requirements, they are turning to fleet cards to streamline payments, monitor usage, and gain real-time insights. These cards offer a dual advantage helping businesses track spending and reduce misuse, while also optimizing route planning and vehicle maintenance schedules. The rise of digital fleet management platforms has further fueled market growth by integrating fleet cards with GPS tracking, telematics, and data analytics, making them particularly appealing to logistics firms and tech-driven enterprises. In addition, tailored fleet card solutions for various industries and fleet sizes are gaining traction. These services offer flexibility to address specific needs, whether it’s multi-brand fuel access, toll payments, repair and maintenance tracking, or real-time expense reporting. This versatility makes fleet cards highly attractive to SMEs, large logistics providers, and government fleets alike. Fleet operators in emerging markets are also increasingly adopting these solutions to improve transparency, reduce administrative overhead, and align with global efficiency standards. Government support for digital payments and fuel subsidy reforms is also contributing to market growth. Moreover, advanced fleet card features like fraud protection tools, customizable spending limits, mobile apps, and real-time alerts are drawing interest from businesses looking for smarter fleet operations. These options reduce risk and enhance decision-making. However, the market faces challenges such as low awareness among smaller transport firms and concerns over data security. Providers must also focus on improving user onboarding and ensuring ease of use. Despite these issues, the fleet card market is expected to expand as bus inesses increasingly prioritize cost savings, efficiency, and smarter fleet management strategies.

Digital payment integration, EV charging support, telematics-enabled expense tracking, AI-driven analytics, and sustainability-focused solutions are the upcoming trends of Fleet Card Market in the globe.

Closed-Loop card is the leading type of Fleet Card Market.

North America is the largest regional market for Fleet Card.

$4.8 trillion is the estimated industry size of Fleet Card by 2034

Shell International B.V., ExxonMobil Fleet Services, Visa Inc., Corpay, Inc., Mastercard International Incorporated, Chevron Corporation, Thomas Silvey Ltd, WEX Inc., Circle K Stores, Inc., Arval UK Limited, and Parkland Corporation are the top companies to hold the market share in Fleet Card.

Loading Table Of Content...

Loading Research Methodology...