Food Logistics Market Insights, 2032

The global Food Logistics Market size was valued at USD 116.3 billion in 2022, and is projected to reach USD 260.6 billion by 2032, growing at a CAGR of 8.3% from 2023 to 2032.

Report Key Highlighters:

The food logistics market study covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

The food logistics market share is highly fragmented, among several players including Agility, AmeriCold Logistics LLC, CJ Logistics, C.H. Robinson Worldwide, Inc, DB Schenker, DHL International GmbH, Hellmann Worldwide Logistics SE & Co. KG, Lineage Logistics, XPO Logistics, and Yusen Logistics.

Market Segments

The food logistics market is segmented into Business Type, Mode of Operation, Product Type and Service Type.

Food logistics is defined as the process to control, execute, and plan the movement of food related material, and service. These services consist of activities such as material handling, packaging, transportation, inventory, security, and warehousing, which are scaled according to customer needs and market conditions. Logistics service providers are responsible for the delivery of materials or goods from manufacturers to consumers. The food logistics industry deals with the business of delivering food and groceries at a desired location.

Advancements in technology have led to the rapid growth of third-party ordering & delivery services, which is driving the growth of the market. In addition, transport companies operating in the market are incorporating new warehousing services in various countries which are propelling the market growth for the storage & warehousing segment. Penetration of fully automated warehousing distribution systems is extremely less, which is expected to provide a remarkable growth opportunity for the key players operating in the food logistics market. Providers of logistics services carry out a variety of duties and services for other businesses, acting as a middleman between the customer and the final consumer. Currently, logistics service providers offer much more than the simple delivery or storage of material or goods; they also handle customs, labelling, assembly, shipping, and other services.

Factors, such as surge in surge in demand for ready-to-eat foods, increase in demand for last mile food delivery, and increased demand of cold chain logistics drive the growth of the food logistics industry. Moreover, increased challenges of truck industry including driver shortage and increased fuel price, and increased competition from bigger player hamper the growth of the market. However, the rise in adoption of IoT, automation and AI technologies in food logistics, and increase in hybrid routing for short timeline deliveries are expected to offer lucrative opportunities for the growth of the food logistics market.

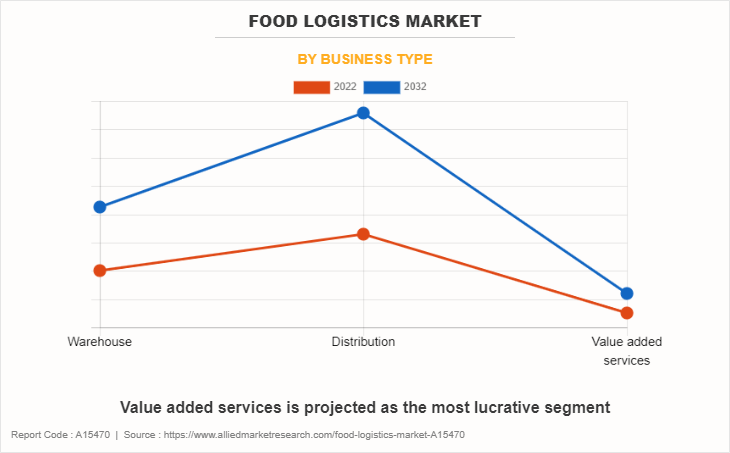

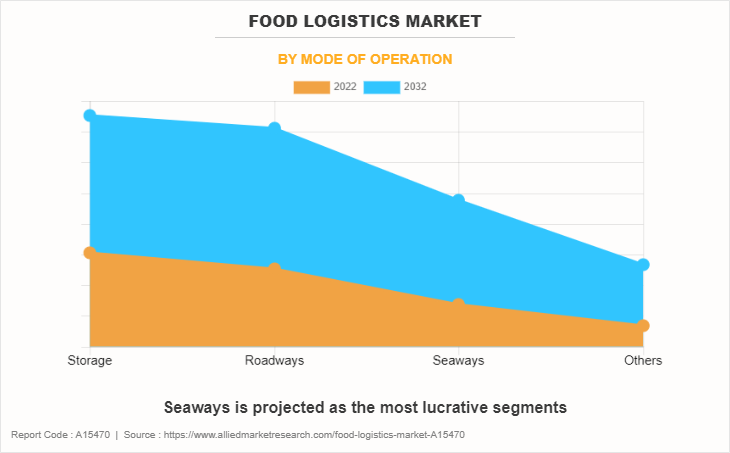

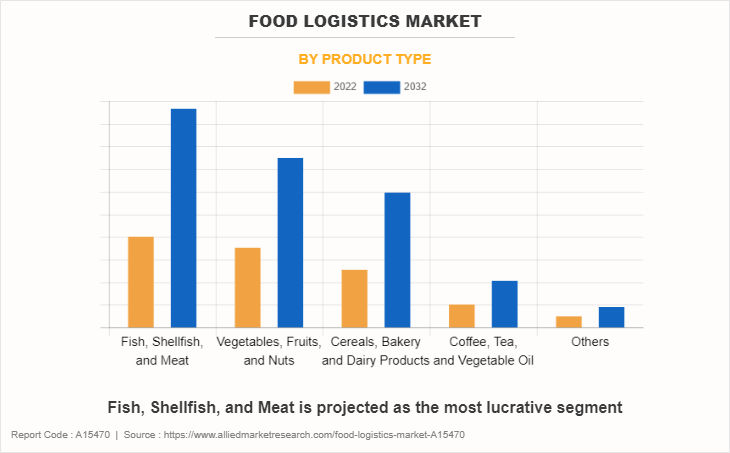

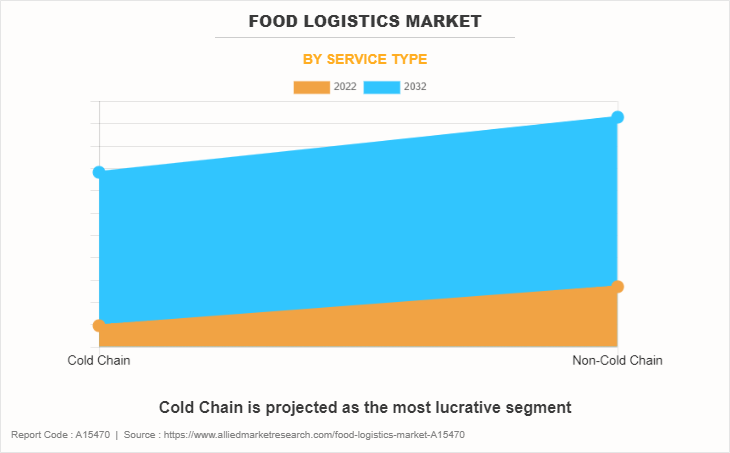

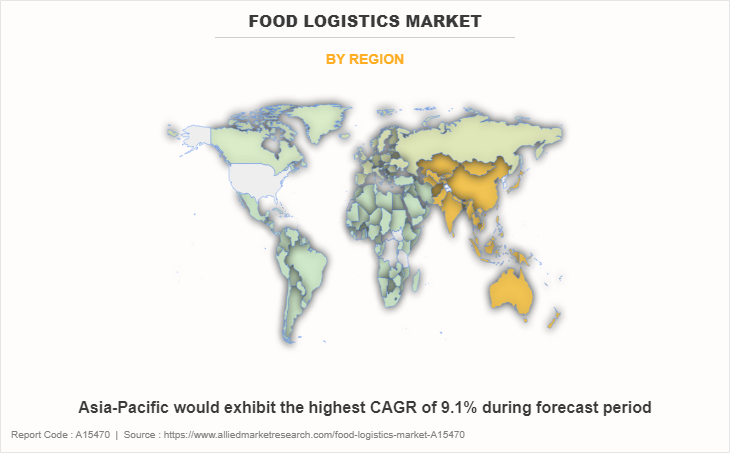

The food logistics market is segmented on the basis of mode of operation, product type, service type, business type, and region. By mode of operation, it is classified into storage, roadways, seaways, and others. By product type, it is divided into fish, shellfish, & meat; vegetables, fruits, & nuts; cereals, bakery & dairy products; coffee, tea, & vegetable oil; and others. By service type, it is bifurcated into cold chain and non-cold chain. By business type, it is categorized into warehouse, distribution, and value-added services. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Some leading companies profiled in the food logistics market report comprise Agility, AmeriCold Logistics LLC, CJ Logistics, C.H. Robinson Worldwide, Inc, DB Schenker, DHL International GmbH, Hellmann Worldwide Logistics SE & Co. KG, Lineage Logistics, XPO Logistics, and Yusen Logistics.

Key Developments in Food Logistics Industry

In May 2023, CJ Logistics Corporation, signed a Logistics Project Collaboration Memorandum of Understanding (MOU) with Beez Logistics, a Saudi Arabian logistics company. This strategic move aims to establish a presence in the Saudi Arabian logistics market. CJ Logistics caters to diverse industries like food and beverage, pharmaceuticals, and health & beauty, providing services encompassing contract logistics, cold chain logistics, and last-mile delivery.

In March 2023, DHL Global Forwarding, the freight specialist division of Deutsche Post DHL Group, has inaugurated its latest facility in Brisbane to cater to the increasing demand for exporting Australian perishable goods. This initiative represents a significant investment of $11.5 million (AU$17 million) over the course of ten years.

In February 2023, Lineage Logistics, LLC, a part of Lineage Logistics Holdings, LLC, launched Lineage Fresh, a strategic service available in Europe. Presented at the Fruit Logistica trade show in Berlin, Lineage Fresh offers fresh storage solutions tailored to major importers, grocers, and producers of fresh fruits and produce. By leveraging Lineage's advanced cold storage technology and extensive logistics network, Lineage Fresh aims to reduce hurdles, risks, and spoilage for products with a limited shelf life.

In November 2022, Lineage Logistics, , a division of Lineage Logistics Holdings, LLC, officially inaugurated its Cool Port II cold storage facility located in the Port of Rotterdam, Netherlands. This strategic addition brings a significant European port location to Lineage's extensive global network of top-tier cold storage facilities. The facility boasts full automation, offering 60,000 pallet locations, three automated truck unloading systems, and a comprehensive range of services for the safe storage and efficient distribution of food products to market.

In August 2022, Lineage Logistics, a division of Lineage Logistics Holdings, LLC, completed the acquisition of VersaCold Logistics Services. VersaCold, a major player in cold chain solutions in Canada, operates 24 temperature-controlled facilities with a total capacity of 114 million cubic feet across nine provinces. This acquisition marks an expansion of Lineage's presence in Canada and opens up new prospects for enhancing cross-border logistics solutions for clients across North America and beyond.

Surge in demand for ready-to-eat foods

In recent years, there has been a notable surge in the demand for ready-to-eat foods within the food logistics market. This trend is primarily driven by evolving consumer preferences characterized by a desire for healthier, hassle-free food options. As modern lifestyles become increasingly fast-paced, consumers look for food products that offer both convenience and health benefits. These foods typically require minimal preparation, cooking, or handling. Ready-to-eat meals, pre-packaged salads, microwaveable dinners, and grab-and-go snacks have gained popularity.

Food logistics companies respond to this demand by developing efficient supply chain solutions to transport and distribute these products. For instance, in March 2023, Ammamma's, an Indian food chain, launched its high-quality, fiber-rich ready-to-eat food products, in collaboration with strategic logistics partner Green Drive Mobility. Its product range includes various packaged chapati products, as well as Poori, Parota, and Dosa-Idly Batter. It sold over 100,000 chapati packets monthly through platforms such as Zepto, Bigbasket, and over 1,000 local stores in Telangana and Andhra Pradesh. Green Drive Mobility played a crucial role in distributing these products to stores across Karnataka, Andhra Pradesh, and Telangana. Thus, growing consumer demand for easy and healthy ready-to-eat foods has driven the food logistics market to develop efficient supply chain solutions, exemplified by food chain collaboration with food logistic companies to launch such products.

Increase in demand for last mile food delivery

The food logistics sector experienced a remarkable increase in the demand for last-mile food delivery services. This surge be attributed to the explosive growth of online grocery shopping and the broader e-commerce industry. As consumers increasingly embraced the convenience of ordering food and groceries online, food logistics companies had to adapt and innovate to meet this demand. Traditional supply chain models were modified to accommodate the intricacies of delivering perishable goods directly to consumers' doorsteps. This shift also led to the emergence of specialized delivery services and apps, further transforming the food logistics landscape. It was a pivotal moment for the industry, as companies sought to optimize delivery routes, enhance packaging for safe transportation, and provide real-time tracking to ensure a seamless online shopping experience for consumers.

Last mile food delivery players now adapting electrification to reduce their carbon footprints. For instance, in August 2023, Gogoro Inc., a prominent provider of electric vehicle battery-swapping solutions, is partnering with Swiggy to encourage the adoption of electric smart scooters among last-mile delivery partners in India's on-demand convenience delivery platform. This collaboration aims to create a smooth pathway for riders to embrace eco-friendly electric transportation, thereby improving operational efficiency for their businesses. Rise in demand for last-mile food delivery, spurred by online purchases, compelled food logistic companies to adapt with specialized services, and the industry is now focusing on electrification for its long-term sustainability.

Increased challenges of truck industry including driver shortage and increased fuel price

The trucking industry is gradually getting better after the challenges brought on by COVID-19. This is crucial because trucks are responsible for moving over 70% of goods in the United States, and they play a significant role in delivering items for the last mile to consumers. However, there are serious shortages of truck drivers in both Canada, with around 25,000 drivers needed, and the United States, which faces an even more significant shortage of approximately 60,000 drivers.

One critical factor affecting all transportation methods is the price of fuel. The conflict between Russia and Ukraine has had a major impact on global crude oil and petroleum product prices. When fuel costs go up, carriers pass on these increased expenses to shippers. In the trucking industry, each carrier sets its own surcharges, which vary widely. In the rail industry, surcharges are based on the weekly average diesel prices reported by the EIA (Energy Information Administration) and are more structured but still fluctuate and get adjusted monthly. These fluctuations in fuel prices have a significant impact on transportation costs and the prices consumers pay for goods.

Rise in adoption of IoT, automation and AI technologies in food logistics

Automation involves using machines and technology to perform tasks traditionally done by humans. In food logistics, this includes automated warehouses with robots picking and packing goods, as well as autonomous vehicles for transportation. AI, on the other hand, uses algorithms and data analysis to make intelligent decisions and predictions. In logistics, AI be used for demand forecasting, route optimization, and inventory management.

Automation and AI technologies offer several advantages to food logistics companies. They significantly reduce labor costs and human errors, leading to higher efficiency and accuracy in order fulfilment. AI-driven analytics help companies make data-driven decisions, optimizing routes to reduce delivery times and fuel consumption. For instance, in March 2023, ROUTD, a last-mile food logistics platform, introduced a new AI capability to its services. This enhancement aims to address issues related to failed orders and provide real-time visibility for wholesalers, retailers, caterers, and their customers. The ROUTD solution offers clients visibility of deliveries, driver performance monitoring, and customer service ratings. It also offers dynamic routes, automated email ETAs, and food temperature data records, ensuring business integrity and providing end-to-end visibility across the supply chain and logistics process.

In addition, automation operate around the clock, improving the speed of deliveries and reducing operational costs. As consumers demand faster and more reliable delivery services, companies that invest in these technologies gain a competitive edge and improve overall supply chain efficiency and cost-effectiveness. Moreover, the food logistic adopted the cold storage with autonomous vehicle for efficient last mile deliveries. For instance, in September 2023, Tyson Foods, Inc., a global food company, and Gatik AI, Inc., a leader in autonomous middle mile logistics, launched a multi-year partnership focused on deploying autonomous refrigerated box trucks to enhance Tyson's routes in Northwest Arkansas. These trucks will operate for 18 hours each day, transporting various Tyson products, including Tyson, Jimmy Dean, and BallPark, to distribution and storage facilities located in the Rogers and Springdale regions of Arkansas. Hence, Automation and AI technologies in food logistics optimize processes, cut labor costs, and meet customer demand for efficient deliveries, which in turn propel the growth of food logistic market.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the food logistics market analysis from 2022 to 2032 to identify the prevailing food logistics market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the food logistics market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global food logistics market trends, key players, market segments, application areas, and market growth strategies.

Food Logistics Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 260.6 billion |

| Growth Rate | CAGR of 8.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 227 |

| By Business Type |

|

| By Mode of Operation |

|

| By Product Type |

|

| By Service Type |

|

| By Region |

|

| Key Market Players | CJ Logistics Corporation, Yusen Logistics CO., LTD., Americold Logistics, Inc., DB Schenker, C.H. Robinson Worldwide, Inc., XPO, Inc., Lineage Logistics Holdings, LLC, Deutsche Post AG, Hellmann Worldwide Logistics, Agility |

The global food logistics market was valued at $116.3 billion in 2022, and is projected to reach $260.56 billion by 2032.

The rise in adoption of IoT, automation and AI technologies in food logistics, and increase in hybrid routing for short timeline deliveries s are the upcoming trends of Food Logistics Market

By mode of operation, storage is the leading application of food logistics market

Asia-Pacific is the largest regional market for food logistics

Some leading companies profiled in the government and education logistics market report comprise Agility, AmeriCold Logistics LLC, CJ Logistics, C.H. Robinson Worldwide, Inc, DB Schenker, DHL International GmbH, Hellmann Worldwide Logistics SE & Co. KG, Lineage Logistics, XPO Logistics, and Yusen Logistics.

Loading Table Of Content...

Loading Research Methodology...