Food Texture Market Research, 2032

The global food texture market size was valued at $13.8 billion in 2022, and is projected to reach $23.9 billion by 2032, growing at a CAGR of 5.7% from 2023 to 2032.

The food texture market refers to the segment of the food industry that focuses on the texture of food products. Texture plays a crucial role in how we perceive and enjoy food, and it encompasses various sensory aspects such as the feel, consistency, and mouthfeel of a product. Food texture refers to the physical properties and sensations experienced when consuming food. It encompasses the way a food feels in the mouth, its consistency, and the sensations it produces during chewing and swallowing. Texture plays a crucial role in the overall sensory perception and enjoyment of food.

The food texture market is projected to be fueled by evolving consumer preferences. The market for food textures has expanded as a result of the change in consumer tastes. Their preferences for particular textures in food products change as consumers get more sophisticated and seek distinctive, enjoyable, and personalized meal experiences. This increases the need for novel texture-enhancing services and goods. Customers look for new and fascinating textures in the foods they choose. They desire a variety of mouthfeels and feelings that go beyond conventional textures. To meet these changing demands, food producers are forced to create and market new items with distinctive textures.

Owing to the shift in customer preferences, technological improvements, and the rise in demand for processed & convenience foods, the food texture market has steadily expanded in recent years. The market includes a range of product categories, such as texture-modifying products, processing tools, and texturizing agents.

Clean label and natural food products have become more popular. Customers become more aware of the components in their food and favor goods without artificial preservatives and additions. As a result, natural texturizing ingredients such as pectin, agar, and guar gum, which enable texture alteration while passing clean label regulations, have become more popular in the food texture industry.

In addition, a greater emphasis is being placed on creating plant-based and alternative food products as a result of the rise in plant-based diets and the surge in demand for alternative protein sources. To replicate the textures of their animal-based counterparts, such as meat and dairy products, texture is necessary. As a result, there is an increase in texture solutions for food that can simulate the necessary textures in goods made from plants and other alternatives.

Moreover, consumers want customized dining experiences that cater to their unique interests. This includes specialized textures to fit their individual tastes and nutritional requirements. The market for food texture responds to this trend by providing a range of ingredients and customized texture solutions that let customers change or alter the texture of their food.

Companies in the food texture sector have a strategic opportunity to work with food makers. Providers of texture solutions can better meet the demands of manufacturers and create specialized texture solutions for their goods by collaborating closely with them. This teamwork method aids in developing distinctive textures and differentiating products in the marketplace.

Research and development in texture-improving substances have a lot of potential. A growing area of study is on creating innovative substances that can improve or alter textures while adhering to clean label and natural ingredient. Hydrocolloids, emulsifiers, and stabilizers are examples of texture-modifying innovations that present potential for businesses to grow their market share.

However, the overall cost of food products may increase if texture-enhancing additives and methods are used. Particularly in price-sensitive markets, the use of specialized texturizing agents and processing procedures may be constrained by their cost. Manufacturers continue to struggle with striking a balance between price and texture enhancement, which may somewhat constrain market expansion.

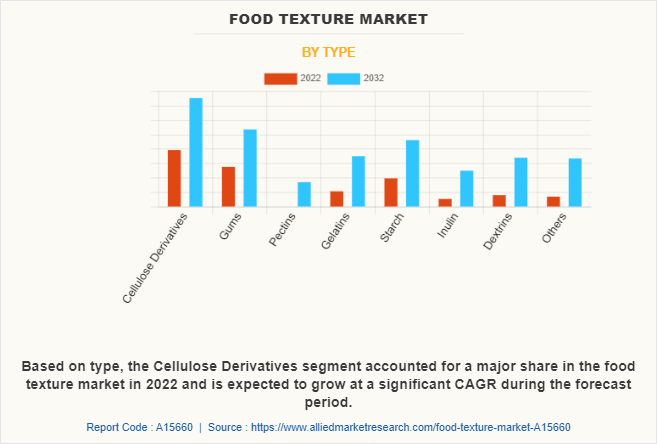

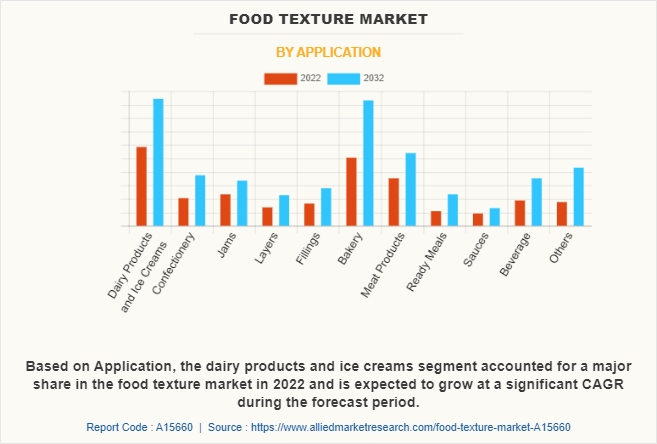

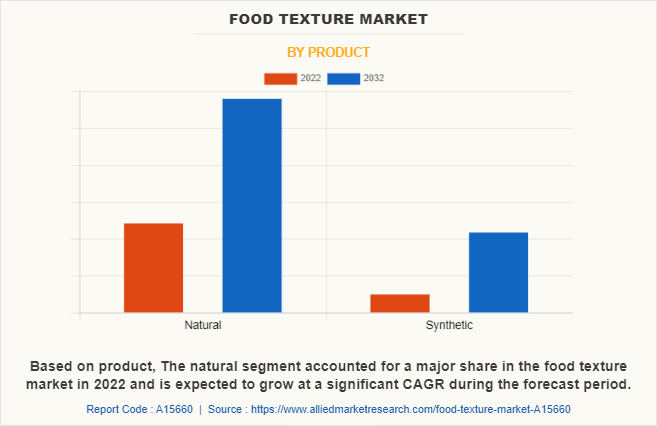

The food texture market is segmented on the basis of type, application, product, and region. On the basis of type, the market is classified into cellulose derivatives, gums, pectins, gelatins, starch, inulin, dextrins, and others. On the basis of application, the market is categorized into dairy products & ice creams, confectionery, jams, layers, fillings, bakery, meat products, ready meals, sauces, beverage, and others. By product, the market is bifurcated into natural and synthetic. Region-wise the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, the Netherlands, Spain, Belgium, Russia, Poland, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, Thailand, Malaysia, and rest of Asia-Pacific), LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

By type, the market is segmented into cellulose derivatives, gums, pectins, gelatins, starch, inulin, dextrins, and others. The Cellulose Derivatives segment accounted for a major share in the food texture market in 2022 and is expected to grow at a significant CAGR during the food texture market forecast period. The demand for cellulose derivatives has increased in view of increased consumer preference for clean labeling and ingredients derived solely from nature. This derivative is derived from plant and natural sources, making it a clean-label alternative to synthetic or chemical-modified ingredients. These are tools for food producers to increase the texture of their products whilst still meeting consumer demand for a more accurate and comprehensible list of ingredients.

According to the food texture market demand, by application, the market is classified into dairy products & ice creams, confectionery, jams, layers, fillings, bakery, meat products, ready meals, sauces, beverage, and others. The dairy products and ice creams segment accounted for a major share in the food texture market in 2022 and is expected to grow at a significant CAGR during the forecast period. Changing consumers' preferences, needs for product differentiation and desire to enhance sensory experience are leading to increased demand for texture-altering ingredients in dairy products and ice cream. A product with more texture, for example, smooth or creamy, is increasingly sought by consumers.

By product, the market is bifurcated into natural and synthetic. The natural segment accounted for a major share in the food texture market in 2022 and is expected to grow at a significant CAGR during the forecast period. Consumers are increasingly buying products with clean labels and natural ingredients. The rise in awareness of ingredients used by consumers and the need to be transparent with food labeling influence consumer behavior. With a view to responding to consumers' demands for clean and minimal processed options, natural products in the food texture market provide an alternative by offering texture enhancing ingredients derived from natural sources.

Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The North America region accounted for a major share in the food texture market in 2022 and is expected to grow at a significant CAGR during the forecast period. The focus is on clean labels and natural ingredients in the North American food texture market. The issue of ingredients used in food has become increasingly important to consumers, and they continue to be sought for products that have more straightforward and identifiable ingredient lists. This has led to an increase in demand for organic and clean-label texture solutions, e.g., natural thickeners, and stabilizers.

The major players operating in the market focus on key market strategies, such as mergers, product launches, acquisitions, collaborations, and partnerships to increase their food texture market share. They have also been focusing on strengthening their market reach to maintain their goodwill in the ever-competitive market. Some of the key players in the food texture market include Cargill Incorporated, DuPont de Nemours, Inc.., Ingredion Inc., Koninklijke DSM N.V., CP Kelco, Kerry Group PLC, Jungbunzlauer Holding AG Deosen Biochemical (Ordos) Ltd., Euroduna Food Ingredients GmbH, and Archer Daniels Midland Company.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the food texture market analysis from 2022 to 2032 to identify the prevailing food texture market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the food texture market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global food texture market trends, key players, market segments, application areas, and food texture market growth strategies.

Food Texture Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 23.9 billion |

| Growth Rate | CAGR of 5.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 378 |

| By Type |

|

| By Application |

|

| By Product |

|

| By Region |

|

| Key Market Players | Koninklijke DSM N.V., Jungbunzlauer Suisse AG, CP Kelco U.S., Inc, Kerry Group P.L.C., Deosen Biochemical (Ordos) Ltd., Archer-Daniels-Midland Company, Euroduna Food Ingredients GmbH, DuPont de Nemours, Inc., Ingredion Incorporated., Cargill, Incorporated |

Analyst Review

According to the insights of the CXOs, the continuous growth in demand for food textures market is supported by an increase in developments within the food processing sector. Surge in industrial developments in the food processing sector, changes in consumers' preferences, growth in demand for convenience foodstuffs, and increased use of food texture agents in processed foods and beverages are expected to drive market growth. The market for food texture continues to expand, providing manufacturers with the opportunity to innovate and meet growing consumer demands across the globe in view of consumers' increasing sensory requirements and demand for convenience foods.

The global food texture market size was valued at $13.8 billion in 2022, and is projected to reach $23.9 billion by 2032

The global Food Texture market is projected to grow at a compound annual growth rate of 5.7% from 2023 to 2032 $23.9 billion by 2032

Some of the key players in the food texture market include Cargill Incorporated, DuPont de Nemours, Inc.., Ingredion Inc., Koninklijke DSM N.V., CP Kelco, Kerry Group PLC, Jungbunzlauer Holding AG Deosen Biochemical (Ordos) Ltd., Euroduna Food Ingredients GmbH, and Archer Daniels Midland Company.

The North America region accounted for a major share in the food texture market in 2022

Evolving Consumer Preference, Product Differentiation and Innovation, Health and Wellness Trends

Loading Table Of Content...

Loading Research Methodology...