Frozen Seafood Market Research, 2032

The global frozen seafood market size was valued at $82.5 billion in 2022, and is projected to reach $137.3 billion by 2032, growing at a CAGR of 5.3% from 2023 to 2032.

Frozen seafood refers to seafood products, including fish, shellfish, and other aquatic delicacies, that are carefully processed, preserved, and stored at very low temperatures to maintain their freshness and quality. This freezing process lowers the temperature of the seafood to well below freezing, typically to -18°C or below, which effectively blocks the growth of microorganisms and helps preserve the food for longer duration. This technique ensures the seafood retains its flavor, texture, and nutritional value adequately. It can be stored for an extended period, making it readily available for various culinary applications. Freezing seafood allows it to be transported over long distances and is not subject to immediate consumption, reducing food waste and providing a practical solution for meal planning and grocery shopping. In addition, frozen seafood can be sourced sustainably, aligning with the preferences of environmentally conscious consumers.

Market Dynamics

The expansion of the frozen seafood market share has been significantly driven by evolving consumer lifestyles and preferences. In today's fast-paced world, with consumers leading increasingly hectic lives, the demand for convenient and time-saving food options has surged in demand. Frozen seafood aligns perfectly with these demands, as it offers a quick and effortless meal solution. Frozen seafood offers a value proposition in the marketplace by providing an extended shelf life that guarantees freshness and minimizes food wastage, which appeals to consumers seeking greater efficiency in meal planning and grocery shopping. The advantages of accessibility and availability further contribute to its growth, as frozen seafood is not subject to geographic or seasonal constraints, ensuring year-round availability irrespective of location. The growth in health consciousness has fueled a significant increase in the popularity of frozen seafood products. The exceptional protein content, omega-3 fatty acids, and essential nutrients in seafood products, aligns with the changing dietary preferences of health-conscious consumers. As individuals seek nutrient-rich and convenient food options, frozen seafood has become a natural choice that meets their nutritional needs and caters to their desire for wholesome and convenient meal solutions in a health-focused society. Sustainability, food safety assurance, diverse product offerings, marketing and education, and price competitiveness have all boosted the growth of the frozen seafood market size.

The market for frozen seafood market faces certain challenges in terms of proper cold storage facilities and transportation infrastructure in many developing and under developed countries across the world. Inadequate cold storage and transportation infrastructure may act as a barrier for the sustained growth of frozen seafood market. Inadequate cold storage and transportation facilities at the retail level may worsen the issue of seafood wastage, especially in underdeveloped nations such as South and South East Asia. While wholesalers typically invest in cold storage solutions for fish distribution, retail suppliers, often comprising small-scale traders and street vendors, rely on less capital-intensive methods like ice for storage. The unorganized nature of fish markets, both wholesale and retail, contributes to the problem. The prevalence of street markets and a lack of proper storage infrastructure in these informal setups result in rapid quality deterioration. Most fish are sold whole, with minimal processing or value addition. Neglect of hygiene and sanitation norms in transportation and storage may worsen contamination risks, thus posing risk in food safety concerns. In addition, seafood is highly susceptible to spoilage and bacterial growth when exposed to improper temperatures, risking food safety and potentially necessitating costly product recalls. The inadequate infrastructure may also curtail the market's expansion as regions with poor facilities may be unable to access a variety of frozen seafood products. This constraint may hamper the frozen seafood market growth and result in supply chain delays that hinder the timely delivery of products, ultimately impacting customer satisfaction.

The surge in demand for sustainable frozen seafood may create plethora of opportunities of the key player operating in the market. The surge in demand for sustainable seafood presents a substantial growth opportunity for the frozen seafood market. This trend is fueled by increasing consumer awareness of environmental issues and a desire to make responsible food choices. The frozen seafood industry can capitalize on this shift in consumer preferences by embracing sustainable practices and responsible sourcing. Thus, by adopting eco-friendly fishing and processing methods, it can meet the growing demand for seafood that does not harm ocean ecosystems and fish populations. The year-round availability of frozen seafood ensures consumers can access sustainable options even when certain species are out of season, which promotes a responsible consumption. In addition, as businesses in the market increasingly promote sustainable products, they are likely to attract a growing segment of eco-conscious consumers. Collaborations with organizations focused on sustainable fishing and ocean conservation may further establish the industry as a responsible player in the sustainability movement. As a result, providing a diverse range of sustainable seafood options, educating consumers, and fostering eco-friendly practices, the frozen seafood market demand is well-positioned to thrive in a business landscape increasingly shaped by environmental consciousness.

Segmental Overview

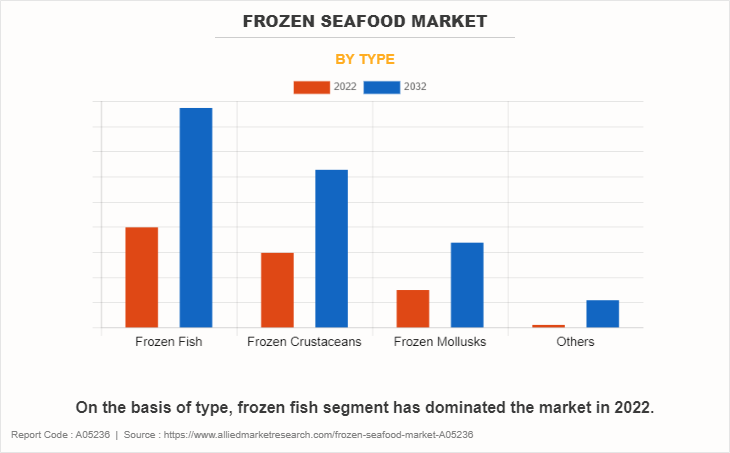

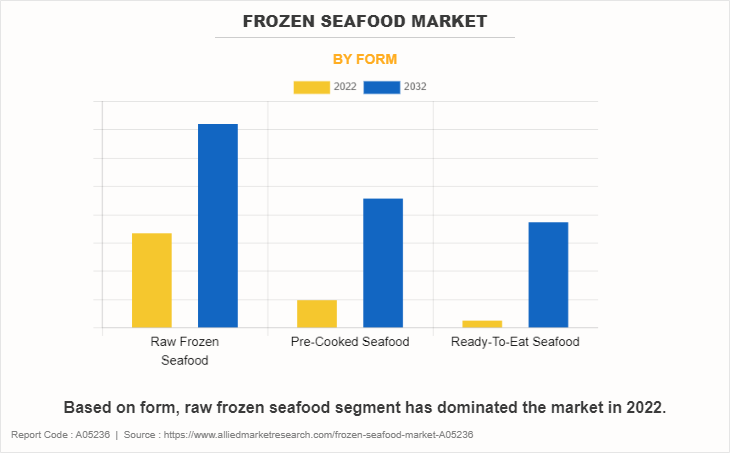

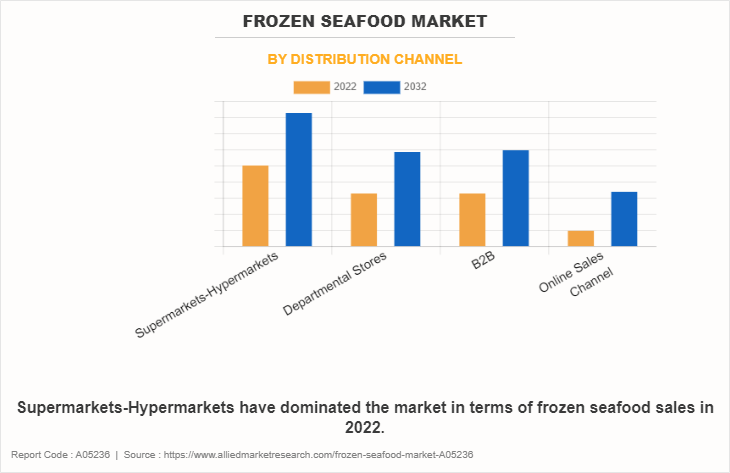

The frozen seafood market share is analyzed on the basis of type, form, distribution channel, and region. By type, it is divided into frozen fish, frozen crustaceans, frozen mollusks, and others. As per form, it is categorized into raw frozen seafood, pre-cooked seafood, and ready-to-eat seafood. Depending on distribution channel, it is fragmented into supermarkets-hypermarkets, departmental stores, B2B, and online sales channel. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Type

As per type, the frozen fish segment dominated the frozen seafood market in 2022 and is anticipated to maintain its dominance throughout the forecast period. Rising disposable incomes and an expanding middle class create an increased demand for convenient and high-quality food options, which has made frozen fish a convenient choice for consumers. Health-conscious consumers are increasingly seeking shelf-stable and preservative-free fish products, that aligns with the trend towards cleaner and more natural food options. The emergence of gourmet frozen fish caters to those who desire restaurant-quality seafood in the comfort of their homes, which presents a niche but influential market segment. The convenience factor also plays a significant role in driving the demand for frozen fish, with consumers increasingly prioritizing products that fit their busy lifestyles. Advances in freezing technology have contributed significantly in preserving the taste and quality of frozen fish, which has further increased its demand in the market.

Moreover, the growing consumption of frozen fish and the attraction of lower prices product are additional factors driving the market growth of this segment. Proper packaging techniques, efficient transportation methods, and recommended defrosting processes ensure that frozen fish maintains its dominance as a convenient and high-quality seafood option. As the market evolves, this segment is expected to adapt to consumer preferences and demands, which may present a dynamic landscape of opportunities for both established and emerging players in the frozen fish industry.

By Form

By form, the raw frozen segment dominated the frozen seafood market in 2022 and is anticipated to maintain its dominance throughout the frozen seafood market forecast period. This helps to drive the demand for powder seaweed extracts in the market. The demand for unaltered, naturally frozen seafood has seen a substantial surge owing to its ready availability through diverse retail channels. This uncooked seafood offers a fresh flavor and a delicate texture, which increases the dining experience with its original tastes and textures. Raw frozen seafood preserves its vital nutrients, encompassing omega-3 fatty acids, vitamins, and minerals, which thus makes it a nutritious option for health-conscious consumers who may prepare it to their dietary preferences. The minimal processing nature of frozen seafood increases its attractiveness among individuals those who prefer unadulterated food choices. Unprocessed frozen seafood is versatile, as it is easily used in dishes such as sushi, sashimi, ceviche, and tartare, for culinary applications. The is anticipated to maintain its popularity in the market owing its purity, natural characteristics, and suitability for various culinary innovations.

By Distibution Channel

Depending on distribution channel, the supermarkets/hypermarkets segment dominated the frozen seafood market in 2022 and is anticipated to maintain its dominance throughout the forecast period. The frozen seafood has a good opportunity to grow with the help of hypermarkets & supermarkets distribution channel. The reason for this is easy availability of the products. Consumers have access to niche products on the market in these types of stores. Thus, the establishment of hypermarkets/supermarkets at a widespread location gives way to lucrative opportunities for global frozen seafood market growth. Manufacturers offer special discounts through these hypermarkets and encourage hypermarkets and supermarket chains to mainly sell their own products. For these strategies, manufacturers are making efforts to increase the visibility of the products, which attracts consumers and contributes to the growth of the market. Thus, the availability of frozen seafood products in supermarkets and hypermarkets is expected to boost with the increase in demand for sustainable and organic fertilizers and processes in coming years.

By Region

Region wise, Europe is predicted to dominate the market with the largest share during the forecast period (2023-2032). The fast-paced lifestyles of European consumers have led them to favor frozen seafood for its ease of use, which thus demands minimal preparation. The surge in demand for convenient and easily prepared meals has propelled frozen seafood as a convenient choice. Consumers are increasingly health-conscious, which has led to increased awareness of the nutritional benefits of seafood. In addition, the increased emphasis on sustainability and responsible sourcing of seafood industry among the consumers has driven the need for certified frozen seafood products that adhere to environmentally friendly practices. Advancements in freezing and packaging technologies has enhanced the quality, texture, and taste of frozen seafood, making it exceptionally attractive to consumers. Frozen seafood, with its extended shelf life compared to fresh alternatives, reduces food waste and enables bulk purchasing for restaurants and other food outlets. Furthermore, the rise of online sales channels and the widespread availability of frozen seafood in physical stores and digital marketplaces have greatly expanded consumer access to these products. As a result, the frozen seafood market in Europe is expected to experience steady growth.

Competitive Landscape

The major players analyzed for the frozen seafood industry include Sirena Group A/S, Sykes Seafood, Nueva Pescanova, S.L., Beaver Street Fisheries, Inc., High Liner Foods Incorporated, Leroy Seafood Group ASA, Maruha Nichiro Corporation, Thai Union Group Public Company Limited, Pacific Seafood Group, and Mazzetta Company, LLC.

Manufacturers of frozen seafood are creating new packaged frozen products to satisfy the change in requirements of their customers. They make investments in R&D to create novel advancements in freezing and packaging technologies with enhanced functionality, stability, and selectivity and create new applications for frozen seafood in various other food products. While developing new products, enhancing production methods, and navigating regulatory requirements, key players operating in frozen seafood business frequently work with local fish farming bodies, regulatory organizations, and other industry players. Manufacturers can increase their capacities, pool their knowledge, and create novel solutions through these collaborations. Manufacturers are improving their production capacity and cutting costs, which can involve both investing in new production facilities and renovating current ones to keep up with the rising demand for frozen seafood.

The frozen seafood market is anticipated to expand due to rise in packaged food products, public knowledge of the advantages of seafood for health benefits, and development of transportation & warehousing facilities for frozen seafood products. In addition, factors such as innovation, collaboration, product launch, and expansion initiatives are opportunistic for market growth.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the frozen seafood market analysis from 2022 to 2032 to identify the prevailing frozen seafood market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the frozen seafood market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global frozen seafood market trends, key players, market segments, application areas, and market growth strategies.

Frozen Seafood Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 137.3 billion |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 280 |

| By Form |

|

| By Distribution Channel |

|

| By Type |

|

| By Region |

|

| Key Market Players | Leroy Seafood Group ASA, Pacific Seafood Group, Sirena Group A/S, High Liner Foods Incorporated, Mazzetta Company, LLC., Sykes Seafood, Maruha Nichiro Corporation, Nueva Pescanova, S.L., Beaver Street Fisheries, Inc., Thai Union Group Public Company Limited. |

Analyst Review

The perspectives of the leading CXOs in the frozen seafood industry are presented in this section. Top executives in the frozen seafood industry hold a positive outlook on its growth prospects. Firstly, they recognize the increasing consumer demand driven by convenience. Frozen seafood offers a hassle-free solution for seafood enthusiasts, as it eliminates concerns about spoilage and allows for extended storage, enhancing overall convenience. Moreover, executives emphasize the importance of quality in this sector. Modern freezing technology has revolutionized the industry, enabling seafood to be frozen at the peak of its freshness. This technological advancement results in high-quality products that increases the taste and appearance of fresh seafood, aligning with the expectations of consumers. According to the top executives, variety of frozen seafood is another key driver of growth. The frozen seafood market boosts a wide array of options, which caters to diverse consumer needs and preferences. This extensive selection empowers consumers to choose products that align with their individual tastes and culinary requirements.

In addition, top executives are expecting huge growth opportunities in emerging markets such as Asia and Africa. These regions exhibit a surging demand for seafood, driven by factors such as changing dietary preferences and an expanding middle class population. In these markets, consumers increasingly seek convenient and affordable options, positioning frozen seafood as an attractive choice.??

Thus, the market is expected to grow owing to change in lifestyle & consumer preference, surge in female working population, and increase in awareness regarding the health benefits associated with various seafood. Moreover, the advancements in packaging and freezing technologies have created an edge for frozen seafood products to grow steadily in coming years.

The global frozen seafood market size was valued at $82.5 billion in 2022, and is projected to reach $137.3 billion by 2032

The global Frozen Seafood market is projected to grow at a compound annual growth rate of 5.3% from 2023 to 2032 $137.3 billion by 2032

The major players analyzed for the frozen seafood industry include Sirena Group A/S, Sykes Seafood, Nueva Pescanova, S.L., Beaver Street Fisheries, Inc., High Liner Foods Incorporated, Leroy Seafood Group ASA, Maruha Nichiro Corporation, Thai Union Group Public Company Limited, Pacific Seafood Group, and Mazzetta Company, LLC.

Region wise, Europe is predicted to dominate the market with the largest share during the forecast period (2023-2032).

Change in lifestyle & consumer preference, Surge in female working population, Increase in awareness regarding the health benefits associated with various seafood

Loading Table Of Content...

Loading Research Methodology...