Functional Safety Market Summary

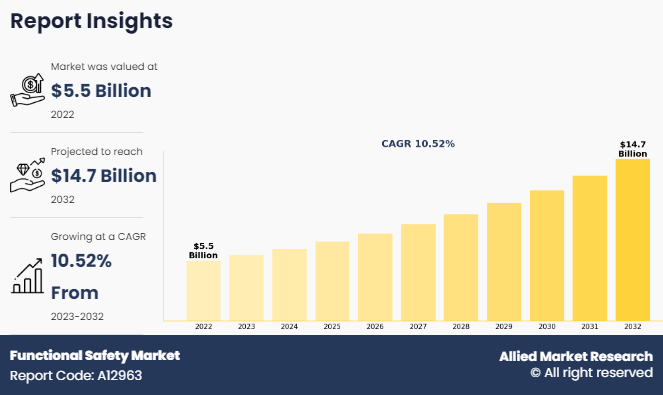

The global Functional Safety Market was valued at $5.5 billion in 2022 and is projected to reach $14.7 billion by 2032, growing at a CAGR of 10.52% from 2023 to 2032. This is fueled by rising awareness of safety across industries and the rapid adoption of IoT devices that enhance safety technologies. However, system integration complexity remains a major challenge. Growth opportunities lie in using IoT for real-time monitoring and predictive maintenance to improve safety.

Market Dynamics & Insights

- The functional safety industry in North America held a significant share of over 38% in 2022.

- The functional safety industry in Germany is expected to grow significantly at a CAGR of 8.5% from 2023 to 2032.

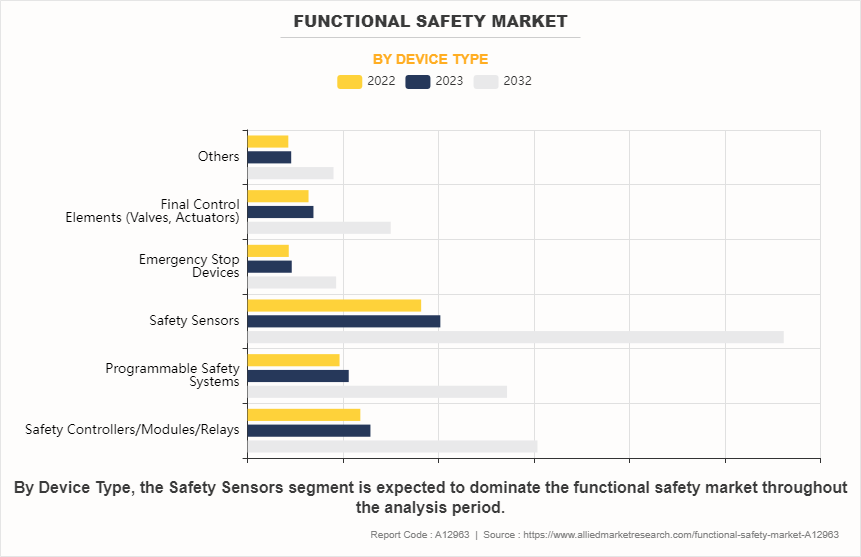

- By device type, the safety sensors segment is one of the dominating segments in the market and accounted for the revenue share of over 33.3% in 2022.

- By industry vertical, the automotive segment is the fastest-growing segment in the market.

Market Size & Future Outlook

- 2022 Market Size: $5.5Billion

- 2032 Projected Market Size: $14.7 Billion

- CAGR (2023-2032): 10.52%

- North America: Largest market in 2022

- Asia-Pacific: Fastest growing market

The global functional safety market is anticipated to experience significant growth during the forecast period, driven by a rise in stringent regulations and standards across various industries that necessitate enhanced safety measures, thus increasing the demand for functional safety solutions. As automation becomes more common across various industries, ensuring the safety of automated processes and systems is essential. Technological advancements, including improvements in sensors, software algorithms, and machine learning, promote the development of advanced functional safety solutions. In addition, emerging markets present significant opportunities for functional safety solutions as industries in these emerging markets rapidly modernize and adopt advanced technologies, highlighting a global shift towards higher safety and reliability standards in terms of technological evolution and regulatory demands.

Functional safety refers to a system's capability to ensure that it operates correctly in response to its inputs, preserving safety for its users, environment, and equipment. It involves implementing safety measures and protocols to prevent or mitigate hazards that could arise from the malfunction or failure of a system, machinery, or equipment. Functional safety standards, such as the ISO 26262 standard for automotive applications or IEC 61508 for general industrial use, provide guidelines and requirements for the development and implementation of safety-related systems to reduce risks and enhance overall safety performance.

Key Takeaways of the Functional Safety Market Report

By device type, the safety sensors segment held the largest market share in 2022 and is anticipated to grow at the fastest CAGR during the forecast period.

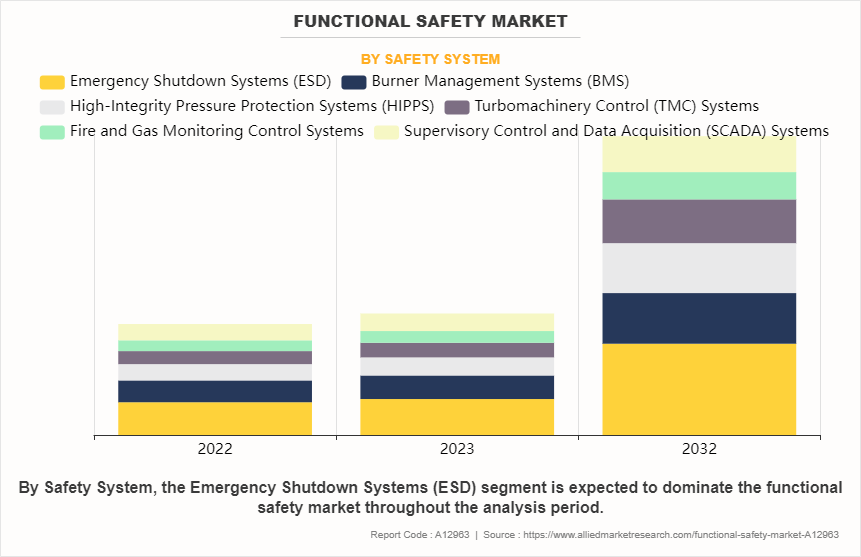

By safety systems, the Emergency Shutdown Systems (ESD) segment dominated the market in terms of revenue in 2022. However, the Turbomachinery Control (TMC) Systems segment is anticipated to grow at the fastest CAGR during the forecast period.

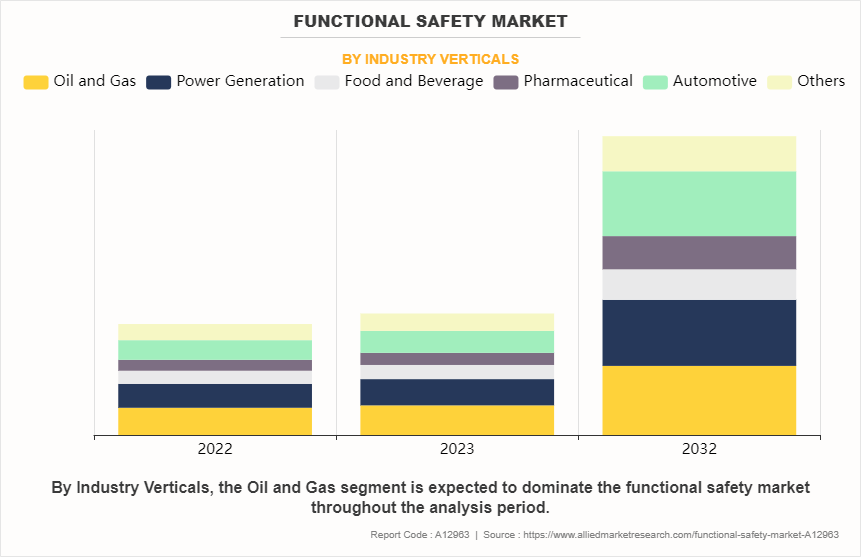

By industry vertical, the oil and gas segment held the largest share in 2022. However, the automotive segment is anticipated to grow at the fastest CAGR during the forecast period.

Region-wise, North America held the largest market share in 2022. The U.S. dominates the functional safety market size by country in the North America region. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

Market Dynamics

Regulatory compliance is driving the functional safety market

An increase in strict standards and regulations imposed by regulatory bodies across various industries regarding safety is a significant driver for functional safety market growth. As industries face a complex web of regional and international safety standards, the need for systems and solutions that can ensure compliance while maintaining operational efficiency has become important. Functional safety systems are designed to mitigate risks to acceptable levels by automatically taking corrective actions in response to identified hazardous events. These systems are essential in industries where safety and compliance are critical, such as pharmaceuticals, oil and gas, automotive, and manufacturing. By implementing functional safety measures, companies can not only protect their employees and assets but also avoid costly downtime and penalties for non-compliance. This is particularly relevant under the functional safety ISO 26262 standard, which addresses automotive safety.

For instance, in July 2022, ABB Ltd. and SKF announced a memorandum of understanding to explore potential collaborations in automating manufacturing processes. In this strategic partnership, ABB Ltd. and SKF intend to leverage their respective strengths and resources through collaboration to improve production efficiency and safety. Such collaborations highlight the industry's move towards integrating advanced safety solutions into manufacturing and other processes to meet stringent safety standards while improving operational efficiency.

High Implementation costs are restraining market growth

The functional safety market faces a significant constraint due to the substantial expenses involved in implementing safety measures. These costs include various aspects such as hardware upgrades, software development, employee training, and certification processes. For companies operating in industries where functional safety is paramount, such as automotive, aerospace, and manufacturing, these expenses can pose a considerable barrier to entry or expansion. The necessity to comply with stringent safety standards further amplifies these financial burdens, hindering some businesses from fully adopting functional safety protocols.

For instance, in January 2023, Tesla, the electric vehicle manufacturer, encountered challenges related to the high implementation costs of functional safety measures. As reported by Reuters, Tesla announced a delay in the release of its highly anticipated autonomous driving features due to the need for additional safety testing and refinement. The company cited the substantial investments required to ensure the reliability and safety of its autonomous driving systems, highlighting the financial constraints associated with implementing extensive functional safety measures. This delay highlights the significant impact that high implementation costs have on the development and deployment of advanced safety technologies in the automotive industry.

Emerging markets create opportunities in the functional safety market

The functional safety market presents notable opportunities in emerging markets characterized by rapid industrial modernization and the adoption of advanced technologies. As industries in these regions strive for greater efficiency, productivity, and safety standards, there is a growing demand for functional safety solutions to ensure the reliability and integrity of critical systems. Emerging economies, particularly in Asia and parts of Africa, are witnessing substantial investments in infrastructure, manufacturing, and transportation sectors, driving the need for robust safety measures to minimize operational risks and maintain regulatory compliance.

In January 2023, Huawei, the Chinese multinational technology company, announced its entry into the functional safety market, targeting emerging markets with its innovative solutions. According to a report by CNBC, Huawei introduced a range of functional safety products and services customized to meet the specific requirements of industries undergoing rapid digital transformation in regions such as Southeast Asia and Africa. Utilizing its expertise in telecommunications and information technology, Huawei aims to address the evolving safety needs of emerging markets, tapping into the growing demand for reliable safety solutions due to increasing industrialization and technological advancement. This strategic move highlights the significant growth potential that emerging markets offer for functional safety providers looking to expand their global footprint and capitalize on new business opportunities.

Segments Overview

The functional safety market is segmented based on device type, safety system, industry vertical, and region.

Based on device type, the functional safety market is segmented into safety controllers/modules/relays, programmable safety systems (PSS), safety sensors, emergency stop devices, final control elements (valves, actuators), and others. In 2022, the safety sensors segment dominated the functional safety market, holding the largest market share and exhibiting the highest CAGR during the forecast period. This growth is primarily driven by the increase in demand for features like autonomous vehicles and advanced driver-assistance systems, which rely heavily on safety sensors.

Based on safety systems, the functional safety market is classified into emergency shutdown systems (ESD), burner management systems (BMS), high-integrity pressure protection systems (HIPPS), turbomachinery control (TMC) systems, fire and gas monitoring control systems, and supervisory control and data acquisition (SCADA) systems. In 2022, the emergency shutdown systems (ESD) segment dominated the functional safety market size in terms of revenue due to stricter regulations and a growing focus on safety in industries with high-risk environments like oil & gas and nuclear power. Moreover, the Turbomachinery Control (TMC) Systems segment is projected to manifest the highest CAGR during the forecast period, owing to an increase in demand for efficient and optimized power generation across industries.

Based on industry verticals, the functional safety market is fragmented into oil and gas, power generation, food and beverage, pharmaceutical, automotive, and other industries. In 2022, the oil and gas segment dominated the functional safety industry in terms of revenue due to strict regulations and high-risk environments in the oil and gas industry. However, the automotive segment is projected to witness the fastest CAGR during the forecast period, owing to an increase in the adoption of autonomous vehicles and ADAS features, which are expected to drive the fastest growth in the automotive functional safety market.

Based on region, the functional safety market is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), Latin America (Brazil, Chile, Argentina, rest of Latin America ), and Middle East & Africa (UAE, Saudi Arabia, South Africa, rest of MEA). North America held the largest market share in the functional safety market in 2022 due to its advanced technological infrastructure and stringent regulatory compliance standards. However, Asia-Pacific is poised to witness the fastest CAGR during the forecast period, owing to rapid industrialization, an increase in automation investments, and a growing emphasis on workplace safety regulations.

Top Impacting Factors

The functional safety market is significantly influenced by several factors. Major drivers include stringent regulatory norms, the increasing adoption of automated systems across various industries, and the rising demand for safety systems in the automotive sector. These factors collectively push for higher standards and the adoption of functional safety solutions. A major restraint is the high cost of implementing functional safety systems, which can hinder market growth, especially in emerging economies. However, the market sees a significant opportunity in the integration of AI and IoT technologies, which can enhance the efficiency and reliability of safety systems. As for Functional Safety Market Statistics and Functional Safety Growth Projections, the market is expected to grow steadily, driven by the expanding scope of industries adopting safety-related systems. The ISO 26262 Standard plays a pivotal role by providing guidelines specifically for the automotive industry, enhancing the adoption of Functional Safety ISO 26262 protocols. Overall, these elements contribute to a dynamic and evolving functional safety market landscape.

Competitive Analysis

The functional safety market insights report highlights the highly competitive nature of the functional safety market, owing to the strong presence of existing vendors. Vendors with extensive technical and financial resources are expected to gain a competitive advantage over their counterparts by effectively addressing functional safety market demands. The competitive environment in this market is expected to increase as product launches and product expansion kind of strategies are adopted by key vendors. Competitive analysis and profiles of the major functional safety companies that have been provided in the report include Rockwell Automation Inc., Emerson Electric Company, Honeywell International Inc., Yokogawa Electric Corporation, ABB Ltd., Siemens AG, Schneider Electric SE, General Electric Company, Mitsubishi Electric Corporation, and Omron Corporation.

Recent Developments in the Functional Safety Industry

According to the functional safety market overview, Rockwell Automation Inc. leads the functional safety market share by company, followed closely by Emerson Electric Company, Honeywell International Inc., Yokogawa Electric Corporation, and ABB Ltd., respectively. The leading functional safety companies are adopting strategies such as product launches and product expansion to strengthen their market position.

In October 2022, Emerson launched its PlantWeb digital ecosystem. This innovative ecosystem integrates the AspenTech portfolio of asset-optimizing software, which harnesses the power of industrial artificial intelligence. This strategic move positions Emerson as a leader in the industry, offering one of the most comprehensive digital transformation portfolios available.

In September 2022, Yokogawa Electric Corporation announced the acquisition of Votiva Singapore Pte Ltd, a Southeast Asian IT consultant offering services for deploying software for enterprise resource planning (ERP) as well as customer relationship management (CRM).

In July 2022, ABB Ltd. signed a memorandum of understanding (MoU) with SKF to investigate the potential for cooperation in the automation of the manufacturing process. Under this MoU, both companies will be working together to find and assess solutions for enhancing production capabilities and supporting the increased production efficiency of the clients.

Report Coverage & Deliverables

This report delivers in-depth insights into the functional safety market, covering device type, safety system,m and industry verticals employed by major players. It offers detailed market forecasts and emerging trends.

Device Type Insights

Safety sensors dominate due to their critical role in monitoring and ensuring safe operations. Programmable safety systems are gaining traction, especially in automated industries, for flexible control. Safety Controllers/Modules/Relays and emergency stop devices are essential for real-time hazard detection and prevention. Final control elements like valves and actuators are vital for executing safety functions, with a growing demand in process industries.

Safety System Insights

The emergency Shutdown Systems (ESD) segment dominates the functional safety market, driven by its critical role in preventing hazardous incidents, particularly in industries like oil & gas and chemical processing. Burner Management Systems (BMS) and High-Integrity Pressure Protection Systems (HIPPS) are essential for safety in energy sectors. Turbomachinery Control (TMC), Fire and Gas Monitoring, and SCADA systems are increasingly adopted for enhanced operational safety and control.

Industry Verticals Insights

The oil and gas sector leads the functional safety market due to stringent safety regulations and high-risk operational environments, driving demand for emergency shutdown systems (ESD) and fire and gas monitoring. The power generation and automotive sectors follow, with increasing automation and safety standards. The food & beverage and pharmaceutical industries are also adopting functional safety systems for compliance and efficiency.

Regional Insights

North America leads the functional safety market, driven by advanced industrial automation and strict safety regulations. Europe follows, with strong demand from the automotive and manufacturing sectors. The Asia Pacific region is rapidly growing due to industrialization, particularly in China and India. Latin America and the Middle East & Africa show steady growth, fueled by expanding oil & gas projects.

Key Benefits for Stakeholders

The market report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the functional safety market from 2022 to 2032 to identify the prevailing market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

An in-depth analysis of the market segmentation assists in determining the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes an analysis of the regional as well as global functional safety market trends, key players, market segments, application areas, and market growth strategies.

Functional Safety Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 14.7 billion |

| Growth Rate | CAGR of 10.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Device Type |

|

| By Safety System |

|

| By Industry Verticals |

|

| By Region |

|

| Key Market Players | ABB Ltd., Emerson Electric Company, Omron Corporation., General Electric Company, Mitsubishi Electric Corporation, Honeywell International Inc., Siemens AG, Yokogawa Electric Corporation, Rockwell Automation Inc., Schneider Electric SE |

Analyst Review

The functional safety market has experienced significant growth and evolution in recent years, driven by growing safety concerns across diverse industries including automotive, manufacturing, oil and gas, and healthcare. This market includes a wide range of safety-related products, services, and solutions designed to prevent accidents, ensure operational integrity, and meet stringent regulatory standards.

One notable trend in the functional safety market is increase in the integration of advanced technologies such as artificial intelligence (AI), machine learning, and IoT (Internet of Things). These technologies enable the development of sophisticated safety systems capable of real-time monitoring, predictive maintenance, and autonomous decision-making, thereby enhancing overall safety performance. Furthermore, the rise in the adoption of functional safety standards such as ISO 26262 in the automotive industry and IEC 61508 across various sectors is propelling the demand for compliant solutions and services.

The functional safety market presents significant opportunities for expansion, particularly in emerging regions and niche application areas. With the rapid industrialization and infrastructure development observed in regions such as Asia-Pacific, there is rise in demand for robust safety solutions to mitigate risks and ensure operational continuity. In addition, rise of Industry 4.0 and the widespread adoption of intelligent technologies create new opportunities for incorporating functional safety systems, particularly in sectors such as smart manufacturing, autonomous vehicles, and healthcare automation.

North America emerges as the highest revenue-generating region in the functional safety market, driven by stringent regulatory frameworks, technological innovation and presence of key industry players. The region's emphasis on workplace safety, coupled with the strong adoption of advanced safety technologies in sectors such as automotive, aerospace, and oil and gas, significantly contributes to the market growth. However, Asia-Pacific emerges as the highest growing region in the functional safety market, owing to rapid industrialization, infrastructure development, and rise in awareness regarding safety standards and regulations, particularly in countries such as China, India, and Japan.

The top 10 key players in the functional safety market, including Rockwell Automation Inc., Emerson Electric Company, Honeywell International Inc., Yokogawa Electric Corporation, ABB Ltd., Siemens AG, Schneider Electric SE, General Electric Company, Mitsubishi Electric Corporation, and Omron Corporation, dominate the market with their extensive product portfolios, technological expertise, and global presence. These players actively engage in strategic initiatives such as product launches, acquisitions, and agreements to strengthen their market position and cater to evolving customer needs.

The industry size of Functional Safety is estimated to be $5.5 billion in 2022.

The Functional Safety Market is expected to grow at a CAGR of 10.5% during the period of 2023 to 2032.

The largest regional market for functional safety is North America.

Rockwell Automation Inc., Emerson Electric Company, Honeywell International Inc., Yokogawa Electric Corporation, ABB Ltd. are the top companies to hold the market share in Functional Safety.

The leading application of the functional safety market is in the automotive industry.

Loading Table Of Content...

Loading Research Methodology...