Gluten-free Pasta Market Outlook - 2025

The global gluten-free pasta market was valued at $909.8 million in 2017 and is projected to reach $1,289.2 million by 2025, growing at a CAGR of 4.5% from 2018 to 2025.

As of 2017, about 40 million population was known to be gluten-sensitive or gluten intolerant in the U.S., whereas approximately 70 million of the population was known to suffer from wheat intolerance in Europe. Therefore, these consumers prefer food products with no gluten content. This eventually triggers the demand for various gluten-free products including gluten-free pasta. According to the World Health Organization (WHO), food intolerance and sensitivities affect approximately 1-2% of the global population. WHO also reveals growing prevalence of celiac disease. Over the past two decades, there has been a rise in the number of consumers having intolerance to various food products such as dairy, meat, soy, as well as gluten, which has provided immense opportunities for the manufacturers of various free-from foods to gain higher revenues and share in the global market. Consumers with food intolerance are very conscious about their food intake. Various key food manufacturers strategize on coming up with free-from food products that cater to the requirement of food intolerant consumers owing to the growth in concern of the consumers about the ingredients in the food. Gluten-free pasta is one of these which eventually triggers gluten-free pasta market growth in terms of value sales.

Similarly, rise in concerns over celiac disease has been another critical factor that drives the growth of the gluten-free pasta market. Celiac is an autoimmune disorder where the parts of small intestine are damaged or destroyed by the immune system due to reaction from gluten ingestion. According to Agriculture and Agri-Food Canada, around 3 million American consumers are reported to suffer from celiac disease; whereas, in Europe 11 million people are suffering from celiac disease. Moreover, the prevalence of celiac disease is said to have higher probability in major parts of Asia-Pacific including India, China, Australia, and New Zealand. Food manufacturers focus on the introduction of gluten-free formats for their existing products, which cater to different requirements of the target customers due to the rise in number of celiac disease consumers. Thus, the pasta market endures a similar kind of trend. Some of the key European and North American countries that include Italy, Switzerland, Germany, France, and the U.S. experience an increase in the rate of pasta consumption. Therefore, the gluten-free pasta market forecast predicts North America and Europe to remain dominant regions during the study period.

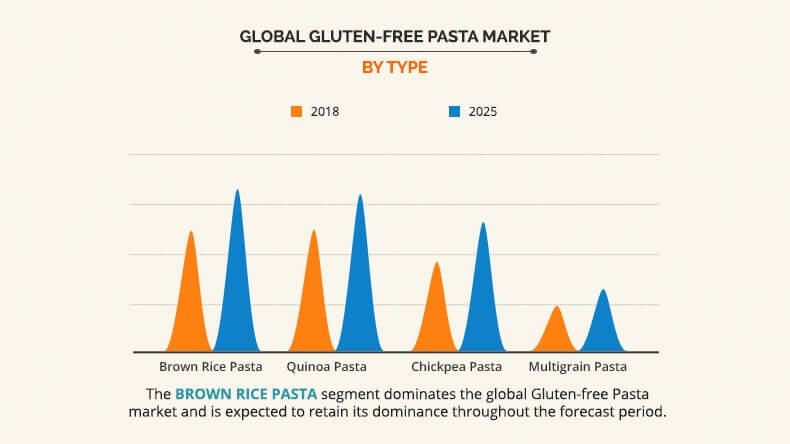

Based on product type, the gluten-free pasta market is segmented into brown rice pasta, quinoa pasta, chickpea pasta, and multigrain pasta. Among these, the brown rice pasta segment accounts for higher value gluten-free pasta market share. Brown rice pasta has mild flavor and chewy texture, which is considered as the potential substitute for traditional pasta dishes. It is one of the most popular gluten-free food products among consumers providing various types of health benefits altogether. Brown rice comprises of vitamins, minerals, and beneficial compounds, and thus, its consumption can help prevent or improve several health conditions, including diabetes and heart disease. This leads to an increase in demand from consumers suffering from celiac diseases as well as people adopting healthy lifestyle. Since the past couple of years, the global organic food and beverages market has been experiencing significant growth owing to rise in demand for various organic products. Therefore, some of the key manufacturers have strategized on coming up with organic formats of brown rice pastas. For instance, in 2013, a U.S. based food company, Lundberg Family Farms launched a new line of organic brown rice pasta for the North American market. Thus, emergence of organic food products is an influential gluten-free pasta market trend in the future.

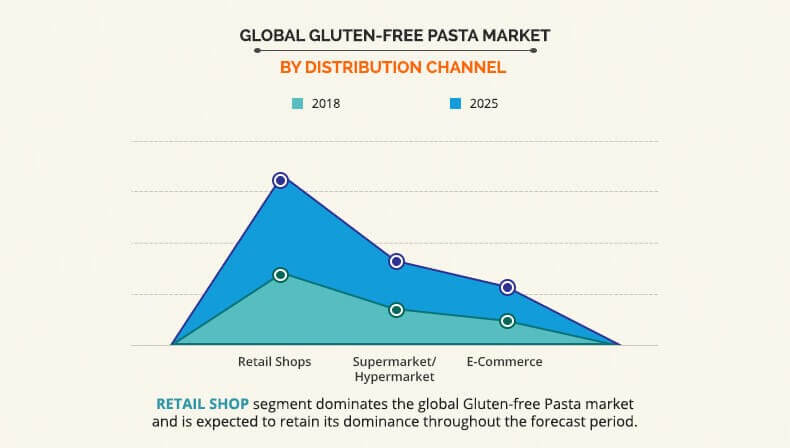

Based on the distribution channel, the gluten-free pasta market is segmented into retail shops, supermarket/hypermarket, and E-commerce. The retail shops sector comprises of various mortar-brick stores that range from specialty stores, independent stores to stand alone stores. Gluten-free pasta that is sold through various retail shops sectors has higher scope of gaining traction among the target customers. Specialty stores that specifically promote food products such as free-from products, organic products, and natural products provide a lot of opportunities for the growth of the gluten-free pasta market.

Based on region, the gluten-free pasta industry is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The Europe gluten-free pasta market has experienced growth owing to various factors. Nearly 11 million people in Europe suffer from celiac disease and a further 70 million people suffer from wheat intolerance, which leads to more number of consumers switching to gluten-free diet. It is estimated that around 135 million Europeans avoid wheat or self-diagnose as intolerant, which makes gluten sensitivity a major concern in Europe. On the other hand, Europe has witnessed an increase in number of health-conscious consumers, which results in more than 60% of the consumers opting for gluten-free products. Therefore, gluten-free pasta market size is expected to grow at a faster rate during the forecast period in Europe.

Key players profiled for global gluten-free pasta market in the report include AMI Operating Inc., Quinoa Corporation, H.J. Heinz Company L.P., Barilla G.E R. F. LLI S.P.A., RPs Pasta Company, DR. SCHR AG/SPA, Bionaturae LLC, Jovial Foods Inc., Pastificio Lucio Garofalo S.p.A., and Doves Farm Foods Ltd.

Key Benefits for Gluten-free Pasta Market:

- The report provides an extensive gluten-free pasta market analysis of the current and emerging market trends and opportunities.

- The report provides detailed qualitative and quantitative analysis of the current trends and future estimations that help evaluate the prevailing gluten-free pasta market opportunity.

- A comprehensive analysis of the factors that drive and restrict the growth of the gluten-free pasta market is provided.

- An extensive analysis of the market is conducted by following key product positioning and monitoring the top competitors within the market framework.

- The report provides extensive qualitative insights on the potential segments or regions exhibiting favorable growth.

Gluten-Free Pasta Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By DISTRIBUTION CHANNEL |

|

| By Region |

|

| Key Market Players | RP's Pasta Company, Doves Farm Foods Ltd, Jovial Foods, Inc, Bionaturae, LLC, Quinoa Corporation, Ebro Foods, S.A. Group (Ebro), The Hain Celestial Group, Inc. (Hain Celestial), Barilla G. e R. F.lli S.p.A. P.I, The Kraft Heinz Company (Heinz), Dr. Schär AG/SPA (Dr. Schär) |

Analyst Review

According to some of the leading gluten-free pasta manufacturers, the rise in number of celiac diseases patients and gluten-intolerant consumers drive the growth of the gluten-free pasta market especially in North America and Europe. In the recent past, companies strategize on evolving its product offering in terms of taste and texture. For some of the key regional players in the gluten-free pasta market, the emergence of private label manufacturers has been sighted as a major threat since they avail their gluten-free products at a comparatively lower price. The Asia-Pacific region paves opportunity for investment for some of the tier-I companies owing to rise in millennial population and surge in number of health-conscious customers.

Over the past couple of years, there has been rise in number of health-conscious consumers due to the increase in awareness about the various benefits associated with the adoption of a healthy lifestyle. These consumers seek food products, which are natural, and have minimal amount of sugar or fat, cutting down of carb, as well as gluten. This sustaining trend and preference for healthy food products among the target customers foster the demand for various free-from products such as dairy free products, vegan products, meat alternatives, as well as gluten-free products.

The global gluten-free pasta market was valued at $909.8 million in 2017 and is projected to reach $1,289.2 million by 2025

The global Gluten-Free Pasta market is projected to grow at a compound annual growth rate of 4.5% from 2018 to 2025 $1,289.2 million by 2025

Barilla G. e R. F.lli S.p.A. P.I, Ebro Foods, S.A. Group (Ebro), Jovial Foods, Inc, Doves Farm Foods Ltd, The Hain Celestial Group, Inc. (Hain Celestial), Dr. Schär AG/SPA (Dr. Schär), RP's Pasta Company, The Kraft Heinz Company (Heinz), Bionaturae, LLC, Quinoa Corporation

Europe

Rise in concerns over celiac disease has been another critical factor that drives the growth of the gluten-free pasta market

Loading Table Of Content...