Group Life Insurance Market Research, 2032

The global group life insurance market was valued at $127.6 billion in 2022, and is projected to reach $348.4 billion by 2032, growing at a CAGR of 10.7% from 2023 to 2032.

Group life insurance is an insurance policy offered by an employer or another large-scale organization, which includes an association or enterprise, to its workers or individuals. It is inexpensive, and in some cases, free for some employees, and is widely used throughout the country. This insurance is often provided at a low coverage amount as part of a larger employer or membership benefit package. Moreover, there is no need for a medical exam to receive this coverage, and it does not involve any individual underwriting.

A growth in understanding of the importance of financial stability and employee well-being has fueled the popularity of group life insurance, leading to an increase in adoption of these policies among organizations. Furthermore, legal assistance and tax benefits for employers offering group life insurance contribute to the growth of group life insurance industry. However, economic uncertainty limits market growth, which may lead some companies to cut costs, thereby reducing insurance coverage. Moreover, interest rate fluctuations can affect the return on investments of insurers and affect group life insurance product prices and benefits. Regulatory changes and compliance complexities further pose challenges for market players. On the contrary, technological advancements that speed up insurance operations, and the potential for product innovation to meet the diverse range of customer needs are expected to provide lucrative growth opportunities to the group life insurance market. The growth in digital transformation in the insurance industry creates a platform for enhanced client engagement and operational efficiency, opening avenues for group life insurance market growth.

The report focuses on growth prospects, restraints, and trends of the group life insurance market forecast. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the group life insurance market outlook.

Key Takeaways:

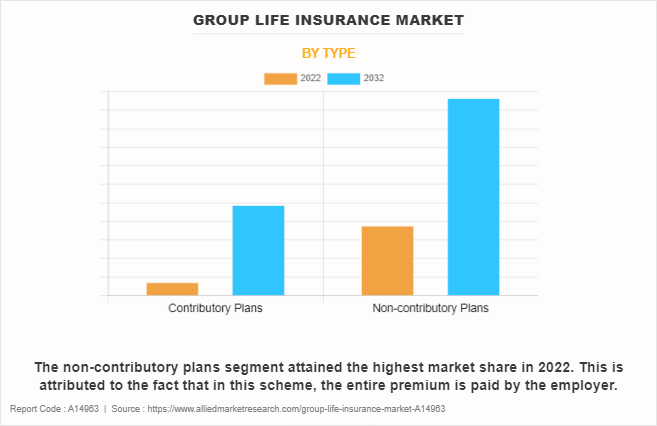

- By type, the non-contributory plans segment held the largest share in the group life insurance market in 2022.

- By enterprise size, the large enterprises segment held the largest share in the group life insurance industry in 2022.

- By distribution channel, the banks segment is expected to show the fastest market growth during the forecast period.

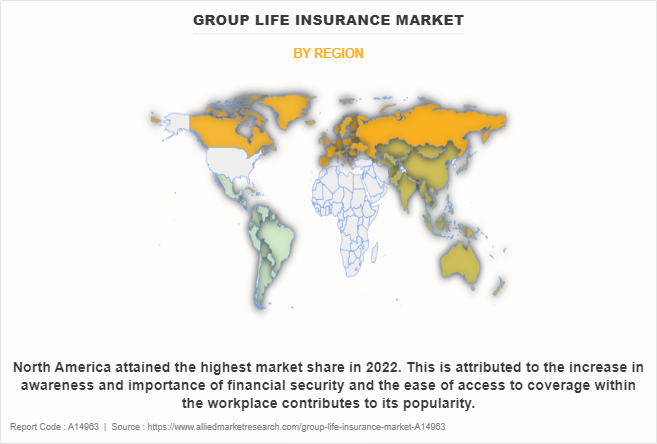

- Region-wise, North America held the largest market share in 2022. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

Segment Review

The group life insurance market is segmented into type, enterprise size, distribution channel, and region. On the basis of type, the market is bifurcated into contributory plans and non-contributory plans. On the basis of enterprise size, the market is bifurcated into large enterprises and small and medium-sized enterprises. On the basis of distribution channel, the market is categorized into direct sales, brokers/agents, banks, and others. On the basis of region, it is analyzed across North America (the U.S., and Canada), Europe (the UK, Germany, France, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), Latin America (Brazil, Argentina, and rest of Latin America), and Middle East and Africa (GCC Countries, South Africa, and rest of Middle East and Africa).

On the basis of type, the non-contributory plans segment acquired a major group life insurance market share in 2022. This is attributed to the fact that in this scheme, the entire premium is paid by the employer. However, the contributory plans segment is considered to be the fastest-growing segment during the forecast period. This is attributed to the fact that in this insurance policy, the premium is paid by both employer and employees covered in the scheme.

On the basis of region, North America dominated the group life insurance market in 2022, owing to the increase in awareness and importance of financial security and the ease of access to coverage within the workplace contributes to its popularity. However, Asia-Pacific is considered to be the fastest-growing region during the forecast period. This is attributed to the convenience of group policies, with simplified underwriting processes and cost-sharing benefits, attracting employers seeking to provide coverage for their workforce.

Competition Analysis

Competitive analysis and profiles of the major players in the group life insurance market include MetLife Services and Solutions, LLC, American International Group, Inc., Prudential Financial, Inc., Allianz, AXA SA, Zurich, The Manufacturers Life Insurance Company, Sun Life Assurance Company of Canada, Cigna Healthcare, and New York Life Insurance Company. These players have adopted various strategies to increase their market penetration and strengthen their position in the group life insurance industry.

Recent Partnerships in the Group Life Insurance Market

In June 2023, Pendella announced that its white-label life insurance offerings are available through Isolved, the provider of people cloud, an intelligently connected human resources, benefits, and payroll platform. Thousands of additional employees and their families get the option to purchase individual life insurance coverage in addition to their employer-provided group coverage policies with this partnership.

In May 2023, Max Life Insurance Company, a private life insurer, entered into a partnership with the Indian Industries Association (IIA) to provide life insurance plans to the MSME sector’s workforce in Uttar Pradesh (UP), India.

Recent Geographical Expansion in the Group Life Insurance Market

In October 2022, YuLife, the tech-driven financial services brand on a mission to inspire life, announced its launch in the U.S. YuLife achieved rapid traction in the UK insurance market through its flagship product, group life insurance. The expansion of the company into the U.S. seeks to redefine how people around the world derive value from financial products.

Recent Product Launch in the Group Life Insurance Market

In July 2021, Leading life insurer Pru Life UK formed a partnership with AstraZeneca, the global biopharmaceutical developer; Avega, the leader of country in healthcare administration; and Intellicare, preeminent Health Maintenance Organization (HMO) of the country, to offer a group insurance package for more companies and their employees.

Recent Acquisition in the Group Life Insurance Market

In June 2021, New York Life acquired group life, accident and disability insurance business of Cigna. The new business was renamed New York Life Group Benefit Solutions and operates within portfolio of strategic businesses of New York Life, which includes group membership associations, institutional annuities, institutional life, New York Life Direct, and Seguros Monterrey New York Life, and others.

Market Landscape and Trends

According to Trondent Development Corp., the U.S. and China are the biggest business travel spenders of the world. Americans make more than 405 million long-distance business trips per year, indicating that approximately 1.1 million people are traveling for business every day in the U.S. The Big Apple, New York City, is the most common business travel destination, though the fastest-growing business travel destination is Shanghai.

In addition, key players in the North America region invest and establish new initiatives to attract customers and generate revenue. For instance, in December 2020, New York Life, the largest mutual life insurer of America, acquired group life, accident of Cigna, and disability insurance business.

Top Impacting Factors

Growth in importance of financial stability and employee well-being

The dynamic nature of the modern workplace has resulted in a paradigm shift, emphasizing the fundamental significance of financial stability and employee well-being. They increasingly acknowledge that building an environment of financial security is essential for attracting and retaining employees as firms recognize the link between employee satisfaction and overall productivity.

Group life insurance is a multifaceted solution that provides financial security for employees and their families while also contributing to robust employee benefit packages. Employers who are aware of the competitive talent market have employed group life insurance to recruit and keep skilled employees. In addition, the COVID-19 pandemic has heightened the awareness of the importance of budgeting and security, increase in the demand for comprehensive employee benefits.

Technological advancements

The integration of AI and advanced data analytics is streamlining the underwriting process, allowing insurers to assess risk more accurately and efficiently. This expedites policy issuance as well as enables insurers to offer more personalized group life insurance plans tailored to the specific needs of diverse customer groups. Furthermore, advancements in wearable technology and health monitoring devices enable insurers to access real-time data on policyholders, fostering a proactive approach to health management. This benefits policyholders by promoting healthier lifestyles as well as allowing insurers to adjust premiums based on individual health metrics, creating a more dynamic and responsive insurance landscape.

In addition, the adoption of blockchain technology enhances the transparency and security of transactions within the group life insurance market. Smart contracts, enabled by blockchain, automate claims processing and payouts, reducing administrative costs and minimizing the potential for fraud. This increased efficiency translates into quicker and more reliable services for policyholders. Moreover, the use of big data analytics facilitates a deeper understanding of group dynamics and risk factors, enabling insurers to develop innovative products and pricing strategies. The group life insurance market size is poised for sustained growth, driven by increased accessibility, enhanced risk assessment capabilities, and the overall improvement of customer experience in the insurance sector as technological advancements continue to evolve.

Interest rate fluctuations

The group life insurance market faces significant challenges as a result of interest rate fluctuations, which limits its growth trajectory. Insurers find it difficult to generate sufficient returns on their investment portfolios, which are frequently heavy on fixed-income securities when interest rates are low. This diminished investment income can force insurers to raise premiums to maintain profitability, making group life insurance less appealing to potential customers. Furthermore, low-interest rates affect the pricing and value of insurance products, resulting in lower profit margins for insurers, which, in turn, limits their ability to expand and innovate within the market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the group life insurance market analysis from 2022 to 2032 to identify the prevailing group life insurance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- The Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the group life insurance market segmentation assists to determine the prevailing group life insurance market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as group life insurance market trends, key players, market segments, application areas, and market growth strategies.

Group Life Insurance Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 245 |

| By Type |

|

| By Enterprise Size |

|

| By Distribution Channel |

|

| By Region |

|

Analyst Review

Group life insurance costs vary depending on the employer, the life insurance company, and the characteristics of the group, such as the average age of employees. The average cost of group life insurance purchased through an employer is usually quite low. For instance, the group life insurance of Walmart, one of the largest companies in the U.S., gives full-time employees company-paid life insurance equal to their annual pay, up to $50,000. Beyond this, hourly associates can pay up to $200,000 in group life insurance, while salaried associates and drivers can pay for up to $1 million in coverage.

Key players in the group life insurance market adopt partnership, acquisition, and product launch as their key development strategy to sustain their growth in the market. For instance, in December 2023, LexisNexis Risk Solutions, a leading data, analytics, and technology provider, announced the availability of LexisNexis Risk Classifier for the supplemental group life insurance market. The advanced solution optimizes the supplemental group life underwriting process, providing insurers with a risk score that corresponds to risk profile of an insured rather than invasive requirements, making the application process easier and faster to help ensure more consumers are able access the life insurance they need. Therefore, such strategies adopted by key players propel the growth of the group life insurance market.

The COVID-19 pandemic acted as a catalyst for the group life insurance market. The pandemic highlighted the importance of financial planning, financial stability, and protection for employees. As a result, there has been a surge in demand for group life insurance policies, particularly term insurance plans, which offer a high amount of coverage at an affordable price. According to IRDAI data, the number of life insurance policies sold and the total amount of premiums collected have registered a year-on-year (y-o-y) increase in June 2022, compared to the same month in the previous year.

The key players in the group life insurance market include MetLife Services and Solutions, LLC, American International Group, Inc., Prudential Financial, Inc., Allianz, AXA SA, Zurich, The Manufacturers Life Insurance Company, Sun Life Assurance Company of Canada, Cigna Healthcare, and New York Life Insurance Company. Major players operating in the market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. Major players have collaborated their product portfolio to provide differentiated and innovative products with an increase in awareness and rise in demand for group life insurance across the globe.

The size of the global group life insurance market was valued at $127.59 billion in 2022 and is projected to reach $348.38 million by 2032.

The key players operating in the global group life insurance market include MetLife Services and Solutions, LLC, American International Group, Inc., Prudential Financial, Inc., Allianz, AXA SA, Zurich, The Manufacturers Life Insurance Company, Sun Life Assurance Company of Canada, Cigna Healthcare, and New York Life Insurance Company.

Partnership, geographical expansion, product launch, and acquisition are the key strategies opted by the operating companies in this market.

Technological advancements that speed up insurance operations, and the potential for product innovation to meet the diverse range of customer needs is the upcoming trend in the global group life insurance market.

Loading Table Of Content...

Loading Research Methodology...