Human Identification Market Research, 2032

The global human identification market size was valued at $1.5 billion in 2022 and is projected to reach $3.7 billion by 2032, growing at a CAGR of 9.3% from 2023 to 2032. Human identification is defined as the branch of science, which is involved in the identification and authentication of individuals using various biometric technologies and systems. This technique is based on the distinguishing of ridges found on the fingers of the suspect because every human possesses unique formations and categorization of ridges. Human identification technology is mostly used in forensic laboratories for the analysis of blood, hair, DNA, skin, and teeth.

Market Dynamics

The human identification market size is expected to grow significantly, owing to technological advancement in human identification systems, a rise in funding from private and government organizations for forensic programs, and a surge in the number of crime cases.

Technological advancements play a crucial role in shaping the field of human identification systems, thus driving the human identification market growth. These advancements have revolutionized the way individuals are identified, enhancing security measures, and streamlining various processes. Every year, advancements in DNA profiling techniques and technologies continue to emerge. For instance, in May 2022, Promega launched a new Spectrum CE System, a new capillary electrophoresis instrument that supports future 8-color technology while maintaining compatibility with existing 5- and 6-color kits. This instrument offers forensic analysts unparalleled flexibility in processing samples through short tandem repeat (STR) analysis. It eliminates scheduling difficulties and accommodates chemistry from major vendors, introducing a new choice for capillary electrophoresis (CE) instruments to support the workflow of human identification in criminal casework and database cases.

Furthermore, the human identification market has experienced a significant rise in funding from both, private and government organizations, serving as a major driving force behind its growth. Governments across the globe have also recognized the critical importance of human identification systems in ensuring national security, public safety, and efficient service delivery. As a result, governments are actively investing in the development and implementation of advanced identification technologies. For instance, in 2022, the Department of Justice’s Office of Justice Programs (OJP) announced almost $160 million in grant awards to support crime laboratories, fund forensics research, decrease DNA backlogs, and help investigators locate missing persons and identify human remains. Furthermore, in 2021, the Department of Justice's Office of Justice Programs (OJP) granted awards totaling more than $210 million to fund crime laboratories, support research and help law enforcement identify missing persons.

Furthermore, in recent years, there has been a noticeable increase in criminal activities globally. With the rising number of crime cases, there is an urgent demand for reliable and rapid human identification techniques. Law enforcement agencies rely heavily on these technologies to solve crimes, identify suspects, and link individuals to criminal activities. As law enforcement agencies and security forces strive to combat these threats, the need for accurate and efficient methods of human identification has become paramount. For instance, As of July 2022, the Mexican government registered more than 101,300 cases of missing or disappeared persons. To tackle this situation the government of Mexico approved the proposal for the National Center for Human Identification, which is meant to search for those who have disappeared and help authorities properly handle and identify human remains.

However, the high cost of genomic instruments and the lack of skilled professionals and trained personnel are expected to act as significant restraints during the human identification market forecast. Genomic instruments such as DNA sequencers and other specialized equipment are crucial for human identification processes, including DNA profiling and analysis. These instruments are often expensive to acquire, maintain, and operate. The cost of genomic instruments can be a barrier for many laboratories and organizations involved in human identification, particularly smaller or resource-limited institutions. Human identification techniques involve complex procedures, including DNA extraction, amplification, sequencing, and data analysis. Skilled professionals are required to perform these tasks accurately and efficiently. Without skilled and trained personnel, the instruments may not be utilized to their full potential, leading to suboptimal performance and results. The lack of trained personnel can restrict the scalability of human identification operations and hinder the adoption of new technologies or methodologies.

The COVID-19 pandemic had negative impacts on the human identification industry, particularly concerning DNA analysis techniques. One significant challenge has been the disruption of forensic DNA analysis processes and casework. The pandemic caused delays and backlogs in forensic laboratories, as social distancing measures and reduced staffing have affected their operational capacity. This resulted in a slowdown in DNA analysis, leading to prolonged waiting times for results and affecting the timely resolution of criminal cases. In addition, the pandemic impacted the use of DNA analysis in other areas, such as paternity testing and genealogy services. Social distancing measures and limited availability of testing facilities led to delays and disruptions in conducting these tests. Families seeking paternity verification or individuals interested in tracing their ancestry experienced setbacks and prolonged waiting times for results. In the post-pandemic phase, the market has recovered significantly, owing to the rise in demand for DNA analysis and rise in the crime rates.

Segments Overview

The human identification market is segmented on the basis of product, technology, application, end users, and region. On the basis of the product, the market is categorized into instruments, assay kits and reagents, and software. The instruments segment is further classified into polymerase chain reaction instruments, capillary electrophoresis instruments, next-generation sequencing instruments, and others. The others include microarray, rapid DNA analysis, automated liquid handling, and nucleic acid isolation and purification instruments. By applications, the market is categorized into forensic applications, paternity identification, and others. The other applications include population genetics, anthropology application, identification of crime related to human trafficking, and disaster victim identification. On the basis of end users, the market is categorized into forensic laboratories and research centers and academic and government institutes. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

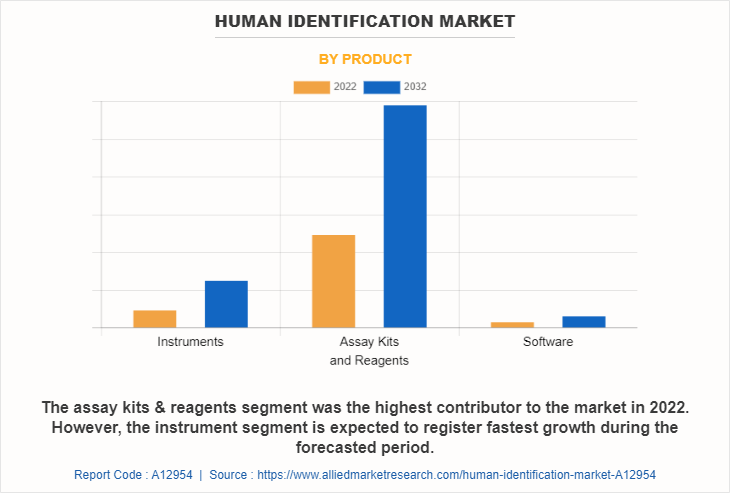

By Product

The human identification industry is categorized into instruments, assay kits and reagents, and software. The instrument segment is further classified into polymerase chain reaction instruments, capillary electrophoresis instruments, next-generation sequencing instruments, and others. The others include microarray, rapid DNA analysis, automated liquid handling, and nucleic acid isolation and purification instruments. The assay kits and reagents segment was the largest revenue contributor to the market in 2022 and is expected to remain dominant during the forecasted period, owing to wide applications of assay kits and reagents in forensic investigation and forensic research.

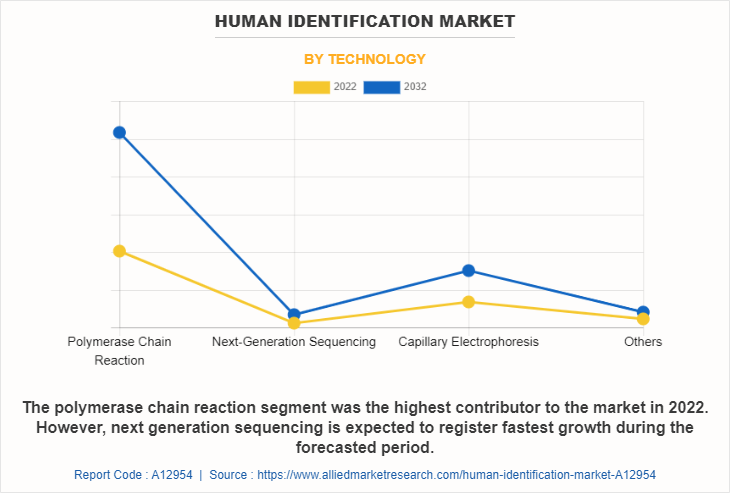

By Technology

On the basis of technology, the market is categorized into polymerase chain reaction, next-generation sequencing, capillary electrophoresis, and others. The polymerase chain reaction segment dominated the market in 2022 and is expected to continue this trend during the forecast period. This is attributed to high sensitivity of PCR technology facilitating accurate analysis even with small fraction of DNA sample.

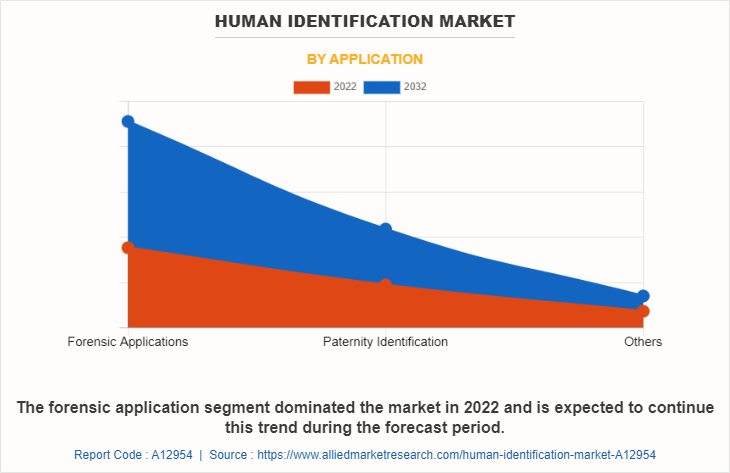

By Application

On the basis of applications, the market is categorized into forensic applications, paternity identification, and others. The other applications include population genetic, anthropology application, identification of crime related to human trafficking, and disaster victim identification the forensic applications segment dominated the market in 2022 and is expected to remain dominant during the forecasted period. This is attributed to rise in forensic investigation due to high crime rate.

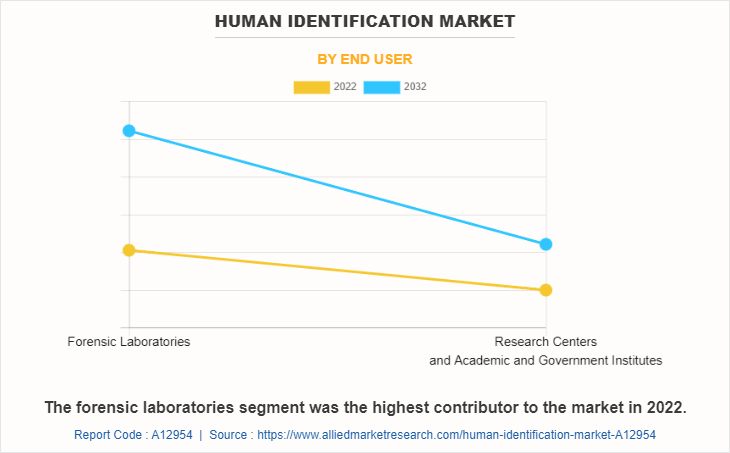

By End User

On the basis of end user, the market is categorized into forensic laboratories and research centers and academic and government institutes. The forensic laboratory segment has largest human identification market share in 2022 and is expected to remain dominant throughout the forecast period, owing to rise in the number of forensic laboratories and government funding’s to establish forensic laboratories.

By Region

On the basis of region, the human identification market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. On the basis of region, North America has the highest human identification market share in 2022, and is expected to maintain its lead during the forecast period, presence of major key players, rise of funds from government and private organization, growing support for the development of forensics, and advancements in technology for forensic science in the region. However, Asia-Pacific is expected to exhibit fastest growth during the forecast period, owing to increase in number of crime cases, rise in awareness about forensic technology, and increase in demand for DNA analysis.

Competitive Analysis

Competitive analysis and profiles of the major players in the human identification market, such as Bio-Rad Laboratories, Inc., Hamilton Company, Promega Corporation, Qiagen N.V., Thermo Fisher Scientific Inc, Carolina Biological Supply Company, Genetek Biopharma GmbH, SecuriGene Technologies Inc, AutoGen INC, InnoGenomics Technologies. Major players have adopted agreement, partnership, and acquisition, and product approval as key developmental strategies to improve the product portfolio and gain strong foothold in the human identification market.

Recent Agreement in the Human Identification Market

- In April 2021, AutoGen Inc. and Isohelix entered into a supply agreement. The new agreement sees Isohelix GeneFix Saliva DNA and RNA Collection Devices integrated into AutoGen FlexSTAR DNA extraction workflows.

Recent Partnership in the Human Identification Market

- In June 2021, Qiagen N.V. announced a commercialization partnership with Verogen that is expected to provide customers of both companies with superior tools and comprehensive support for the human identification (HID) workflows in their laboratories.

Recent Acquisition in the Human Identification Market

- In June 2023, Qiagen N.V. announced it has completed the acquisition of Verogen, a leader in the use of next-generation sequencing (NGS) technologies to drive the future of human identification (HID) and forensic investigation.

- In April 2022, Bio-Rad Laboratories, Inc. announced that it has reached an agreement to acquire all of the outstanding shares of Curiosity Diagnostics. Curiosity Diagnostics, a late-stage, pre-commercial platform company, is in the process of developing a sample-to-answer, rapid diagnostics PCR system for the molecular diagnostics market.

Recent Product Approval in the Human Identification Market

- In June 2023, Qiagen announced that the U.S. Federal Bureau of Investigation (FBI) approved its ForenSeq MainstAY workflow.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the human identification market analysis from 2022 to 2032 to identify the prevailing human identification market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the human identification market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global human identification market trends, key players, market segments, application areas, and market growth strategies.

Human Identification Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 3.7 billion |

| Growth Rate | CAGR of 9.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 350 |

| By Product |

|

| By Technology |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | InnoGenomics Technologies, AutoGen Inc., Promega Corporation, Hamilton Company, SecuriGene Technologies Inc., Carolina Biological Supply Company, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc. , Qiagen N.V, Genetek Biopharma GmbH |

Analyst Review

Growth of the human identification market is attributed to factors such as rise in the number of criminal cases and human trafficking, increase in funds from private and government organizations for forensic research activities, and surge in demand for the advanced analytical system.

The human identification market gains interest from forensic laboratories and research centers, owing to surge in demand for polymerase chain reaction, next-generation sequencing, capillary electrophoresis, and DNA analysis for forensic investigation as well as research. This leads to increase in adoption of advanced technology by researchers to save time and cost for analysis of DNA. Moreover, the market has gained high traction due to the rise in government funds for research activities and initiative taken by government for forensic program. However, high costs associated with genomic instruments and lack of skilled professionals are anticipated to restrain the market growth during the forecast period.

Furthermore, North America witnessed highest growth in 2022, in terms of revenue, owing to presence of major key players, rise of funds from government and private organization, growing support for the development of forensics, and advancements in technology for forensic science in the region. However, Asia-Pacific is expected to exhibit the fastest growth during the forecast period, owing to increase in the number of crime cases, rise in awareness about forensic technology, surge in number of conferences and workshops, growth in demand for DNA analysis, and rise in the number of research centers.

North America is the largest regional market for human identification owing to rise in number of crime and strong presence of key players.

The forcast period for human identification market is 2023 to 2032

The base year is 2022 in human identification market.

The estimated industry size of human identification in 2032 is $3,705.38 million.

Top companies such as QIAGEN, Thermo Fisher Scientific, Promega Corporation, and Bio-Rad Laboratories held high market share in 2022.

Rise in use of human identification techniques for criminal identification, rise in government initiative and funds for forensic laboratories, rise in the number of instances of identity theft and fraud are the factors responsible for the market growth.

The polymerase chain reaction segment is the most influencing segment owing to high accuracy offered by PCR segment and large number of PCR-based products offered by key players.

Asia-Pacific is expected to experience the growth rate of 11.1% during the forecast period, owing to rise in government funding’s to establish forensic centers and increased interest of youth towards forensic education.

Loading Table Of Content...

Loading Research Methodology...