Humidifiers Market Research, 2032

The Global Humidifiers Market size was valued at $3 billion in 2022, and is projected to reach $5.6 billion by 2032, growing at a CAGR of 6.6% from 2023 to 2032.

A humidifier is an air conditioning appliance that increases the moisture level of air in a room or an entire building. Humidifiers are available for commercial, industrial, institutional buildings, shopping complexes, and others. In addition, for the humidification of a single room residential humidifiers are used, while to provide humidity to the entire house, the furnace or whole-house humidifiers are connected to HVAC system of a home.

Humidifiers Market Dynamics

Increase in diseases such as asthma, sinusitis, and other allergies owing to dry air have created awareness among customers to maintain specific humidity in the air by using humidifier appliances. Moreover, low humidity causes discomfort in homes in winter seasons and when air conditioners are used during the summer season. For instance, in an article published by Medical News Today in February 2023, tips to prevent or reduce eye strain suggested using a humidifier in a room to reduce dry eye syndrome, using eye drops, using glasses, and other tips. Therefore, these are the health-related factors that are expected to drive the humidifiers industry during the forecast period.

In addition, smart connected humidifier via smartphone for the residential sector is expected to further boost the humidifier market growth. Rise in industrialization and growth in concerns regarding a healthy work environment are expected to boost the adoption of humidifiers in the industrial sector such as healthcare, pharmaceuticals, and automotive. In addition, there has been a rise in construction of residential and commercial buildings such as shopping malls, hospitals, schools, and others are across the world. For instance, as of January 2023, a well-known building developer ‘Triple Five Group’ planned to construct the American Dream Mall near Everglades National Park in Florida. Such factors are expected to drive the humidifiers market growth.

Moreover, governments of different countries have made efforts to safeguard the workplace by imposing norms, rules, and regulations for the comfort of workers and employees, especially in the industrial sector. For instance, in July 2023, the Occupational Safety and Health Administration (OSHA) stated that office temperature and humidity are matters of human comfort. OSHA recommends temperature control in the range of 68° F to 76° F range and humidity control in the range of 20% to 60%. This helps prevent fatigue as well as dry air diseases among workers and provides a healthy work environment. In addition, these regulations are also followed by other countries with certain modifications according to the suitable temperature and atmosphere.

In order to prevent the spread of airborne infections, humidifiers must undergo routine maintenance because mold development is common on their interior parts, including the fans, filters, and other hardware. If they are not properly maintained or cleaned, humidifiers cause sickness in the home and pose a health risk. As a result, the humidifier market is expected to be hampered by the growth of molds and other bacteria throughout the forecast period.

The development of innovative technologies by key players, including humidity level controllers and automated shutdown, as well as the conceptualization of remote controlling systems via smartphones, are anticipated to significantly contribute to the expansion of the humidifiers market during the course of the projected year. Key market competitors have concentrated on new product launches as a strategy for business expansion. For instance, Xiaomi introduced a Smart Humidifier 2 in August 2022 with UV-C sterilization and purification for improved comfort. The humidifier has a 4.5 L tank and can produce 350 ml of mist each hour. The humidifier offers one-touch control technology, smart humidity control, can be operated remotely via the Mi Home app. Such trends are expected to drive the humidifiers market and offer lots of growth opportunities during the forecast period.

Humidifiers Market Segmental Overview

The humidifiers market is segmented on the basis of humidifier type, installation type, end user, and region. On the basis of humidifier type, the humidifier market is segmented into vaporizer humidifiers, ultrasonic humidifiers, and wick/evaporative humidifiers. On the basis of installation type, the market is further bifurcated into fixed humidifiers and portable humidifiers. On the basis of end user, the humidifier market is divided into residential, and commercial/industrial.

On the basis of region, the humidifier market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, the UK, Italy, France, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), LAMEA (Latin America, Middle East, Africa).

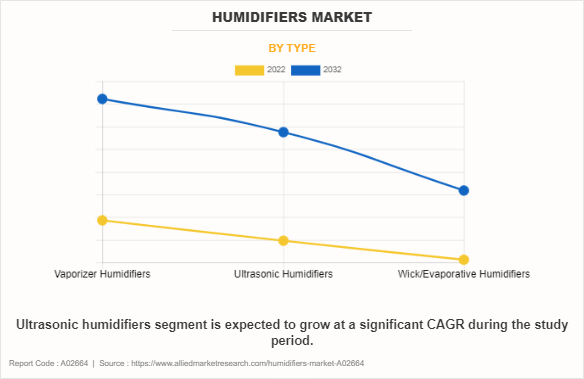

By Type:

The humidifiers market is divided into vaporizer humidifiers, ultrasonic humidifier, and wick/evaporative humidifiers. The vaporizer or warm mist humidifier heat the water and expels steam into the room to increase the humidity in the air. This humidifier is also widely used in residential applications mainly because it collects all the essential minerals in the water, which are good for moisturizing human cells. Ultrasonic cool mist humidifiers are best used to combat allergies and seasonal flu symptoms. The ultrasonic humidifier is used in laboratories, print work, and manufacturing facilities, such as electronics, warehouse, and other.

Users have increasingly switched to ultrasonic humidifiers for reasons of efficiency, lower maintenance cost, and cost efficient in operation as compared to other humidifiers. In evaporative systems mist is produced by blowing water through a wick filter with the use of a fan. Hot air goes through a wet filter causing an increase in humidity and decrease of temperature. The advantage of this kind of humidifier is that the wick filter ensures a pure and clean mineral-free moisture output. Moreover, fans are powerful enough to cover large areas with a single humidifier. The vaporizer humidifiers segment is expected to exhibit the largest revenue contributor during the forecast period. The ultrasonic humidifier segment is expected to exhibit the highest CAGR share in the type segment in the humidifiers market during the forecast period.

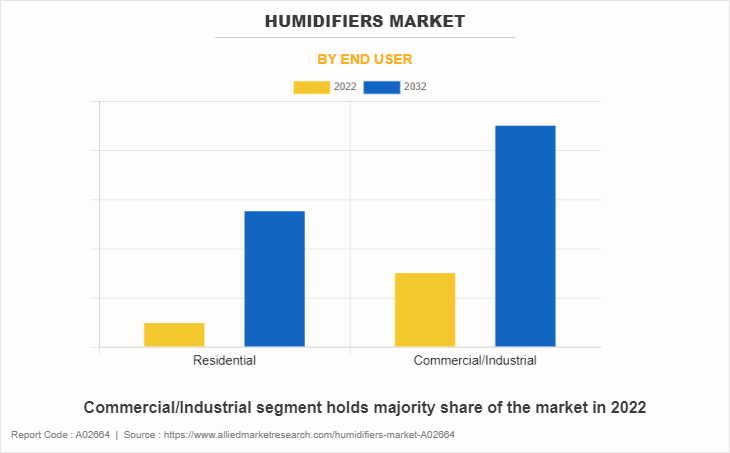

By End User:

The humidifiers market is divided into residential, and commercial/industrial. The humidifiers are used in warehouses, restaurants, malls, greenhouses, printing facilities automotive manufacturing, medical device manufacturing, packaging industries, and other commercial/industrial applications to maintain the humidity and improve productivity in many commercial and industrial end users. the residential humidifier segment consists of technology driven humidifiers such as smart connected humidifiers, which is expected to have positive impact on the growth of the global humidifiers market. The commercial/industrial segment is expected to be the largest revenue contributor during the forecast period, and the residential segment is expected to exhibit the highest CAGR share in the end user segment in the humidifiers market during the forecast period.

By Region:

The humidifiers market forecast is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, the UK, Italy, France, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), LAMEA (Latin America, Middle East, Africa). In 2022, Asia-Pacific had the highest revenue in humidifiers market share, and LAMEA is expected to exhibit the highest CAGR during the forecast period. Fixed humidifiers are preferred for industrial, commercial, or large-scale residential applications. A portable humidifier is a small, independent device made to raise the humidity levels in a particular space, usually a room or small area. These units are convenient for moving around and do not need to be permanently installed. The fixed humidifier segment is expected to be the largest revenue contributor during the forecast period, and the portable humidifier segment is expected to exhibit the highest CAGR share in the installation type segment in the humidifiers market during the forecast period.

Competition Analysis

The major players profiled in the humidifiers market Armstrong International, Inc., Condair Group, Honeywell International Inc., Koninklijke Philips N.V, Levoit, Mitsubishi Heavy Industries, LTD., Munters AB, Skuttle Indoor Air Quality Products, Spirax Sarco Limited., and UCAN Co., Ltd.

Major companies in the humidifier market have adopted product launch, business expansion, and other strategies as their key developmental strategies to offer better products and services to customers in the humidifiers market.

Some examples of expansion and product launch on the humidifier market.

In March 2023, Levoit Company launched first-ever smart tower humidifier Levoit OasisMist 1000S Humidifier. The product offers 60 % higher mist and covers around 600 sq feet of open space.

In September 2022, Munters opened a new factory in Virginia, the U.S. for the climate control equipment for data center cooling. The plant is focused on the production of energy-efficient and advanced cooling and humidity control equipment.

In August 2022, Levoit launched the OasisMist Smart Humidifier, a new dual mist humidifier to promote wellness and beauty benefits. The humidifier offers voice assistance, auto mode, and quiet mode, and has a 4.5 L storage capacity with 45 hours of mist.

In February 2022, Mitsubishi Heavy Industries, Ltd. launched overall 23 products in the air conditioner segment. The R Series of products are equipped with linking three models of the “roomist” SHK Series of hybrid evaporative warm-mist humidifiers.

In December 2021, Honeywell International Inc. announced the launch of the new range of Honeywell Branded Air Purifiers. The new purifier collection is divided into three categories: Value Series, Platinum Series, and Ultimate Series, with features such as UV LED, Ioniser, and Humidifier.

In March 2021, Condair Group launched a brand new in-duct evaporative cooler and humidifier. The humidifiers have the capacity to supply mist of 360 kg/h humidity with 245kW adiabatic cooling and air handling unit.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the humidifier market segments, current trends, estimations, and dynamics of the humidifiers market analysis from 2022 to 2032 to identify the prevailing humidifiers market opportunity.

- The humidifier market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the humidifiers market overview and segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global humidifier market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the humidifier market players.

- The report includes the analysis of the regional as well as global humidifiers market trends, key players, market segments, application areas, and market growth strategies.

Humidifiers Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 5.6 billion |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 220 |

| By End user |

|

| By Type |

|

| By Installation Type |

|

| By Region |

|

| Key Market Players | Munters Group AB, Condair Group, Koninklijke Philips N.V., Honeywell International Inc., UCAN Co., Ltd., Armstrong International, Skuttle Indoor Air Quality Products, Mitsubishi Heavy Industries, Ltd., Spirax Sarco Limited, Levoit |

Analyst Review

The humidifiers market has witnessed substantial growth owing to an increase in health awareness, and government standards and regulations to maintain humidity. This has further fueled the adoption of humidifiers among health-conscious consumers.

The United States Department of Labor and the European Union have formulated strict rules and regulations to maintain humidity at commercial and industrial places, which is expected to further boost the market growth. North America and Europe were early adopters of humidifiers, thereby collectively accounting for a 53.2% share in 2022. In terms of growth, Asia-Pacific is expected to be a lucrative market, due to the significant increase in adoption of humidifiers in China, India, and Japan. Growth in adoption of humidifiers in various end-user industries such as healthcare, paper, textile, and others, drives the market in the region. Humidifiers are widely used in commercial spaces such as offices, and hotels as well as in households, to maintain a healthy environment. Residential usage of humidifiers accounted for the revenue share, constituting over 41.6% in 2022.

The global humidifiers market was valued at $2,989.5 million in 2022, and is projected to reach $5,626.6 million by 2032, registering a CAGR of 6.6% from 2023 to 2032.

The forecast period considered for the global humidifiers market is 2022 to 2032, wherein, 2022 is the base year, 2023 is the estimated year, and 2032 is the forecast year.

The latest version of global humidifiers market report can be obtained on demand from the website.

The base year considered in the global humidifiers market report is 2022.

The major players profiled in the humidifiers market include Armstrong International, Inc., Condair Group, Honeywell International Inc., Koninklijke Philips N.V, Levoit, Mitsubishi Heavy Industries, LTD., Munters AB, Skuttle Indoor Air Quality Products, Spirax Sarco Limited., and UCAN Co., Ltd.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Based on type, the vaporizer humidifiers segment was the largest revenue generator in 2022.

Loading Table Of Content...

Loading Research Methodology...