Industrial Packaging Market Research, 2034

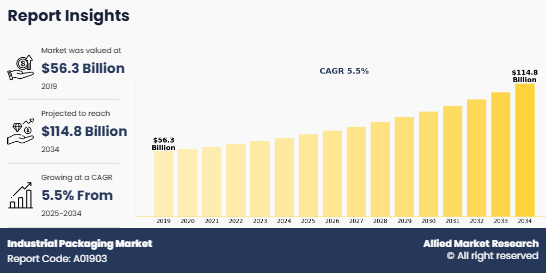

The global Industrial Packaging Market Size was valued at $56.3 billion in 2019, and is projected to reach $114.8 billion by 2034, growing at a CAGR of 5.5% from 2025 to 2034.

The industrial packaging market encompasses materials, products, and services designed to protect, transport, and store goods during manufacturing, handling, and distribution processes. This includes containers, drums, sacks, intermediate bulk containers (IBCs), pails, and corrugated boxes made from materials such as plastic, metal, paperboard, and wood. The goal of industrial packaging is to ensure product safety, durability, and efficiency across supply chains while meeting environmental and regulatory standards.

Key Takeaways

- The industrial packaging market share covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2025-2034.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major decorative coatings industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

The industrial packaging market has witnessed substantial Industrial Packaging Market Growth, driven by rapid industrialization, expanding global trade, increasing demand for sustainable materials, and the rise of e-commerce and logistics sectors. This dynamic market is shaped by regulatory frameworks, advancements in material science, automation in packaging processes, and the growing need for efficient and cost-effective transport and storage solutions. Industrial packaging products are primarily designed to offer strength, protection, and reusability, enhancing supply chain efficiency and minimizing product loss or contamination.

Governments are playing a crucial role in advancing the industrial packaging sector by implementing regulations that promote sustainability, recyclability, and safe material handling. These public-sector initiatives focus on reducing plastic waste, encouraging the use of renewable materials, and aligning industry standards with circular economy goals. A notable example is the European Union’s Packaging and Packaging Waste Regulation (PPWR), which emphasizes recyclability, waste reduction, and responsible sourcing across the packaging value chain. This framework ensures that industrial packaging manufacturers prioritize eco-friendly design, product safety, and compliance with global environmental objectives.

As global trade and manufacturing activities expand, industries across sectors such as chemicals, food and beverage, pharmaceuticals, and construction are increasingly dependent on reliable and durable packaging solutions. In response, the industrial packaging market has emerged as a critical component of global logistics and supply chain management. Modern packaging solutions are designed to withstand harsh handling conditions, maintain product integrity, and support efficient storage and transport. This integrated approach enhances operational efficiency, reduces waste, and ensures product safety from origin to destination, contributing to cost savings and improved sustainability performance.

Furthermore, technology is one of the key drivers of the Flexible industrial packaging market. Integration of automation, IoT-enabled tracking, Smart industrial labeling, and advanced material technologies enables real-time monitoring, improved traceability, and optimized packaging design for better performance. In 2024, several leading manufacturers introduced AI-powered packaging systems that analyze product characteristics, optimize material usage, and predict supply chain risks. Such advancements not only improve operational efficiency but also reduce environmental impact by minimizing material waste and promoting reusable or recyclable packaging solutions.

In addition to this, the growing adoption of sustainable materials and innovative packaging designs is expected to further accelerate the evolution of the industrial packaging market. Biodegradable plastics, recycled polymers, and fiber-based materials are being increasingly used to replace conventional, non-recyclable packaging. Additionally, the use of returnable and reusable packaging systems supports circular economy initiatives and reduces overall carbon footprints. Some major industrial packaging providers have partnered with material technology companies to develop next-generation sustainable packaging solutions tailored for high-demand industries such as chemicals and pharmaceuticals. For instance, in 2025, Mauser Packaging Solutions collaborated with BASF SE to expand the use of recycled resins in industrial containers, aiming to reduce COâ‚‚ emissions and promote circular packaging practices.

Despite its rapid growth and potential to revolutionize global logistics, the industrial packaging market faces a series of complex challenges that must be addressed to ensure its long-term sustainability and scalability. One of the most pressing issues is the lack of standardized recycling and reusability infrastructure across regions. As industrial packaging involves diverse materials and designs, inconsistencies in recycling systems, material recovery processes, and waste management regulations can impede circular economy efforts. Developing globally harmonized standards and interoperable recycling frameworks remains a major hurdle, especially in regions with limited waste management capacity or fragmented regulations.

Additionally, the high cost of sustainable materials and limited adoption of advanced technologies in developing economies create barriers to large-scale implementation. Without strong infrastructure, supply chain digitization, and industry collaboration, packaging optimization and circularity goals remain difficult to achieve. Furthermore, user adoption of sustainable packaging is influenced by varying levels of regulatory enforcement, Industrial Packaging Industry awareness, and economic feasibility—particularly in regions where traditional packaging methods still dominate industrial operations.

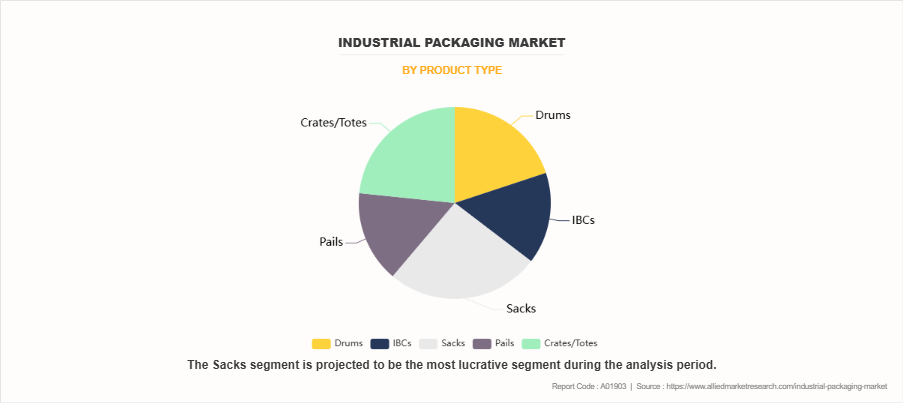

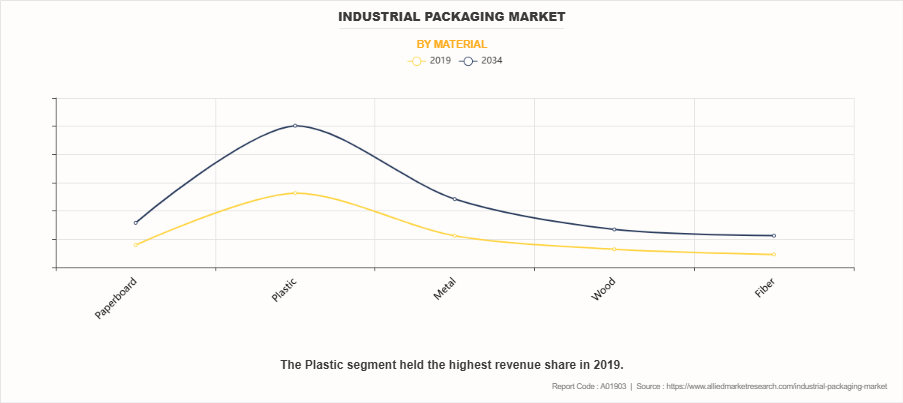

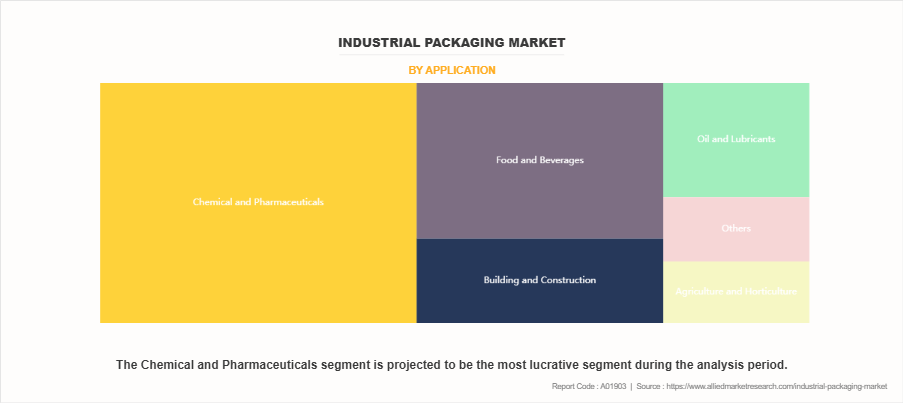

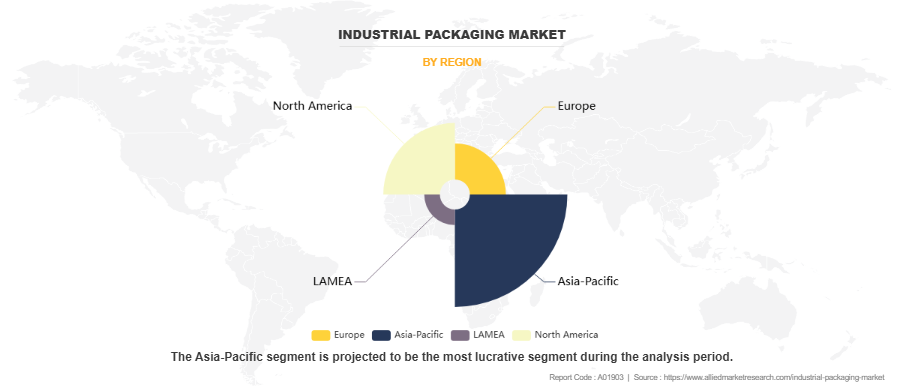

The industrial packaging market is segmented on the basis of product, material, application, and region. By product, the Industrial Packaging Industry is categorized into drums, IBCs, sacks, pails, and crates/totes. On the basis of material, it is classified into paperboard, plastic, metal, wood, and fiber. By application, it is categorized into chemical and pharmaceuticals, building and construction, oil and lubricant, agriculture and horticulture, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA (Latin America, and the Middle East & Africa).

By Product Type

Based on product type, the crates/totes segment dominated the global market in the year 2019 and is likely to remain dominant during the Industrial Packaging Market Forecast period. This dominance is attributed to the high durability, stack ability, and reusability of crates and totes, which make them ideal for handling, storage, and transportation of bulk materials across various industries. Their ability to provide superior protection against damage, contamination, and environmental exposure further enhances their adoption in sectors such as food and beverage, chemicals, automotive, and pharmaceuticals.

By Material

Based on material, plastic platforms accounted for the largest market share in 2019 and are projected to lead during the forecast period. As plastic packaging offers excellent strength-to-weight ratios, making it ideal for protecting industrial goods during storage and transportation. The increasing emphasis on sustainability and circular economy practices has also encouraged manufacturers to develop eco-friendly plastic packaging solutions, reinforcing the segment’s continued leadership in the industrial packaging market.

By Application

Based on application, chemical and pharmaceuticals held the highest market share, owing to the extensive use of durable, leak-proof, and contamination-resistant packaging solutions required for the safe storage and transportation of hazardous and sensitive materials. The sector demands high-performance packaging that can withstand extreme conditions, ensure regulatory compliance, and maintain product integrity throughout long supply chains.

By Region

Based on region, the Asia-pacific region dominated the global market in the year 2019 and is likely to remain dominant during the forecast period. This dominance is attributed to rapid industrialization, expanding manufacturing activities, and the strong presence of key end-use industries such as chemicals, food and beverages, construction, and pharmaceuticals. Additionally, the region’s growing export activities, increasing demand for efficient logistics solutions, and government initiatives promoting sustainable packaging practices further contribute to market growth.

Competition Analysis

The key players included in the industrial packaging market analysis are Grief, Inc., Mondi PLC., Amcor Limited, Westrock Company, International Paper Company, Bemis Company, Inc., Orora Limited, Mauser Group, Sigma Plastics Group, and Wuxi Sifang Drums Limited Company.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the industrial packaging market analysis from 2019 to 2034 to identify the prevailing industrial packaging market Industrial Packaging Market Opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the industrial packaging market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The Industrial Packaging Market Outlook includes the analysis of the regional as well as global industrial packaging market trends, key players, market segments, application areas, and market growth strategies.

Industrial Packaging Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 114.8 billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2019 - 2034 |

| Report Pages | 300 |

| By Application |

|

| By Product Type |

|

| By Material |

|

| By Region |

|

| Key Market Players | WestRock Company, Amcor plc, Wuxi Sifang Group Co., Ltd., Mauser Packaging Solutions, Mondi, Grief, Veritiv Operating Company, International Paper, Orora Limited, Sigma Plastics Group |

Analyst Review

The industrial packaging market is currently navigating a transformative phase, influenced by sustainability imperatives, technological innovation, and evolving global trade dynamics. Historically, the sector’s focus revolved around functionality, durability, and cost efficiency. However, recent years have seen a marked shift toward sustainability-driven strategies and digital integration. One of the most notable developments is the increasing adoption of fiber-based packaging materials, often referred to as “paperization.” Fiberboard and other paper-based substitutes are progressively replacing plastics in applications such as shipping containers, blister packs, and pouches. This transition is reinforced by regulatory mandates including Extended Producer Responsibility (EPR) frameworks, coupled with rising consumer demand for eco-friendly solutions. Companies are aligning their portfolios with circular economy principles through recyclable, biodegradable, and reusable packaging innovations, thereby addressing landfill concerns and strengthening compliance with environmental standards.

The expansion of e-commerce continues to act as a significant growth driver. Packaging within this domain is no longer limited to protective functionality but has evolved into a critical customer touchpoint, enabling companies to communicate reliability, sustainability, and product value directly through their packaging solutions. The use of corrugated fiberboard, lightweight containers, and tamper-proof formats highlights the balance sought between logistics efficiency, cost containment, and consumer experience. Additionally, consumer preferences are reinforcing this shift; studies show that over 80% of U.S. buyers—particularly within the Gen Z demographic—express a willingness to pay a premium for sustainable packaging, underlining its growing role in brand loyalty and competitive positioning.

Nevertheless, the industry faces certain structural challenges. Volatility in raw material prices, particularly in pulp and polymer markets, continues to exert pressure on manufacturer margins. Economic downturns further intensify these risks, leading to fluctuations in demand volumes, as observed in the reduced order intake reported by industry leaders such as UPM and Mondi.

The adoption of closed-loop reuse systems offers measurable gains in resource efficiency, cost optimization, and carbon footprint reduction. Concurrently, advancements in smart packaging—including IoT sensors, RFID, and QR code-enabled traceability—are reshaping the industry’s value proposition. With more than half of the global enterprises expected to adopt smart packaging solutions by 2034, the convergence of sustainability and digitalization is anticipated to redefine competitive strategies and drive the next phase of growth in the industrial packaging market.

The Industrial Packaging Market was valued for $56,246.7 million in 2019 and is estimated to reach $114,760.8 million by 2034, exhibiting a CAGR of 5.5% from 2019 to 2034.

Sustainable materials, smart and connected packaging, automation, cold chain solutions, lightweighting, regulatory compliance, and minimalist design. are the upcoming trends in Industrial Packaging Market.

The sample for Industrial Packaging Market report can be obtained on demand from the AMR website. Also, the 24*7 chat support and direct call services are provided to procure the sample report

Chemical and Pharmaceuticals is the most influencing segment growing in the Industrial Packaging Market.

The company profiles of the top market players of the market can be obtained from the company profile section mentioned in the report. This section includes analysis of top ten player’s operating in the industry

Loading Table Of Content...

Loading Research Methodology...