Liquid Biopsy Market Overview, 2028

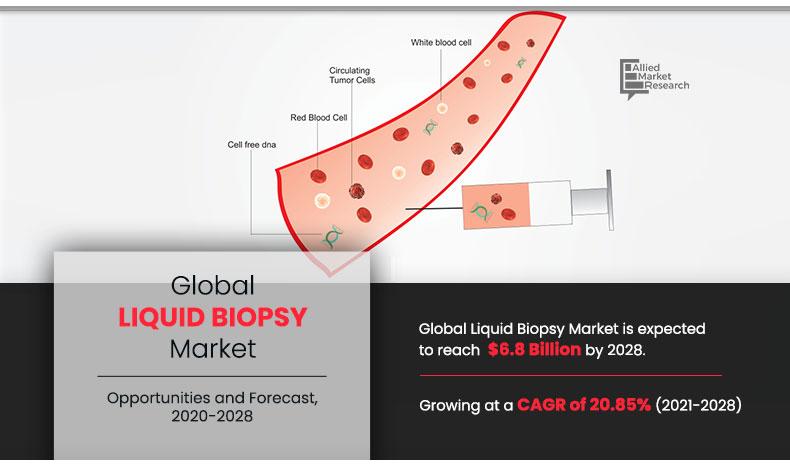

The global liquid biopsy market size accounted for $1,204.2 million in 2020, and is estimated to reach $6,804.9 million by 2028, registering a CAGR of 20.9% from 2021 to 2028. Liquid biopsy is a convenient, fast, non-invasive, and reproducible sampling method that can reflect the changes in tumor gene expression profile, and provide a robust base for individualized therapy and early diagnosis of cancer. Moreover, screening early cancer, monitoring tumor progression, assessing therapeutic response & clinical prognosis, and detecting recurrent & refractory tumors is been focused on in the recent years. Furthermore, liquid biopsy has recently gained widespread attention as a non-invasive alternative technique to tissue biopsy in patients with cancer, due to technological advances regarding both feasibility and turnaround time.

The coronavirus disease (COVID-19) has spread across the globe. Hence, governments have imposed several rules and lockdowns across the globe, owing to increase in number of corona virus patients, which has impacted the market growth in the initial phase of the forecast period. This has resulted in the suspension of early diagnosis programs. In addition, there has been a decrease in screenings, visits, therapies, and surgeries related to cancer, with variation by cancer type and site of service globally resulting in increase of cancer morbidity and mortality in 2020. The pandemic has also impacted the logistics and supplies of cancer diagnostic raw materials and components and other essential commodities used in the production of liquid biopsy. These factors limit the growth of the liquid biopsy market during COVID-19 pandemic.

The liquid biopsy market is experiencing growth due to advancements such as next-generation sequencing for advanced cancer patients in liquid biopsies, increase in number of cancer patients, and rise in patient preference for minimally invasive therapies. However, lack of awareness of liquid biopsy in the developing regions restricts to the market growth. On the contrary, increase in healthcare expenditure in the developing countries, such as India and China, and use of liquid biopsy tests to treat rare cancers are expected to present ample opportunities for market growth.

Global Liquid Biopsy Market Segmentation

The liquid biopsy market is categorized on the basis of product & service, cancer type, circulating biomarker, end user, and region. By product & service, it is divided into kits & reagents, platforms & instruments, and services. By cancer type, it is classified into lung cancer, breast cancer, colorectal cancer, prostate cancer, liver cancer, and other cancers. By circulating biomarker, it is categorized into circulating tumor cell, extracellular vesicle, circulating tumor DNA [ctDNA], and other biomarkers. By end user, it is classified into hospital & laboratory and government & research centers. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Product & Service Segment Review

By product & service, the market is categorized into kits & reagent, platforms & instruments, and service. The platforms & instruments segment is expected to be the fastest growing segment during forecast period owing to large number of ongoing research & development of platforms & instrument and approvals in 2020. For instance in 20202020, Personalis, Inc. launched NeXT Liquid Biopsy, a high-performance, exome-scale, tumor-profiling platform that utilizes blood samples from advanced-stage solid tumor cancer patients. Further Guardant Health, Inc. is developing new precision oncology medicines GuardantINFORM platform with an extensive clinical-genomic liquid biopsy dataset of advanced cancer patients.

By Product & Service

Kits & Reagent segment holds a dominant position in 2020

Circulating Biomarker Segment Review

By circulating biomarker, the market is divided into circulating tumor cell, extracellular vesicle, circulating tumor DNA, and other biomarker. The circulating tumor cell segment generated the highest revenue in 2020 owing to increased number of clinically imperative tests with genomic analyses in recent years. Further, circulating tumor DNA is expected to be the fastest growing segment during the forecast period, owing to rapid development of next-generation sequencing (NGS) technologies in liquid biopsy advancements applied to circulating tumor DNA (ctDNA).

By Circulating Biomarker

Circulating Tumor DNA is the most lucrative segment during the forecast period

Cancer Type Segment Review

By cancer type, the market is classified into lung cancer, breast cancer, colorectal cancer, prostate cancer, liver cancer, and other cancers. The lung cancer segment is anticipated to dominate the liquid biopsy market owing to increase in prevalence of non-small cell lung cancer form across the globe. For instance, as per the World Health Organization, lung cancer is by far the leading cause of cancer death among both men and women, estimated to have around 1.80 million deaths globally in 2020. Further, prostate cancer is expected to be the fastest growing segment during the forecast period as it is the most prevalent type of cancer and the second leading cause of death in North America.

By Cancer Type

Breast Cnacer is the most lucrative segment during the forecast period

End User Segment Review

By end user, the market is bifurcated into hospitals & laboratories and government & academic research centers. The hospital & laboratory segment dominated the liquid biopsy market in 2020 attributed to wider usage of liquid biopsy tests across hospitals and laboratory settings which are the preferable healthcare facilities for patients.

By End User

Breast Cnacer is the most lucrative segment during the forecast period

Region Segment Review

Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2020, North America accounted for the highest contribution to the total revenue generated, owing to the presence of large key players such as Biocept, F. Hoffmann-La Roche AG, Qiagen N.V. and among others. In addition, high cancer prevalence and wider adoption of novel liquid-biopsy tests support the growth of the North America liquid biopsy market. However, Asia-Pacific is expected to witness the highest CAGR during the analysis period. This is attributed to rise in disposable income, increase in government initiatives to modernize healthcare infrastructure, and rise in healthcare expenditure. In addition, strategic approvals and partnerships between leading market players to promote liquid biopsy technology in this region is expected to boost the market growth.

By Region

Asia-Pacific region would exhibit the highest CAGR of 20.7% during 2020-2028.

Competitive Analysis

Prominent players operating in the global liquid biopsy market include Bio-Rad Laboratories, Inc, Biocept Inc., Guardant Health Inc., Illumina, Inc., F. Hoffmann-La Roche Ltd. (FOUNDATION MEDICINE, INC.), Johnson & Johnson, Laboratory Corporation of America Holdings, MDxHealth SA, QIAGEN N.V., and Thermo Fisher Scientific Inc.

Key Benefits For Stakeholders

- This report entails a detailed quantitative analysis along with the current and future global liquid biopsy market trends from 2020 to 2028 to identify the prevailing opportunities along with strategic assessment.

- The liquid biopsy market forecast is studied from 2021 to 2028.

- The market size and estimations are based on a comprehensive analysis of key developments in the industry.

- A qualitative analysis based on innovative products facilitates strategic business planning.

- The development strategies adopted by the key market players are enlisted to understand the competitive scenario of the liquid biopsy market.

Key Market Segments

By Product & Service

- Kits & Reagents

- Platforms & Instruments

- Services

By Circulating Biomarker

- Circulating Tumor Cells

- Extracellular Vesicles

- Circulating Tumor DNA [ctDNA]

- Other Biomarkers

By Cancer Type

- Lung Cancer

- Breast Cancer

- Colorectal Cancer

- Prostate Cancer

- Liver Cancer

- Other Cancers

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Taiwan

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Turkey

- Saudi Arabia

- South Africa

- Rest of LAMEA

Liquid Biopsy Market Report Highlights

| Aspects | Details |

| By PRODUCT & SERVICES |

|

| By CIRCULATING BIOMARKER |

|

| By CANCER TYPE |

|

| By END USER |

|

| By Region |

|

| Key Market Players | Thermo Fisher Scientific Inc., LABORATORY CORPORATION OF AMERICA HOLDINGS, MDXHEALTH SA, JOHNSON & JOHNSON, GUARDANT HEALTH INC., BIOCEPT, INC., BIO-RAD LABORATORIES, INC., QIAGEN N.V., ILLUMINA, INC., F. HOFFMANN-LA ROCHE LTD. (FOUNDATION MEDICINE, INC.) |

Analyst Review

The liquid biopsy tests have gained popularity as an efficient, non-invasive alternative to solid tissue biopsies for cancer treatment. At present, liquid biopsy tests are used for molecular and diagnostic characterization of tumor fragments and agents, such as circulating biomarkers, which include circulating tumor cells, circulating tumor Deoxyribonucleic acid (DNA), extracellular vesicles, and others released into the blood of cancer patients. These tests are anticipated to manage and treat patients with rare cancers and help improve their survival rates in the near future. Further, improved diagnostic testing, increase in awareness among the population regarding cancer, and surge in launches of liquid biopsy diagnostic devices and multicenter early detection test devices are further anticipated to provide growth opportunities and increase the adoption rate of liquid biopsy tests such as next-generation sequencing companion diagnostic test. Liquid biopsies have positively impacted cancer diagnostics, therapeutics, and treatment.

Rise in number of cancer cases has led to an increase in number of therapies to treat cancer, resulting in an increase in the need for prognostic and diagnostic tests, especially liquid biopsies. These tests serve this purpose by predicting the best approach for cancer treatment, understanding the molecular characteristics of the cancer, predicting the probability of cancer recurrence, and improving the patient stratification along with real-time monitoring of therapies. Increase in number of healthcare professionals have preferred these tests to choose the appropriate cancer therapy and understand the onset of the disease. Liquid biopsies are expected to help improve the patient survival rate and reduce the cost of treatment for cancer patients, owing to the help provided in prediction of the drug therapeutic targets.

The liquid biopsy market is highest in North America, owing to the increase in adoption of this test in the region, higher awareness about the benefits among the healthcare providers, and increase in disposable income among patients. Although the use of liquid biopsies in Asia-Pacific and LAMEA is low, the adoption rate is expected to increase, owing to rise in disposable income and government initiatives in the developing countries, such as China and India, to improve the care provided to the patients and contribute toward market growth. Thus, the Asia-Pacific and LAMEA regions are expected to offer lucrative growth opportunities to the key players in the industry.

Top companies such as, F. Hoffmann-La Roche Ltd., Qiagen N.V, Biocept Inc., Guardant Health Inc., and Illumina, Inc. has garnered the maximum market share in 2020. These key players held a high market postion owing to the strong geographical foothold in different regions.

circulating tumor DNA segment segment is the most influencing segment This is attributed due to an rapid development of next-generation sequencing (NGS) technologies applied to circulating tumor DNA (ctDNA).

The major factor that fuels the growth of the global liquid biopsy market includesThe advantages of implementing liquid biopsies are expected to boost the growth of the market. Also, minimal invasiveness and metastatic relapse evaluation, are expected to increase the demand for these tests. Surge in prevalence of cancer cases, and patient preference for minimally invasive therapies are anticipated to fuel the market growthtechnological advancement to ease and simply the process of thawing, and rise in launches and agreement of liquid biopsy . In addition, rise in awareness and government initiative towards the plasma donation and increase in number of embryo donors and rise in awareness of third party reproduction.

Asia-Pacific has the highest growth rate in the market which is growing this is attributed due to Asia-Pacific have a large patient pool with a rise in disposable income, increase in government initiatives to modernize healthcare infrastructure, and rise in healthcare expenditureAn increase in the number of chronic diseases that lead to organ failures is expected to boost the demand for thawed blood.

Liquid biopsies are non-invasive blood tests that detect tumor DNA & RNA fragments and circulating tumor cells (CTCs), which are released into the blood from the primary tumors and metastatic sites

Liquid biopsy is a simple and precise alternative to surgical biopsies, which allows physicians & surgeons to detect & treat cancer at an early stage and acquire tumor information through blood samples. These biopsies are particularly significant as they help the physician understand the molecular changes and dynamics of cancer. Moreover, cancer recurrence is expected to be understood through well-timed liquid biopsies.

The total market value of liquid biopsy market is $1,204.2 million in 2020

The forcast period for liquid biopsy market is 2020 to 2028

The market value of liquid biopsy market in 2028 is $6,804.9 million

The base year is 2020 in liquid biopsy market

Loading Table Of Content...