Logistics Business Outsourcing Market Insights, 2032

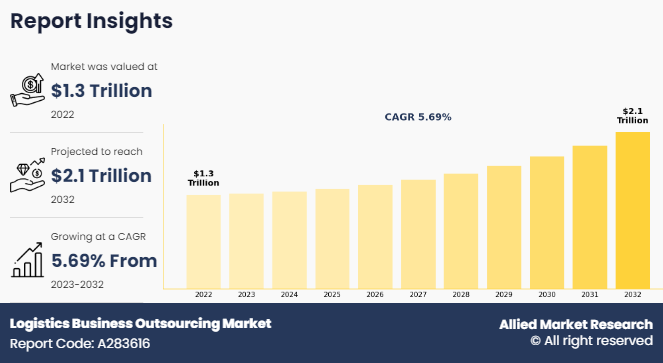

The global logistics business outsourcing market was valued at USD 1.3 trillion in 2022, and is projected to reach USD 2.1 trillion by 2032, growing at a CAGR of 5.7% from 2023 to 2032.

Logistics outsourcing involves a company enlisting the services of a third-party provider to oversee different aspects of its supply chain operations. These external providers, often referred to as third-party logistics (3PL) companies, are capable of managing tasks such as warehousing, inventory control, fulfillment services, shipping, freight forwarding, and handling reverse logistics.

Logistics service providers are responsible for the delivery of materials or goods from manufacturers to consumers. The logistics industry market comprises Third-Party Logistics (3PL), Fourth-Party Logistics (4PL), inbound logistics, outbound logistics, reverse logistics, green logistics, military logistics, and other logistics services. This process provides efficient and effective transport & storage of goods and services. Currently, logistics services are widely used in various applications, including warehousing, procurement, supply chain, material handling, inbound & outbound transport, packaging, and inventory.

Key Takeaways

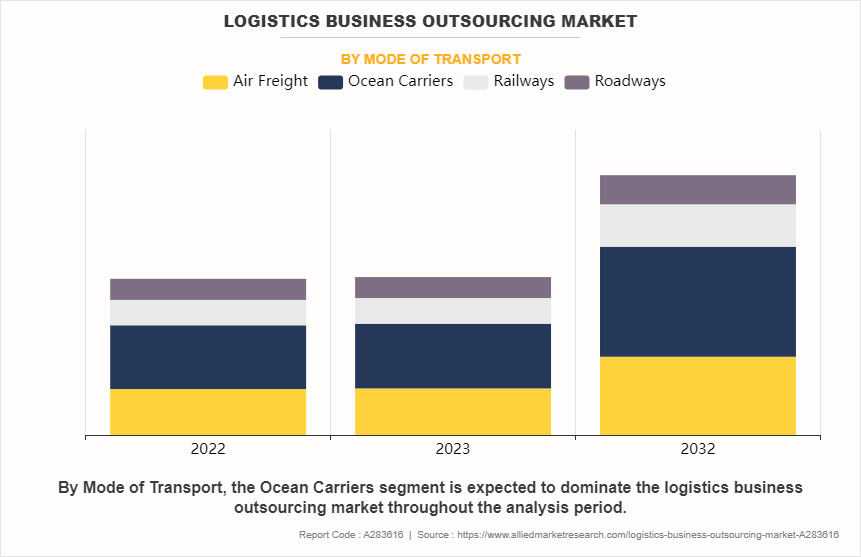

- On the basis of mode of transport, the ocean carriers segment held the largest share in the logistics business outsourcing industry in 2022.

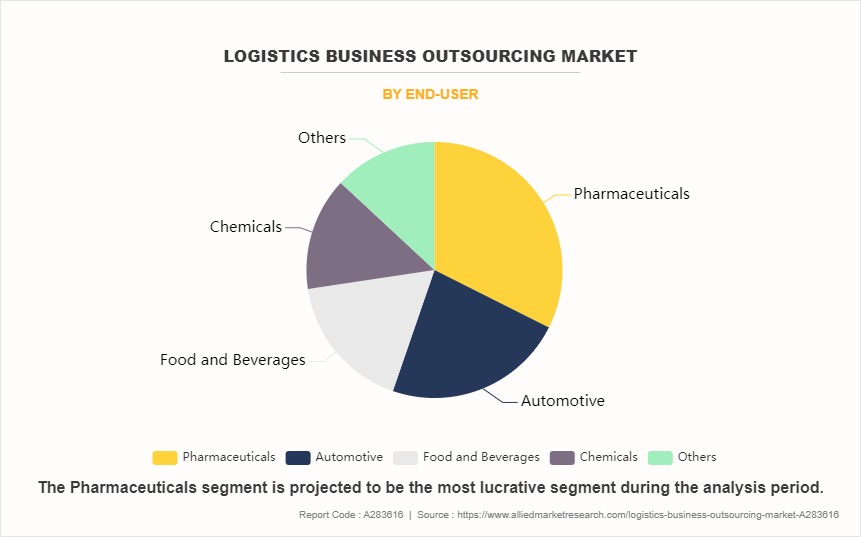

- By end-user, the pharmaceuticals segment held the largest share in the market in 2022.

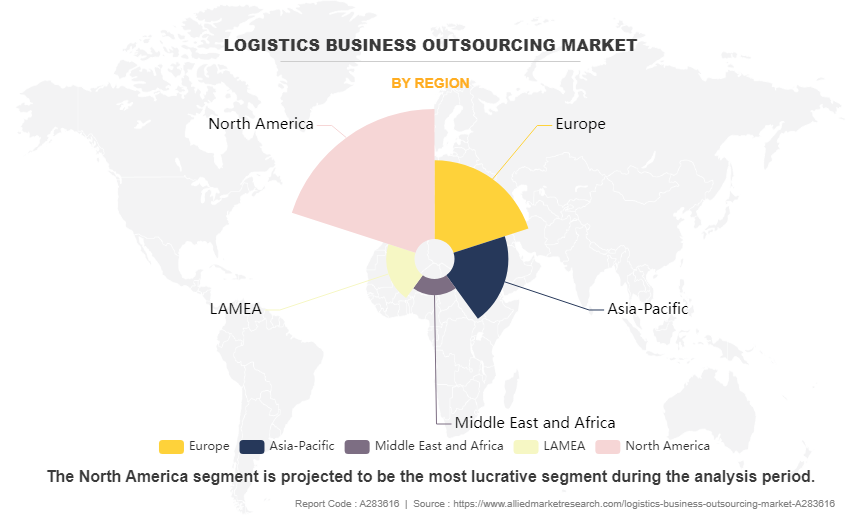

- On the basis of region, North America held the largest market share in 2022.

The factors, such as the growth in the e-commerce industry coupled with rise in reverse logistics operations and rise in trade related agreements, fuel the growth of logistics business outsourcing industry. In addition, rise of tech-driven logistics services and growth in adoption of IoT-enabled connected devices are also expected to drive the market growth. However, lack of control of manufacturers on logistics service, poor infrastructure, and higher logistics costs hinder the market growth. Furthermore, the emergence of last mile deliveries, logistics automation, and cost cutting & lead time reduction due to adoption of multi-modal system are some of the factors that are anticipated to foster growth of logistics business outsourcing market.

Logistics providers are updated of the latest technological trends in logistics due to the specialization in supply chain services. They have access to modern technologies such as warehouse management solutions, cloud logistics, RFID (radio-frequency identification) technology, and others. Engaging the services of a logistics provider enhance the supply chain through the integration of these advanced technologies.

The COVID-19 outbreak has created an unprecedented economic, public health, and logistical challenge across the world, but technology stepped up when COVID-19 struck. One of the biggest impacts witnessed in recent months due to the COVID-19 has been a huge behavioral shift in technology adoption.

For instance, logistics firms have invested in technologies such as the Internet of Things (IoT), cloud computing, automation, and data analytics. In addition, logistics service providers have adopted robots, drones, and autonomous vehicles for safe delivery. AI has played a pivotal role in reshaping the functional dynamics of the logistics industry. In addition, introduction of automated processes through AI and ML is anticipated to boost the speed of warehousing activities and control in the warehousing management system while following social distancing rules.

The logistics outsourcing market is segmented on the basis of mode of transport, end user, and region. On the basis of mode of transport, the market is divided into ocean carriers, railways, roadways, and air freight. On the basis of end user, it is categorized into pharmaceuticals, automotive, chemicals, food & beverages, and others. Region-wise, it is studied across North America, Europe, Asia-Pacific, and LAMEA.

Key Developments

The leading companies have developed strategies such as product launch, acquisition, agreement, expansion, partnership, and contract to strengthen their market position.

In September 2023, the e-commerce giant Amazon announced an expansion of its logistics operations through the introduction of 'Supply Chain by Amazon.' This comprehensive, fully automated suite of supply chain services is designed to provide sellers with an end-to-end solution for efficiently moving products from manufacturers to customers on a global scale.

Segmental Overview

Logistics outsourcing market analysis is segmented into mode of transport, end user, and region. On the basis of mode of transport, the market is categorized into air freight, ocean carriers, railways, and roadways. On the basis of end user, the market is divided into automotive, chemical, food and beverages, pharmaceuticals and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Mode of Transport

The ocean carriers segment dominated the global logistics outsourcing market share in 2022, as maritime transport facilitates the seamless and timely movement of goods for businesses across various locations. Ports constitute a vital element of the global transport sector, playing a crucial role in the continued growth of the global economy. Maritime logistics and services involve the use of merchant vessels, staffed by civilian crews, to transport goods efficiently through sea routes from one destination to another due to which it is preferred widely.

By End User

The pharmaceutical segment dominated the global logistics outsourcing market share in 2022, owing to surge in demand for over the counter (OTC) medications, including vitamins, minerals, supplements (VMS), typical cough and cold remedies, gastrointestinal drugs, and dermatology products.

By Region

The logistics outsourcing market is analyzed across North America, Europe, Asia-Pacific, LAMEA. Asia-Pacific accounted for a major share of the logistics outsourcing market in 2022 and is expected to maintain its dominance during the logistics outsourcing market forecast‐¯period.‐¯The growth of imports and exports is the main factor which drives the growth of the market in Asia-Pacific. The increase in demand for reverse logistics in the pharmaceutical sector and the surge in population is one of the major factors impacting the market growth positively.‐¯

Growth in E-commerce Industry Coupled with Rise in Reverse Logistics Operations

E-commerce refers to the buying and selling of goods by using internet.Third-party logistics service providers encompass shipping of products to consumers. In addition, the e-commerce industry utilizes logistics service to manage and oversee the supply chain of e-commerce companies, which allows these companies to focus on marketing and other business operations. Thus, there is a rise in adoption of logistics service at a significant rate due to numerous benefits provided by logistics to the e-commerce industry, which has driven the growth of the logistics outsourcing market.

For instance, according to the latest report by the trade and development body (UNCTAD) of the UN released in April 2020, e-commerce sales hit $25.6 trillion globally in 2018, which was equivalent to 30% of the global gross domestic product (GDP). The value of global B2B e-commerce in 2018 was $21 trillion, representing 83% of all e-commerce, whereas B2C e-commerce was valued at $4.4 trillion. The growth is attributed to fast expansion in consumers and cross-border purchases. According to the report, more than 1.4 billion people shopped online in 2018 while the U.S., China, and Japan dominated e-commerce sales to consumers. Therefore, growth in e-commerce industry coupled with rise in reverse logistis operation is driving the demand of the logistics business outsourcing market size.

Rise in Trade Related Agreements

Rise in various trade related activities due to globalization has made it difficult for manufacturers or retailers to keep track of these activities in an efficient manner. This factor is expected to drive the logistics outsourcing market for logistics outsourcing companies.

Moreover, development of the overseas market is a significant factor that fuels the growth of the market. Logistics services have become extremely vital for price-sensitive customers who require a wider choice of high-quality products with timely delivery. Thus, the increase in trading activities due to globalization fuels the growth of the logistics outsourcing market. For instance, in 2019, Nepal and China signed the Protocol on Implementing Agreement on Transit and Transport along with 6 other agreements to enable Nepal to access Chinese sea and land ports. China has agreed to let Nepal use Tianjin, Shenzhen, Lianyungang, and Zhanjiang open seaports; and Lanzhou, Lhasa, and Xigatse dry ports for trading with other countries. In addition, in December 2020, India and the UK announced a plan to finalize free trade agreement (FTA) in areas such as pharmaceuticals, fintech, chemicals, defense manufacturing, petroleum, and food products by 2021. Therefore, rise in trade related agreements is driving the demand of the logistics business outsourcing market forecast.

Poor Infrastructure and Higher Logistics Costs

Logistics demands good infrastructure, supply chain, and trade facilitation. Firms are required to build up more stock reserves and working capital without these, which are expected to strongly affect national and regional competitiveness due to high financial costs. In addition, lack of infrastructure hinders the logistics outsourcing market as it increases costs and reduces supply chain reliability. These include significant inefficiencies in transport, poor condition of storage infrastructure, complex tax structure, low rate of technology adoption, and poor skills of logistics professionals.

For instance, according to a report by the Economist, an international newspaper, Latin America lacks adequate infrastructure. More than 60% of roads in the region are unpaved. Furthermore, inconsistency in the address and postal system is the other challenge for parcel delivery in Latin American countries. Shipping companies often have trouble delivering parcels successfully as many countries lack postal codes and rely on local landmarks for addresses. Moreover, logistics costs are heavily determined by the availability and quality of infrastructure. Infrastructure directly influences transport costs and indirectly affects the level of inventories, and consequently financial costs.

Emergence of Last Mile Deliveries Coupled with Logistics Automation

Last mile logistics refers to the final step of the delivery process from a distribution center or facility to the end user. The provision of efficient last mile deliveries has witnessed a major upswing in the logistics industry with the continuous increase in proliferation of e-commerce companies. In addition, getting a package within the same day of delivery is almost common currently, resulting in the growth of the last mile delivery services. Moreover, rise in pharmaceuticals and food & beverages e-commerce industries have witnessed a greater emphasis on last mile delivery options across logistics industries.

Furthermore, the continuous effort of logistics companies to offer efficient last mile deliveries is another opportunity that is expected to fuel the logistics outsourcing market growth in the near future. In addition, automation has also been gaining traction in the logistics industry. The inception of logistics 4.0 is one of the key logistics trends opening lucrative opportunities in the logistics industry. For instance, in July 2020, Movile Group, a mobile commerce platform company, announced a new investment in a Colombian last-mile delivery startup Mensajeros Urbanos. It aims to expand its operations in 10 major cities in Colombia and Mexico. The company is anticipated to open 50 urban warehouses within the 10 cities it serves to reduce delivery time windows further and provide certain items for same-day delivery. Therefore, emergence of last mile deliveries coupled with logistics automation is lucuractive opportunity for the logistics business outsourcing market analysis.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the logistics business outsourcing market size analysis from 2022 to 2032 to identify the prevailing logistics business outsourcing market share opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the logistics business outsourcing market growth segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global logistics business outsourcing market trends, key players, market segments, application areas, and market growth strategies.

Logistics Business Outsourcing Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.1 trillion |

| Growth Rate | CAGR of 5.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 485 |

| By Mode of Transport |

|

| By End-user |

|

| By Region |

|

| Key Market Players | DHL International GmbH, XPO Logistics, Inc., UNITED PARCEL SERVICE OF AMERICA, INC., Kuehne + Nagel International AG, Nippon Express Co., Ltd., Deutsche Bahn AG, DSV A/S, FedEx Corporation, inexia (sncf group), A.P. Moller - Maersk |

Increased use of technologies like AI, IoT, blockchain, and predictive analytics for enhanced visibility, efficiency, and decision-making.

The leading application of the Logistics Business Outsourcing Market is transportation management, including freight forwarding, carrier selection, routing optimization, and shipment tracking.

North America is the largest regional market for Logistics Business Outsourcing

USD $2129.38 billion is the estimated industry size of Logistics Business Outsourcing

United Parcel Service of America, Inc., XPO Logistics, Inc., DHL International GmbH, Kuehne + Nagel International AG, FedEx Corporation, Deutsche Bahn AG, Nippon Express Co., Ltd., DSV A/S, SNCF Group, A.P. Moller – Maersk

Loading Table Of Content...

Loading Research Methodology...