Microbial Identification Market Research, 2032

The global microbial identification market was valued at $3.5 billion in 2022, and is projected to reach $6.4 billion by 2032, growing at a CAGR of 6.2% from 2023 to 2032. The rise in the prevalence of foodborne diseases significantly led to a rise in demand for microbial identification technologies. For instance, according to Centers for Disease Control and Prevention (CDC), in 2022, FoodNet identified 25,479 cases of infection and 5,981 hospitalizations. Infection incidence was highest for Campylobacter followed by Salmonella. In addition, according to the World Health Organization (WHO), each year around 600 million cases of foodborne diseases occur across the globe.

Microbial identification is the process of determining the specific types of microorganisms present in each sample, such as bacteria, viruses, fungi, or protozoa. It involves the analysis of morphological, biochemical, and genetic characteristics of microorganisms to classify and differentiate them. Utilizing various techniques, including microscopy, culture methods, and advanced molecular biology tools like DNA sequencing and mass spectrometry, microbial identification is fundamental in fields such as microbiology, medicine, food safety, and environmental science, contributing to disease diagnosis, research, and the implementation of targeted control measures.

Key Takeaways

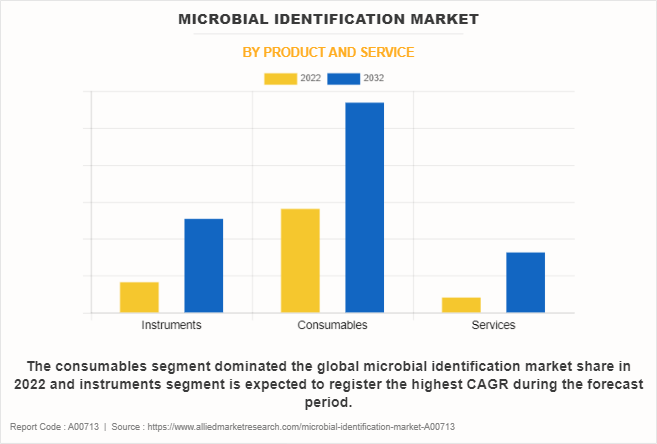

- By product and service, the consumables segment dominated the global microbial identification market size in terms of revenue in 2022. However, the instruments segment is expected to register the highest CAGR during the forecast period.

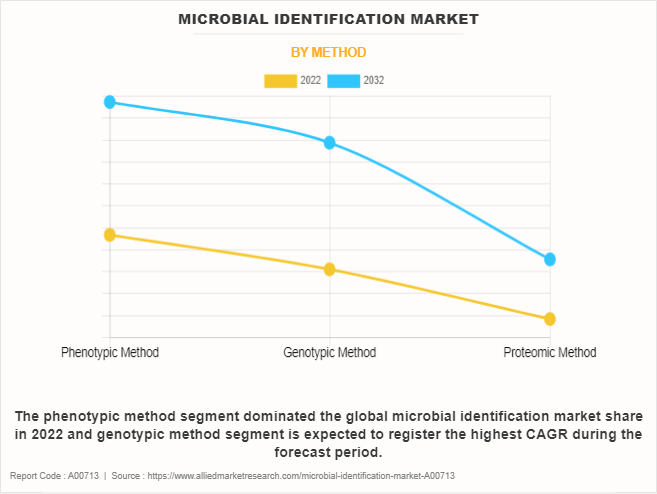

- By method, the phenotypic method segment dominated the global market in terms of revenue in 2022. However, the genotypic method segment is expected to register the highest CAGR during the forecast period.

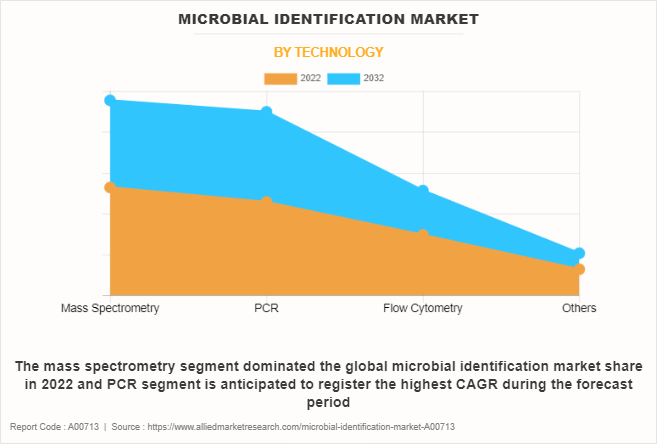

- By technology, the mass spectrometry dominated the global market in terms of revenue in 2022. However, the PCR segment is expected to register the highest CAGR during the forecast period.

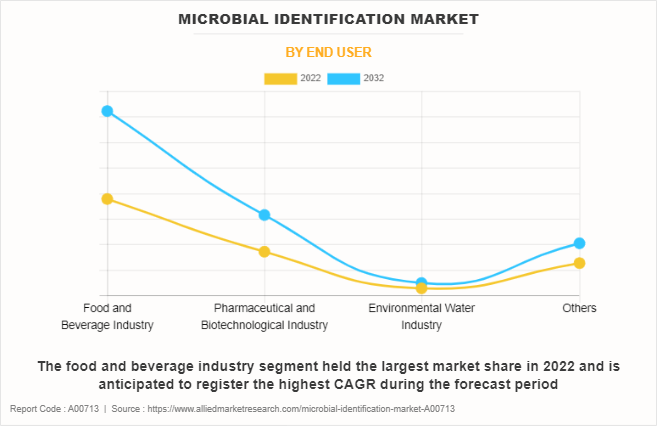

- By end user, the food and beverage industry segment dominated the market in terms of revenue in 2022 and is expected to register the highest CAGR during the forecast period.

- By region, North America dominated the microbial identification market size in terms of revenue in 2022. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Market Dynamics

Microbial identification market trends include growing pharmaceutical and medical device industries, along with the rising adoption of microbial identification during the production and before the marketing of drugs and medical devices. In addition, the increase in prevalence of significant infectious diseases has led to a consistent escalation in the demand for microbial identification methods. For instance, the World Health Organization reported that in January 2023, a total of 64 infectious diseases were affecting 235 countries and regions. Thus, rise in prevalence of infectious diseases is a significant driver of the microbial identification market expansion, as microbial identification is essential in the quality control process for drugs and medical devices.

In addition, the continuous technological advancements play a pivotal role in propelling the microbial identification market growth. Innovations in molecular biology, genomics, and other advanced techniques have revolutionized microbial identification methods. Next-generation sequencing, polymerase chain reaction (PCR), mass spectrometry, and other cutting-edge technologies enhance the precision, speed, and efficiency of microbial identification. These advancements not only improve the accuracy of identification but also enable high-throughput analysis, addressing the growing demand for rapid and comprehensive identification solutions.

Furthermore, the increase in awareness of food safety issues contributes significantly to the demand for microbial identification solutions. Foodborne illnesses pose substantial risks to public health, prompting regulatory bodies, food producers, and consumers to prioritize the implementation of robust identification methods. Microbial identification plays a pivotal role in ensuring the safety and quality of food products by detecting and controlling pathogens in the food supply chain. For instance, governments work with international organizations, such as the World Health Organization (WHO) and the Food and Agriculture Organization (FAO), to develop and implement global food safety initiatives and standards. This awareness-driven demand spans the entire food industry and propels the microbial identification market growth.

However, advanced microbial identification technologies may not be readily available or accessible in certain developing regions due to infrastructure limitations, lack of resources, and insufficient training facilities. This hinders the widespread adoption of sophisticated identification methods in areas. In contrast, in emerging markets, the growing emphasis on preventive healthcare measures, and the rising investments in healthcare infrastructure represent untapped microbial identification market opportunity.

During a recession, organizations across different sectors, including healthcare and research, may face budget constraints. Funding reductions can impact investment in new technologies, including those related to microbial identification. Laboratories, healthcare facilities, and research institutions may experience limitations in acquiring or upgrading microbial identification tools due to financial constraints. Despite these challenges, there is a rise in demand for microbial identification technologies as these tools become integral for effective disease diagnosis, outbreak management, and biodefense preparedness, which is expected to drive microbial identification market growth.

Segments Overview

Microbial identification market analysis is segmented into product type, method, technology, end user, and region. By product and service, the market is categorized into instruments, consumables, and services. By method, the market is divided into phenotypic method, genotypic method, and proteomic method. By technology the market is divided into mass spectrometry, PCR, flow cytometry, and others. By end user, it is segregated into food and beverage industry, pharmaceutical and biotechnological industry, environmental water industry, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, LA, and MEA.

By Product and Service

The consumables segment dominated the global microbial identification market share in 2022, owing to its fundamental role in supporting routine laboratory procedures and microbial identification processes across various industries. However, the instruments segment is expected to register the highest CAGR of 6.9% during the forecast period, owing to the ongoing technological advancements in instruments, rise in demand for high-throughput identification, and the trend towards decentralized diagnostics drives the demand for instruments.

By Method

The phenotypic method segment dominated the global microbial identification market share in 2022, owing to the adaptability of phenotypic methods to various sample types and their compatibility with diverse microbial species. However, the genotypic segment is expected to register the highest CAGR during the forecast period. This is attributed to the increasing recognition of genotypic methods as advanced and reliable techniques for microbial identification and as they offer specificity, allowing for the differentiation of closely related microorganisms and the identification of strains with greater precision.

By Technology

The mass spectrometry segment dominated the global market share in 2022, owing to advancements in mass spectrometry platforms, including matrix-assisted laser desorption/ionization time-of-flight mass spectrometry (MALDI-TOF MS), have further improved the speed and accuracy of microbial identification. These advancements contribute to the widespread adoption of mass spectrometry across various industries. However, the PCR segment is expected to register the highest CAGR during the microbial identification market forecast period. This is attributed to advancements in PCR technology, including real-time PCR and high-throughput PCR platforms, contribute to its efficiency and speed in microbial identification.

By End User

The food and beverage industry segment held the largest market share in 2022 and is expected to register the highest CAGR during the forecast period, owing to increasingly invest in cutting-edge microbial identification technologies to uphold safety standards and meet consumer demands for safer and higher-quality food product. In addition, advancements in technologies have improved the speed and accuracy of microbial identification, making them more appealing for integration into the food and beverage production processes which further support the segment growth.

By Region

The microbial identification market is analyzed across North America, Europe, Asia-Pacific, LA, and MEA. North America accounted for a major share of the market in 2022 and is expected to maintain its dominance during the forecast period. The well-established infrastructure, technological advancements in testing methodologies, pharmaceutical innovation and research and development activities have led to an increased demand for microbial identification which drive the market growth in this region. However, Asia-Pacific offers profitable opportunities for key players operating in the microbial identification market and is expected to register the fastest growth rate during the forecast period, owing to the expanding pharmaceutical and biotechnology sectors, the rise of contract manufacturing and research activities, and increased healthcare investments.

Competitive Analysis

Major key players such as bioMérieux and Bruker Corporation have adopted product approval, agreement, product launch, and partnership as key developmental strategies to improve the product portfolio of the microbial identification market. For instance, in May 2022, bioMérieux, a world leader in the field of in vitro diagnostics, announced that it has finalized the acquisition of Specific Diagnostics, a privately held U.S. based company that has developed a rapid antimicrobial susceptibility test (AST) system that delivers phenotypic AST directly from positive blood culture.

Recent Developments in the Microbial Identification Industry

In August 2023, BD (Becton, Dickinson and Company), a leading global medical technology company, announced U.S. Food and Drug Administration (FDA) 510(k) clearance for the BD Respiratory Viral Panel (RVP) for BD MAX System, a single molecular diagnostic combination test that identifies and distinguishes SARS-CoV-2, influenza A, influenza B, and Respiratory Syncytial Virus (RSV) in approximately two hours.

In November 2023, QIAGEN announced the launch of the Microbiome WGS SeqSets, a comprehensive sample to insight workflow designed to provide an easy-to-use solution that maximizes efficiency and reproducibility in microbiome research. Microbiome WGS SeqSets provide a complete sample insight solution that combines our industry-leading extraction technology with easy-to-use downstream NGS library preparation and intuitive bioinformatics.

In August 2022, BD (Becton, Dickinson and Company) and Accelerate Diagnostics, Inc., an innovator of rapid in-vitro diagnostics in microbiology, announced a worldwide commercial collaboration agreement where BD will offer Accelerate's rapid testing solution for antibiotic resistance and susceptibility offering results in hours, versus one to two days with some traditional laboratory methods. Companies will work together to bring rapid antimicrobial identification and susceptibility diagnostics to more clinicians and patients worldwide.

In April 2022, Bruker Corporation announced further advances in its market leading MALDI Biotyper (MBT) platform and launched new multiplex PCR infectious disease assays that are based on its proprietary LiquidArray technology. Bruker further expands its mycobacteria portfolio with the FluoroType Mycobacteria PCR assay, launched on the high-precision FluoroCycler XT thermocycler. The MALDI Biotyper platform, known for its accuracy in identifying microorganisms through Matrix-Assisted Laser Desorption/Ionization Mass Spectrometry, is a key player in microbial identification industry.

In March 2022, bioMérieux, a world leader in the field of in vitro diagnostics, announced that VITEK MS PRIME, its new MALDI-TOF mass spectrometry identification system, has received 510(k) clearance from the U.S. Food and Drug Administration (FDA). This next generation system for routine microbial identification in minutes is now commercially available in countries that recognize CE-marking and in the U.S.

In May 2021, bioMérieux, a world leader in the field of in vitro diagnostics, announced CE marking of the new generation of IgG serology test with VIDAS SARS-COV-2 IgG II to semi-quantitatively detect antibodies in people who have been exposed to the SARS-CoV-2 that causes the COVID-19 disease. VIDAS SARS-COV-2 IgG II offers a semi-quantitative interpretation of the level of IgG antibodies directed against the Receptor-Binding Domain (RBD) of the Spike (S) viral protein.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the microbial identification market analysis from 2022 to 2032 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the microbial identification market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Microbial Identification Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 296 |

| By Product and Service |

|

| By Method |

|

| By Technology |

|

| By End User |

|

| By Region |

|

| Key Market Players | Merck KGaA, Bruker Corporation, Shimadzu Corporation, Becton, Dickinson and Company, Danaher Corporation, Thermo Fisher Scientific Inc. , Charles River Laboratories, Qiagen NV., Bio-Rad Laboratories, Inc. , BioMerieux SA |

Analyst Review

The microbial identification market is expected to witness a significant growth in the future, owing to rise in global infectious diseases, including emerging pathogens, and emphasizes the critical role of accurate and rapid microbial identification in disease diagnosis and management. However, lack of skilled personnel and limited accessibility in developing regions restricts market growth.

In addition, advancements in microbial identification technologies and key players adopting strategies such as product launches are expected to boost the growth of the market. For instance, in May 2021, bioMérieux, a world leader in the field of in vitro diagnostics, announced CE marking of the new generation of IgG serology test with VIDAS SARS-COV-2 IgG II to semi-quantitatively detect antibodies in people who have been exposed to the SARS-CoV-2 that causes the COVID-19 disease.

Moreover, North America accounted for the largest share in 2022 and is expected to remain dominant during the forecast period. This is attributed to the robust healthcare infrastructure, advanced technological capabilities, and a well-established regulatory framework supporting the growth of microbial identification in the region.

However, Asia-Pacific is anticipated to witness notable growth owing to rise in incidences of the infectious diseases, a rise in healthcare awareness and growth in emphasis on research and development activities further contribute to the adoption of innovative microbial identification solutions.

The total market value of microbial identification market is $3.5 billion in 2022.

The market value of microbial identification market in 2032 is $6.4 billion.

The forecast period for microbial identification market is 2023 to 2032.

The base year is 2022 in microbial identification market.

North America is accounted for the largest market share in 2022 owing to well established healthcare infrastructure, rise in prevalence of infectious diseases and proactive health management practices.

Increasing incidence of infectious diseases, advancements in molecular techniques, such as PCR assays and MALDI-TOF mass spectrometry, growing awareness of the microbial infections and investments in healthcare infrastructure.

Microbial identification is the process of determining the specific type or species of microorganisms, such as bacteria, viruses, fungi, or parasites.

BIOMÉRIEUX, Bruker Corporation, Thermo Fisher Scientific Inc, Becton, Dickinson and Company, and Charles River Laboratories held a high market position in 2022.

Loading Table Of Content...

Loading Research Methodology...