Mobile Money Market Overview

The global mobile money market was valued at $8.5 billion in 2022, and is projected to reach $121.6 billion by 2032, growing at a CAGR of 30.8% from 2023 to 2032. Growing smartphone penetration, increased internet access, financial inclusion initiatives, regulatory support, growing e-commerce, and demand for convenient, secure, and real-time financial transactions contribute to the growth of the market.

Market Dynamics & Insights

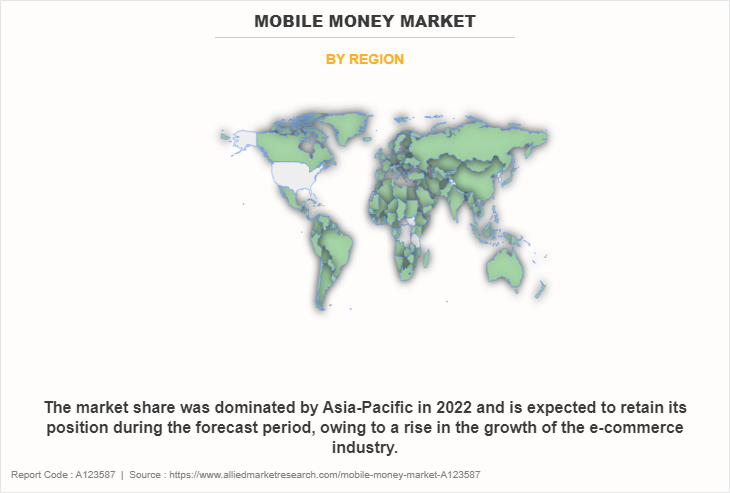

- The mobile money industry in Asia-Pacific held the largest share of 35% in 2022.

- By payment type, the remote payment segment is one of the dominating segment in the market, accounting for the revenue share of 62% in 2022.

- By application, the mobile transfer segment dominated the industry in 2022 and accounted for the largest revenue share of 44%.

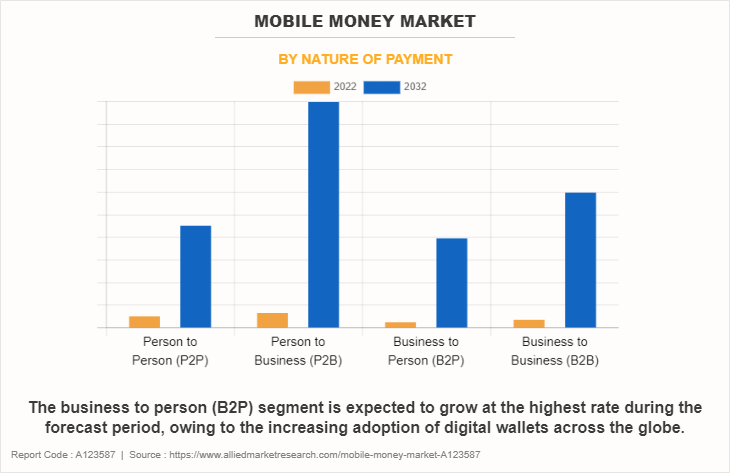

- By nature of payment, the business to person (B2P) segment is the fastest growing segment in the market, growing at a CAGR of 34.2% from 2023-2032.

Market Size & Future Outlook

- 2022 Market Size: $8.5 Billion

- 2032 Projected Market Size: $121.6 Billion

- CAGR (2023-2032): 30.8%

- Asia-Pacific: Largest market in 2022

- LAMEA: Fastest growing market

What is Meant by Mobile Money

Mobile money is one that is made using digital channels. Both the payer and the payee send and receive money using digital methods in digital payments. Another name for it is electronic payment. Mobile money doesn’t include real money. As per industry standards, mobile money is referred to as non-cash transactions carried out via digital platforms. Moreover, in mobile money technology, Near-Field Communication (NFC) effectively transmits encrypted data to the Point of Sale (POS) devices directly and instantly. This saves time significantly compared to PIN and chip technology. NFC in mobile devices makes use of close-proximity radio frequency identification to effectively communicate with NFC-enabled card machines. Customers need not come into physical contact with the POS devices to transfer information and only the mobile devices need to be near the terminal.

Increase in the use of digital payment-based business models and increase in the efficiency of mobile money transactions is boosting the growth of the global mobile money market. In addition, increase in adoption of mobile POS is positively impacts growth of the market. However, security issues and privacy concerns and lack of accessibility is hampering the market growth. On the contrary, rise in government initiatives and regulatory support is expected to offer remunerative opportunities for expansion of the mobile money market during the forecast period.

Mobile Money Market Segment Review

The mobile money market is segmented on the basis of transaction mode, payment type, nature of payment, application, and region. On the basis of transaction mode, the market is categorized into point of sale, mobile apps, and QR codes. On the basis of payment type, the market is fragmented into remote payment and proximity payment. On the basis of the nature of payment, the market is classified into person-to-person (P2P), person-to-business(P2B), business-to-person(B2P), and business-to-business(B2B). By application, it is classified into money transfers, bill payments, airtime transfers & top-ups, travel & ticketing, and merchandise & coupons. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In terms of nature of payment, the person to business (P2B) segment holds the highest mobile money market size, owing to increase in aggressive investments by private equity and venture capital firms in B2B payments. However, the business to person (B2P) segment is expected to grow at the highest rate during the forecast period, owing to the increasing adoption of digital wallets and mobile money app across the globe.

Region-wise, the mobile money market share was dominated by Asia-Pacific in 2022 and is expected to retain its position during the forecast period, owing to a rise in the growth of the e-commerce industry. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to the rising adoption of smart appliances like smartphones. Additionally, the expansion of the mobile money industry in this region is being supported by growing government initiatives as well as growing initiatives from mobile companies offering fast internet service.

The key players that operate in the mobile money market are Apple Inc., Amazon Inc, Alipay, Fiserv Inc, global payments inc., Google Inc, Mastercard Inc., Orange, PayPal, and Vodafone Group. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Digital Capabilities

Mobile money refers to financial transactions and services that can be carried out using a mobile device such as a mobile phone or tablet. These services may link directly to a bank account. In addition, mobile money allows for the transfer of money between cellphone devices. The technology is installed in the SIM card of the device and can be used on regular and smartphone devices. Users can receive, withdraw, and send money without being connected to the formal banking system. The product differs from mobile banking where users connect using internet-enabled mobile devices to manage the funds in their bank account. Mobile money can also be helpful for financial resilience as it facilitates saving.

Moreover, Mobile money electronically records all transactions, which improves the security of payments as well as their transparency, the consequences of which could be far-reaching on the economy. Greater transparency of earnings, transactions, and remittances could greatly improve tax collection. Furthermore, Near-field communication (NFC), QR codes, and other contactless technologies are making it easier for consumers to complete transactions using their mobile devices or wearables. Further advances will make it even easier and faster to make payments without cash or a physical card. Such advantages drives the growth of the mobile money market demand.

What are the Top Impacting Factors in Mobile Money Market

Increase in the use of Digital Payment-based Business Models

Increase in adoption of digital payment-based solutions such as mobile wallets, UPI, and card payments is changing the landscape of mobile money services. In addition, the integration of such facilities with the banking process assists in advancing their visualization capabilities, resolving customer queries, and making complicated data usable. Moreover, these technologies help in increasing connectivity and providing advanced security methods in banks & financial institutions. For instance, according to PWC insights, 42% increase in global cashless payment volumes.

Furthermore, mobile applications provide real time insights to end-users and help to improve network security, accelerating digital businesses and offering a better customer experience. The rising adoption of such initiatives is expected to create various opportunities for players in the mobile money market. Key companies focus on completing partnerships and collaborations with other players to launch advanced solutions on the basis of core technologies such as AI and others. For instance, in June 2022, Bushel launched a digital payment network for agriculture in the U.S. It allows agricultural producers and agribusinesses to conveniently move money in real time across the agriculture supply chain.

Moreover, the solution simplifies complex loan processing and lifecycle management across lending lines and geographies, addressing the needs of large tier one as well as regional banks, many of which are struggling to seize the growth opportunity in corporate lending due to disparate systems and a lack of integration. These technical developments in improved application standards drive growth of the mobile money market.

Increase in Adoption of Mobile POS

Mobile point of sale has significantly enhanced mobile phones’ ability to collect payment. In addition, all businesses can conduct in person and brick and mortar transactions with the help of mPOS technology. Moreover, using mPOS devices minimizes liability since they reduce risk of security breaches and make following requirement easier and faster. The mPOS gadget does not save information such as card numbers, and transaction details which are encrypted.

Furthermore, mPOS uses biometric such as fingerprint or facial recognition to provide an extra layer of protection to consumers, these features have increased the number of customers. Furthermore, growth in popularity of e-commerce and cashless transactions such as MasterCard, Visa Cards, and EuroPay in developed as well as developing countries is driving the growth of the mobile money market. Adoption of cloud-based mPOS is seen to be favorable by conventional stores, retail outlets, supermarkets, and restaurants due to data security features and easy operations. In addition, with further growth in investment across the world and the rise in demand for mPOS, various companies have expanded their current product portfolio with increased diversification among customers.

For instance, in January 2022, Adyen, the global payments platform of choice for many of the world's leading companies launched mobile Android point of sale (POS) terminals in the EU, the UK, and the U.S. The devices represent a fundamental change in the role of the payment terminal, functioning as an all-in-one solution, eliminating the need for separate cash registers, barcode scanners, and customer facing displays. Additionally, the terminals come with an app management system, allowing merchants to upload and manage the apps they use every day, for inventory management, loyalty programs, returns and more. Such demands are driving the growth of the mobile money market.

Restraint

Security Issues and Privacy Concerns

Security is one of the most significant concerns associated with mobile application implementation. Lack in awareness among banks regarding sharing account information and confidential data online hampers the growth of the mobile money market. In addition, possibilities of unauthorized access to accounts of users via hacked log-in credentials create huge security & privacy concerns among banks. Furthermore, sharing sensitive customer data by banks to digital service providers results in disclosure of personal information and exposes business to security risk. For instance, in the U.S., official statistics of digital payments from the country government projected that around 3,500 cyber-attacks against banks were recorded in the first seven months of 2019. This, as a result, has become a major factor that hampers mobile money market growth.

Opportunity

Rise in Government Initiatives and Regulatory Support

Governments and regulatory bodies have been actively promoting digital payments as part of their financial inclusion agendas. Initiatives such as demonetization, promoting digital wallets, and establishing regulatory frameworks for digital payments have accelerated adoption and usage. For instance, The World Bank’s Universal Standards for Digital Financial Services have been adopted by over 30 countries to ensure safety and security of digital financial transactions, including those involving mobile money.

Moreover, various governments across the globe are introducing different types of regulatory reforms for banks and other payment agencies to prevent frauds and to ensure customers are not using insurance to perpetrate financials. For instance, in India, the Reserve Bank of India (RBI) has established regulations for mobile money services, including Know Your Customer (KYC) requirements and restrictions on fees charged by service providers. Thus, various initiatives taken by the government are helping to create various opportunities for the digital payment in mobile money market.

Key Market Highlights

Social Commerce is the New Vogue in the Market

Social media and commerce are converging, changing how people buy things. Mobile money apps are using this change by adding shopping features. This means people can buy and sell products right inside messaging apps or social media sites, without needing separate payment apps.

By doing this, mobile money apps make it easier for people to shop while they communicate this increases the growth of the mobile money market. They're using the trust and familiarity people have with social media to make shopping simpler and more fun. This helps them get more users and more transactions on their apps. By this conjunction, these apps are making shopping easier and more enjoyable for everyone, helping the market prosper.

Like, Stitch, a South African fintech startup launched WigWag in September 2023. WigWag is a social commerce payment platform that enables small businesses to accept digital payments via a unique payment link.

Cryptocurrencies are Being Integrated into Mobile Money Platforms

Mobile money platforms are now adding cryptocurrencies to their services, making it possible for people to use digital currencies alongside regular money. This is becoming popular because it offers a way to manage different types of money in one place. It is particularly fascinating for those tech-savvy users who want to invest in digital assets and send money internationally with lower fees.

By including cryptocurrencies, the mobile money market platforms highlights the necessity of staying adaptive and appealing to new users interested in digital money. This shows a move towards more modern and flexible financial services, meeting the changing needs of users in today's digital age.

Like, in April 2024, Fintopio, launched Fintopio DeFi Wallet. This wallet guarantees quick and easy switching between cryptocurrencies, integrates with other DeFi apps and wallets, and securely stores user deposits, giving users complete control over their assets.

Mobile Money Market Trends Analysis

Kenya is leading the market. West Africa is a global leader with more than US$ 491 billion worth of transactions recorded in 2022. This rise is ascribable to the Payment Service Bank (PBS) licensed in 2018.

Governments in North America and Asia Pacific are implementing supportive policies and regulations. They are recognizing the potential of this mobile money market solutions for economic development.

Expansion of agent networks is bolstering the market growth. Investments are rising in rural and remote areas where traditional banking infrastructure is poor.

Rise of FinTech startups is driving innovation in the market. Advanced encryption techniques and AI algorithms are being used for more secure and user-friendly experiences.

With cyber threats on the rise, the market is focusing on more secure platforms. The aim is to reduce risks of unauthorized access or fraud.

Mobile Money Market Opportunity Analysis

Increase in cross-border remittance flows due to the globalization of labor markets presents opportunities. Offering competitive exchange rates and lower transaction fees can prove beneficial.

Due to the generation of enormous data volumes, using data analytics can improve revenues and foster innovation in the market. Mobile money providers can improve decision-making and operational efficiency through mobile money market transfers.

Offering microfinance and micro-investing services in developing countries can be opportunistic. Businesses can empower individuals to build assets and generate income by this. This can foster economic development and the market.

Reduction in inequality and poverty can be achieved by supporting agricultural and rural development initiatives. Agricultural loans and crop insurance can promote sustainable rural development and generate revenue.

Category-wise Insights

The mobile money platform segment holds the leading mobile money market shares in 2024. These platforms are rising because they are easy to use and make managing money simple for mobile money market providers. With just a smartphone and internet connection, users pay bills and send money to others quickly and safely. This is especially helpful in places where traditional banks are not easy to access. Plus, mobile money apps usually have strong security measures to keep users' information safe. Because of these benefits, more people are choosing mobile money as their preferred way to handle finances, making it the leading component in the mobile money market.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the mobile money market analysis from 2023 to 2032 to identify the prevailing market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the mobile money market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global mobile money market forecast.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the mobile money market players.

- The report includes the analysis of the regional as well as global mobile money market trends, key players, mobile money market segments, application areas, and market growth strategies.

Mobile Money Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 121.6 billion |

| Growth Rate | CAGR of 30.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 256 |

| By Payment Type |

|

| By Nature of Payment |

|

| By Application |

|

| By Region |

|

| Key Market Players | Mastercard Inc., Orange, Fiserv Inc, Vodafone Group, Apple Inc., Alipay, Global Payments Inc., PayPal, Amazon, Google Inc. |

Analyst Review

Mobile money is an alternative to outmoded payment system that use cash, cheques, or credit cards as the medium of exchange. Mobile money permit customers to buy goods and services using wireless devices such as smartphones, tablets, and others. In addition, mobile money employes numerous technology such as near field communication (NFC), SMS based transactional payments, and direct mobile billing to advance transaction security and deliver hassle-free transactions.

The global mobile money market is expected to register high growth, owing to rise in smartphone saturation and growth of e-commerce industry is driving the growth of the mobile money market. Thus, the increase in adoption of mobile money, owing to its high reliability and low latency networks is one of the most significant factors driving the growth of the market. With surge in demand for mobile money, various companies have established alliances to increase their capabilities. For instance, in December 2021, Alipay partnered with Western Union to enable global money transfers. The partnership would allow users to send and receive money through Alipay's platform to over 200 countries and territories worldwide..

In addition, with further growth in investment across the world and the rise in demand for mobile money, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in June 2021, Apple Pay launched a new feature called "Apple Pay Later." The feature allowed users to make purchases and pay for them later in installments with interest.

Moreover, with the increase in competition, major market players have started acquisition companies to expand their market penetration and reach. For instance, April 2021, -Zeepay acquired Mangwee Mobile Money to operate as an alternative wallet targeting university students in Zambia with the aim of assisting to drive the cost of mobile money services downward.

The mobile money market is estimated to grow at a CAGR of 30.8% from 2023 to 2032.

The Mobile money market is projected to reach $121,586.65 million by 2032.

Increase in the use of digital payment-based business models and increase in the efficiency of mobile money transactions is boosting the growth of the global mobile money market. In addition, increase in adoption of mobile POS is positively impacts growth of the mobile money market. However, security issues and privacy concerns and lack of accessibility is hampering the mobile money market growth. On the contrary, rise in government initiatives and regulatory support is expected to offer remunerative opportunities for expansion of the mobile money market during the forecast period.

The key players profiled in the report include Apple Inc., Amazon Inc, Alipay, Fiserv Inc, global payments inc., Google Inc, Mastercard Inc., Orange, PayPal, and Vodafone Group.

The key growth strategies of mobile money market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

The estimated industry size of the mobile money market is $ 25,885.8 million.

North America accounted for the highest market share in 2022.

The leading application for the mobile money market is a mobile phone-based payment systems.

The upcoming trends in the mobile money market include increased use of Central Bank's Digital Currencies (CBDCs), digital payments, cross-border banking, and crypto. Open payment platforms will also play a critical role in the future.

U.S. and China country has the highest market share during the forecast period.

Loading Table Of Content...

Loading Research Methodology...