Monoclonal Antibodies Market Research, 2030

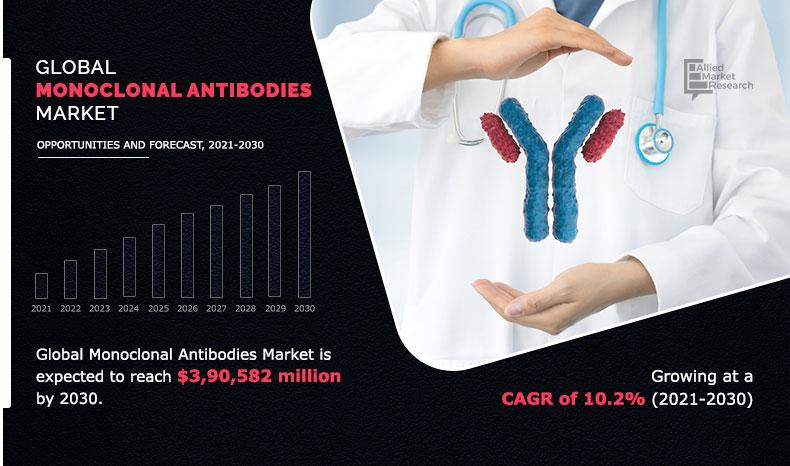

The global monoclonal antibodies market size was valued at $146,642 million in 2020, and is projected to reach $390,582 million by 2030, registering a CAGR of 10.2% from 2021 to 2030. Monoclonal antibody (mAb) therapy is a form of immunotherapy that utilizes monoclonal antibodies to attach mono specifically to specific proteins or cells. Monoclonal antibodies are replicas of a unique parental cell derived from identical immune cells. These antibodies can bind to a particular antigen when administered, as they have monovalent affinity. Monoclonal antibodies serve as an important tool to detect or purify substances, owing to their site specificity; thus, they have important end use in biochemistry, molecular biology, and medicine.

Increase in prevalence of cancer, increase in demand for cost-efficient biosimilar monoclonal antibodies, high demand for biologics, and increase in R&D activities in genomics coupled with the introduction of technologically advanced genetic platforms, such as next-generation sequencing are the major factors that drive the growth of the market. In addition, surge in research collaborations for the development of robust drugs pipeline, rise in awareness levels among patients & physicians pertaining to the applications of monoclonal antibodies (mAb) therapy, and increase in approval of blockbuster mAbs for a variety of applications further boost the growth of the market. Moreover, employment of advanced genetic engineering technology in mAbs production, presence of a well-established healthcare infrastructure, government support in infection control & management, and increase in incidence of lifestyle associated diseases are the other factors that fuel the growth of market. However, poor demand in underdeveloped countries is expected to restrain the growth of the monoclonal antibodies market. Conversely, growth opportunities in emerging markets are expected to offer lucrative opportunities during the forecast period.

The World Health Organization (WHO) on January 30, 2020 declared COVID-19 outbreak a public health emergency of international concern. COVID-19 has affected around 210 countries across the globe. The COVID-19 pandemic is an unprecedented global public health challenge and is anticipated to have a positive impact on the monoclonal antibodies market for the development of monoclonal antibodies therapy to treat COVID-19. The recognition of the urgent necessity for treatments available on a global scale has encouraged the rapid development of a large number of SARS-CoV-2 (severe acute respiratory syndrome coronavirus 2) neutralizing monoclonal antibodies (mAbs). Thus, COVID-19 infection uplifted growth and opportunities for key players of monoclonal antibodies during the forecast period.

Monoclonal Antibodies Market Segmentation

The monoclonal antibodies market is segmented on the basis of source, indication, end user, and region. On the basis of source, the market is categorized into murine, chimeric, humanized, and human. By indication, the market is divided into cancer, autoimmune diseases, inflammatory diseases, infectious diseases, and others. The cancer segment is further classified into breast cancer, colorectal cancer, lung cancer, ovarian cancer, and others. By end user, the market is fragmented into hospitals, research institutes, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Source

On the basis of source, the human segment is the major revenue contributor, and is projected to grow significantly during the forecast period. Rise in integration of advanced technology such as phage or yeast display, and transgenic mice, for human monoclonal antibodies generation, increase in usage for treatment of various chronic diseases, employment of advanced genetic engineering technology, increase in government support in infection control & management, and increase in number of product approvals are the major factors that drive the growth of the market.

By Source

Human segment is projected as one of the most lucrative segment.

By Indication

By indication, the cancer segment is the major shareholder in the monoclonal antibodies market, owing to increase in prevalence of cancer, and rise in adoption of monoclonal antibodies in cancer treatment. In addition, surge in number of drug pipelines, surge in demand for biosimilar monoclonal antibodies, and increase in awareness level among the patient population regarding cancer treatment procedures further drive the growth of the market.

By End User

Hospitals segment held a dominant position in 2020 and will continue to maintain the lead over the forecast period.

Snapshot of Asia-Pacific Monoclonal Antibodies Market

Asia-Pacific presents lucrative opportunities for key players operating in the monoclonal antibodies market, owing to increase in number of initiatives and enhanced investments from governments for overall R&D of monoclonal antibody therapy and rise in number of product approvals. In addition, ongoing innovations in monoclonal antibodies, availability of advanced healthcare systems, and significant surge in demand for advanced healthcare facilities contribute toward the growth of the market. Moreover, surge in focus of leading manufacturers on expanding their geographical presence in emerging Asia-Pacific countries to capture high market share is expected to drive the growth of the monoclonal antibodies market in the region.

By Region

Asia-Pacific would exhibit the highest CAGR of 11.7% during 2021-2030.

List of Key Companies

- Abbott Laboratories

- Amgen Inc.

- AstraZeneca plc

- Bayer AG

- Eli Lilly

- GlaxoSmithKline Plc

- Johnson & Johnson

- Merck & Co. Inc.

- Novartis

- Pfizer

Key Benefits For Stakeholders

- The study provides an in-depth analysis of the monoclonal antibodies market size along with the current trends and future estimations to elucidate the imminent investment pockets.

- It offers monoclonal antibodies market analysis from 2020 to 2030, which is expected to enable the stakeholders to capitalize on the prevailing opportunities in the market.

- A comprehensive analysis of four regions is provided to determine the prevailing opportunities.

- The profiles and growth strategies of the key players are thoroughly analyzed to understand the competitive outlook of the global monoclonal antibodies market growth.

Key Market Segments

By Source

- Murine

- Chimeric

- Humanized

- Human

By Indication

- Cancer

- Breast cancer

- Colorectal cancer

- Lung cancer

- Ovarian cancer

- Others

- Autoimmune Diseases

- Inflammatory Diseases

- Infectious Diseases

- Others

By End User

- Hospitals

- Research Institutes

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- South Africa

- Rest of LAMEA

Monoclonal Antibodies Market Report Highlights

| Aspects | Details |

| By SOURCE |

|

| By INDICATION |

|

| By END USER |

|

| By Region |

|

| Key Market Players | AstraZeneca PLC., Abbott Laboratories, Johnson & Johnson, PFIZER INC., Merck & Co., Inc., Novartis AG, Eli Lily and Company., GlaxoSmithKline plc, Bayer AG., Amgen Inc |

Analyst Review

Monoclonal antibodies are laboratory-produced molecules that are similar to human antibodies in the immune system. The monoclonal antibodies can be made by four sources such as murine, chimeric, humanized, and human. The monoclonal antibodies are developed with the generation of hybridomas.

Factors, such as rise in number of chronic diseases across the globe, rise in public awareness toward minimal adverse effects by monoclonal antibody therapies over drugs & chemotherapy for cancer treatment, introduction of low-priced biosimilar monoclonal antibodies, and surge in popularity of chimeric monoclonal antibodies in clinical development are expected to drive the growth of the market. Moreover, rise in R&D expenditure in the pharmaceutical & biopharmaceutical industry and increase in government support in infection control & management further boost the growth of the market. However, poor demand in underdeveloped countries is expected to restrain the growth of the monoclonal antibodies market.

The total market value of Monoclonal Antibodies market is $146,642.0 million in 2020.

The forcast period for Monoclonal Antibodies market is 2021 to 2030

The market value of Monoclonal Antibodies market in 2021 is $1,62,479.3 million.

The base year is 2020 in Monoclonal Antibodies market

Top companies such as Abbott Laboratories, Amgen Inc., AstraZeneca plc, Bayer AG, Eli Lilly, and GlaxoSmithKline Plc held a high market position in 2020. These key players held a high market postion owing to the strong geographical foothold in different regions.

Human segment is the most influencing segment owing to increase in Rise in integration of advanced technology such as phage or yeast display, and transgenic mice, for human monoclonal antibodies generation, increase in usage for treatment of various chronic diseases, employment of advanced genetic engineering technology, and increase in government support in infection control & management

Increase in prevalence of cancer, increase in demand for cost-efficient biosimilar monoclonal antibodies, high demand for biologics, and increase in R&D activities in genomics coupled with the introduction of technologically advanced genetic platforms, such as next-generation sequencing are the major factors that drive the growth of the market.

Asia-Pacific has the highest growth rate in the market which is growing due to increase in number of initiatives and enhanced investments from governments for overall R&D of monoclonal antibodies and rise in number of product approvals. In addition, ongoing innovations in monoclonal antibodies, availability of advanced healthcare systems, and significant surge in demand for advanced healthcare facilities contribute toward the growth of the market.

Monoclonal antibody (mAb) therapy is a form of immunotherapy that utilizes monoclonal antibodies to attach mono specifically to specific proteins or cells.

Monoclonal antibodies are used to improve & suppress the immune responses in several medical conditions and to treat different diseases such as cardiovascular, cancer, and cerebrovascular diseases.

Loading Table Of Content...