Multiplex Assay Market Research, 2032

The global multiplex assay market size was valued at $3.6 billion in 2022, and is projected to reach $7.7 billion by 2032, growing at a CAGR of 7.8% from 2023 to 2032. The growth of the multiplex assay market size is driven by increase in R&D activities by using multiplex assay technique, rise in awareness regarding use multiplex assay kits for diagnosis of disease, and rise in prevalence of chronic and infectious diseases, which further increases the demand for multiplex assay products and services. For instance, according to the report published by WHO in July 2023, each year there are an estimated 374 million new infections with 1 of 4 curable, more than 500 million people 15–49 years of age are estimated to have a genital infection with herpes simplex virus (HSV or herpes).

Key Takeaways:

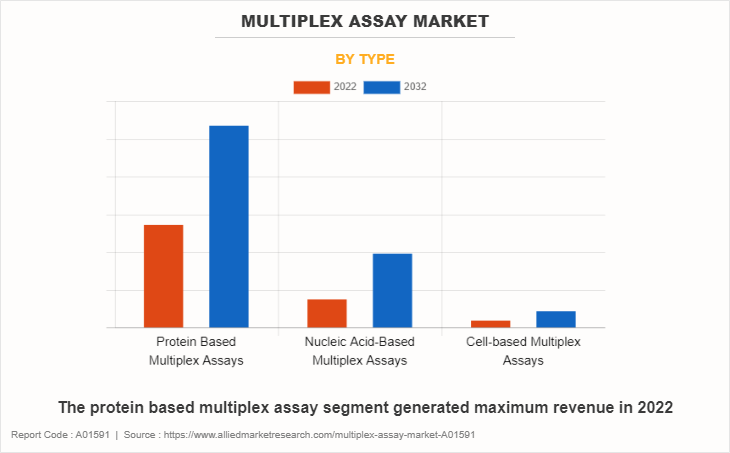

- On the basis of type, the protein based multiplex assay segment was the highest contributor to the market in 2022.

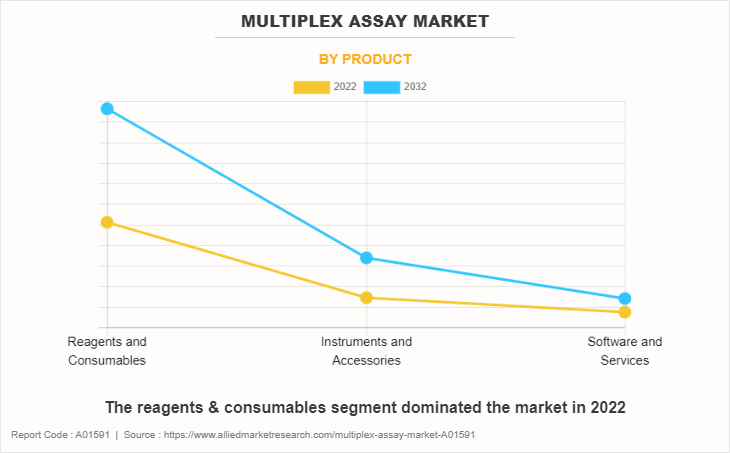

- On the basis of product, the reagents and consumables segment dominated the market in 2022.

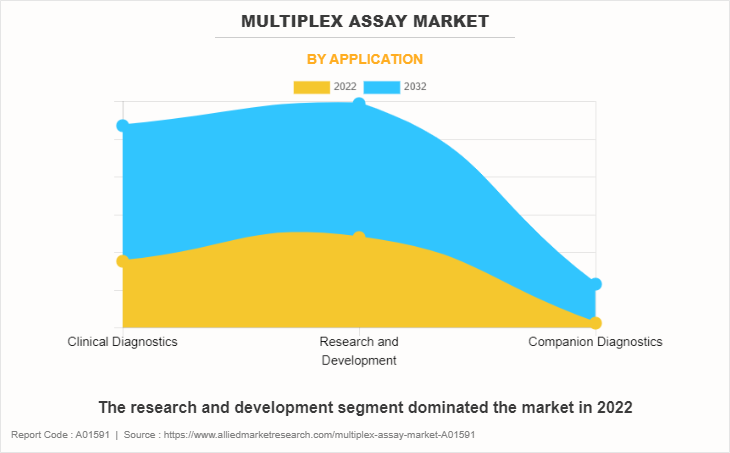

- On the basis of application, the R&D segment was the highest contributor to the market in 2022.

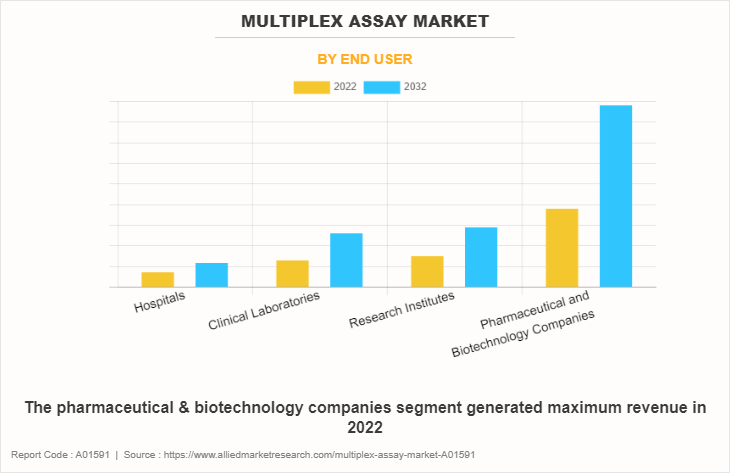

- On the basis of end user, the pharmaceutical & biotechnology companies segment was the highest contributor to the market in 2022.

- On the basis of region, Asia-Pacific is expected to witness the highest CAGR during the multiplex assay market forecast period.

A multiplex assay is a laboratory procedure used to simultaneously measure multiple analytes including proteins, nucleic acids, or other molecules in a single biological sample. This laboratory technique allows researchers to gather more information from a single sample and is commonly used in various fields of biology, medicine, and diagnostics. The multiplex assay technique is widely used by hospitals, clinical laboratories, research institutes, and pharmaceuticals & biotechnological companies.

Market Dynamics

In addition, an increase in technological advancement in multiplex assay products is expected to boost the growth of the multiplex assay market size. For instance, xMAP technology of Luminex Corporation enables the detection of numerous analytes in fields such as cancer, infectious diseases, and autoimmune disorders, leading to quicker and more accurate disease profiling.

Furthermore, multiple assays prove to be highly useful for comprehensive production of personalized medicines. Therefore, the rise in demand for personalized medicines drives the growth of multiplex assay market share. Multiplex assays can detect multiple cancer-related biomarkers in blood, tissue, or other biological samples. They are able to enhance the accuracy of cancer diagnosis and enable early detection by measuring various biomarkers simultaneously, potentially leading to better treatment outcomes. Therefore, the rise in prevalence of cancer drives the growth of multiplex assay market share.

In addition, many companies engaged in research of advanced multiplex instruments and introducing new multiplex assay products are expected to drive the multiplex assay market growth during forecast. For instance, in March 2022, Bio-Rad launched first StarBright Red Dye and extends range of antibody markers conjugated to starbright dyes to enhance multiplex flow cytometry and research capabilities.

Moreover, the increase in utilization of advanced healthcare devices and technologies, growth opportunities in emerging economies and rise in adoption of strategies by key players to expand their market share are the major factors that creating significant growth opportunities for the multiplex assay market.

Recession 2023 Impact Analysis on Multiplex Assay Market

In the healthcare industry, recession results in reduced funding for R&D activities, including multiplex assay products & services. However, the intrinsic value of multiplexed assay products & services in providing comprehensive and efficient healthcare information suggests that the long-term potential of the market remains promising. The demand for advanced multiplex assay products that offer a holistic perspective on the health of a patient is anticipated to propel the multiplex assay market back onto a growth trajectory.

Moreover, the healthcare industry, including pharmaceutical and biotechnology companies, typically demonstrates some level of delay in technological advancement, as the technological progress often relies on sustained research investments, which are disrupted during recessions. Ultimately, the specific impact of a recession on the multiplex assay market in 2023 would depend on a range of factors, including the severity and duration of the recession, government policies, industry trends, and individual company strategies.

Furthermore, rise in prevalence of chronic and infectious disease, rise in R&D activities, rise in initiative taken by key players to reduce the burden of diseases, and high growth potential in developing countries are expected to drive the market growth rate during the forecast period.

Segmental Overview

The multiplex assay market is segmented on the basis of type, product, application, end user, and region. On the basis of type, the market is divided into protein based multiplex assay, nucleic acid-based multiplex assay, and cell-based multiplex assays. On the basis of product, the market is classified into reagents & consumables, instruments & accessories, and software & services. On the basis of application, the multiplex assay market is segregated into clinical diagnostics, research and development, and companion diagnostics.

On the basis of end user, the market is segregated into hospitals, clinical laboratories, research institutes, and pharmaceuticals & biotechnology companies. On the basis of region, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

By Type

The protein based multiplex assay segment generated maximum revenue in 2022, owing to surge in adoption of protein based multiplex assay, and continuous investments in R&D for introduction of innovative technologies. The nucleic acid-based multiplex assay is expected to witness the highest CAGR during the forecast period, owing to rise in use of nucleic acid-based multiplex assay and increase in research regarding nucleic acid-based multiplex assay.

By Product

The reagents & consumables segment dominated the market in 2022, owing to high adoption of reagents & consumables, and recurring purchase of assays and reagents for increasing research applications. However, the instruments & accessories segment is expected to witness the highest CAGR during the forecast period, owing to a rise in adoption of instruments & accessories and increase in R&D labs which further uses instruments & accessories.

By Application

The research and development segment generated maximum revenue in 2022, owing to wide applications of multiplex assay technologies in R&D and convenience and quicker results offered by multiplex assays while performing assays. The clinical diagnostics segment is expected to witness the highest CAGR during the forecast period, owing to a rise in prevalence of chronic disease and increase in awareness regarding diagnosis of diseases.

By End user

The pharmaceutical & biotechnology companies segment generated maximum revenue in 2022 and is expected to witness the highest CAGR during the forecast period, owing to rise in penetration of multiplex assays in pharmaceutical & biotechnology companies, as compared to conventional assays, for biomolecular detection, biomarker validation, and measuring pathways for diseases & physiological activities.

By Region

North America accounted for a major share of the multiplex assay market in 2022 and is expected to maintain its dominance during the forecast period. The presence of several major players, such as Becton, Dickinson and Company, Bio-Rad Laboratories, Inc., Illumina Inc., and Thermo Fisher Scientific Inc., and high healthcare expenditure from government organizations in the region drive the growth of the market. Moreover, the high adoption rate of multiplex assay products & services, and the significant increase in capital income in developed countries boost the growth of the multiplex assay market in North America.

Furthermore, the availability of advanced healthcare systems, and availability of newly launched products in the region fosters the growth of the market. In addition, the U.S. is anticipated to contribute to a major share of the regional market and is expected to drive the growth of the multiplex assay market during the forecast period. The presence of key players, R&D labs, high medical tourism and high purchasing power propels the growth of the market.

Asia-Pacific is expected to grow at the highest rate during the forecast period, owing to rise in the number of people suffering from chronic and infectious disease, increase in awareness regarding the use of multiplex assay products & services, and increase in purchasing power of populated countries, such as China and India.

Furthermore, the market growth in the region is attributable to factors such as entry of key players, increase in per capita spending, and increase in government initiatives for improving healthcare infrastructure. The countries in Asia-Pacific possess a huge population base, with China being the first having 1,411,778,724 population in 2020 and India as the second most populated country having 1,380,004,385 population in 2020. Therefore, a rise in population along with longer life expectancy is expected to drive the growth of the market in Asia-Pacific during the forecast period.

Competition Analysis

Competitive analysis and profiles of the major players in the multiplex assay market, such as Abcam plc, Becton, Dickinson and Company, Bio-Rad Laboratories, Inc., DiaSorin S.p.A. (Luminex Corporation), Illumina Inc., Meso Scale Diagnostics LLC, QIAGEN N.V., Randox Laboratories Ltd., Seegene Inc., Thermo Fisher Scientific Inc. These major players have adopted acquisition, agreement, expansion, partnership, product launch, product approval as key developmental strategies to improve their product portfolio.

Recent acquisition in the Multiplex Assay Market

In July 2021, DiaSorin S.p.A. announced that it has completed the acquisition of Luminex Corporation. DiaSorin gained access to multiplexing technology and a portfolio of Luminex that strengthened its existing offering, while expanding the Group presence in the U.S. through the acquisition.

Recent Agreement in the Multiplex Assay Market

In June 2023, Bio-Rad Laboratories, Inc., a global leader in life science research and clinical diagnostic products, announced today that it has reached an agreement to acquire all of the outstanding shares of Curiosity Diagnostics, Sp. Z. o. o. from Scope Fluidics, S.A., a Warsaw, Poland, based developer of the PCR ONE technology for rapid, automated detection of infections via highly multiplexed PCR assays.

Recent Collaboration in the Multiplex Assay Market

In August 2022, BD (Becton, Dickinson and Company) announced a collaboration agreement with Labcorp, a leading global life sciences company, creating a framework to develop, manufacture, market and commercialize flow cytometry-based companion diagnostics (CDx) intended to match patients with life-changing treatments for cancer and other diseases. According to Puneet Sarin, president of BD Biosciences, In the companion diagnostic landscape, there is a clear and urgent need for high sensitivity and multiplexing capabilities, and that is where flow cytometry can help.

Recent Expansion in the Multiplex Assay Market

In July 2023, QIAGEN announced that the expansion of its digital PCR (dPCR) offering for the development of cell and gene therapies in the biopharma industry. The company partnered with Niba Labs to offer customized dPCR assay design services to biopharma customers and also launched the new CGT Viral Vector Lysis Kit that enables a standardized workflow from cell lysates to absolute and precise quantification of viral titers for multiple serotypes. The partnership between QIAGEN and Niba Labs is expected to allow QIAcuity customers to use the combined expertise of both companies to develop new custom simplex or multiplex assays for the quantification of nucleic acids and to optimize existing qPCR assays for the use in digital PCR.

In July 2022, QIAGEN adds new biopharma products to QIAcuity digital PCR portfolio and launches Expert Custom Assay Design Service.New solutions are now available with ten new QIAcuity Cell and Gene Therapy (CGT) dPCR Assays for use in adeno-associated virus (AAV) titer quantification and three new QIAcuity Residual DNA Quantification Kits for checking carryover of host cell DNA. The newly launched custom assay design provides dPCR users with access to tailored multiplex assays for use beyond biopharma applications.

In December 2021, BD announced that it has expanded the BD COR System to include a new MX instrument for high-throughput molecular testing for infectious diseases. The new instrument and its first test for sexually transmitted infections (STI) have been CE marked to the IVD directive 98/79/EC. The availability of the MX instrument expands the use of the platform and automates testing for an expanding list of high-demand, essential assays for health and STI testing of women using multiplex PCR assay design, starting with BD's CTGCTV2 test.

Recent Partnership in the Multiplex Assay Industry

In June 2021, Seegene Inc. has signed a partnership agreement with American biotechnology company Bio-Rad Laboratories, Inc. for the clinical development and commercialization of infectious disease molecular diagnostic products for the U.S. Market. Under the terms of the agreement, Seegene is anticipated to provide diagnostic tests for use on CFX96 Dx Real-Time PCR System of Bio-Rad for the U.S. market, pending clinical development and approval from the U.S. Food and Drug Administration (FDA).

Recent Product Approval in the Multiplex Assay Industry

In June 2022, Seegene Inc. has obtained EU approval for its Allplex SARS-CoV-2/FluA/FluB/RSV Assay that is compatible with the fully automated ‘AIOS’ (All-in-One System) of the company. This is expected to help small hospitals, local clinics, and public health centers effectively identify COVID-19, influenza A and B and respiratory syncytial virus (RSV). The Allplex SARS-CoV-2/FluA/FluB/RSV Assay can detect six targets associated with the four respiratory viruses. The targets include three distinct COVID-19 genes (S, RdRp, N) to reliably identify positive cases even as new variants emerge.

Recent Product Launch in the Multiplex Assay Market

In May 2022, Becton, Dickinson and Company (BD) announced a new high-throughput molecular diagnostic combination test for SARS-CoV-2 and Influenza A/B, the second test available for the BD COR™ PX/MX System to have been CE marked to the IVD directive 98/79/EC. The BD SARS-CoV-2/Flu assay for the BD COR System is an automated multiplexed real-time RT-PCR test to detect and differentiate SARS-CoV-2 and influenza A, and/or influenza B from a single nasal sample from patients who have shown signs of respiratory viral infection, as well as those who are asymptomatic.

In November 2020, QIAGEN launched the NeuMoDx multiplex test to complete the range of SARS-CoV-2 testing solutions in Europe and other markets. The European launch of the NeuMoDx Flu A-B/RSV/SARS-CoV-2 Vantage Test is expected to help healthcare professionals quickly identify and differentiate between patients with common seasonal respiratory infections and COVID-19.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the multiplex assay market analysis from 2022 to 2032 to identify the prevailing multiplex assay market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the multiplex assay market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global multiplex assay market trends, key players, market segments, application areas, and market growth strategies.

Multiplex Assay Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 7.7 billion |

| Growth Rate | CAGR of 7.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 430 |

| By End User |

|

| By Type |

|

| By Product |

|

| By Application |

|

| By Region |

|

| Key Market Players | MESO SCALE DIAGNOSTICS, LLC, Illumina Inc., Seegene Inc, Bio-Rad Laboratories, Inc. , Randox Laboratories Limited, Becton, Dickinson and Company, Diasorin S.p.A., Qiagen N.V, Thermo Fisher Scientific Inc. , Abcam plc. |

Analyst Review

According to the insights of the CXOs, the multiplex assay market is poised to grow at a notable pace due to a rise in prevalence of chronic infectious diseases and cancers, which further boosts the demand for multiplex assay reagents and equipment.

As per the perspectives of CXOs, factors that fuel the growth of the global multiplex assay market include the technological advancements in multiplex assay equipment and increase in awareness about healthcare. In addition, there is an increase in government funds for detection of new biomarkers and increase in R&D activities to introduce novel drug therapies are expected to drive the growth of market.

North America garnered the highest market share in 2022 and is expected to maintain its lead during the forecast period, in terms of revenue, owing to high adoption of multiplex assay equipment, availability of robust healthcare infrastructure, and strong presence of key players. However, Asia-Pacific is anticipated to witness notable growth owing to rise in healthcare expenditure, high unmet medical demands, surge in prevalence of infectious diseases, and increase in public–private investments in the healthcare sector.

The base year is 2022 in Global Multiplex assay Market.

The Multiplex Assay Market was valued at $3.6 billion in 2022

The rapid technological advancements in multiplex assay equipment, increase in R&D activities in pharmaceuticals for treatment of several diseases are the upcoming trends of Multiplex Assay Market in the world.

The forcast period for Global Multiplex assay Market is 2023 to 2032

The estimated industry size is expected to reach $7.7 billion by 2032

The research and development is the leading application of Multiplex Assay Market

North America is the largest regional market for Multiplex Assay

The DIASORIN (Luminex Corporation), Thermo Fisher Scientific Inc., Bio-Rad Laboratories Inc., Seegene Inc. are the top companies to hold the market share in Multiplex Assay.

Loading Table Of Content...

Loading Research Methodology...