Nuclear Medicine Market Overview

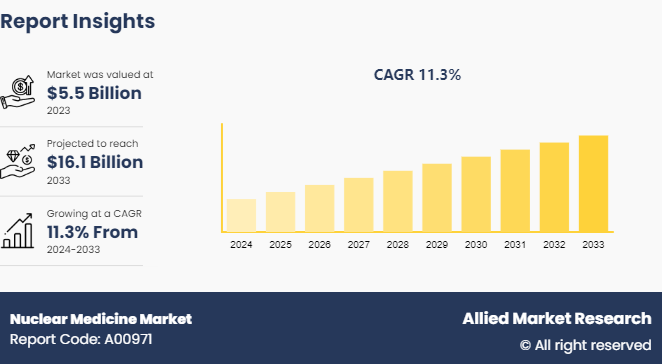

The global nuclear medicine market size was valued at $5.5 billion in 2023, and is projected to reach $16.1 billion by 2033, growing at a CAGR of 11.3% from 2024 to 2033. Growing prevalence of cancer and cardiovascular diseases, which require advanced diagnostic and therapeutic solutions as well as increasing adoption of SPECT and PET imaging technologies and rising investments in radiopharmaceutical research are major drivers of the market.

Market Size & Future Outlook

- 2023 Market Size: $5.5 Billion

- 2033 Projected Market Size: $16.1 Billion

- CAGR (2024-2033): 11.3%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The global nuclear medicine market is experiencing growth due to several factors such as increase in incidence of cancer and cardiovascular conditions necessitating advanced diagnostics and therapies, higher investments in healthcare infrastructure and services and development of novel radiopharmaceuticals and innovative treatment methods.

Market Introduction and Definition

Nuclear medicine is a specialized area of medical imaging that uses small amounts of radioactive material to diagnose, determine the severity of, or treat a variety of diseases, including many types of cancers, heart disease, gastrointestinal, endocrine, and neurological disorders. Contrary to traditional imaging methods, which only show the body's structure, nuclear medicine treatments offer comprehensive details about the anatomy and physiology of organs and tissues. This is accomplished by using radiopharmaceuticals, which are chemicals that release gamma rays that may be picked up by specialized cameras. These cameras combine with computers to create finely detailed images that show the body's radioactive material concentration and distribution. Nuclear medicine improves patient care by providing the viewing of physiological processes at the molecular level, which helps with early diagnosis and accurate treatment planning.

Key Takeaways

- The nuclear medicine market size study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major nuclear medicine industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- global nuclear medicine market is experiencing growth due to several factors such as increase in incidence of cancer and cardiovascular conditions necessitating advanced diagnostics and therapies, higher investments in healthcare infrastructure and services and development of novel radiopharmaceuticals and innovative treatment methods.

Key Market Dynamics

One of the primary drivers which drives nuclear medicine market growth is the increasing prevalence of chronic diseases such as cancer and cardiovascular conditions, which necessitates advanced diagnostic and therapeutic solutions. For instance, the use of PET and SPECT imaging for early cancer detection and management has become crucial, boosting market demand. Technological advancements, such as the development of more precise radiopharmaceuticals, also drive the market. Additionally, growing investments in healthcare infrastructure in emerging regions, along with supportive government policies, are significant contributors to market expansion.

However, the high cost of nuclear medicine procedures and equipment can limit accessibility and affordability, particularly in low- and middle-income countries. There are also stringent regulatory requirements and lengthy approval processes for new radiopharmaceuticals, which can delay the introduction of innovative products. Furthermore, the potential health risks associated with exposure to radiation pose safety concerns that can hinder market growth.

Furthermore, the increasing focus on personalized medicine, which tailors treatment based on individual patient characteristics, offers significant potential for nuclear medicine. For instance, theranostics, which combines diagnostic imaging and targeted therapy, is a growing area of interest. Additionally, expanding applications in neurology and cardiology, and the development of novel radiopharmaceuticals targeting specific disease markers, provide avenues for growth. Collaborations between research institutions and pharmaceutical companies to advance nuclear medicine technologies also present substantial nuclear medicine market opportunity for innovation and market expansion.

Nuclear Medicine Market Segmentation Overview

The nuclear medicine industry is segmented into type, modality, application, end-user and region. On the basis of type, the market is classified into diagnostics, therapeutics, biochemistry research. Based on modality, the market is divided into SPECT, PET, Alpha-emitters, Beta-emitters and brachytherapy. As per application, the market is segregated into oncology, cardiology, neurology, thyroid, and others. Based on end user, the market is divided into hospitals & diagnostic centers and research institutes. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America has the largest nuclear medicine market share and experiencing significant growth driven by several key factors. A major driver is the increasing prevalence of chronic diseases such as cancer and cardiovascular conditions, which necessitates advanced diagnostic and therapeutic techniques. In addition, technological advancements in imaging modalities and radiopharmaceuticals have also played a crucial role in expanding the market. Innovations such as hybrid imaging systems (PET/CT, SPECT/CT) enhance diagnostic accuracy and efficiency. Furthermore, growing investments in research and development, coupled with favorable government initiatives and funding, are propelling the market growth. The rising awareness and adoption of personalized medicine, which nuclear medicine supports by providing detailed molecular insights, is another significant factor driving the growth during nuclear medicine market forecast.

Furthermore, the nuclear medicine market is experiencing significant growth in emerging regions due to increasing investments in healthcare infrastructure, rising prevalence of chronic diseases such as cancer and cardiovascular conditions, and growing awareness about the benefits of early diagnosis and targeted therapies. Additionally, supportive government policies and the establishment of advanced medical facilities are fostering the adoption of nuclear medicine. Technological advancements and collaborations between local and international players are further propelling market expansion in these regions.

- The Government of Canada has made significant strides in revitalizing and enhancing the country's biomanufacturing and life sciences sector, committing over $2 billion since March 2020. This investment has facilitated 36 major projects, expanding the sector's capabilities to better address medical challenges, treat diseases, and provide comprehensive patient care. Recognizing the critical role of medical isotopes in modern healthcare, the government is also prioritizing investments in this area to maintain Canada's position as a global leader in medical treatments, ensuring Canadians have access to cutting-edge healthcare solutions.

- In May 2024, Bruce Power in Ontario will double production of life-saving medical isotopes. Lutetium-177 will be used to treat a range of cancers including prostate cancer and neuroendocrine tumors.

Industry Trends

- In February 2024, The (Indian) government medical college and hospital (GMCH) Nagpur has been chosen for setting up new skill labs worth US$3.51 million (Rs.29 crore) for postgraduate student and faculty especially surgeons. The latest nuclear medicine diagnostic unit is being setup at a cost of US$ 1.09 million (Rs. 9 crore) through the district planning and development.

- In October 2022, The U.S. Department of Health and Human Services spent $290 million on a drug (Nplate) to treat radiation sickness.

- In May 2024, Mauritius opened its new National Cancer Centre in Solferino, bringing an end to nearly ten years of IAEA support for the development of nuclear medicine in the nation. Anticipated to significantly transform cancer treatment for Mauritius patients, the new facility will consolidate all oncology services, including nuclear medicine, under one roof.

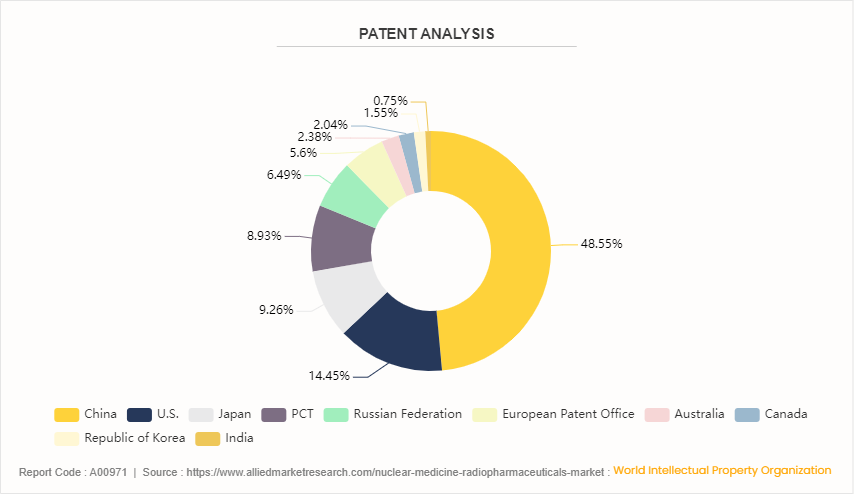

Patent Analysis, By Country, 2015-2024

China witnessed the highest number of nuclear medicine market share in patent approvals and applications, due to favorable government policies, new technological advancement and new product launches in the country. The U.S. has 14.5% of the total number of patents, followed by Japan at 9.3% and PCT at 8.9%.

Competitive Landscape

The major players operating in the nuclear medicine market include GE Healthcare, Jubilant Life Sciences Ltd, Nordion (Canada) , Inc., Bracco Imaging S.P.A, The Institute for Radioelements (IRE) , NTP Radioisotopes SOC Ltd., The Australian Nuclear Science and Technology Organization (ANSTO) , Eczacibasi-Monrol, Lantheus Medical Imaging, Inc., and Eckert & Ziegler. Other players in nuclear medicine market includes Mallinckrodt, Cardinal Health, Telix Pharmaceuticals, Inc., Nordic Nanovector, Y-mAbs Therapeutics, Inc., NorthStar Medical Radioisotopes, FUJIFILM Toyama Chemical Co., Ltd., ITM Isotope Technologies Munich SE, Penang Adventist Hospital (PAH) , Navidea Biopharmaceuticals, Inc. and so on.

What are the Recent Key Strategies and Developments

- In December 2023, Eli Lilly and Company finalized a definitive agreement to acquire POINT Biopharma, Inc., a prominent radiopharmaceutical company. This strategic maneuver is geared towards broadening Lilly's capabilities within the oncology sector, with a particular emphasis on advancing next generation radioligand therapies.

- In November 2023, BWXT Medical, a subsidiary of BWX Technologies, is set to supply Fusion Pharmaceuticals with generators for producing actinium-225, a crucial medical isotope in cancer treatment trials. This agreement grants Fusion a preferential radium-225 supply and access to advanced generator technology, supporting the manufacturing of Ac-225 for clinical trials.

- In November 2023, Telix Pharmaceuticals strategically initiated the acquisition of radiopharmaceutical company QSAM for a significant USD 125 million. The structured payment plan includes an initial USD 2 million upfront, USD 33 million upon closing, and potential milestone-based payments of up to USD 90 million. The acquisition encompasses QSAM's lead therapeutic agent, CycloSam. Expected to conclude in Q1 2024.

- In March 2023, Life Healthcare acquired TheraMed Nuclear to set operation in South Africa for non-clinical imaging operations in Gauteng.

- In June 2021, Bayer acquired Noria Therapeutics Inc. and PSMA Therapeutics Inc. to obtain exclusive rights to a differentiated alpha radionuclide investigational compound based on actinium-225 and a small molecule directed towards prostate-specific membrane antigen (PSMA) . The acquisition broadens Bayer’s existing oncology portfolio of targeted alpha therapies (TATs) , which currently includes Xofigo (radium Ra 223 dichloride) , which is approved for metastatic castration resistant prostate cancer (mCRPC) with symptomatic bone metastases and no known visceral metastases, and the proprietary platform of investigational TATs based on thorium-227.

- In August 2021, NorthStar Medical Radioisotopes, LLC, and GE Healthcare announced the signing of an exclusive agreement for the manufacturing and distribution of iodine-123 (I-123) capsules in the U.S.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the nuclear medicine market trends, current trends, estimations, and dynamics of the nuclear medicine market analysis from 2023 to 2033 to identify the prevailing nuclear medicine market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the nuclear medicine market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global nuclear medicine market statistics.

Key Sources Referred

- Centers for Disease Control and Prevention

- World Health Organization

- National Center for Biotechnology Information

- The Lancet

- National Perinatal Epidemiology and Statistics Unit (NPESU)

- Science Direct

- Health Resources and Services Administration (HRSA)

- Department of Health and Human Services (HHS)

- National Institutes of Health (NIH)

Nuclear Medicine Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 16.1 Billion |

| Growth Rate | CAGR of 11.3% |

| Forecast period | 2024 - 2033 |

| Report Pages | 260 |

| By Type |

|

| By Modality |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Jubilant Life Sciences Ltd, NTP Radioisotopes SOC Ltd., Eczacibasi-Monrol, Bracco Imaging S.P.A, Lantheus Medical Imaging, Inc.,, Eckert and Ziegler, Nordion, Inc., The Institute for Radioelements, GE Healthcare, The Australian Nuclear Science and Technology Organization |

Analyst Review

Radiopharmaceuticals is a medical specialty that uses specific radiotracers, and have emerged as an efficient imaging technology in the field of nuclear medicine. The non-invasive nature of radiopharmaceuticals has quickened the diagnosis of various diseases such as cardiovascular diseases, neurological disorders, and cancers. Nowadays, therapeutic radiopharmaceuticals are preferred to conventional therapeutic modalities, such as chemotherapy, in the field of oncology for treating cancers. Radiopharmaceuticals are mostly used in diagnostic applications due to advancements in the field such as hybrid imaging technologies using PET/CT and SPECT/CT.

Convenient therapeutic radiopharmaceuticals procedures have a higher capability of mapping physiological functions and metabolic activities and providing specific information about organ function and dysfunction as compared to conventional imaging modalities such as magnetic resonance imaging (MRI), computed tomography (CT), and ultrasonography (US) among others. Furthermore, increase in incidence of cancer & cardiovascular aliments, growing demand for alpha radio immunotherapy-based targeted cancer treatment, need for nuclear imaging techniques, and advancements in radiotracers have opened new avenues for radiopharmaceutical manufactures.

The SPECT and PET radiopharmaceuticals modality are widely used at hospitals and diagnostics centers adopting novel methods of radiolabeling with advanced targeting specificity and better therapeutic efficacy. Therefore, the use of SPECT and PET scans facilitates early and accurate diagnosis of complex diseases such as cancer. Increased usage of SPECT and PET scans in turn fosters the demand for radiopharmaceuticals across varied applications such as cancer, cardiac diseases, neurological diseases, and renal & respiratory diseases, among others. The steady progress in the field of nuclear medicine is expected to continue in the near future, which would eventually help in improving the medical diagnostic sector.

Positron emission tomography (PET) scans are widely used in the medical sector, as they provide better quality images and higher precision diagnosis. The other reasons attributed to the high demand for PET scans include upsurge in R&D activities, especially in developing economies, and wide scope of radiopharmaceutical applications such as thyroid, oncology, and bone pain palliation. The radiopharmaceutical market is dominated by Asia-Pacific region followed by Europe and North America. However, Asia-Pacific region is growing at fastest pace during the study period due to large pool of targeted diseases with unmet medical demands in China and India. The Asia-Pacific radiopharmaceuticals market would offer lucrative growth opportunities to the market players due to improvement in healthcare infrastructure, high disposable incomes, and increasing government initiatives to promote early diagnosis of diseases.

The global nuclear medicine market is experiencing growth due to several factors such as increase in incidence of cancer and cardiovascular conditions necessitating advanced diagnostics and therapies, higher investments in healthcare infrastructure and services, and development of novel radiopharmaceuticals and innovative treatment methods.

Nuclear medicine is a specialized area of medical imaging that uses small amounts of radioactive material to diagnose, determine the severity of, or treat a variety of diseases, including many types of cancers, heart disease, gastrointestinal, endocrine, and neurological disorders.

The GE Healthcare, Jubilant Life Sciences Ltd, Nordion (Canada) , Inc., Bracco Imaging S.P.A, The Institute for Radioelements (IRE) , NTP Radioisotopes SOC Ltd. held a high market position in 2023.

The base year is 2023 in nuclear medicine market.

The forecast period for nuclear medicine market is 2024 to 2033.

The market value of nuclear medicine market in 2033 is $16.1 billion.

The total market value of nuclear medicine market is $5.5 billion in 2023.

Loading Table Of Content...