Nutraceutical Ingredients Market Research, 2031

The global nutraceutical ingredients market size was valued at $163.9 billion in 2021, and is projected to reach $327.3 billion by 2031, growing at a CAGR of 7.3% from 2022 to 2031.

Ingredients called nutraceuticals are added to a variety of functional foods and beverages to boost their nutritional value. The finished food item's appearance, flavor, and sensory attributes are also improved. As consumer demand for products with better taste, flavor, and nutrition increases, new products are introduced to the market.

Market Dynamics

Growing customer preference for natural goods is a significant element impacting market expansion. The demand for nutraceuticals is expanding as a result of consumers' rising concerns about preventative healthcare and the effectiveness of these substances on their health. Because more people are consuming functional foods, which in addition to providing essential nourishment also have the potential to benefit health, the demand for nutraceutical ingredients has surged. The vast majority of individuals in today's world suffer from obesity, digestive issues, gastrointestinal infections, and other illnesses. As a result, industry participants are creating nutraceutical substances to aid in the treatment of such illnesses. Currently, the market for nutraceutical ingredients is not being significantly impacted by rising health concerns, but this is anticipated to change soon.

The majority of consumers are oriented toward nutraceutical ingredient products since they are more concerned with improving their health than with spending enormous medical expenditures for therapy. Nutraceuticals are becoming more significant and common in people's daily diets all around the world. Currently, product changes are done in accordance with the prevailing market trend. As a result, functional and nutraceutical foods that target both general and specific health issues can now be produced by large producers thanks to innovation and technology. Additionally, implementing preventative healthcare practices has a significant positive impact on product sales worldwide. One of the fastest-growing industries for beverages is the functional beverage sector, which has development potential in emerging nations. The demand for improved water and ready-to-drink beverages is rising in the functional beverage market.

The nutraceutical ingredients market demand has grown significantly across all age groups, and this demand has grown significantly faster than the world average disposable income. Global consumers are more concerned about changes in their quality of life and are paying close attention to the foods they eat. The market for nutraceutical ingredients will have abundant growth opportunities as a result of the strong customer base for fortified foods from emerging markets. One of the key elements boosting the usage of nutraceutical ingredients is the rising demand for bread and confectionery products. Soluble nutraceutical ingredients are frequently used in baking and confectionery to fortify and increase the nutritional value of products.

The global for nutraceutical ingredients market size is expanding favorably due to a wide range of driving factors. An important reason in the market's expansion has been the rising incidence of chronic illnesses and diseases. This has raised awareness about leading a healthy lifestyle and eating well. Non-communicable diseases have significantly increased in prevalence in recent years. The majority of cases are brought on by evolving lifestyles that are predominately unhealthy. Naturally, this has contributed to the rise in demand for nutraceutical substances that aid in the prevention of such disorders. As a result, the market has recently experienced a significant expansion.

The efforts made by governments throughout the world to promote its use is an significant factor driving the growth of the global market for nutraceutical ingredients. This has aided in raising awareness and making them more widely accessible. This has also fueled the growth of the nutraceutical ingredients market globally. Additionally, the global market is being fueled by the expanding developments in the healthcare industry.

One of the main factors influencing market expansion is consumers' growing preference for natural products. The industry is expanding as a result of consumers' increased concerns about preventative healthcare and the benefits of probiotic bacteria. Increased intake of functional foods, which in addition to providing essential nourishment, have the potential to promote health, has led to an increase in the demand for probiotics. Obesity, digestive problems, gastrointestinal infections, vaginal infections, and other illnesses affect the majority of people today. Market participants have created probiotic products to assist in the treatment of such disorders in light of this. The rise in health concerns has had a modest effect on the probiotics business, but it is anticipated to grow rapidly.

Segmentation Overview

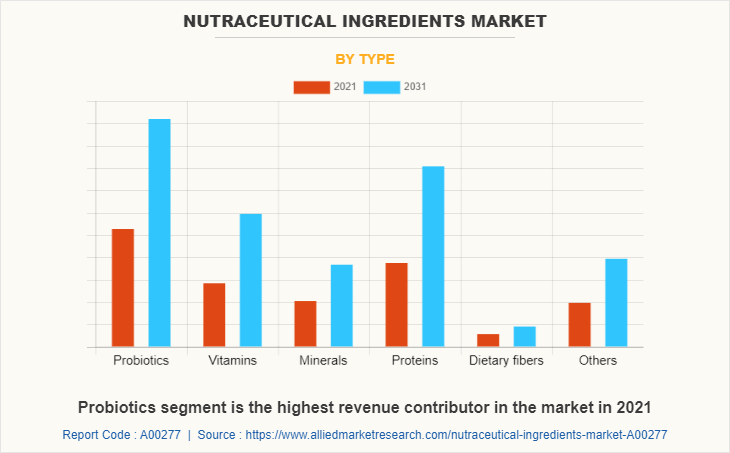

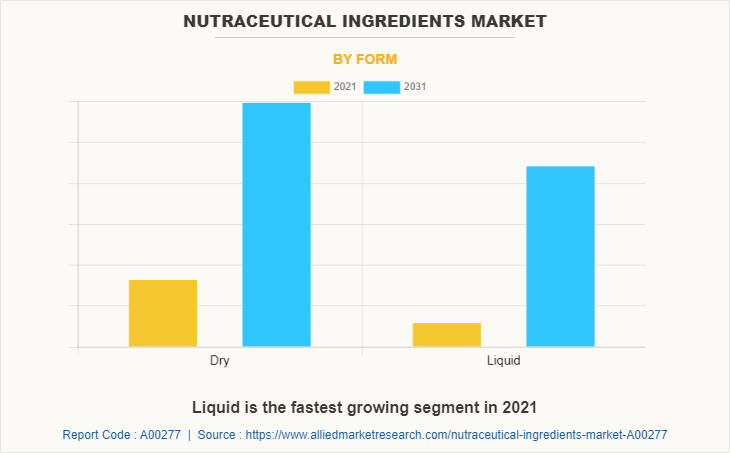

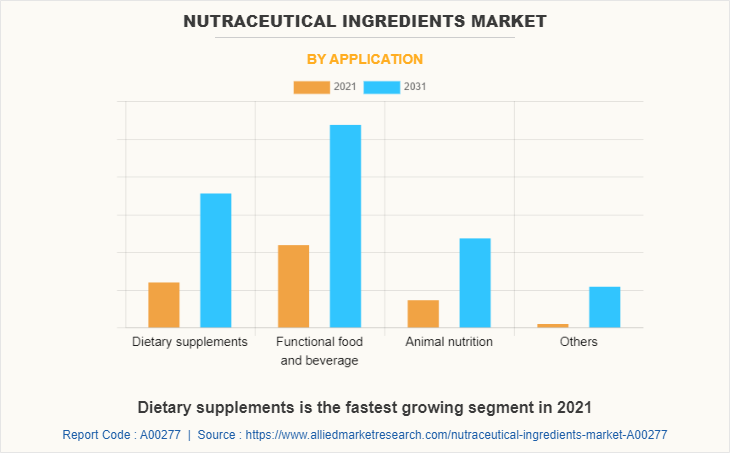

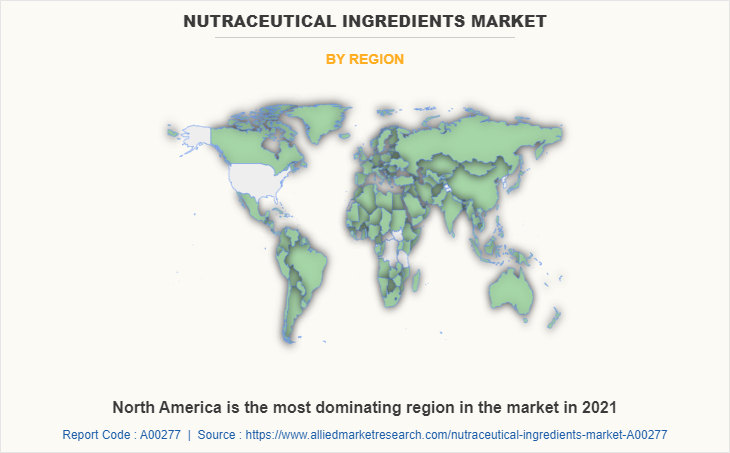

The nutraceutical ingredients market is analyzed based on type, form, application, and region. By type, the market is divided into probiotics, vitamins, minerals, proteins, dietary fibers, and others. Further, proteins segment is bifurcated into plant proteins and animal proteins. By form, the market is divided into dry and liquid. By application, it is classified into dietary supplements, functional food & beverage, animal nutrition, others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Product Type

The probiotics segment, as per product type, dominated the global medical nutraceutical ingredients market in 2021 and is anticipated to maintain its dominance throughout the forecast period. Probiotics have positive benefits on the body when ingested in sufficient levels, such as enhanced gut health and decreased intestinal inflammation. Probiotics are essential for preventative healthcare since they boost immune function and stop the development of diseases. Therefore, increasing awareness of preventive healthcare is anticipated to fuel market expansion.

By Form

The liquid segment is the fastest growing segment in the global nutraceutical ingredients market. Due to its use in yogurt, the most widely consumed source of probiotics, which is a liquid form of a nutrient, the demand for liquid nutraceutical ingredients has increased as compared to dry nutraceutical ingredients. Kefir water, probiotic juices, and drinks made with yogurt are a few other products that contain liquid ingredients and are all beneficial daily supplements. It is anticipated that in the upcoming years, the Asia-Pacific region would be a significant market for nutraceutical ingredients. Considering how extensively functional food and drink are consumed in China, there is a significant opportunity for both domestic and foreign businesses to enter the market.

By Application

The functional food & beverage segment exhibits the fastest growth in the global nutraceutical ingredients market. Some of the factors affecting the market for nutraceutical ingredients include awareness, belief in their efficacy, and safety. Dairy products, non-dairy beverages, cereals, and newborn formula are just a few of the functional food and beverage applications where nutraceutical additives are being used on a large scale.

By Region

Region wise, North America dominated the market with the largest share during the nutraceutical ingredients market forecast period. The nutraceutical ingredients market growth in this region is attributed to an increase in the usage of dietary supplements since people are becoming more aware of the health advantages of taking them because they include nutrients, primarily minerals and vitamins. 80% of American adults use dietary supplements, according to U.S. Pharmacopeia Convection.

In addition, Asia-Pacific region is the fastest growing region in the global nutraceutical ingredients market. Convenience food consumption has increased as a result of busy lifestyles, and the region's economies have grown more rapidly. This has increased demand for enriched nutritional food and beverage items. Another important factor likely fueling market expansion in the Middle East & Africa and the Asia-Pacific is growing consumer expenditure on health and wellness products as a result of changing lifestyles and rising disposable income.

Competitive Analysis

The major players analyzed for the nutraceutical ingredients industry Amway Corporation, AOR Inc., Archer Daniels Midland, Cargill Incorporated, Danone, EID Parry, General Mills, Herbalife International of America Inc., Innophos, Matsun Nutrition, Mead Johnson, Nestle SA, Natrol, Royal DSM, and Valensa International. Key players operating in the market have adopted product launch, business expansion, and mergers & acquisitions as key strategies to expand their nutraceutical ingredients market share, increase profitability, and remain competitive in the market. In order to get an advantage over rival manufacturers in the market, they are primarily focused on improving the quality of their products. Manufacturers have an advantage in expanding their product line internationally due to an advanced distribution network and manufacturing knowledge and expertise.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the nutraceutical ingredients market analysis from 2021 to 2031 to identify the prevailing nutraceutical ingredients market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the nutraceutical ingredients market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global nutraceutical ingredients market trends, key players, market segments, application areas, and market growth strategies.

Nutraceutical Ingredients Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 327.3 billion |

| Growth Rate | CAGR of 7.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 300 |

| By Application |

|

| By Type |

|

| By Form |

|

| By Region |

|

| Key Market Players | Matsun Nutrition, Danone, , Nestle S.A., Cargill, Incorporated, Mead Johnson, aor international, Royal DSM, AMWAY CORPORATION, natrol, inc., Archer Daniels Midland Company, valensa international, Innophos Holdings Inc, EID Parry India Ltd, Herbalife Ltd., General Mills, Inc. |

Analyst Review

The perspectives of the leading CXOs in the nutraceutical ingredients industry are presented in this section. The nutraceutical ingredients market is anticipated to be significantly influenced by the rising demand for functional foods and dietary supplements during the forecast period. A positive perspective toward medical nutrition in light of its growing use to treat cardiovascular disease and malnutrition is likely to stimulate the industry's expansion.

The CXOs further added that due to the widespread knowledge of the advantages of dietary fibers and minerals for maintaining physical health, these nutrients are expected to increase in popularity. While minerals help to increase the retention and passage of nutrients into cells and support blood clotting, among other tasks, fibers tend to facilitate better bowel movements while providing essential cleansing of internal organs. The nutraceutical ingredients market is also anticipated to grow in size due to the high adoption rates of herbal medicines among people around the world as a result of growing concerns about the potentially dangerous side effects of conventional pharmaceuticals during the forecast period.

It is anticipated that rising healthcare costs and an increase in the global elderly population will support the growth of the nutraceutical ingredients market. The enhanced health and wellness advantages that functional meals provide are primarily to blame for the extremely positive attitude that consumers have toward these items. A number of factors have contributed to the total growth, including the aging population, growing healthcare costs, changing lifestyles, food innovation, and expectations for higher prices.

The global nutraceutical ingredients market size was valued at $163.9 billion in 2021, and is projected to reach $327.3 billion by 2031

The global Nutraceutical Ingredients market is projected to grow at a compound annual growth rate of 7.3% from 2022 to 2031 $327.3 billion by 2031

The major players analyzed for the nutraceutical ingredients industry Amway Corporation, AOR Inc., Archer Daniels Midland, Cargill Incorporated, Danone, EID Parry, General Mills, Herbalife International of America Inc., Innophos, Matsun Nutrition, Mead Johnson, Nestle SA, Natrol, Royal DSM, and Valensa International.

Region wise, North America dominated the market with the largest share

Growing customer preference for natural food products, increase in popularity of probiotic dietary supplements, rising concerns of consumers about preventative healthcare and the effectiveness of these substances on their health, increase in consumer preference for functional foods, and surge in incidence of chronic diseases among the population propel the growth of the global nutraceutical ingredients market

Loading Table Of Content...