Patient Temperature Management Market Research, 2035

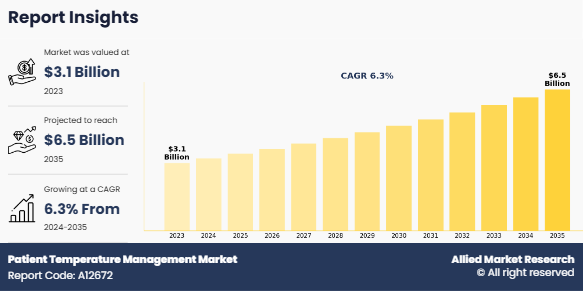

The global patient temperature management market size was valued at $3.1 billion in 2023, and is projected to reach $6.5 billion by 2035, growing at a CAGR of 6.3% from 2024 to 2035. The growth of the patient temperature management market is driven by increase in incidence of surgical procedures, rising awareness about the risks of temperature imbalances during surgery, and advancements in medical technologies that offer better temperature regulation. In addition, the growing emphasis on patient safety and comfort, particularly in critical care and emergency settings, further fuels market expansion.

Key Takeaways

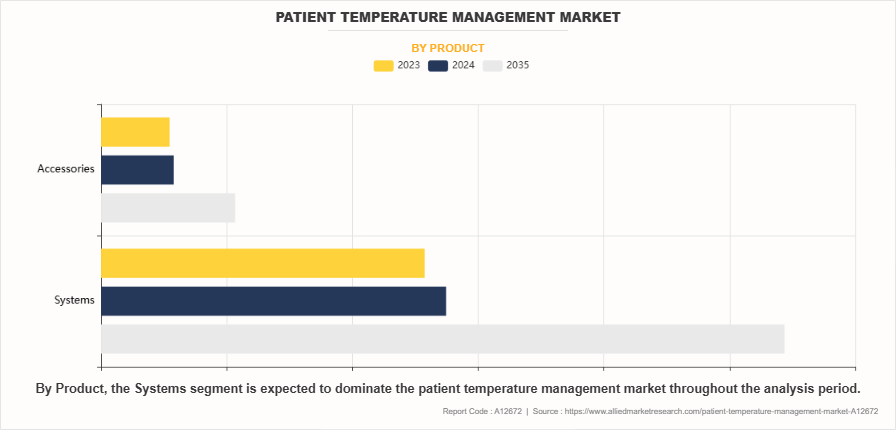

- On the basis of product, the patient warming system segment dominated the global patient temperature management market share in 2023 and is expected to register the highest CAGR during the forecast period.

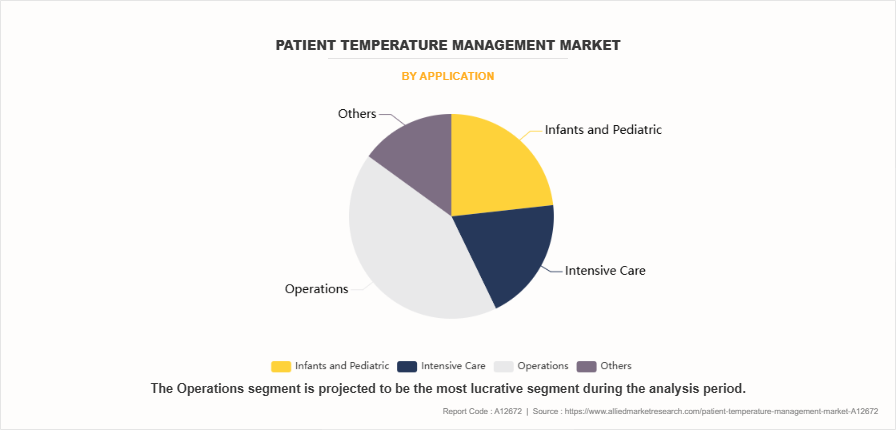

- On the basis of application, the operating segment dominated the patient temperature management market share in terms of revenue in 2023 and is expected to register the highest CAGR during the forecast period.

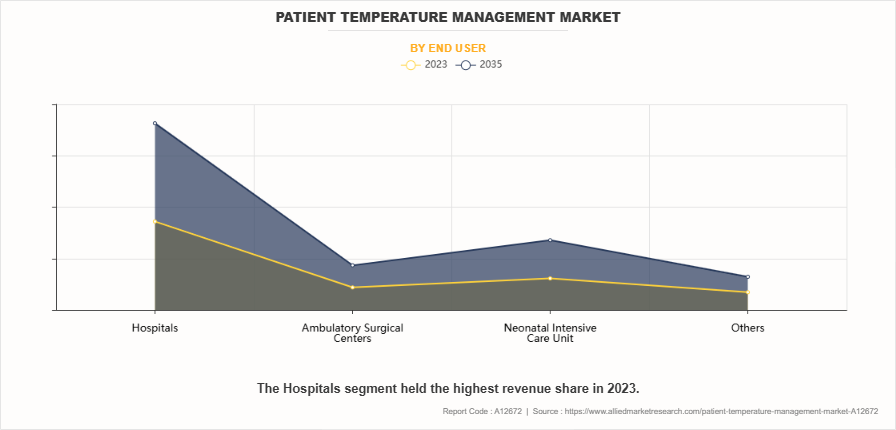

- On the basis of end user, the operating room segment dominated the market in terms of revenue in 2023.

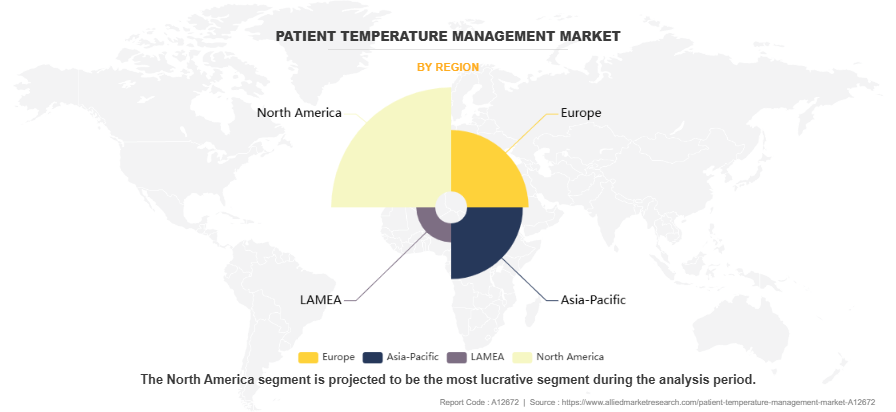

- Region wise, North America dominated the market in terms of revenue in 2023. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Patient temperature management refers to the clinical practice and use of medical devices aimed at regulating a patient's body temperature during surgery, intensive care, or recovery. The primary goal is to prevent complications arising from temperature imbalances, such as hypothermia or hyperthermia, which can affect a patient's overall health and recovery. This process involves the use of technologies such as warming and cooling blankets, external cooling or heating systems, and temperature monitoring devices to maintain a stable body temperature throughout medical procedures or treatment. Proper temperature management is essential for optimizing patient outcomes, enhancing recovery, and preventing adverse effects associated with temperature fluctuations. The patient temperature management systems enable the nursing staff to manage the core body temperature of critically ill and surgical patients easily.

Market Dynamics

The patient temperature management market growth is experiencing significant growth driven by technological advancements are at the forefront, with innovative non-invasive monitoring devices and sophisticated temperature regulation systems transforming patient care. The emergence of AI-integrated temperature tracking technologies enables more precise and personalized thermal management, addressing critical healthcare challenges. One of the primary drivers is the increasing prevalence of chronic conditions, surgical procedures, and critical care situations, all of which require careful management of patient body temperature. As medical technology continues to evolve, the ability to precisely control a patient's body temperature during surgery, trauma care, and recovery has become a crucial component of patient safety and clinical outcomes. Hypothermia and hyperthermia can lead to complications, including organ failure, extended recovery times, and increased risk of infection, so effective temperature management solutions are integral to preventing these adverse effects.

Another significant factor contributing to the market's expansion is the rising focus on patient safety and comfort. Healthcare professionals are becoming more aware of the impact that temperature fluctuations can have on patient outcomes, particularly in critical care environments such as operating rooms, emergency departments, and neonatal units. As a result, hospitals and healthcare facilities are increasingly adopting temperature management solutions as part of their standard protocols. In addition, rising patient awareness about the importance of temperature regulation during medical procedures is also driving the demand for these technologies, as patients seek treatments that improve recovery times and reduce the likelihood of complications. Expanding healthcare infrastructure, particularly in developing countries, is creating substantial patient temperature management market opportunity.

The growing number of surgical procedures and increasing awareness about temperature-related patient complications are driving demand for advanced temperature management solutions. An aging global population further amplifies the need for precise thermal monitoring, especially in perioperative, and critical care settings. However, the high cost associated with advanced temperature management devices and technologies may limit the market growth. The cost of acquiring, installing, and operating these devices, including training healthcare personnel, can create a barrier for adoption, limiting their widespread use. On the other hand, advancements in medical technology, increase in healthcare awareness, and rise in demand for patient safety and recovery create an opportunity for patient temperature management market growth.

One of the key opportunities lies in the growing adoption of minimally invasive temperature management systems, which offer more comfortable and efficient solutions for patients compared to traditional methods. Moreover, the rise in global awareness of patient safety and the importance of comprehensive care also presents a significant market opportunity. Governments, hospitals, and healthcare providers are becoming more focused on improving patient outcomes through enhanced safety measures. As a result, there is growing demand for effective solutions that prevent temperature-related risks and improve recovery times. Furthermore, with increasing healthcare spending, particularly in emerging markets, there is a substantial opportunity for the introduction and adoption of advanced temperature management systems in these regions, where healthcare infrastructure is rapidly evolving.

Segmental Overview

The patient temperature management market is segmented on the basis of product, application, end user, and region. By product, the market is classified into patient warming systems, patient cooling systems, and accessories. By application, the market is segmented into infants and pediatric, intensive care, operations, and others. By end user, the market is segmented into operating rooms, neonatal intensive care units, emergency room, intensive care units, and others. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

By Product

The patient warming system segment dominated the market share in 2023 and is anticipated to register the highest CAGR during the forecast period. This is attributed to the increase in adoption of patient warming systems in surgical procedures and critical care settings. These systems are essential for preventing hypothermia during surgeries, improving patient recovery times, and enhancing overall safety. Advancements in technology, including non-invasive and more efficient warming devices, are driving further demand. In addition, the rising prevalence of surgeries and the growing awareness of patient safety are expected to fuel the segments growth.

By Application

The operations segment dominated the market share in 2023 and is anticipated to register the highest CAGR during the forecast period. This is attributed to the critical need for precise temperature management during surgical procedures. Maintaining optimal body temperature during surgery reduces the risk of complications such as infection, bleeding, and prolonged recovery. The growing number of surgical procedures, along with advancements in patient warming and cooling technologies, is driving the demand for temperature management systems in operating rooms. In addition, heightened awareness among healthcare providers regarding the importance of temperature regulation in surgical outcomes contributes to the segment's growth.

By End User

The operating room segment dominated the patient temperature management market size in terms of revenue in 2023 and is anticipated to register the highest CAGR during the patient temperature management market forecast period. This is attributed to the critical need for maintaining stable body temperature during surgeries. Temperature management in the operating room is essential for preventing hypothermia, reducing complications, and promoting faster recovery. As the number of surgeries continues to rise globally and advancements in temperature control technologies improve, the demand for efficient warming and cooling systems in operating rooms is expected to increase. In addition, the growing emphasis on patient safety and optimal surgical outcomes further contributes to the segment's growth.

By Region

The patient temperature management market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America region dominated the market in terms of revenue in 2023. The growth in this region is attributed to the presence of advanced healthcare infrastructure, high adoption rates of cutting-edge medical technologies, and increase in awareness about patient safety and recovery. For instance, according to American Medical Association, the health spending in the U.S. increased by 4.1% in 2022 ($4.4 trillion). Rise in healthcare expenditures, there is a corresponding increase in investment in advanced medical technologies, which contributes towards market growth. The region also benefits from a large number of surgical procedures and critical care cases, which drive the demand for effective temperature management solutions. Furthermore, government initiatives to improve healthcare standards, coupled with significant investments in healthcare systems, are contributing to the market growth in North America. In addition, the growing prevalence of chronic diseases and an aging population are key factors influencing market expansion in the region.

Asia-Pacific is expected to grow at the highest rate during the forecast period. This is attributed to rapid expansion of healthcare infrastructure, increase in investments in medical technologies, and rise in healthcare awareness across the region. In addition, the growing elderly population and a rising prevalence of chronic diseases are contributing to the demand for advanced patient temperature management solutions. As the region sees an increase in the number of surgeries and critical care cases, the need for efficient temperature management systems is expected to grow significantly. Moreover, emerging economies, particularly in countries such as China and India, are experiencing improvements in healthcare access, which further drives market growth in the region.

Competition Analysis

Key players such as Asahi Kasei Corporation and Medtronic plc. have adopted product approval, product launch, and others, as key developmental strategies to improve the product portfolio of the patient temperature management industry. For instance, in January 2024, ZOLL, an Asahi Kasei company that manufactures medical devices and related software solutions, announced that it has received FDA clearance and CE mark for a significant upgrade to the versatility of the Thermogard Temperature Management System.

Recent Developments in Patient Temperature Management Industry

- In August 2022, Medtronic plc announced it entered into a strategic partnership with BioIntelliSense, a continuous health monitoring and clinical intelligence company, for the exclusive U.S. hospital and 30-day post-acute hospital to home distribution rights of the BioButtonR.

- In June 2023, ICU Medical, Inc. announced the availability of the Level 1 H-1200 Fast Flow Fluid Warmer, a blood and fluid warming device used to heat blood, blood products, and other intravenous solutions in hospital settings, a critical process required for patients experiencing blood loss, at risk of hypothermia after surgery, or undergoing urological irrigation.

- In October 2020, Gentherm, a global market leader and developer of innovative thermal management technologies announced that it has received 510(k) clearance from the U.S. Food and Drug Administration (FDA) and has launched the ASTOPADTM Patient Warming System in the U.S. The ASTOPAD system can be utilized in all surgical procedures and helps prevent and treat hypothermia in patients throughout the perioperative journey.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the patient temperature management market analysis from 2023 to 2035 to identify the prevailing patient temperature management market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the patient temperature management market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global patient temperature management market trends, key players, market segments, application areas, and market growth strategies.

Patient Temperature Management Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 6.5 billion |

| Growth Rate | CAGR of 6.3% |

| Forecast period | 2023 - 2035 |

| Report Pages | 385 |

| By Product |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | TSC Life, Becton, Dickinson and Company, Stryker Corporation, Medline Industries, LP., 3M Company, Gentherm Incorporated, Asahi Kasei Corporation, Medtronic plc, ICU Medical, Inc., Inspiration Healthcare Group plc |

Analyst Review

This section provides various opinions of the patient temperature management market. The patient temperature management market expansion is driven by the increasing prevalence of chronic diseases, growing number of surgeries, and rising focus on patient safety and optimized recovery. The demand for temperature management systems is also fueled by advancements in medical technologies, such as non-invasive, portable, and precision-controlled devices that enhance the effectiveness and accessibility of these solutions.

In addition, the adoption of clinical guidelines and recommendations, including those from organizations such as the American Heart Association, and the expansion of healthcare infrastructure in emerging markets, are contributing to the market’s growth. As the awareness of temperature management’s benefits continues to rise, the market is expected to experience sustained growth globally.

North America generated the largest revenue in 2023, owing to its advanced healthcare infrastructure, high healthcare spending, and early adoption of cutting-edge medical technologies. The region’s strong regulatory frameworks, favorable reimbursement policies, and the presence of leading market players further support the widespread use of patient temperature management systems. However, Asia-Pacific is expected to register the highest CAGR during the forecast period, owing to expanding healthcare infrastructure, rapid advancements in healthcare infrastructure, increased healthcare spending, and a growing demand for advanced medical technologies.

The total market value of patient temperature management market was $3.1 billion in 2023.

The forecast period for patient temperature management market is 2024 to 2035.

The market value of patient temperature management market is projected to reach $6.5 billion by 2035.

The base year is 2023 in patient temperature management market.

Increasing surgical procedures, growing awareness of the importance of temperature control in critical care, technological advancements in temperature management devices, and rising incidences of conditions requiring temperature management are key drivers.

Patient temperature management refers to the use of various devices and methods to regulate a patient’s body temperature during medical procedures, surgeries, or in critical care settings to ensure optimal health and recovery.

Loading Table Of Content...

Loading Research Methodology...