Pen needles are specialized medical devices designed for the delivery of injectable medications, commonly used in conjunction with insulin pens for diabetes management. These needles are integral to insulin delivery systems, allowing for a more convenient and less painful method of self-administration compared to traditional syringes. A pen needle is essentially a thin, hollow needle that attaches to an insulin pen or other pen-style injector. It is engineered to penetrate the skin and deliver medication in a controlled and precise manner.

Market Value Projections and Insights

- The global pen needles market size was valued at $1.7 billion in 2022, and is projected to reach $4.5 billion by 2032, growing at a CAGR of 10.3% from 2023 to 2032.

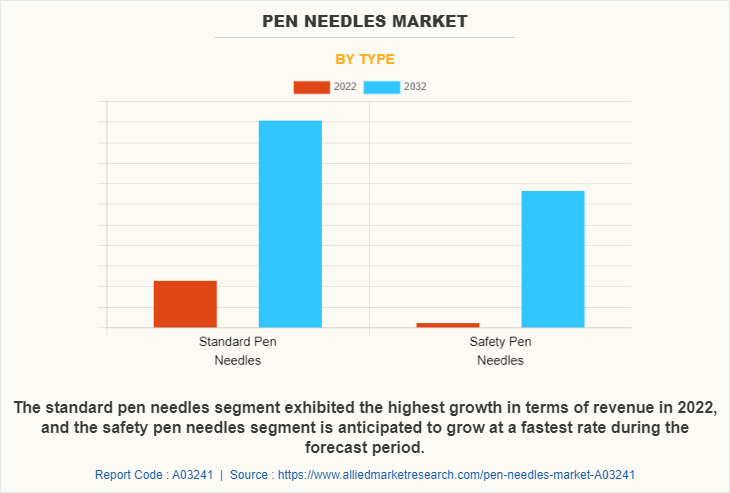

- By type, the standard pen needles segment was the highest contributor to the market in 2022.

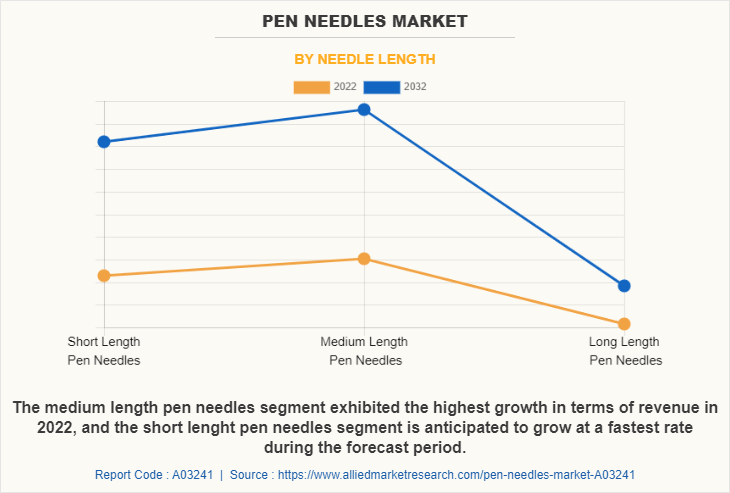

- On the basis of needle length, the medium length pen needles segment dominated the market in 2022, and the short length pen needles segment is anticipated to grow at the fastest rate during the forecast period.

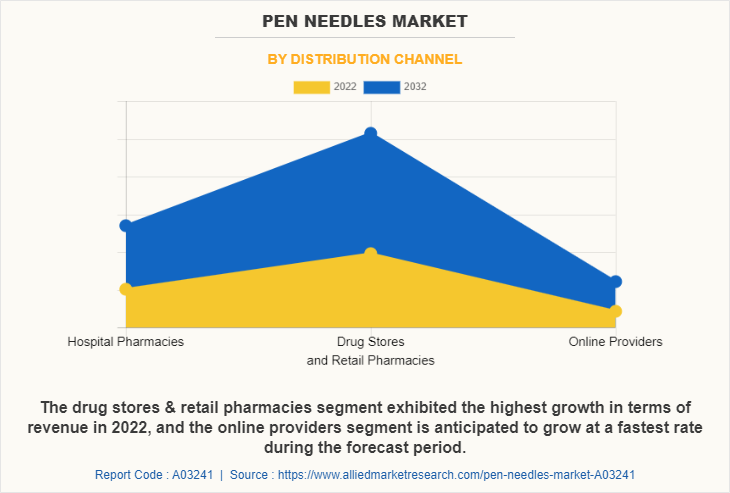

- Depending on distribution channel, the drug stores & retail pharmacies segment dominated the market in 2022 and the online providers segment anticipated to grow at the highest CAGR during the forecast period.

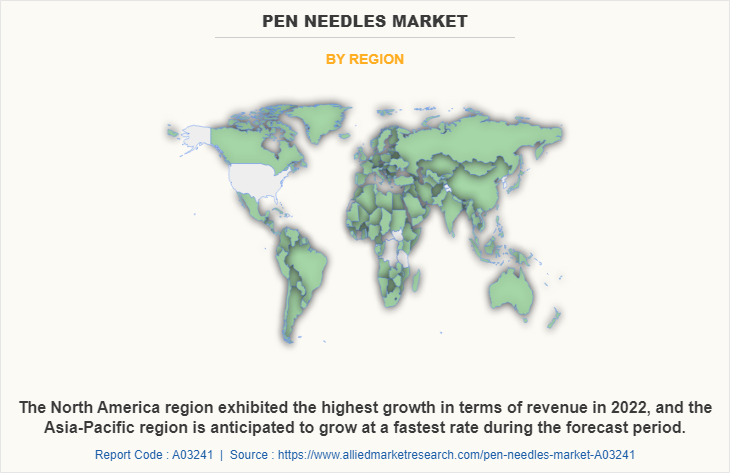

- Region wise, North America generated the largest revenue in 2022. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

The pen needles market is experiencing significant growth due to several key trends and drivers. A notable trend is the increasing preference for safety pen needles, driven by a heightened focus on patient safety and reducing needle-stick injuries. Additionally, the growing adoption of diabetes management devices and advancements in needle technology are propelling market expansion.

Drivers include the rising prevalence of diabetes globally, which boosts demand for insulin delivery systems. Innovations in needle design, such as ultra-fine needles and ergonomic features, enhance patient comfort and adherence. Moreover, the shift towards online pharmacies and e-commerce platforms is expanding market reach.

Challenges include the high cost of advanced needle systems and regulatory hurdles that may impact product approval and market entry. Also, price competition among manufacturers can affect profitability.

Opportunities lie in the emerging markets of Asia-Pacific, where increasing diabetes rates and improving healthcare infrastructure offer significant growth potential. Additionally, the development of next-generation pen needles with smart technology integration could open new avenues for market expansion.

Industry Highlights

- The demand for pen needles is primarily driven by the increasing prevalence of diabetes and the growing adoption of insulin pens for diabetes management. Standard pen needles are widely used due to their cost-effectiveness and reliability in delivering insulin.

- The rise in safety concerns and needle-stick injury prevention has significantly accelerated the demand for safety pen needles, which are designed to minimize the risk of accidental needle sticks and enhance patient safety.

- The technological advancements in pen needle design, such as improved needle sharpness and ergonomics, are contributing to better patient compliance and comfort, further driving pen needles market growth.

- Hospital Pharmacies, drug stores and retail pharmacies are key distribution channels for pen needles, ensuring widespread availability and accessibility to patients. Online platforms are also becoming increasingly important for reaching consumers.

- North America remains a leading regional market for pen needles due to its well-established healthcare infrastructure, high prevalence of diabetes, and advanced healthcare practices. The region's focus on safety and innovation is also fostering growth in the safety pen needles segment.

Pen needles have long been valued for their crucial role in diabetes management, offering precision and ease of use for insulin delivery. Standard pen needles are widely appreciated for their cost-effectiveness and reliable performance, making them a staple in diabetes care. The introduction and adoption of safety pen needles have become increasingly important due to growing concerns over needle-stick injuries and the need for enhanced patient safety. These needles feature advanced safety mechanisms that reduce the risk of accidental needle sticks, providing added security and comfort for users.

Pen needles that incorporate innovations such as improved needle sharpness, ergonomic designs, and integration with advanced insulin delivery systems are particularly valuable. These innovations not only improve patient comfort and adherence but also enhance the overall efficacy of diabetes management. The pen needles market is driven by a strong demand for products that offer both safety and convenience, making them a preferred choice among healthcare providers and patients. The emphasis on reducing healthcare risks and improving patient outcomes continues to foster growth in the pen needles market, with a strong focus on technological advancements and safety features.

Key Areas Covered in the Report

- Pen needles are essential for effective diabetes management, known for their precision, convenience, and ease of use in delivering insulin. They play a critical role in ensuring accurate dosage and patient compliance.

- The market faces competition from alternative insulin delivery systems, such as insulin pumps and continuous glucose monitors (CGMs), which offer different approaches to diabetes management and may impact the demand for traditional pen needles.

- The rise of safety pen needles has introduced significant innovation and diversity in the market, addressing growing concerns over needle-stick injuries and enhancing patient safety with advanced safety features.

- The demand for pen needles is driven by the increasing prevalence of diabetes and the need for reliable and comfortable insulin delivery solutions. Both standard and safety pen needles continue to be crucial in the management of diabetes, contributing to their sustained market presence and growth.

Pen needles are facing competition from alternative insulin delivery systems such as insulin pumps, continuous glucose monitors (CGMs), and other advanced diabetic care technologies. As diabetes management continues to evolve, these alternatives offer various benefits like real-time glucose monitoring and insulin delivery, potentially impacting the demand for traditional pen needles.

The growing focus on patient safety has led to significant advancements in safety pen needle technology. Innovations such as retractable needles and integrated safety features are addressing concerns about needle-stick injuries, thereby driving the demand for safety pen needles. This trend reflects a broader industry shift towards enhancing patient safety and comfort, particularly for those requiring frequent insulin administration.

Pharmaceutical and medical device companies are investing in improving pen needle technology to enhance user experience and clinical outcomes. Enhanced needle sharpness, ergonomic designs, and compatibility with various insulin pens are key areas of development. These advancements aim to improve injection comfort, reduce pain, and facilitate better diabetes management, contributing to the growing popularity of both standard and safety pen needles.

The increasing prevalence of diabetes worldwide is driving demand for efficient and reliable insulin delivery solutions. As more people are diagnosed with diabetes and the emphasis on effective diabetes management intensifies, the market for pen needles continues to expand. The accessibility of pen needles through pharmacies, hospitals, and online platforms further supports their widespread adoption.

The rise of telemedicine and digital health platforms is also influencing the pen needles market by offering greater convenience in managing diabetes care. These platforms provide patients with easier access to necessary medical supplies, including pen needles.

Topics discussed in the report

- Analysis of market trends, drivers, and opportunities across key segments.

- Competitive landscape and strategic initiatives of key market players.

- Regional analysis highlighting the dominance of North America in the global market.

- Insights into the role of safety pen needles in the future of the industry.

- Growth prospects for online providers as a key distribution channel for pen needles.

Segment Overview

The global pen needles market is segmented into type, needle length, distribution channel, and region. By type, the market is categorized into standard pen needles and safety pen needles. Depending on needle length, it is segregated into short length pen needles, medium length pen needles, and long length pen needles. On the basis of distribution channel, it is divided into hospital pharmacies, drug stores & retail pharmacies, and online providers. By region, the market is divided into North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, Spain, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and the Rest of LAMEA).

The standard pen needles segment holds a dominant pen needles market share in terms of revenue in 2022 and is anticipated to remain dominant during the forecast period. The growth of the standard pen needles segment is attributed to the extensive range of products available from leading manufacturers in the market. The medium length pen needles segment dominated the global market in 2022 and is anticipated to remain dominant during the forecast period. Due to their benefits for individuals with thicker or more muscular body types since they can penetrate deeper layers of subcutaneous fat tissue and deliver insulin more effectively. As a result, they are often recommended for such individuals to ensure proper insulin administration and hence hold a significant pen needles market share.

Comparative Matrix of Key Segments

Parameters | Standard Pen Needles | Safety Pen Needles |

Market Share | Traditionally holds a larger share due to lower cost and established use. | Growing rapidly due to increasing focus on safety and prevention of needle-stick injuries. |

Distribution Channels | Pharmacies, hospitals, clinics, online platforms | Pharmacies, hospitals, clinics, specialized diabetes care stores, online platforms |

Challenges | Concerns about safety and risk of needle-stick injuries, regulatory pressure | Higher production costs, complex design and manufacturing processes, limited availability |

Key Players | BD (Becton, Dickinson and Company), Terumo Corporation, Smiths Medical | BD (Becton, Dickinson and Company), Medtronic, Ypsomed |

Regional Dynamics and Competition

The global pen needles market is experiencing robust growth across various regions, driven by increasing diabetes prevalence and advancements in injection technologies. North America remains a dominant market, led by high consumer awareness, advanced healthcare infrastructure, and significant adoption of insulin pens. The U.S. is a key contributor, reflecting the large diabetic population and high demand for efficient self-management tools.

In Europe, stringent regulations and a focus on patient safety have accelerated the development of safety pen needles, with leading markets including Germany and the U.K. The emphasis on reducing needle-stick injuries and improving injection comfort supports pen needles market growth in this region.

The Asia-Pacific region presents substantial growth opportunities, with countries such as India, China, and Japan driving demand. Factors such as increasing diabetes rates, expanding healthcare access, and rising disposable incomes contribute to this growth. Additionally, advancements in pen needle technology and the rise of contract manufacturing organizations (CMOs) in these countries are further enhancing market prospects.

Emerging markets in Latin America and the Middle East also show potential, driven by expanding healthcare infrastructure and rising awareness of diabetes management solutions. Overall, the pen needles market is set to benefit from growing health-conscious trends and technological innovations across these diverse regions.

Some of the major players analyzed in this report are MTD Medical Technology and Devices S.p.A, Trividia Health, Inc., Terumo Corporation, Owen Mumford Ltd., Ypsomed AG, Novo Nordisk A/S, B.Braun SE, Embecta Corp., UltiMed, Inc, Allison Medical Inc.

Pen needles market News Release

- In April 2023, Ypsomed AG held a groundbreaking ceremony for a new production facility in the Changzhou National Hi-tech District. The new production facility is expected to expand Ypsomed's production capacity for its range of medical devices, including insulin pens and pen needles, and allow for greater access to the growing Chinese market.

- In January 2023, Embecta Corp. announced its geographical expansion by building a new global headquarters office at 300 Kimball Drive, Suite 300, in Parsippany, N.J.

- In September 2022, Terumo Corporation announced the launch of FineGlide, sterile pen needle for patients requiring regular insulin injections or other self-medication.

- In April 2022, Embecta Corp. announced that it has completed its spin-off from Becton Dickinson and Company and is listed on NASDAQ as a global leader in diabetes care.

- In February 2021, UltiMed, Inc. launched a new UltiCare safety pen needle, the technology that hides the needle before and after use, helping to provide protection from accidental needle stick injuries.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pen needles market analysis from 2022 to 2032 to identify the prevailing pen needles market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the pen needles market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global pen needles market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the pen needles market players.

- The report includes the analysis of the regional as well as global pen needles market trends, key players, market segments, application areas, and market growth strategies.

Pen Needles Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 4.5 billion |

| Growth Rate | CAGR of 10.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Type |

|

| By Needle Length |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | MTD Medical Technology and Devices S.p.A, Owen Mumford Ltd., Trividia Health, Inc., Allison Medical Inc., Embecta Corp., UltiMed, Inc, Novo Nordisk A/S, Ypsomed AG, Terumo Corporation, B.Braun SE |

Analyst Review

This section provides various opinions in the global pen needles market. Increase in prevalence of diabetes and other chronic diseases, along with a growing awareness of the benefits of using pen needles for medicine administration, is expected to drive the growth of pen needle market.

In addition, advancements in needle technology and the availability of a wide range of pen needle sizes and brands are creating opportunities for companies to innovate and differentiate their products in a highly competitive market. The pen needle market is being driven by surge in adoption of self-injection devices.

Moreover, patients are seeking devices that offer greater ease of use, convenience, and pain reduction, which is driving the demand for pen needles. However, the pen needle market is highly regulated, with strict quality standards and regulations governing the manufacture, distribution, and sale of medical devices. This can create challenges for companies looking to enter or expand in the pen needles market.

Furthermore, North America is expected to witness the highest growth, in terms of revenue, owing to surge in demand for pen needles due to rise in adoption of injector pens for management of various conditions, developed healthcare infrastructure, and easy availability of pen needles through established distribution channels. Furthermore, Asia-Pacific is anticipated to witness notable growth during the forecast period owing to rise in demand for pen needles, as more people are becoming aware of the technological advancements in pen needles. In addition, improvement in health awareness and rise in healthcare expenditure contribute toward the market growth.

Pen needle is a small disposable medical device used to administer medication for treatment of different diseases, attached to an injector pen, which is a device used for injecting medication under the skin.

Key factors driving the growth of the pen needles market includes the increase in prevalence of chronic conditions, surge in awareness and adoption of injector pens and surge in awareness and adoption of injector pens.

Major players that operate in the pen needles market are Allison Medical, B.Braun SE, Becton, Dickinson and Company, MTD Medical Technology and Devices S.p.A, Novo Nordisk A/S, Owen Mumford Ltd, Terumo Corporation, Trividia Health, Inc., UltiMed, Inc., and Ypsomed AG.

The base year is 2022 in pen needles market.

The forecast period for pen needles market is 2023 to 2032.

The total market value of pen needles market is $1.7 billion in 2022.

The market value of pen needles market in 2032 is $4.5 billion.

The standard pen needles segment is the most influencing segment in 2022, which is attributed to relatively low cost of standard pen needles compared to safety pen needles. Moreover, standard pen needles are simpler in design and do not have additional safety features of safety pen needles, which can make them less expensive to produce.

Loading Table Of Content...

Loading Research Methodology...