Pharmaceutical Warehousing Market Insights : 2032

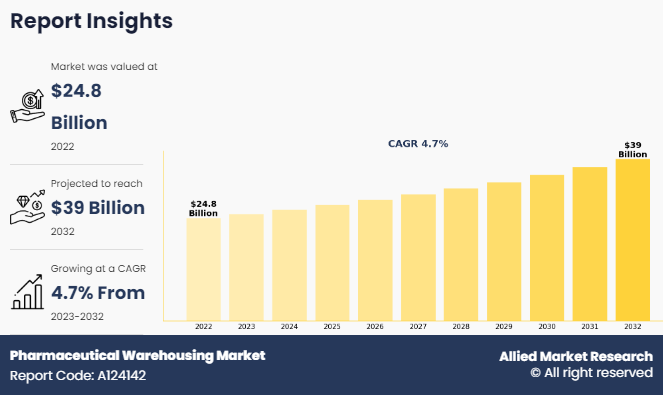

The global pharmaceutical warehousing market size was valued at USD 24.8 billion in 2022 and is projected to reach USD 39 billion by 2032, growing at a CAGR of 4.7% from 2023 to 2032.

Expansion of the global pharmaceutical warehousing market is driven by growth in the pharmaceutical, an increase in demand from the e-commerce industry, and surge in demand for reverse logistics. However, lack of standardization in pharmaceutical logistics & storage, poor infrastructure, and higher logistics costs hinder market growth. Furthermore, factors such as introduction of the blockchain technology and technological growth in the market are anticipated to offer lucrative growth opportunities during the forecast period.

Report Key Highlighters:

- The pharmaceutical warehousing market study covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($billion) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The pharmaceutical warehousing market share is highly fragmented, into several players including RSA TALKE, KEMITO, Brenntag SE, Rinchem Company, LLC, Univar Solutions LLC, Commonwealth Inc., DHL GROUP, Anchor 3PL, Broekman Logistics and Odyssey Logistics & Technology Corporation. The companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

Pharmaceutical warehousing the storage and management of pharmaceutical products in a controlled environment such as cold chain and non-cold chain warehouses. These warehousing facilities are vital parts of the overall pharmaceutical supply chain, enabling safe, secure, and compliant storage of an extensive range of pharmaceutical items, including raw materials, and finished products.

Pharmaceutical warehousing is an important element of the overall pharmaceutical logistics chain. It provides optimal storage for temperature, light, and humidity sensitive medications, as a result, pharmaceutical medications are stored and delivered to patients in an organized way

Segmental Analysis:

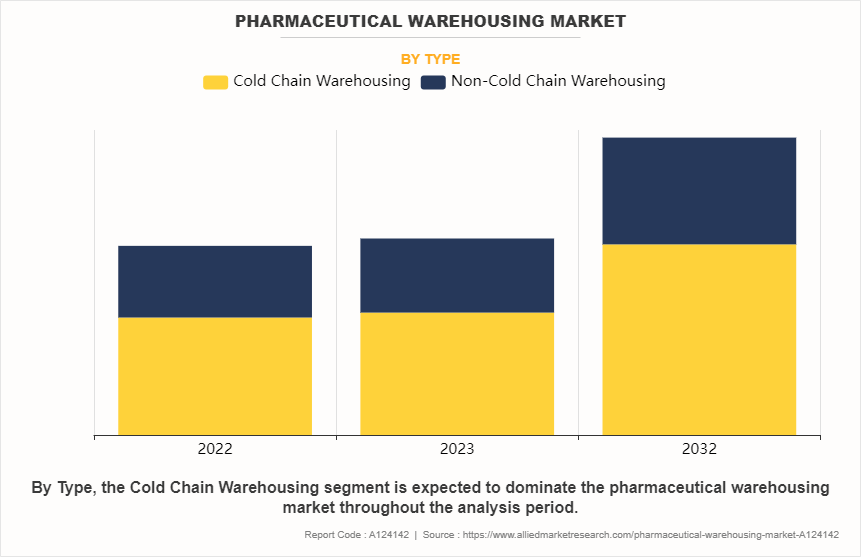

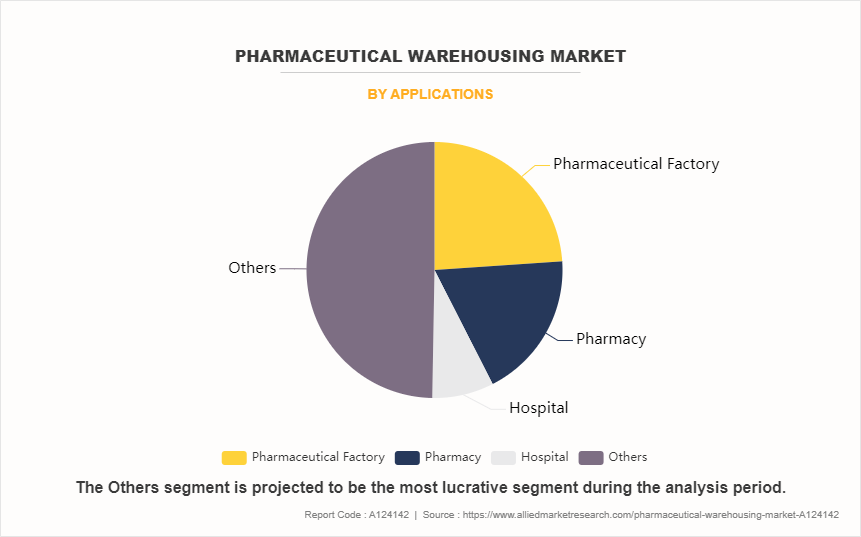

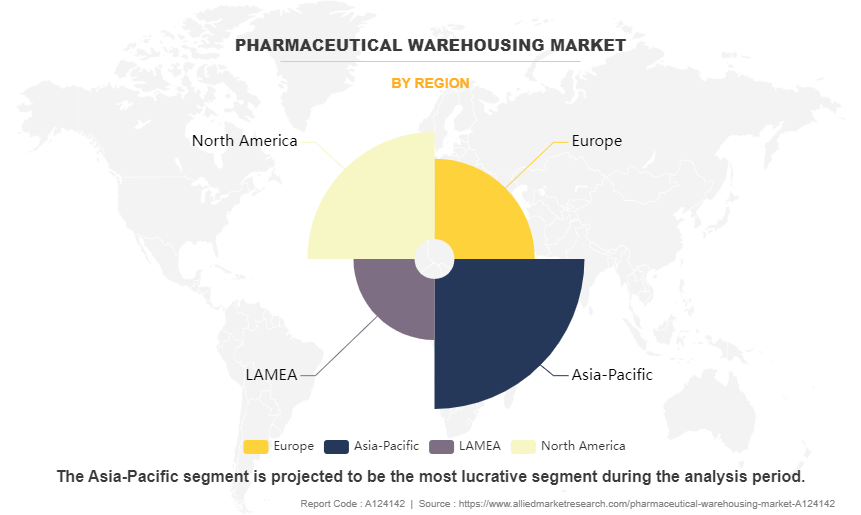

The pharmaceutical warehousing market is segmented into type, application, and region. Depending on type, the global pharmaceutical market share is classified into cold chain warehousing and non-cold chain warehousing. On the basis of application, it is divided into pharmaceutical factories, pharmacies, hospitals, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The pharmaceutical sector in the last decade have seen increased growth due to surge in instances of chronical diseases, diabetes, and cancer, which has resulted in pharmaceutical companies spending more on R&D, thus further helping in the growth of the pharmaceutical industry. Moreover, the COVID-19 pandemic helped in the growth of pharma sector, fostering need for cold chain logistics that were crucial for transport of temperature sensitive medicines and vaccines, thus help in driving the demand in the pharmaceutical warehousing market trend.

Pharmaceutical manufacturers increasingly focused on the product quality and sensitivity of pharmaceutical products. Factors such as the development of complex biological-based medications as well as the distribution of hormone therapies, vaccinations, and complex proteins require the use of specialized transportation and storage. Temperature-controlled logistics and warehousing of pharmaceutical products & medical devices are the significantly growing divisions of the pharmaceutical warehousing. Moreover, the increase in need for effective cold chain logistics services to maintain the quality of goods fuels the growth of the pharmaceutical warehousing market.

By type, the cold chain warehousing segment dominated the market in 2022. Similarly, the cold chain warehousing segment is anticipated to show the highest CAGR due to the growing emphasis on biotechnology & personalized medicine and an increase in the development & production of temperature-sensitive medications.

Key Developments in the Industry:

The leading companies have adopted strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- On November, 2023, Brenntag SE expanded the business in collaboration with Zeochem, the Swiss manufacturer of high-quality molecular sieves, chromatography gels and deuterated compounds. This strategy adds high-performance chromatography silica gels to Brenntag's pharmaceutical portfolio, providing state-of-the-art purification solutions to customers in EMEA.

- On May 2023, Brenntag SE developed service for the protection and improvement of the performance of enzymes that are used in biocatalysis. This process is used to initiate, accelerate or control chemical reactions, for instance, in the production of drugs such as insulin.

- On August 2022, DHL GROUP expanded its Life Sciences and; Healthcare (LSH) Campus in Florstadt near Frankfurt Airport. The new branch expansion adds a third logistics center to the multi-user campus specializing in pharmaceutical and medical products. The site is registered as per the German Federal Emission Control Act (BImSchG). A capacity of 10,000 pallet locations has been established in one dedicated section of the facility.

- On February 2022, DHL GROUP pharmaceutical and medical device distribution network in the United States by investing $400 million. Through this expansion, it offers warehousing, secondary packaging, managed transportation, and end-to-end supply chain management services.

The others segment dominated the global market in 2022, owning to the increase in sales of pharmaceutical products through online channel mode resulting in third party logistics and e-commerce companies spending more on pharmaceutical warehousing. However, pharmaceutical factory is anticipated to show the highest CAGR owning to increase in production of medication and pharmaceutical drugs due to increase in instances of chronical diseases, diabetes, and cancer across the globe.

The pharmaceutical warehousing market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific region held the largest market share in 2022, and is anticipated to show the fastest CAGR growth due to rise in investment in development of pharmaceutical storage by major companies and growing pharmaceutical & healthcare industry in the region.

Top Impacting Factors:

Increase in Demand for Reverse Logistics

In recent years, the reverse logistics in the pharmaceutical industry has grown increasingly. Reverse logistics process is used for unsalable or expired drug and other pharmaceutical products that are sent back to the manufacturers for disposal.

Reverse logistics services help pharmacies, hospitals, and distributors with the disposal of waste or expired medical products. As government restrictions for the disposal of medical wastes have become more stringent, pharmaceutical corporations have created reverse logistics infrastructure. An increase in government and private sector initiatives to ensure the safe disposal of medical waste during the forecast period is anticipated to help the pharmaceutical logistics market flourish. Moreover, increase in recalls for pharma drugs from various drugs manufacturing companies propels the demand for pharmaceutical reverse logistics, which in turn, boosts the growth of pharmaceutical warehousing market.

Lack of Standardization in Pharmaceutical Logistics and Storage

Pharmaceutical logistics and storage demands come with specific needs. The lack of standards and accreditations poses significant challenges to the pharmaceutical industry where quality and flexibility of available warehousing space is major concern at present. In many cases, companies invest further to upgrade the space and its specifications to standards that support the pharmaceutical industry as well as their operations. The standards formulated by the policy makers build pressures on developers as expected. Upgrading the facility in terms of temperature compliance or accommodating automated equipment is not easy. Training the manpower, developing the technology, and handling the products involve heavy capital involvement and it remains the necessity of industry time to time. Thus, lack of standardization in pharmaceutical logistics is anticipated to hamper the growth of the market.

Technological Growth in Pharmaceutical Warehousing

The increase in demand for modern and automated pharmaceutical warehouses is anticipated to create lucrative growth for companies operating in the market. Owing to rise in concerns regarding energy conservation and environment protection, pharmaceutical warehouse service providers are increasingly investing in cost-effective warehousing solutions that combine green practices and smart technology, such as the Internet of Things (IoT), smart sensors, and robotics. In addition, vendors provide digital tools to automate pharmaceutical warehousing and process data with enhanced productivity, efficiency, and convenience. Moreover, growth in use of Artificial Intelligence (AI), machine learning, radio-frequency identification (RFID), and Bluetooth is further helping in improving pharmaceutical warehouse operations. Therefore, growth in technological advancements in the logistics industry offers lucrative growth opportunities for the pharmaceutical warehousing market.

Key Benefits For Stakeholders:

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pharmaceutical warehousing market analysis from 2022 to 2032 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Pharmaceutical Warehousing Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 39 billion |

| Growth Rate | CAGR of 4.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 197 |

| By Type |

|

| By Applications |

|

| By Region |

|

| Key Market Players | Anchor 3PL, Brenntag SE, Univar Solutions LLC, Broekman Logistics, Commonwealth Inc., RSA TALKE, Odyssey Logistics & Technology Corporation, DHL GROUP, KEMITO, Rinchem Company, LLC |

The pharmaceutical warehousing market was valued at $24.80 billion in 2022.

Brenntag SE, DHL GROUP, and RSA TALKE are some of the major companies operating in the market.

Asia-Pacific is the largest region for pharmaceutical warehousing market.

Maintaining pharmaceutical drug quality is the leading application of the pharmaceutical warehousing market.

Cold chain warehousing are the upcoming trend of the market.

Loading Table Of Content...

Loading Research Methodology...