Photonic Sensors Market Research, 2030

The global photonic sensors market size was valued at $20,185.8 million in 2020, and is projected to reach $94,267.9 million by 2030, growing at a CAGR of 16.8% from 2021 to 2030. The photonic sensors market has gone through a drastic change based on the research that has been conducted in photonic technology in the past. The photonic technology has advanced into a phase where it is being used in varied fields. The innovations in the field of fiber optics have spurred the development of photonic sensors. These developments have expanded the spectral range of sensors being used in several industries. Photonic sensors offer better sensing function, and it is expected that this technology would give a high return on investment in the long run.

The photonic sensors are now focused on the development of efficient products, and it is projected that over the next few years, eco-friendly & energy-saving photonic sensors will be developed and launched into the market. The need for enhanced safety & security solutions, better alternatives for conventional technology, and the rise in wireless sensing technology are some of the major factors that act as drivers for the photonic sensors market growth. Similarly, lack of industrial & technological standards, high initial investments, and lack of awareness can be considered as restraints for the photonics sensor market growth.

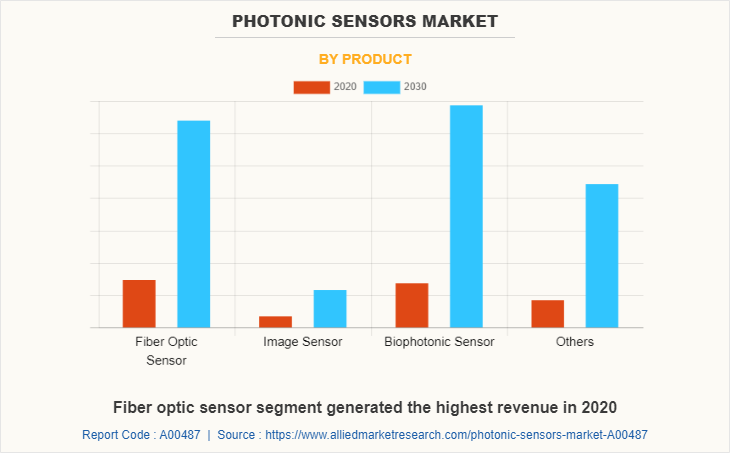

The biophotonic sensors have a wide range of applications in the field of defense and medicine. They are used in the detection of biological & chemical agents, field intelligence, and biowarfare defense & detection of explosives in defense applications. In medical applications, they are used in vaccine & drug development, diagnostics, and therapeutics. Biophotonic sensors are also used in oil and natural gas exploration expeditions.

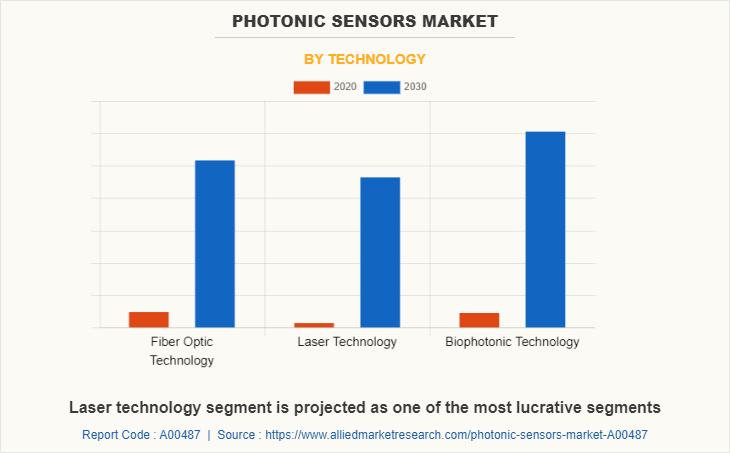

The optics and photonics technologies have made a huge impact on the global economy by developing devices and services that can be used in various industrial sectors. Research in laser technology, which was initiated in the 1950s, led to several advancements in multiple sectors encompassing transportation, information technology, and defense. Laser technology has been the key in the development of sensors, which transformed the processes of several applications such as welding, communication, surgery, etc. In addition, the developments in the field of fiber optics spurred the development of photonic sensors, which expanded the usage of the spectral range of sensors in several industries. These sensors accentuate the sensing functions, thereby demonstrating that the technology would give a high return on investment shortly.

The value chain of the photonic sensors industry includes various stakeholders such as manufacturers of components, semiconductor manufacturers, original equipment manufacturers, and service providers. Each of these players shares a specific value at their point of operation, which, in turn, contributes toward the competitive value of the product. R&D activities, innovations, marketing strategies, and aesthetic concerns enhance the overall value associated with end-deliverables by each of the photonic sensors market players.

Segmentation Overview:

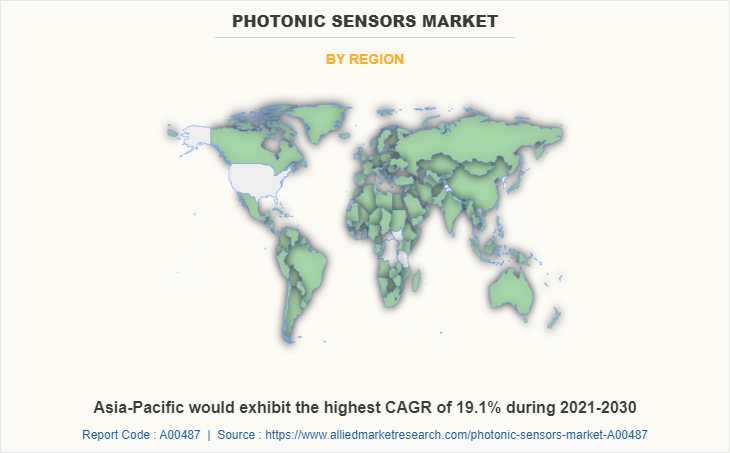

The photonic sensors market share is segmented based on product, technology, application, and region. By product, the market is fragmented into fiber optic sensors, image sensors, biophotonic sensors, and others. By technology, the photonic sensor market is classified into fiber optic technology, laser technology, and biophotonic technology. By application, the photonic sensors market is divided into industrial, healthcare, automotive & transportation, safety & security, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players mentioned in the photonics sensor market analysis are BAE Systems, BK Technologies, General Dynamics Corporation, Hytera Communications, ICOM Inc., L3 Harris, Leonardo S.P.A., MCS Digital, Motorola Solutions, and Thales Group. These key players have adopted strategies, such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations to enhance their market penetration.

Top Impacting Factors

Significant factors that impact the photonic sensors market opportunity include the need for enhanced safety & security solutions, better & enhanced alternatives for conventional technology, and a rise in wireless sensing solutions that are anticipated to have a positive impact on the photonic sensor market. Growth in a number of smart industries and increased adoption of photonics technology in developing economies may act as a potential opportunity for the photonic sensors industry.

Need for an enhanced safety and security solution

The photonic sensors offer enhanced safety and security measures, which are major concerns of the end users. Earlier manual systems were used for safety and security, which required continuous physical monitoring; however, these sensors allow round-the-clock self-operated surveillance, which provides end-users a sense of assurance. The automated system works in a highly efficient way by collecting and storing data on a central server, and allows continuous monitoring. These factors encourage various industrial sectors to deploy these smart photonic sensors in their work processes, which is a driving factor for the photonic sensors market outlook.

High Initial Investment

Initially, many companies have to make high investments for installing photonic sensors. The cost of these devices is currently very high, as the market is not mature yet. However, with the introduction of new technologies and continuous research, the impact of the initial investment factor would reduce in the future.

Rise in wireless sensing technology

On the basis of technological advances taking place in wireless sensing, the photonic sensors market is expected to grow significantly. The ability of these devices to provide remote sensing functions is one of the key factors whose impact on the market is expected to continue to grow in the future.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the photonic sensors market from 2020 to 2030 to identify the prevailing photonic sensors market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the photonic sensors market segmentation helps determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global photonic sensors market trends, key players, market segments, application areas, and market growth strategies.

Photonic Sensors Market Report Highlights

| Aspects | Details |

| By Product |

|

| By Technology |

|

| By Application |

|

| By Region |

|

| Key Market Players | Leonardo S.R.L., Motorola Solutions, ICOM Incorporation, Hytera Communications Corporation Ltd, General Dynamics Corporation, omnisys - thales group, MCS Digital, BK Technologies Corporation, BAE Systems plc, L3 Harris |

Analyst Review

According to insights of CXOs of leading companies, the photonics sensor market holds high potential for the defense industry. Current business scenario has witnessed an increase in demand for photonics technology, particularly in developing regions such as China and India. Companies in this industry have adopted various innovative techniques to provide customers with advanced and innovative product offerings.

The photonic sensors market has a come a long way with the developments in photonic technology. The market has been widely commercialized owing to the development of various photonic sensory devices such as fiber optic sensors, brag grating sensors, distributed sensors, point sensors, charge-coupled devices (CCD), complementary metal oxide semiconductors (CMOS) etc. Owing to the adaptability to various optical signals, photonic sensors can be designed in a large number of varieties. The photonic sensors market has therefore expanded its applicability in various fields and it is expected that the market would grow beyond conventional sensors in the next few years.

Development of eco-friendly and energy saving photonic sensor is one of the prime focus of photonic sensors industry. North America is the main hub for photonics sensor, as this market comprises of major market players. Thus, this region is among the few to adopt the latest technology launched in the market. North America leads the revenue share of the photonic sensor market followed by the European region. In Asia-Pacific, Japan has been the market leader in development of the photonic sensor, as many leading companies such as Hamamatsu, Nippon and Mitsubishi have headquarters in Japan. These companies have developed photonic sensors for several industrial applications. In fact, Japan has been one of the global market leaders in development of the photonic sensor along with the U.S. On the basis of these facts, it can be estimated that Asia-Pacific would be the fastest growing market for photonic sensors.

Increasing adoption of Biophotonics and laser technology in healthcare and industrial applications is expected to be the major trends in the world

Healthcare is the leading application of photonics sensors market

North America is the largest market for photonics sensors

By 2030, the photonics sensor market is expected to reach $94.27 billion.

Prominent companies in photonics sensor market such as BAE Systems, BK Technologies, General Dynamic Corporation, Hytera Communications, ICOM Inc, L3 Harris, Leonardo S.P.A., MCS Digital, Motorola Solutions, and Thales Group to hold major market share

Loading Table Of Content...