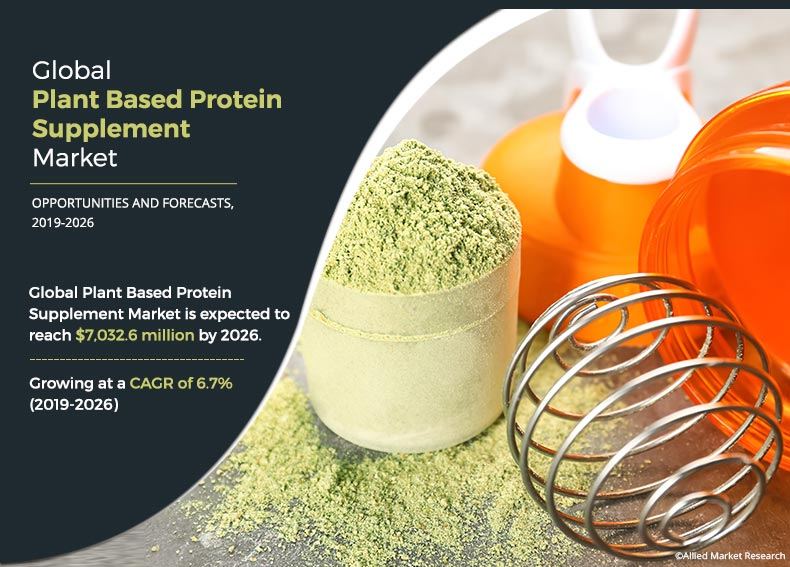

Plant Based Protein Supplement Market Outlook - 2026

The Plant Based Protein Supplement market size was valued at $4.2 billion in 2018 and is expected to reach $7.0 billion by 2026, registering a CAGR of 6.7% from 2019 to 2026.

Protein supplements that are processed and derived from different types of nutritional plant sources are known as plant-based protein supplement products. Soy, pea, chickpea, brown rice, and others are some of the key plant-based sources used as a prime ingredients for plant protein supplement.

Increase in awareness about the benefits of healthy food products and growth in vegan population are the major factors that boost the demand for the plant-based protein supplement products. In addition, increase in health consciousness, rise in disposable income, and awareness toward chemical-free products are the factors that boost the market growth. Higher cost compared to conventional milk/milk-based products and prominence of low-cholesterol, and low-fat conventional milk/milk-based products have emerged to be major challenge for the players operating in the market. The market is anticipated to offer attractive business opportunities owing to the rise in lactose intolerance and increase in demand for soy, rice, and almond proteins for global plant based protein supplement market.

Increase in obesity rates all over the world, growth in health problems such as heart diseases, high blood pressure, diabetes, asthma, , and others, have uplifted the overall health consciousness among consumers. Per-capita consumption of meat has witnessed a decline, especially in developed economies in the recent past. Food products with high nutritional value and similar taste and texture as that of meat, gain prominence among consumers. Aggressive marketing and positioning strategies coupled with innovative product launches are amongst other major factors that drive the market growth.

By Distribution Channel

The hypermarket/supermarket segment dominates the global Plant Based Protein Supplement market and is expected to retain its dominance throughout the forecast period.

The global Plant Based Protein Supplement market is segmented on the basis of nature, by product type, by form, by application, by distribution channel and region. Based on nature, it is classified into nature and conventional. By product type, the market is divided into soy, spirulina, pumpkin seed, pea and others. By from the market is segmented into protein powder, protein bar and ready-to-drink. By Application the market is segmented into sports nutrition and supplement nutrition. By distribution channel, the market is further sub segmented into Hypermarket/Supermarket, Specialty Store and online store. Based on region, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, Spain, UK, Italy, France, and rest of Europe), Asia-Pacific (China, India, Australia, New Zealand and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, UAE, and rest of LAMEA).

By Nature

The conventional segment dominates the global Plant Based Protein Supplement market and is expected to retain its dominance throughout the forecast period.

Based on nature, Plant Based Protein Supplement market size is segmented into organic and conventional. Among these natures, the conventional segments accounts to higher value plant based protein supplement market share since such products are easily available at affordable rates for its target customers. Majority of the key players for global plant-based protein supplement market operates in this segment. Rise in number of health-conscious customers in most the developed and key developing regions, has been one of the key factors in driving the demand for conventional plant-based protein supplement products. Manufacturers in the global plant-based protein supplement market strategizes on extending its product offerings in conventional formats that specifically caters to the requirements of its health-conscious customers.

By Product Type

The soy segment dominates the global Plant Based Protein Supplement market and is expected to retain its dominance throughout the forecast period.

Based on product type, the Plant Based Protein Supplement market is segmented into Soy, Spirulina, Pumpkin Seed, Pea and others. Among the product types, soy segment accounts to higher value plant based protein supplement market share. Soy protein is the protein that is being obtained from isolation of soybeans. For vegetarians, vegans, or consumers who are lactose-intolerant, soy protein serves as the major source of proteins and nutrients to their diet. Soy protein contains very little fat content and less proportion of cholesterol. Soy protein powder is used to make infant soy formula as well as various other types of meat and dairy alternatives. According to the United Soybean Board, nearly 35% Americans consume soy foods or beverages once a week or more, which suggest that there has been a gradual rise in demand for soy-oriented products. This is attributed to various health benefits associated with the consumption of soy products. Soy proteins are available in both liquid and powdered formats. Among the two, liquid soy protein has been gaining traction at a significant rate. Some of the key vendors for liquid soy protein are: Archer Daniel Midland Company, Cargill, and Batory Foods.

By Form

The protein powder segment dominates the global Plant Based Protein Supplement market and is expected to retain its dominance throughout the forecast period.

Based on region, the Plant Based Protein Supplement industry is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America is the most dominant region in the global Plant Based Protein Supplement market. According to International Health, Racquet & Sports club Association (IHRSA), the U.S. health and fitness industry was valued at US$30 billion in 2017. The industry is expected to grow at faster rate during the plant based protein supplement market forecast and shows no signs of slowing down since major of the U.S. customers have been adapting a healthy lifestyle or indulging in activities that promotes active and good health. Currently, about 20% of the American adult have fitness club membership and in the future the numbers are expected to exceed. There is an increase in the demand for healthy food owing to the rise in number of health-conscious customers. Consumers are gradually shifting their preference from industrial-scale processed food to health promoting food products. This fuels the demand for protein supplements as well.

By Application

The sports nutrition segment dominates the global Plant Based Protein Supplement market and is expected to retain its dominance throughout the forecast period.

Key players profiled in the report include Archon Vitamin LLC., Sequel Natural Ltd., Glanbia plc, MusclePharm Corporation, True Nutrition, General Nutrition Centers, Inc., Nutiva Inc., NOW Health Group, Inc., Vital Amine, Inc., Hormel Foods Corporation, , and others.

By Region

The Europe dominates the global Plant Based Protein Supplement market and is expected to retain its dominance throughout the forecast period.

Key Benefits for Plant Based Protein Supplement Market:

- The report provides an extensive Plant Based Protein Supplement market analysis of the current and emerging market trends and opportunities.

- The report provides detailed qualitative and quantitative analysis of the current Plant Based Protein Supplement market trends and future estimations that help evaluate the prevailing Plant Based Protein Supplement market opportunity.

- A comprehensive analysis of the factors that drive and restrict the Plant Based Protein Supplement market growth.

- An extensive analysis of the market is conducted by following key product positioning and monitoring the top competitors within the market framework.

- The report provides extensive qualitative insights on the potential segments or regions exhibiting favorable growth.

Plant Based Protein Supplement Market Report Highlights

| Aspects | Details |

| By Nature |

|

| By Product Type |

|

| By Form |

|

| By Application |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Nutiva Inc., NOW Health Group, Inc., VEGA, True Nutrition, Vital Amine, Inc., Hormel Foods Corporation, MusclePharm Corporation, General Nutrition Centers, Inc., Glanbia plc., Reliance Private Label Supplements |

Analyst Review

According to the insights of CXOs of the leading companies, over the past couple of years, there has been surge in demand for different types of vegan food products which is attributable to the rise in awareness about the health benefits associated with the product consumption.

With the surge in demand for plant-based food products coupled with the rise in number of health conscious consumers, some of the key players in the global plant-based protein supplement market strategizes on expanding its production capacity.

The rise in rate of internet penetration around the major parts of the world makes way for manufacturers to initiate several key online marketing programs as online platforms are one of the easiest ways to create awareness about the specifications and features of the plant-based protein supplement products among the target customers.

The Plant Based Protein Supplement market size was valued at $4.2 billion in 2018 and is expected to reach $7.0 billion by 2026

The global Plant Based Protein Supplement market is projected to grow at a compound annual growth rate of 6.7% from 2019 to 2026 $7.0 billion by 2026

General Nutrition Centers, Inc., NOW Health Group, Inc., Hormel Foods Corporation, MusclePharm Corporation, VEGA, True Nutrition, Vital Amine, Inc., Glanbia plc., Reliance Private Label Supplements, Nutiva Inc.

The Europe dominates the global Plant Based Protein Supplement market

People take protein supplements to fulfill the necessary energy and vitamins needed through strenuous workouts as well as to compensate the nutrients & vitamins loss during reduction of food intake. Health benefits associated with consuming protein supplements and rise in fitness concerns among people in different regions drive the plant based protein supplement market.

Loading Table Of Content...