Quantum Sensors Market Research, 2032

Global Quantum Sensors Market was valued at $0.3 billion in 2022, and is projected to reach $1.11 billion 2032 by 2032, growing at a CAGR of 14.07% from 2023 to 2032. The increase in the application of quantum sensors in space communication is expected to enhance the coverage of satellite networks, especially for space exploration missions. In addition, the increase in demand for high-precision measurement devices, equipped with quantum sensors, among end users such as agriculture, defense, and healthcare sectors is boosting market growth at a healthy rate during the forecast period.

A quantum sensor is a device that utilizes principles of quantum mechanics to measure physical quantities such as light, magnetic fields, or temperature with extremely high precision and sensitivity. These sensors often quantum quantum-enhanced Sensing, such as superposition and entanglement, to achieve unprecedented levels of accuracy. Quantum sensors have diverse applications, ranging from metrology and fundamental physics research to medical imaging, environmental monitoring, and navigation systems. They offer the potential for breakthroughs in measurement technology by enabling measurements at the quantum level with unparalleled precision.

Key Takeaways:

On the basis of product type, the magnetic sensors segment dominated the quantum sensor market in terms of revenue in 2022 and is anticipated to grow at the fastest CAGR during the forecast period.

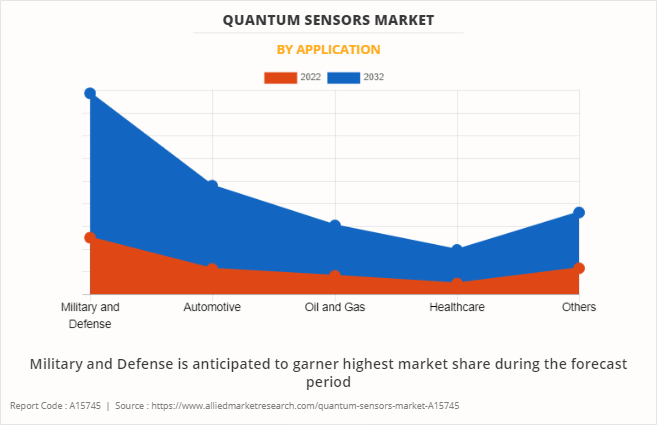

- On the basis of application, the military and defense segment dominated the quantum sensor market share in terms of revenue in 2022, owing to increasing applications in communication, imaging, and navigation systems.

- Further, among applications, the automotive segment is anticipated to grow at the fastest CAGR during the forecast period, owing to the increase in demand for LiDAR, Inertial Measurement Units, and gas sensor device production in the sector.

- Region-wise, the North America region dominated the quantum sensor market in terms of revenue in 2022. Specifically US dominates the quantum sensors market size by country in the North America region. The market in Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Segment Overview

The quantum sensor market segmentation is segmented based on product type, application, and region.

Based on product type, the quantum sensor industry is divided into atomic clocks, magnetic sensors, and par quantum sensors. In 2022, magnetic sensors will dominate the market in terms of revenue. Moreover, the atomic clocks segment is projected to manifest the highest CAGR during the forecast period owing to the increasing adoption of emerging technologies such as 5G networks, autonomous vehicles, the Internet of Things (IoT), and distributed ledger technology (e.g., blockchain) which necessitate highly accurate timing synchronization, driving the demand for atomic clocks.

By Product Type

Magnetic Sensors accounts for the largest share in 2022

Based on application, the quantum sensor market is classified into military and defense, automotive, oil and gas, healthcare, and others. In 2022, the military and defense segment dominated the market in terms of revenue and is expected to follow the same trend during the forecast period owing to the growing need for advanced surveillance and reconnaissance capabilities in military operations, including border security, counterterrorism, and situational awareness, drives the adoption of quantum sensors for enhanced detection and tracking.

Based on region, quantum sensor market overview is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Italy, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), Latin America (Brazil, Argentina, and Rest of Latin America), and Middle East and Africa (UAE, Saudi Arabia, Qatar, South Africa, and Rest of Middle East and Africa). Asia-Pacific, specifically China, remains a significant participant in the quantum sensor market with a CAGR of 15.30% due to high investments in the military & defense sector, which is driving the growth of the quantum sensors industry in the Asia-Pacific region.

Competitive Analysis

Quantum sensor market share by company and profiles includes Robert Bosch GmbH, Adtran Networks, Biospherical Instruments Inc, GWR Instruments Inc., Microchip Technology, Microsemi Corporation., Spectrum Technologies Inc, AOSense Inc., Apogee Instrument Inc., M Squared Laser Limited. are provided in this report. Product launch and acquisition business strategies were adopted by the major market players in 2022. For instance, in December 2022, AOSense Inc. developed the first generation of quantum technology. The company is actively engaged in the development of quantum sensors tailored for precision navigation, working closely with NASA's Goddard Space Flight Center. This collaboration underscores AOSense's commitment to advancing quantum sensing applications and contributing to cutting-edge technology that has the potential to redefine navigation capabilities and scientific research, particularly in the field of gravimetry.

Market Dynamics

Surge in investment in space communication

The increase in investment in space communication serves as a significant driver for the quantum sensor market growth. With the expansion of satellite networks, deep space exploration missions, and the emergence of new space-based applications, the demand for robust and secure communication systems has escalated. Quantum sensors offer revolutionary capabilities to enhance the security and reliability of space communication by leveraging quantum principles such as entanglement and superposition. These sensors enable the development of ultra-secure quantum communication channels immune to interception or hacking attempts, ensuring the integrity and confidentiality of data transmitted over vast distances in space. Furthermore, quantum sensors play a critical role in mitigating signal degradation and interference caused by cosmic phenomena, space debris, or electromagnetic radiation, thereby enhancing the overall efficiency and resilience of space communication infrastructure.

For instance, in November 2020, Astrogate Labs, a communication startup in India, raised an undisclosed amount of funding $750,000 in a pre-Series A round, which was led by Speciale Invest, a deep-tech-focused investment fund based in Chennai, India. The company aims to use this investment for the launch of its flight terminals into space and for building space heritage in 2021.

High cost of deployment and maintenance

The high cost of deploying and maintaining quantum sensor technology poses a significant restraint on the quantum sensor growth projections. Initial deployment costs include the specialized materials and intricate fabrication processes required for quantum sensor production. In addition, ongoing maintenance expenses, such as calibration and upgrades, contribute to the overall cost burden. These high costs may discourage potential users, especially in industries with limited budgets or uncertain returns. Furthermore, the complexity of quantum technology necessitates skilled personnel for operation and troubleshooting, adding to the overall cost of ownership. For instance, in the aerospace industry, the deployment of quantum sensors for precise navigation and communication purposes incurs substantial upfront costs for equipment acquisition and installation, alongside ongoing expenses for maintenance and skilled personnel training, thereby presenting a significant financial barrier to adoption.

Growth in demand for quantum sensors in the medical sector

Quantum sensors market opportunity lies in the increasing demand for quantum sensors in the medical sector. Quantum sensors offer unparalleled precision and sensitivity, making them ideal for various medical applications such as imaging, diagnostics, and monitoring. For instance, quantum sensors can enhance the accuracy of medical imaging techniques such as magnetic resonance imaging (MRI) and positron emission tomography (PET), enabling healthcare professionals to diagnose diseases more accurately and efficiently. Moreover, quantum sensors can be used for monitoring vital signs and detecting biomarkers with exceptional sensitivity, facilitating early disease detection and personalized treatment strategies. For instance, in June 2023, SandboxAQ raised $50 million for developing quantum dot gas sensors for brain imaging and other biomedical applications. As the medical sector continues to prioritize advancements in diagnostic accuracy and patient care, the demand for quantum sensors is expected to grow, creating opportunities for innovation and market expansion within the quantum sensors industry.

Recent Developments in the Quantum Sensor Industry

- In September 2022, the Tokyo Institute of Technology and Yazaki Corporation's MEXT Q-LEAP Flagship project developed a prototype diamond quantum sensor that can measure currents across a broad range and identify milliampere-level currents in a noisy environment, increasing detection accuracy from 10% to within 1%. The sensor achieved 1% accuracy in estimating battery charge while precisely tracking the charge and discharge current from -50 A to 130 A.

- In May 2022, iXblue introduced a new commercial quantum sensor for accurate underground mapping. This sensor utilizes quantum technology to achieve high levels of accuracy in mapping underground structures and features. Commercial quantum sensor offers advanced capabilities for detecting and mapping various subsurface elements, including pipelines, cables, and geological formations. This innovation represents a significant advancement in underground mapping technology.

- In September 2023, Apogee's revolutionary sensors, including quantum and ePAR sensors, pyrometers, pyranometers, and an infrared radiometer, are tested by NASA in a rigorous vacuum and vibration test to ensure the sensors can withstand the extreme conditions of space flight and rocket launch. Apogee's commitment to quality and reliability makes their sensors trusted components in space missions, contributing to advancements in space research and ensuring the accurate collection of critical data in the challenging environment of outer space.

- In July 2022, Impedans Ltd., Ireland, which specializes in intelligent sensors for RF and plasma processing, raised $3.5 million from a combination of new and existing investors, including venture capital and investment management firm SOSV and Irish Government agency Enterprise Ireland. This funding round includes support from venture capital and investment management firm SOSV and Ireland's government agency, Enterprise Ireland. This strategic investment will further bolster Impedans' position as a key player in the field of intelligent sensor technology for RF and plasma applications.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the quantum sensors market from 2022 to 2032 to identify the prevailing quantum sensors market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the quantum sensors market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global sensor quantum market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the quantum sensors companies.

- The report includes an analysis of the regional as well as global quantum sensor market trends, key players, market segments, application areas, and market growth strategies.

Quantum Sensors Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.1 billion |

| Growth Rate | CAGR of 14.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Product Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | M Squared Laser Limited, Spectrum Technologies Inc, Biospherical Instruments Inc, microchip technology, Microsemi Corporation., GWR Instruments Inc., Apogee Instrument Inc., Robert Bosch GmbH, AOSense Inc., Adtran Networks |

Analyst Review

The global quantum sensor market holds high potential for the semiconductor industry. The business scenario witnesses an increase in the demand for quantum sensor devices, particularly in developing regions, such as China, India, the U.S., the UK, and others. Companies in this industry have been adopting various innovative techniques to provide customers with advanced and innovative product offerings.

The quantum sensor market is expected to witness notable growth owing to rise in the number of research activities in quantum field and increase in investment in space communication. On the contrary, high cost of deployment and maintenance limits the growth of the quantum sensor market. Moreover, growing demand for quantum sensors in the medical sector is expected to create lucrative opportunities for the key players operating in this market.

The key players profiled in the report include Robert Bosch GmbH, Adtran Networks, Biospherical Instruments Inc, GWR Instruments Inc., Microchip technology, Microsemi Corporation., Spectrum Technologies Inc, AOSense Inc., Apogee Instrument Inc., and M Squared Laser Limited. These key players have adopted strategies such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations to enhance their market penetration.

Growing trend towards miniaturization and integration of quantum sensors into portable devices and IoT (Internet of Things) systems, and increasing investments and funding in quantum technology are the upcoming trends of the quantum sensors market in the world.

Military and Defense is the leading application of quantum sensors market.

North America is the largest regional market for quantum sensors.

The Quantum sensor market was valued at $0.3 billion in 2022.

Robert Bosch GmbH, Adtran Networks, Biospherical Instruments Inc, GWR Instruments Inc., Microchip technology, Microsemi Corporation., Spectrum Technologies Inc, AOSense Inc., Apogee Instrument Inc., M Squared Laser Limited are the top companies to hold the market share in quantum Senors.

Loading Table Of Content...

Loading Research Methodology...