Table Of Contents

- Key Trends in the Food & Beverages Industry in 2023

- Commitment Towards Sustainable Packaging

- Rising Cost of Raw Materials: Innovating Through Upcycling

- Increased Demand for RTD Alcoholic Beverages

- Increased Demand for Ethically Sourced Food

- Growth in Carbon-Neutral Initiatives

- Food Ingredients Outlook: Demand & Supply

- North America Market Landscape

- Global Economic Implications for the Food & Beverage Industry: A Macro-indicator Analysis

- Merger and Acquisition Insights: A Perspective from 2023

- 2023 Verdict Food & Beverage Industry: Adapting to Evolving Demands

Roshan Deshmukh

Pooja Parvatkar

Food & Beverage Industry Review: 2023 Insights

In the ever-evolving landscape of global economies and industry dynamics, the food and beverage sector is influenced by multiple macro-indicators and market trends. The sector remains resilient yet susceptible to external forces. The emergence of geopolitical tensions, policy changes, and extreme weather events cause uncertainty, potentially disrupting the supply and demand and impacting international trade in food commodities. However, amidst these challenges, the industry is witnessing significant strengths and growth drivers.

In 2023, the food and beverage sector witnessed significant shifts driven by evolving consumer preferences, technological advancements, and changing market dynamics. Innovative product offerings, such as plant-based alternatives and functional foods, gained traction among health-conscious consumers, reshaping traditional consumption patterns. Additionally, advancements in food processing technologies and supply chain management improved efficiency and product quality, enhancing industry competitiveness. The rise of e-commerce and delivery platforms further transformed the sector, providing convenience and expanding market reach. Amidst these changes, sustainability emerged as a key focus area, with companies increasingly adopting eco-friendly practices to meet consumer demands and mitigate environmental impact. The Food & Beverage Industry Review 2023 by Allied Market Research offers a comprehensive analysis of the sector's performance and trends.

Key Trends in the Food & Beverages Industry in 2023

The food and beverage industry has a rich history that has evolved over centuries. In 2023, the sector saw constant development, driven by changing consumer preferences, technological advancements, and environmental concerns. The food and beverage industry has become a globalized and highly competitive sector. It encompassed a wide range of businesses, including agriculture, food processing, restaurants, cafes, bars, and food retail.

Commitment Towards Sustainable Packaging

Sustainable packaging solutions have long been a priority for the food and beverage industry. However, with the growing concerns about climate change, stakeholders demanded a clear commitment to sustainable practices in 2023. Advancements in engineering and material science led to the development of more environmentally friendly packaging options that can accommodate a variety of products. Plant-based and biodegradable packaging solutions also gained traction, empowering companies to reduce their carbon footprint and contribute to a greener future.

Rising Cost of Raw Materials: Innovating Through Upcycling

The rising cost of raw materials became a significant challenge for businesses in the food and beverages industry. To combat this issue, companies turned to upcycling, a process that involved reusing excess or waste materials to create valuable food ingredients. By upcycling food waste, businesses reduced costs, promoted sustainability, and minimized environmental impact. This trend drove innovation in the upcycling sector as companies sought new and effective ways to transform food waste into useful products. The growing demand for eco-friendly and sustainable products expanded the global upcycled food products market.

Increased Demand for RTD Alcoholic Beverages

In today's fast-paced world, convenience, flavor, variety, and quality are paramount for consumers when choosing beverages. Ready-to-drink (RTD) alcoholic beverages perfectly align with these preferences, making them increasingly popular and outpacing the spirits sector in terms of market growth. The RTD market witnessed significant expansion in 2023, offering a wide range of options including wine spritzers, hard seltzers, and pre-mixed cocktails. Consumers were particularly drawn to RTDs bursting with floral and botanical flavors, low in sugar, and made with a variety of spirits. This trend highlighted the importance of providing familiar products with a unique twist to cater to evolving consumer tastes.

Increased Demand for Ethically Sourced Food

Consumers today are increasingly interested in understanding the journey of their food, from farm to plate. They prioritize ethically sourced ingredients and sustainable farming practices. In 2023, the demand for responsibly sourced components extended to various product categories, including infant food and pet food. Consumers expected businesses to provide transparency regarding their manufacturing and supplier chains, empowering them to make informed decisions about the food and beverages they consume. This trend reflected a shift towards conscious consumerism, where individuals consider the social and environmental impact of their choices.

Growth in Carbon-Neutral Initiatives

In the pursuit of achieving net-zero emissions, major food and beverage companies launched carbon-neutral products. By obtaining certifications for carbon or climate neutrality, these companies showcased their commitment to environmental stewardship. For instance, Anheuser-Busch and Riff introduced carbon-neutral products through collaborations with organizations like Climate Neutral and Carbonfund.org. These initiatives involved reducing greenhouse gas emissions from the production and distribution of goods.

In 2023, the food industry demonstrated significant strengths and growth drivers that contributed to its resilience and expansion.

One key factor is its structural resilience. The demand for food remained consistent, regardless of economic fluctuations, due to its essential nature in sustaining human life. Consumers prioritized spending on food, ensuring a steady demand that supported the industry’s stability even during uncertain times. Moreover, the food industry benefited from the growth opportunities presented by emerging markets. Rising disposable incomes enabled consumers to afford higher value-added food products, driving the demand and revenue growth. This trend also encouraged innovation and diversification within the industry to meet the changing preferences of consumers.

Consumer tastes and preferences are also evolving, particularly towards foods that offer health benefits. With increased awareness of health and wellness, consumers were seeking out products that aligned with their dietary goals. This shift prompted food companies to invest in research and development, introducing new products that catered to these changing consumer demands.

The integration of new technologies transformed various aspects of the food industry. From the use of big data solutions for enhancing supply chain management to the development of scientifically engineered ingredients and products, technology boosted efficiency and innovation across the sector. These advancements streamlined operations and enabled food companies to respond more effectively to consumer trends and market demands, positioning the industry for sustained growth and competitiveness in the years ahead.

However, the food industry faced notable restrainers amidst its growth. In 2023, it was susceptible to sudden crises like geopolitical conflicts, price volatility, and extreme weather events, which disrupted supply chains and impacted prices unpredictably. Additionally, the rise of critical consumers demanding transparency about sourcing and production methods necessitated industry adaptation to maintain trust and competitiveness. Addressing these restrainers was crucial for the food industry to foster resilience, sustainability, and consumer confidence while navigating unpredictable market dynamics.

Food Ingredients Outlook: Demand & Supply

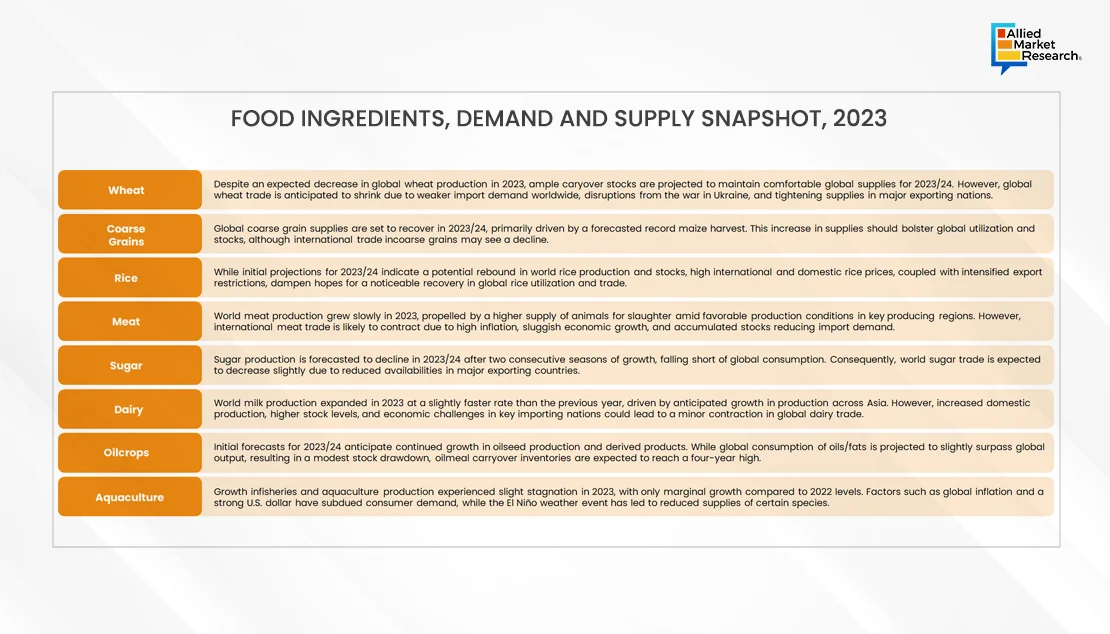

The global food ingredients and production systems were still susceptible to various risks, including extreme weather events, increasing geopolitical tensions, and policy shifts. These factors could disrupt the balance between supply and demand, which could affect international trade in food commodities and global food security. Various food ingredient categories.

North America Market Landscape

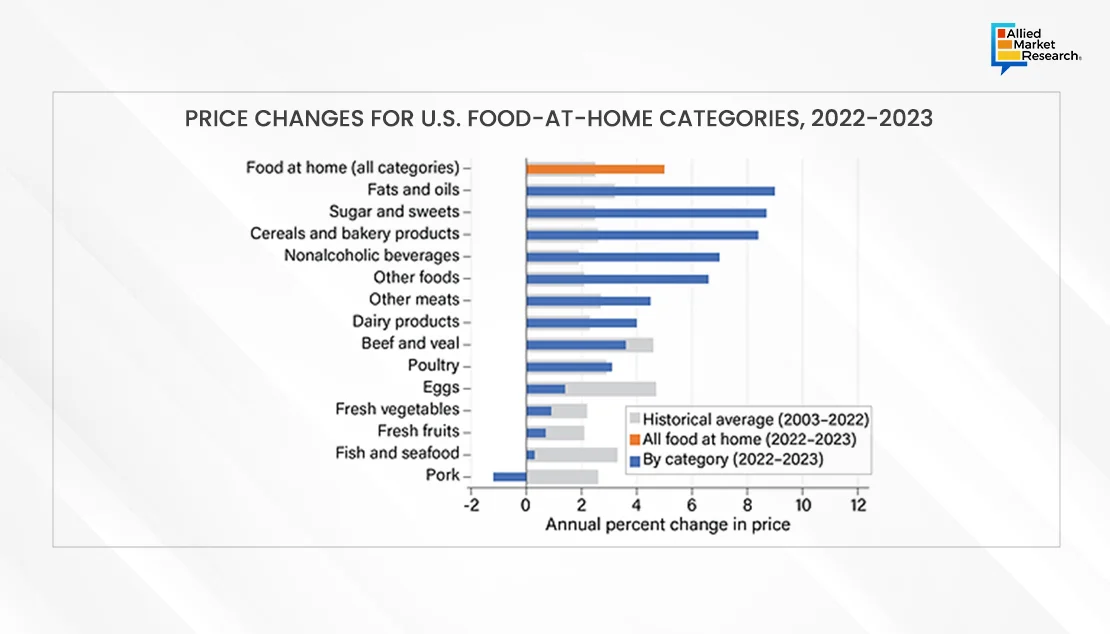

U.S. held the highest share in the North America market. It remained one of the most prominent food products consumers and led the innovations in 2023 as well. In the U.S. food industry, food away from home was the major contributor to the overall revenue of the food industry in 2023. According to USDA, in 2022, the collective spending on food by U.S. consumers, businesses, and government entities amounted to $2.39 trillion. Within this, spending on food-at-home rose from $954.7 billion in 2021 to $1.05 trillion in 2022, while spending on food-away-from-home increased from $1.16 trillion in 2021 to $1.34 trillion in 2022. Notably, food-away-from-home expenditures constituted 56% of the total food expenses in 2022.

In 2023, the average annual prices for food-at-home were 5.0 percent higher than those in 2022. To provide context, the historical retail food price inflation over the past 20 years has been at a rate of 2.5 percent per year. In comparison, the rate of price growth in 2023 slowed down from the previous year, where food-at-home prices had increased by 11.4 percent.

Global Economic Implications for the Food & Beverage Industry: A Macro-indicator Analysis

After dropping from 5.8% in 2021 to 3% in 2022, global GDP growth decreased in 2023 and is forecasted to further settle at an average of 2.6% over the next ten years. The Asia-Pacific region, notably India, China, and Southeast Asia, is predicted to experience the most robust GDP growth from 2023 to 2032. Sub-Saharan Africa and the Near East and North Africa are expected to have higher-than-average GDP growth rates compared to the global average, while Latin America and the Caribbean, along with OECD countries, are anticipated to have lower growth rates.

Before the recent conflict in the Middle East, agricultural commodity prices experienced a 3 percent decrease in the third quarter of 2023. This decline was mainly influenced by lower prices in the food sector, the main component of the index. The food price index dropped by 3 percent, with grains leading the decline with a 7 percent decrease. Factors such as the non-renewal of the Black Sea Grain Initiative, India's ban on non-basmati rice exports, and the approaching El Niño contributed to price volatility in agricultural markets. However, due to sufficient supplies, prices remained on a modest downward trajectory.

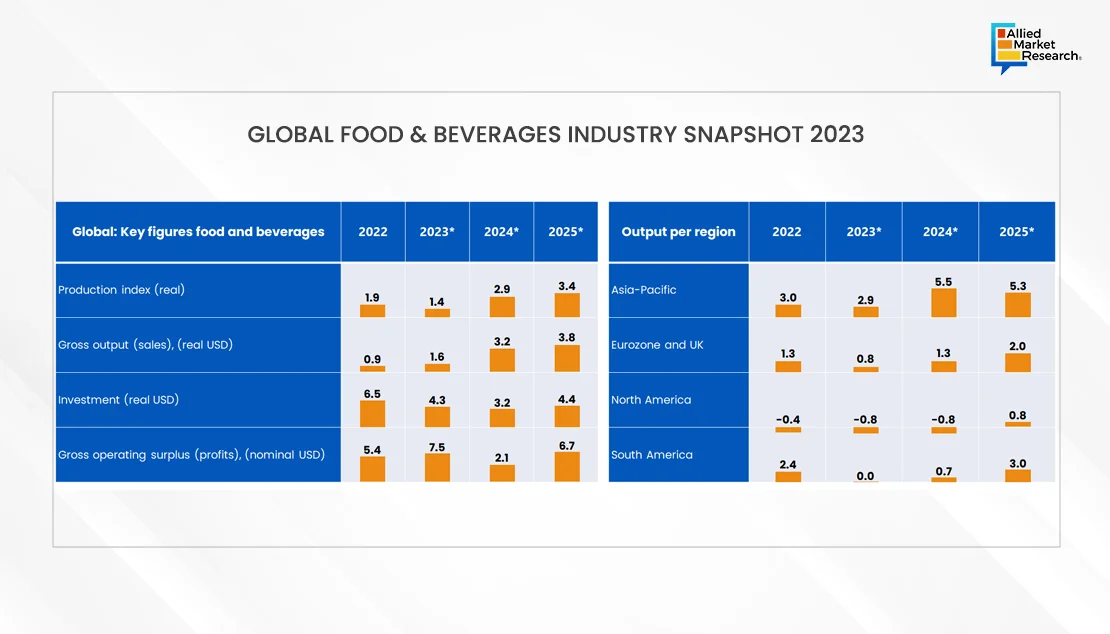

The global economic landscape presented significant challenges, particularly evident in the performance of the food and beverages industry. The global food and beverages output experienced deceleration except for the Asia-Pacific region. The growth is projected to be a mere 1.4% in 2023, whereas sector investment is expected to increase by 4.3% in 2023, a decline from the 6.5% seen in 2022.

In 2023, several factors contributed to high prices and prompted consumers to reduce spending on nonessential food items. Foremost among these factors were supply chain disruptions, many of which impacted from the conflict in Ukraine. The absence of an extension to the Russia-Ukraine grain agreement increased the severe impact of the war on the global food industry. Ukraine was one of the significant players, accounting for around 4% of the world’s wheat supply, 13% of corn, and over a third of global sunflower oil trade in 2023.

Merger and Acquisition Insights: A Perspective from 2023

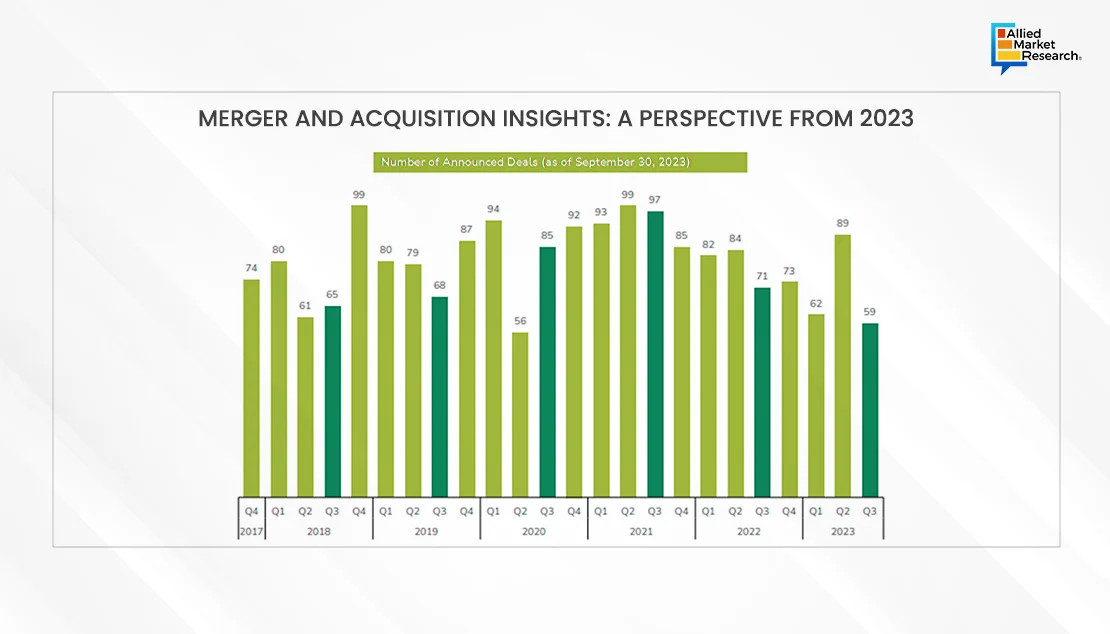

In 2023, deal activity surged in the food & beverage industry, echoing levels seen during the COVID-19 pandemic. Despite rising interest rates and inflation, investors displayed growing confidence, although accessing debt became more costly and challenging. While deal flow escalated, concerns over mounting input costs persisted, compounded by consumer resistance to price hikes and ongoing global supply chain disruptions. Nonetheless, major corporations and private equity firms retained substantial cash reserves, indicating continued robust demand for premium assets in the sector.

There were around 283 deals announced in the food and beverage sector for the trailing twelve months (TTM) ending September 30, 2023, marking a decrease of 39 transactions compared to the previous TTM period. Overall, deal activity declined by 17% year over year and 34% quarter over quarter.

Significant transactions in this sector included Campbell Soup Company's proposed acquisition of Sovos Brands and Tilray Brands’ purchase of assets from Anheuser-Busch Companies. The most active categories in terms of deal volume were alcoholic beverages, general, confectionery/snacks, and protein producers, accounting for 63% of total transactions in the quarter.

Mergers and acquisitions in the food and beverage industry for TTM September 2023 were primarily driven by strategic buyers, including companies primarily owned by private equity investors, accounting for 78% of total deal volume. Out of the 283 deals announced during the year, 238 (84%) were completed by privately owned buyers.

2023 Verdict Food & Beverage Industry: Adapting to Evolving Demands

In 2023, the food and beverages industry underwent significant transformation. Trends such as increased raw material costs, commitments to sustainable packaging, the surge in popularity of ready-to-drink alcoholic beverages, the introduction of carbon-neutral products, and a focus on responsible sourcing and transparency played pivotal roles in shaping the industry landscape. Businesses that embraced these trends were able to align with shifting consumer preferences, achieve sustainability objectives, and foster innovation within the sector. The future trajectory of the food and beverages sector hinges on its ability to adapt to evolving demands while upholding environmental and social responsibilities.

In 2024, the food and beverages industry might be one of the best performing sectors. The industry is expected to show flexibility in its shift to sustainability, technological advancements in the domain, robust nature of the industry, and actions of major companies in the sector will catapult the industry ahead in the coming period. For a deeper understanding of emerging trends and strategic insights shaping the food & beverages industry, contact our esteemed analysts today.