Table Of Contents

- The Rise of Digital Innovations in Chemicals Industry

- Incorporation of IoT in Chemical Industry

- Digital Twins and Blockchain

- AR & VR Technologies

- High Demand for Materials and Chemicals in Renewable Energy

- Rising Demand for Bio-Based, Green, and Sustainable Materials

- Adoption of Green Building Materials Rising in Construction Sector

- Impact of Russia Ukraine War and Inflation on Chemicals and Materials Industry

- The Way Ahead for the Materials & Chemicals Industry

Yerukola Eswara Prasad

Pooja Parvatkar

Transforming Trends in the Materials & Chemicals Industry - Industry Review 2023

In the constantly evolving materials & chemical industry, 2023 marked a pivotal year characterized by profound digital innovation and a resolute commitment to sustainability. The materials & chemical industry is leading the way in this revolutionary shift as the world keeps moving inevitably towards a future defined by environmental awareness and technological innovation. The industry is going through a paradigm shift that promises to redefine its operations, priorities, and impact on global sustainability goals. This transition is fueled due to several factors, including the growing demand for eco-conscious materials and the persistent integration of artificial intelligence and sophisticated analytics.

This materials and chemical industry Review 2023 by Allied Market Research offers a compelling overview of the major trends, market dynamics, and strategic moves by industry professionals influencing the growth trajectory of the industry.

The Rise of Digital Innovations in Chemicals Industry

The chemical industry has been experiencing significant digital innovations in recent years. These innovations hold the potential to transform various aspects of the industry, including research and development, manufacturing processes, supply chain management, and customer engagement. Key digital innovation trends in the chemical industry includes advanced analytics, artificial intelligence, internet of things (IoT), digital twins, blockchain technology, augmented reality (AR), virtual reality (VR), data-driven product development, cloud computing and big data, some of which are detailed below:

Incorporation of IoT in Chemical Industry

The chemical industry harnessed advanced analytics and AI (IoT) to extract insights from vast data sets, enhancing process optimization, predicting equipment failures, and refining product quality. Using big data, chemical companies made exceptional real-time scheduling and asset use decisions. This resulted in an improved yield, either owing to enhanced production or reduced waste. Big data also made it easier to lower downtime. Equipment such as compressors, turbines, and others were fitted with sensors that continually collected data. The data could be used to spot patterns and prompt intervention prior to breakage. Further, big data optimized a lean supply chain, particularly transportation logistics. Chemical organizations could examine weather patterns using big data and anticipate events that might cause a delay in the supply chain. For instance, in 2022, Sundaram Clayton Limited (SCL), the leading provider of light metal castings announced scaling up Altizon Inc.’s Datonis digital factory deployment in all its manufacturing plants. Also, Mitsubishi Electric Computerized Numerical Controllers (CNCs) opened 'Me-eye Experience Centre' in Peenya under its CNC Technical Centre. This initiative will develop IoT solutions for the CNC metal cutting industry, such as user applications via mobile phone, PC, and web. According to a study by AMR, the IoT in chemical industry market is anticipated to grow by more than 10% on an annual basis.

Digital Twins and Blockchain

In the chemical industry, digital twins replicate physical assets or processes to simulate and enhance manufacturing procedures. By merging real-time IoT data with simulation models, firms forecast and refine process outcomes, enhancing energy efficiency and minimizing waste. Blockchain stands to transform supply chain management by offering a decentralized, transparent platform for transaction tracking and verification. This ensures authenticity and traceability across raw materials, intermediates, and final products. Additionally, blockchain streamlines procurement, inventory oversight, and regulatory adherence. For instance, AGC Inc. developed a Process Digital Twin (PDT) for vinyl chloride monomer manufacturing plant of P.T. Asahimas Chemical in Indonesia in April 2023. This technology can reproduce the current state of a plant into a process simulator and instantly perform high-speed calculations. Using these systems, operating conditions and asset performance can be visualized via simulators. These technological advancements signify a profound shift in operational efficiency and transparency within the chemical sector.

AR & VR Technologies

AR and VR technologies have been increasingly utilized for training, maintenance, and visualizing processes within the chemical industry in 2023. Furthermore, cloud-based platforms have further enhanced data sharing and cooperation among various industry stakeholders, fostering efficiency and innovation. For instance, BASF along with Augmented Reality software from Hololight and Microsoft’s HoloLens AR-glasses, initiated training in production in 2020. The AR software guides through the training with 3D animations and speaker audio, so that each participant can complete the training at his or her own pace. Such approaches by the company help in training the employees in matters not disclosed through traditional means. Also, companies such as Nanome and Visyon through various tools help to understand atomic and molecular chemistry of various materials.

The digital innovation trends that have been stated are just a few examples of the revolutionary shifts that the chemical industry is experiencing. Many chemical companies are adopting these innovative technologies with great enthusiasm, recognizing that they have the potential to transform operations, increase productivity, and open new avenues for innovation never seen before. These digital innovations have the potential to completely change the industry landscape by streamlining operations, improving safety, and opening new business opportunities in a market that is always changing. Prominent market players such as BASF, Dow Chemical, DuPont, Evonik, Covestro, and Lanxess are leading the charge in the digital revolution by consciously allocating resources towards innovation to maintain a competitive edge in a growing market.

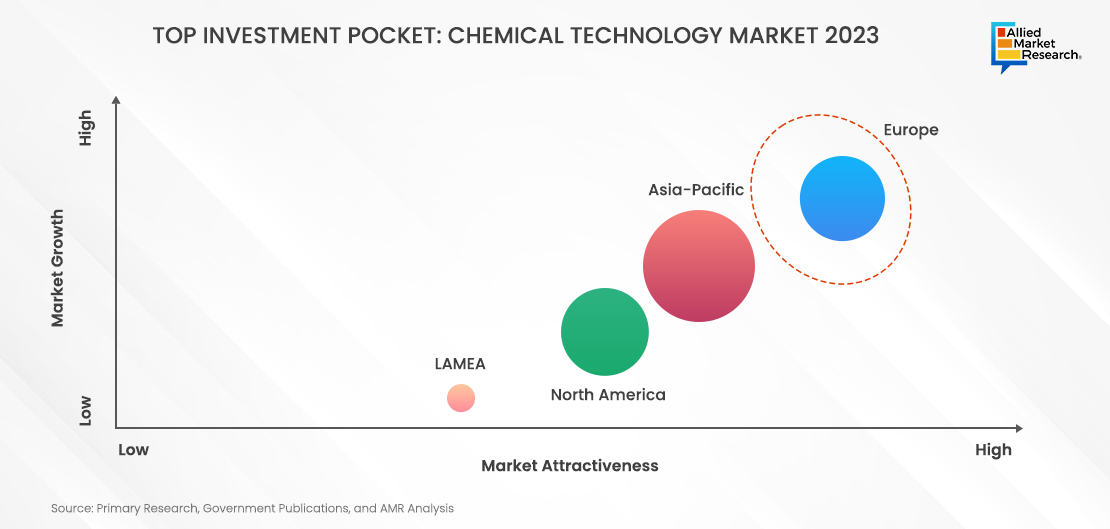

The above figures illustrate the various technological offerings in the chemical industry in 2023. Here it can be seen that Europe was the most lucrative market in chemical technology on a global level, based on market size and growth rate. The chemical industry in Europe plays a crucial role in delivering innovative materials and technological solutions to support the region's industrial competitiveness. The chemical industry is at the heart of the Europe manufacturing industry as 56% of the regional chemicals sold to downstream users go to other industrial sectors. With technological innovations needed for increasing chemical production, the demand for various IoT technologies is anticipated to increase considerably.

High Demand for Materials and Chemicals in Renewable Energy

The global shift towards renewable energy, especially in 2023, is bolstering the demand for materials and chemicals pivotal in renewable technologies. Solar panels rely on semiconductor materials like silicon, conductive metals, and polymers for efficient energy conversion. Wind turbines necessitate lightweight yet sturdy composite materials for their blades, along with steel and concrete for structural components. For instance, according to Global Wind Energy Council, the new on-shore wind energy installations totaled 68,816 megawatts, while new off-shore installations totaled 8,771 megawatts. Wind energy generation showed a growth of 9% between 2021 and 2022. Renewable energy consumption showcases a minimum growth rate of 8% on an annual basis. Energy storage systems, crucial for renewable energy integration, primarily employ lithium-ion batteries comprising lithium, cobalt, nickel, and graphite for electrodes and electrolytes. Similarly, electric vehicle batteries demand high-performance materials like lithium-ion chemistries tailored for automotive use. This surge in demand is prompting advancements in material science and chemical engineering to enhance efficiency, durability, and sustainability, driving innovation across the renewable energy sector. With the increase in demand for renewable energy, the necessary need for advanced materials and chemicals is also expected to increase considerably in the coming years.

Rising Demand for Bio-Based, Green, and Sustainable Materials

The materials & chemicals industry experienced a surge in demand for bio-based, green, and sustainable materials in 2023. This trend reflects a growing awareness of environmental concerns and a shift towards more eco-friendly alternatives. Bio-based materials, derived from renewable sources like plants and agricultural waste, offer reduced carbon footprint and lower environmental impact compared to traditional petrochemical-based materials. Green materials prioritize energy efficiency, recyclability, and non-toxicity, contributing to sustainable manufacturing processes and product lifecycle management. The increased adoption of these sustainable materials aligns with consumer preferences for environmentally responsible products and regulatory initiatives promoting sustainable practices across industries.

Adoption of Green Building Materials Rising in Construction Sector

The construction sector witnessed a significant surge in the adoption of green building materials, marking a pivotal shift towards sustainable practices in 2023. This trend was driven by various factors, including heightened environmental awareness, stringent regulations, and growing consumer demand for eco-friendly structures. The adoption of green building materials offers several benefits to both builders and occupants. They contribute to reduced carbon emissions, lower energy consumption, improved indoor air quality, and enhanced durability. Additionally, they often qualify for green building certifications like LEED (Leadership in Energy and Environmental Design), enhancing the marketability and value of constructed properties. In order to promote green building materials, the Government of India through LEED announced incentive through tax (Developers can claim up to 100% depreciation on the cost of green building assets ), loans (low-interest loans through the Indian Renewable Energy Development Agency (IREDA) for building projects with green certifications), public procurement (policy that requires all government buildings to be certified green), fast-track approvals (green building certified are eligible for expedited inspections and reduced building fees) and renewable energy promotion (government subsidies and tax benefits to promote renewable energy) As sustainability continues to gain traction as a core principle in construction, the momentum behind the adoption of green building materials is expected to accelerate further. This shift signifies a fundamental change in the industry towards more responsible and environmentally conscious practices, paving the way for a greener and more sustainably built environment. For instance, in 2019, DuPont announced plans to invest more than $400 million in safety & construction to increase capacity for the manufacture of TYVEK nonwoven materials at its Luxembourg site due to rise in global demand. The new operating line of TYVEK nonwoven materials commenced with the production of these materials.

The above figure depicts that exterior product green building materials showcased the highest market attractiveness in 2023 due to incorporation of various products. Solar mounted panels, electrochromic glass, thin film solar panels, recycled glass, and other products were launched in recent years for use in the exterior of buildings. Such innovative products have increased the demand for green building materials in developed as well as emerging economies globally.

Impact of Russia Ukraine War and Inflation on Chemicals and Materials Industry

Amidst geopolitical tensions and economic challenges, the global materials & chemicals industry finds itself at a crossroads in 2023. Sluggish global demand for chemicals has been influenced by various factors, including a recession in Europe, inflation in the United States, and slower-than-anticipated growth in demand from China. Additionally, excessive ordering in 2021 and 2022 has led to elevated inventory levels, resulting in destocking. Consequently, chemical output saw minimal growth of less than 1% year over year in the first eight months of 2023, with several segments experiencing decreased output. Many companies focused on cost reduction and efficiency improvements to mitigate output decline.

In the United States, concerns regarding an economic downturn have diminished, replaced by indications of a "soft landing," although economic growth is projected to decelerate. Destocking may transition to restocking for numerous chemicals, persistent weaknesses in demand and excess capacity for certain products are expected to persist. Given these market conditions, chemical companies must strike a balance between short-term and long-term objectives. The American Chemistry Council forecasts that capital spending in the US chemical industry will largely remain unchanged year over year in 2024 before increasing to a growth rate of 3%–4% annually in 2025–2026. However, the strategic deployment of this capital will be crucial in determining companies' competitive positioning in the near future.

The European chemical industry remains under the influence of multiple factors, including the ongoing conflict between Russia and Ukraine, sluggish demand, elevated energy expenses, increasing interest rates, and inflationary pressures. The European chemical industry council reported a substantial 10.6% decrease in production for the EU27 chemical industry during the first nine months of 2023. Furthermore, capacity utilization in this sector declined, reaching 74.1% in the third quarter of the same year. These statistics underscore the significant challenges facing the European Union's chemical sector, prompting a profound transformation towards climate neutrality, circularity, and digitalization. This strategic shift aims to facilitate the transition to safer and more sustainable chemicals, reflecting a concerted effort to align with evolving environmental and regulatory standards.

The Way Ahead for the Materials & Chemicals Industry

The trends and innovations in the chemical industry in 2023 pave the way for a sustainable and efficient future. Looking ahead, the materials and chemicals industry stands at a pivotal juncture, poised for continued transformation and growth. As digital innovation reshapes traditional practices and sustainability becomes increasingly paramount, companies must remain agile and proactive in their approach. It is imperative for governments and companies to sustain their support and investments in these trends to expedite progress towards a sustainable environment. Embracing emerging technologies, fostering strategic partnerships, and prioritizing sustainability initiatives will be essential for staying competitive in an ever-evolving landscape. Moreover, navigating geopolitical uncertainties and economic challenges will require a keen understanding of market dynamics and the ability to adapt swiftly to changing conditions.

For deeper insights into the future of the materials & chemicals industry, reach out to AMR analysts today. Our team of experts offers comprehensive research and analysis, providing invaluable guidance to help companies navigate the complexities of the industry and seize emerging opportunities. Contact us today to learn more about how we can assist your business in charting a successful path forward.