Rice Starch Market Research, 2031

The global rice starch industry was valued at $520.4 million in 2021 and is projected to reach $932 million by 2031, growing at a CAGR of 6% from 2022 to 2031. Asia-Pacific was the highest contributor and is estimated to reach $381.2 million by 2031, with a CAGR of 6.5%. The primary ingredient in rice and a naturally occurring polymeric carbohydrate is rice starch. It is an insoluble white powder that contains both amylose and amylopectin in its natural state. Similar to rice, its composition and structure can vary substantially.

Even though rice export and quarantine limitations were lifted globally, some nations' rice prices remained elevated during the ensuing months, which reduced demand for rice-based products and had a substantial influence on the rice starch market. The outbreak of COVID-19 pandemic had a negative impact on the rice starch market. In addition, it has led to either closure or suspension of their rice production activities in most of the industrial units across the world. Moreover, the pandemic has disrupted the supply chain and affected the buying pattern of the consumers across the globe.

One of the most common cereal starches with cutting-edge functional qualities is rice starch. The characterization of rice starches extracted from various rice cultivars has advanced significantly in recent years. Studies have shown that the rice germplasm, isolation process, climate, agronomic conditions, and grain development have an impact on the molecular structure and functional qualities. Rice starch granule sizes (2 to 7 m) and forms (polyhedral, irregular) have been found to differ significantly in morphological studies (microscopy and particle size analysis). In comparison to waxy rice starches, nonwaxy and long-grain rice starches exhibit more variance in granular size. The amylose percentage of waxy and long-grain rice starches ranges from nearly zero to roughly 35%, with rice starch granules being smaller than those of other cereal starches.

Beneficial functional compounds such as fructose, maltose syrups, wine, glucose, and trehalose are produced from rice starch. In addition, rice starch can be used to create bioethanol, a biofuel that can substitute for some of the energy in petroleum and other fossil fuels. In addition, another application for rice starch is the production of rice wine. One of the oldest alcoholic beverages in existence, rice wine, often referred to as Chinese rice wine or yellow wine, has long been a favorite in China, Japan, Korea, and other Asian nations. As a result, it is in high demand throughout Asia-Pacific.

Due to its small granule size and low gelling temperature, waxy rice starch offers good water binding performance at low process temperatures of roughly 70–80°C that is likely to boost the growth in the rice starch industry. It is the best clean label component to control the production and juiciness of meat, fish (shrimps), and vegetables (mushrooms) after vacuum impregnation or injection. Native precooked and cooked rice starches can also easily help to reduce fat in spreadable foods such as pâté due to their high level of added creaminess, and this is another element that leads to the growth of the rice starch market.

However, key players face numerous threats due to the availability of alternatives to rice starch. As compared to rice starch on the market, corn starch, wheat starch, and potato starch are far more popular across industries. These starches are crucial in the production of salad dressings, confections, and sweets, including pies and puddings. Other starches also aid in retaining moisture, reducing the crystallization of other sugars, and enhancing the suppleness and shelf life of cakes, cookies, icings, and fillings. The most extensively farmed raw material for starch manufacturing is grains such as wheat, rice, corn or maize, barley, oats, rye, and millets. The production of rice starch is also far lower than that of corn, wheat, or potato starch.

The high-value food processing industry, where demand for starches and derivatives is substantial but yet in its infancy, is the most intriguing and promising of all the sectors. The need for starch in food is rising by 20%, with frozen food being the dominant segment and is expected to increase in the rice starch market forecast period. Starch usage has been growing in noodles and soups, and the use of starch in ground spices is one of the rice starch market trends across the globe. The Food Safety and Standards Authority (FSSA) revised the law on the use of modified starches in food in the middle of 2016. The dose of modified starches in processed foods may now be GMP (Good Manufacturing Practice) rather than the previous dosage limit of 0.5%, per the new legislation. In addition to increasing the dose of the ingredient in existing applications, this modified starch regulation modification will also open the door to new ones, which is anticipated to have a favorable impact on the rice starch market demand.

Based on its unique properties and high cost, rice starch will become more and more popular as consumer demand for novel products and high-quality goods increases. The price of milled rice and its starch may trend downward as a result of such changes, which would increase the rice starch market growth. There is no doubt that a wide range of factors will affect how rice starch is produced and used in the future. Therefore, new kinds with distinctive qualities tend to increase demand in the rice starch market forecast period. In addition, rice germplasm exhibits a high degree of genetic diversity with regard to end-use quality factors. As a result of the inadequate investigation, this variation has not been utilized as a resource for product creation. Waxy varieties of rice starch as well as low and intermediate amylose varieties are available on the market today. Because of this, a substantial segment of the food industry thinks that these are the only types of rice that exist. A better understanding of the various end-use quality types that are currently available as variations and the potential for creating new varieties with novel attributes could lead to an increase in the consumption of rice starch, hence boosting the rice starch market growth.

Segmental Overview

The rice starch market segmentation is done on the basis of type, form, nature, end use, and region. On the basis of type, the market is bifurcated into waxy rice starch and regular rice starch. According to form, it is classified into native and modified. As per nature, the market is segregated into organic and conventional. Depending on end use, it is divided into food & beverage industry, cosmetic & personal care industry, paper industry, laundry industry, pharmaceutical industry, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

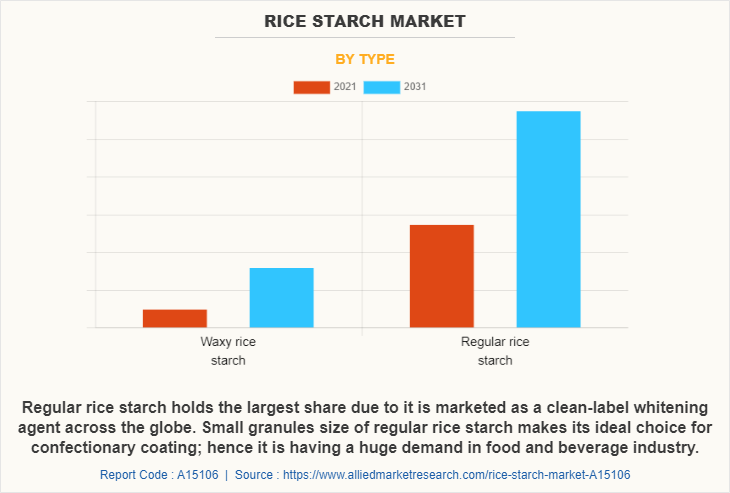

By Type

On the basis of type, the regular rice starch segment dominated the global market in the year 2021, and is likely to remain dominant during the forecast period. This is attributed to the higher exhibit of relative crystallinity values, as well as increased swelling and solubility indices. In addition, it includes varieties such as Koganemochi (Kog), Hakuchomochi (Hak), and Kantomochi 172 (K172). Due to its high amylopectin content, waxy rice starch is isolated from rice and treated to achieve greater gelatinization temperatures. Moreover, it produces a gel that has no retrogradation and is pH, temperature, and microwave stable.

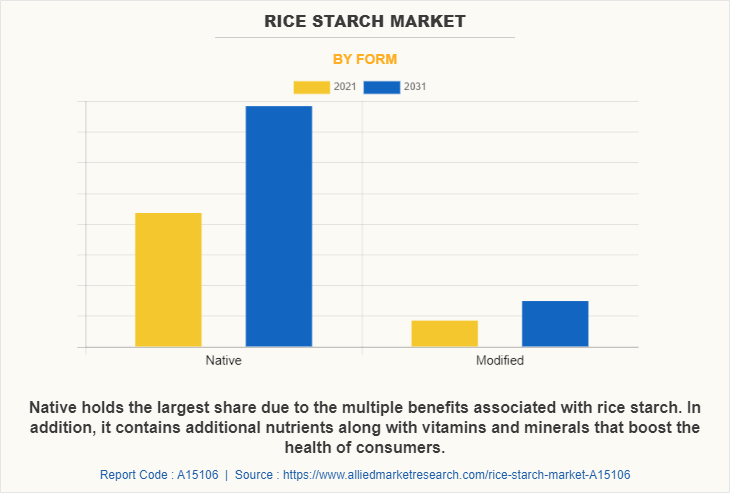

By Form

On the basis of form, the native segment dominated the global rice starch market share in the year 2021, and is likely to remain dominant during the forecast period. This is attributed to its myriad applications in bakery mixes, frozen cakes, brewing adjuncts, sheeted snacks, batters & breading, dry mix soups and sauces, and pet foods. Furthermore, native rice starches have been utilized in the food industry for a long time, but due to drawbacks such as degrading after reheating or in acidic environments its consumption is expected to reduce during the forecast period. However, such drawbacks create opportunities for various manufacturers to innovate the product and increase the demand in the rice starch market.

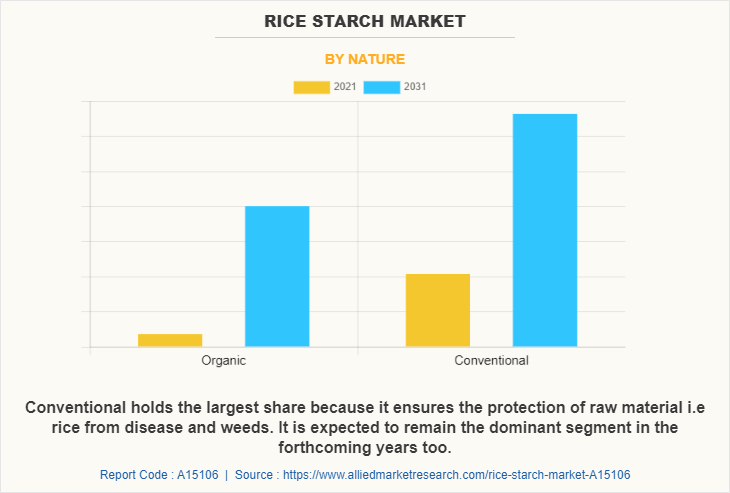

By Nature

On the basis of nature, the conventional segment dominated the global rice starch market share in the year 2021, and is likely to remain dominant during the forecast period. This is attributed to the various benefits conventional farming offers to the farmers such as ease, convenience, and safety of crops in farming. Conventional farming offers huge availability of raw materials at a low cost. Conventionally produced rice used for manufacturing rice starch ensures a good amount of yield to the farmers and it generates significant revenue for the farmers. However, the organic segment is likely to be the fastest-growing segment during the forecast period. An upsurge has been witnessed in the adoption and popularity of organic rice starch in the past few years. The growing concerns regarding the environment, sustainability, and healthy food are a few factors that are expected to boost the demand for organic rice starch globally. Moreover, the manufacturers and traders have a high-profit margin associated with the trading of rice starch in the market. The farmers are also benefitted from the farming of organic rice, and organic rice farming is totally eco-friendly. All these factors are expected to foster the demand for organic rice and ultimately boost the global organic rice starch market in terms of revenue.

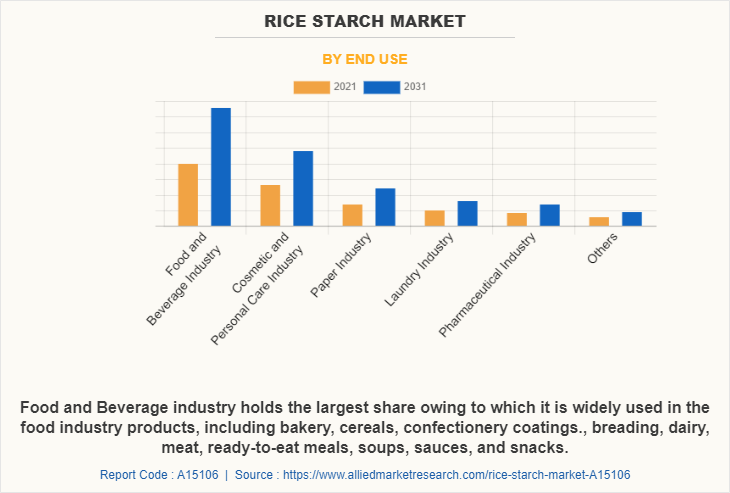

By End Use

On the basis of end use, food & beverage industry dominated the global rice starch market size in the year 2021, and is likely to remain dominant during the forecast period. With numerous functional properties and tiny granule sizes, rice starch aids in coating by smoothing down rough surfaces on confectionery products. Improving the viscosity, syneresis management, and shelf-life are some of the benefits of rice starch. In addition, it has a great flavor and a creamy texture suitable for infant meals. Moreover, it enhances the texture of baked food products such as hardness, crunchiness, brittleness, and softness.

By Region

On the basis of region, Asia-Pacific dominated the global rice starch market size in the year 2021, and is likely to remain dominant during the forecast period. According to World Economic Forum, more than half of the world's production came from China and India, which together produced 389 million tons followed by Bangladesh and Indonesia, which each generated about 54.6 million tons, by a wide margin. Moreover, 9 out of 10 top rice producers across the globe are from Asia-Pacific. Hence, there is a huge production of rice starch as a result of rice production and consumption in the region.

Competitive Landscape

According to the market players, the major obstacle attributed to the pandemic was the disruption of the supply chain. Furthermore, all the distribution channels were nearly shut down in the first quarter of the pandemic. However, online channels such as Amazon and Flipkart were delivering the products. The key players included in the market analysis are A&B Ingredients, AGRANA Beteiligungs-AG, Anhui Shunxin Shenyuan Biological Food Co. Ltd., Aromantic Ltd., Bangkok Starch Industrial Co., Ltd., Beneo, Burapa Prosper, Ettlinger Corporation, Herba Ingredients, Ingredion, JiangXi Golden Agriculture Biotech Co., Ltd, and Pruthvi's Foods Private Limited.

Key Benefits for Stakeholders

- This report provides a quantitative rice starch market analysis of the market segments, current trends, estimations, and dynamics of the rice starch market analysis from 2021 to 2031 to identify the prevailing rice starch market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the rice starch market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global rice starch market trends, key players, market segments, application areas, and market growth strategies.

Rice Starch Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 932 million |

| Growth Rate | CAGR of 6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 298 |

| By Type |

|

| By Form |

|

| By Nature |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Anhui Shunxin Shenyuan Biological Food Co. Ltd., JiangXi Golden Agriculture Biotech Co., Ltd., Ettlinger Corporation, Sacchetto SpA, Wuxi Jinnong Biotechnology Co., Ltd., Ingredion Incorporated, Burapa Prosper, AGRANA Beteiligungs-AG, Trulux Pty Ltd., Herba Ingredients, Shafi Gluco Chem (Pvt.) Ltd., Aromantic Ltd., A & B Ingredients, BENEO GmbH, WFM Starch Products, Starch Asia, Thai Flour Industry Co., Ltd., Pruthvi's Foods Private Limited, Tiba Starch & Glucose Manufacturing Co., Bangkok Starch Industrial Co., Ltd. |

Analyst Review

The consumption of rice starch is on the rise owing to a surge in consumption from the commercial segment, majorly in restaurants for noodles and soups. The high-value food processing industry, where demand for starches and derivatives is substantial but yet in its infancy, is the most intriguing and promising of all the sectors. The need for starch in food is rising by 20%, with frozen food being the dominant segment in the market.

In the middle of 2016, the Food Safety and Standards Authority (FSSA) changed the regulation regarding the use of modified starches in food. The new legislation permits GMP (Good Manufacturing Practice) as opposed to the former dosage cap of 0.5% for modified starches in processed foods. This updated starch regulation change will not only allow for new applications but will also increase the dose of the ingredient in existing ones, which is expected to boost the demand for starch.

Another factor that influences the demand for rice starch is the rise in demand for organic rice starch. There is an increase in the demand for organic products as consumers are becoming health conscious. Consequently, the demand for organic rice starch has seen a multifold increase in the past four years, especially in the developed countries of North America and Europe regions including but not limited to the U.S., Canada, UK, and Germany. The demand for organic rice starch is likely to gain high traction across the world with the growing consumer awareness regarding the organic variant of the product and downward pressure on the price point.

The global rice starch industry was valued at $520.4 million in 2021 and is projected to reach $932 million by 2031

The global Rice Starch market is projected to grow at a compound annual growth rate of 6% from 2022 to 2031 $932 million by 2031

The key players included in the market analysis are A&B Ingredients, AGRANA Beteiligungs-AG, Anhui Shunxin Shenyuan Biological Food Co. Ltd., Aromantic Ltd., Bangkok Starch Industrial Co., Ltd., Beneo, Burapa Prosper, Ettlinger Corporation, Herba Ingredients, Ingredion, JiangXi Golden Agriculture Biotech Co., Ltd, and Pruthvi's Foods Private Limited.

On the basis of region, Asia-Pacific dominated the global rice starch market

Rice starch is used in the production of beneficial functional compounds such as fructose, maltose syrups, wine, glucose, and trehalose, Rice starch is also used to create bioethanol, a biofuel that can substitute for some of the energy in petroleum and other fossil fuels, Another application of rice starch is the production of rice wine, one of the oldest alcoholic beverages in existence

Loading Table Of Content...