Salicylic Acid Market Research, 2030

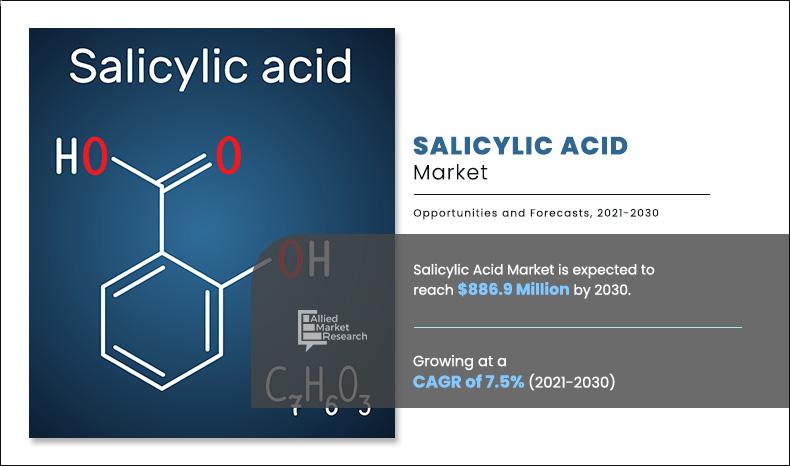

The salicylic acid market was valued at $431.7 million in 2020, and is projected to reach $886.9 million by 2030, growing at a CAGR of 7.5% from 2020 to 2030. The salicylic acid market is witnessing significant growth driven by the rising demand for skincare products and an increasing awareness of acne treatment among consumers. Salicylic acid, known for its effective exfoliating properties and ability to penetrate deep into the pores, is a key ingredient in many over-the-counter acne treatments. As more individuals seek solutions for acne and other skin concerns, the popularity of salicylic acid formulations continues to rise.

Introduction

Salicylic acid is a colorless, bitter-tasting organic compound with the chemical formula C₇H₆O₃. It belongs to the family of beta hydroxy acids (BHAs) and is widely known for its role in various medicinal and cosmetic applications. Salicylic acid is naturally found in willow bark, where it has been used for centuries as a traditional remedy for pain and inflammation. Its structure includes a hydroxyl group (-OH) and a carboxylic acid group (-COOH), which contribute to its distinctive properties, including its ability to penetrate the skin.

Market Dynamics

Rise in awareness of skincare and self-care routines is a key driver of demand for the salicylic acid market. In recent years, there has been a notable shift in consumer attitudes towards skincare, with more individuals recognizing the importance of maintaining healthy skin as part of their overall wellness. This growing awareness has led to an increased focus on effective ingredients that can address specific skin concerns, such as acne, which has contributed to the popularity of salicylic acid. Moreover, the rise of social media platforms has played a significant role in promoting skincare and self-care practices. Influencers and beauty experts frequently share their skincare routines, often highlighting products with salicylic acid for their effectiveness. All these factors are expected to drive the demand for the salicylic acid market during the forecast period.

However, salicylic acid is renowned for its effectiveness in treating acne and exfoliating the skin, it can also cause adverse reactions in certain individuals. Some users may experience redness, dryness, or peeling, particularly if they have sensitive skin or are using products with high concentrations of acid. This risk of irritation can lead to negative consumer experiences, discouraging potential buyers from trying salicylic acid products or causing them to discontinue use. Furthermore, the awareness of skin sensitivity is growing among consumers, who are increasingly cautious about the ingredients they apply to their skin. As a result, individuals with a history of skin allergies or conditions such as eczema may shy away from products containing salicylic acid due to the fear of irritation. This hesitance can limit market expansion, especially in demographic segments that are more prone to skin sensitivities. All these factors hamper the growth of the salicylic acid market during the forecast period.

On the contrary, as consumers become more aware of their unique skin types and concerns, there is an increasing preference for personalized products that address individual needs. This trend is particularly relevant for acne treatment, where one-size-fits-all solutions often fall short of delivering effective results. Salicylic acid, known for its targeted action against acne, can be effectively incorporated into customized skincare regimens, allowing brands to develop tailored products that resonate with consumers. All these factors are anticipated to offer new growth opportunities for the global salicylic acid market throughout the forecast period.

Market Segmentation

The salicylic acid market is segmented on the basis of application and region. Depending on application, the market is segregated into pharmaceutical, skin care, hair care and food preservatives and others. Region wise, the salicylic acid market is analyzed across North America, Latin America, Europe, Africa, Asia-Pacific and Middle East. Furthermore, the salicylic acid market share is analyzed across all significant regions and countries.

Competitive Landscape

The salicylic acid market analysis covers in-depth information of the major industry participants. Some of the major players in the market are Alfa Aesar, Avonchem limited, J.M. Loveridge Limited, Novacyl, Midas Pharma GmbH, Wego Chemical Group, Solvay Merck KGaA, and Reagents.

The factor contributing toward the salicylic acid market growth is increased demand for packaged food& beverages drives the market for salicylic acid. This is majorly attributed to the fact that the use of salicylic acid in the food & beverage industry is increasing, as it helps to prevent spoilage and fermentation of packaged food products. However, the food & beverage sector and cosmetics industry are highly regulated which is a challenging factor for the salicylic acid market. In addition, the market is also hindered by presence of alternatives. On the contrary, the growing pharmaceutical industry in Asia-Pacific and Africa is expected to offer lucrative salicylic acid market opportunities for the industrial participants. Asia-Pacific is the fastest growing across the globe, due to surge in demand for salicylic acid from the pharmaceutical & cosmetics industries, for shampoos, lotions, creams, moisturizers, and oral care lotions. China, Japan, and India are the major contributors to the growth of this region. China, Japan, and India are the major contributors to the growth of this region. Zhenjiang Gaopeng Pharmaceutical Co., Ltd., Hebei Jingye Group, Shandong Xinhua Longxin Chemical Co. Ltd., SiddharthCarbochem Products Ltd., and Alta Laboratories Ltd. are some of the prominent salicylic acid manufacturers in this region. Large-scale use of salicylic acid for different dermatological conditions and increase in production of salicylic acid derivatives such as aspirin, sodium salicylate, acrylic acid and salicylic acid amine for use in pharmaceutical sector are the major drivers of the salicylic acid market in this region.

Salicylic Acid Market, by Application

By application, the pharmaceutical segment garnered highest market share in 2020 in terms of volume. It has garnered 59.8% in 2020, in terms of volume. Salicylic acid is used in pharmaceuticals due to its anti-inflammatory properties. It is a key ingredient in the manufacturing of aspirin; it reacts with acetic acid to produce aspirin. Aspirin is an anti-inflammatory drug that is widely used as a painkiller and to treat fever, cold, and cough. In addition, it is one of the largest selling pharmaceutical drugs across the globe, and its consumption is on rise, as it offers superior pain-relieving action.

By Application

Pharmaceutical application holds a dominant position in 2020 and skin care application is projected as the most lucrative segment.

Salicylic Acid Market, by Region

Region wise, Asia-Pacific is expected to grow at a CAGR of 7.8%, in terms of revenue, during the forecast period. This is attributed to the presence of economies such as China and Japan. These economies have rapidly growing consumer base such as personal care, and pharmaceutical. In addition, the region comprises major industrial participants especially in China. Furthermore, the major competitive advantage of Chinese salicylic acid companies is its cheap cost. Furthermore, Africa is expected to grow at a CAGR of 7.6% in terms of revenue during the forecast period. The increasing scarcity of medications in various nations drives the expansion of the pharmaceutical market in Africa. Moreover, the rising fashion industry might lead to increase demand for the skin care products, which might fuel the demand for salicylic acid and acts as the major driving factor for the market during the forecast period. Additionally, rapid expansion of cities led to increase in the salons, which led to increase in demand for salicylic acid-based products.

By Region

Asia-Pacific holds a dominant position in 2020 and is expected to grow at fastest growth rate during the forecast period.

Key benefits for stakeholders

- The report outlines the current trends and future scenario of the market from 2021 to 2030 to understand the prevailing opportunities and potential investment pockets.

- The salicylic acid market size is provided in terms of volume and revenue.

- The report provides an in-depth analysis of the market along with the current and future salicylic acid market trends.

- This report highlights the key drivers, opportunities, and restraints of the salicylic acid market along with impact analysis during the forecast period.

- The report also covers the impact of governmental regulations on the salicylic acid market.

- Porter’s five forces analysis helps analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

- The study provides a comprehensive analysis of the factors that drive and restrain the salicylic acid market growth.

Analyst Review

According to the perspective of the CXOs of leading companies, the salicylic acid market is likely to exhibit high growth potential during the forecast period, owing to surge in demand from end-use industries especially from countries such as the U.S., Brazil, Germany, and China as well as rise in need for aspirin drug & personal care products. However, harmful effects of salicylic acid are likely to hinder the market growth. By region, Latin America and Africa are projected to register significant growth as compared to the other regions. This is attributed to rise in consumer base such as pharmaceutical, skin care, and haircare industries.

The CXOs further added that numerous economies across the globe are expected to emphasize pharmaceutical and healthcare industries in the next few years, owing to the increased health awareness due to COVID-19. This might boost demand for salicylic acid, as it is one of the key ingredients in the pharmaceutical industry. However, harmful effects associated with the usage of salicylic acid can have a restraining effect on the growth of the market. Furthermore, in the forecast period from 2021 to 2030, shifting consumer preferences for natural food additives, as well as rising health concerns, are projected to create new opportunities for the salicylic acid market.

Salicylic Acid Market Report Highlights

| Aspects | Details |

| By Application |

|

| By Region |

|

Analyst Review

According to the perspective of the CXOs of leading companies, the salicylic acid market is likely to exhibit high growth potential during the forecast period, owing to surge in demand from end-use industries especially from countries such as the U.S., Brazil, Germany, and china as well as rise in need for aspirin drug & personal care products. However, harmful effects of salicylic acid are likely to hinder the market growth. By region, Latin America and Africa are projected to register significant growth as compared to the other regions. This is attributed to rise in consumer base such as pharmaceutical, skin care, and haircare industries.

The CXOs further added that numerous economies across the globe are expected to emphasize on pharmaceutical and healthcare industries in next few years, owing to the increased health awareness due to COVID-19. This might boost demand for salicylic acid, as it is one of the key ingredients in the pharmaceutical industry. However, harmful effect associated with the usage of salicylic acid can have a restraining effect on the growth of the market. Furthermore, in the forecast period from 2021 to 2030, shifting consumer preferences for natural food additives, as well as rising health concerns, are projected to create new opportunities for the salicylic acid market.

Increased demand from pharmaceutical and skin & hair care industry is driving the demand for salicylic acid market.

The global salicylic acid market was valued at $431.7 million in 2020, and is projected to reach $886.9 million by 2030, growing at a CAGR of 7.5% from 2020 to 2030.

Novacyl, Alfa Aesar, Midas Pharma GmbH, and Merck KGaA are some of the major players in the salicylic acid market

Food preservative and cosmetic industry in projected to increase the demand for salicylic acid market.

Pharmaceutical Skin Care Hair Care Food preservatives and others application are covered in salicylic acid market report.

Increased demand for aspirin drug among pharmaceuticals is the main driver of salicylic acid market.

Packaged food industry and pharmaceutical industry are expected to drive the adoption of salicylic acid.

COVID-19 pandemic is going to positively impact salicylic acid market in 2021 owing to the increased demand for pharmaceuticals and packaged food due to COVID-19 pandemic.

Loading Table Of Content...