Security as a Service Market Overview

The global security as a service market size was valued at USD 13 billion in 2022 and is expected to grow USD 75 billion by 2032, growing at a CAGR of 19.4% from 2023 to 2032.

Data privacy and security concerns in outsourcing models are significantly impacting the growth of the SECaaS market. Moreover, the complexity of seamlessly incorporating SECaaS into existing IT infrastructure is negatively impacting the security as a service market size. Many organizations face difficulties in integrating these security solutions with their current systems, leading to operational disruptions and compatibility issues. On the contrary, the increase in demand for advanced threat intelligence and analytics solutions is anticipated to provide lucrative growth opportunities to the security as a service industry in the upcoming years.

Security as a services market is growing due to an increasing cyber threat incident which increased the demand for security services. This escalating threat landscape has led to higher adoption of security as a service solution, where organizations outsource their security needs to specialized providers. Furthermore, with the rise in complexity of cyber threats, there is a surge in demand for advanced security solutions, propelling the expansion of the SECaaS market. In addition, the increasing adoption of cloud-based services plays a vital role in the security as a service market growth. As businesses migrate their operations to the cloud for enhanced flexibility and efficiency, they are faced with new security challenges. Cloud environments introduce unique vulnerabilities that require specialized protection against data breaches and cyber threats, which drives the need for advanced security measures.

Introduction

Security as a Service (SECaaS) is a cloud-based model of outsourcing cybersecurity. SECaaS is an increasingly popular data security solution for corporations because it is easier to scale as the business grows. With SECaaS, a service provider offers security solutions such as email security, identity and access management (IAM), endpoint security, incident response, and others via a subscription-based approach rather than hardware.

The report focuses on growth prospects, restraints, and trends of the security as a service market forecast. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the market outlook.

Segment Review

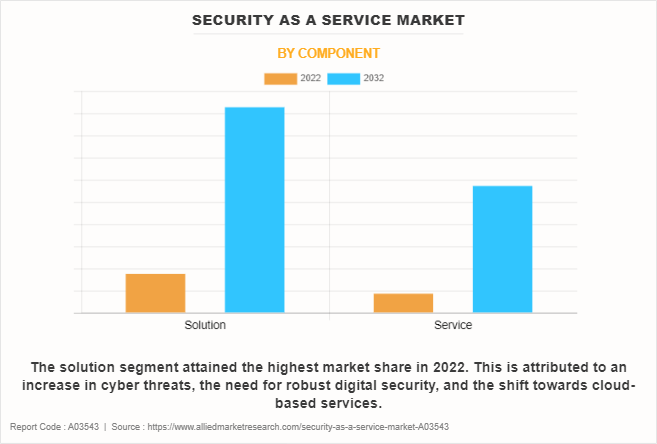

The market is segmented into component, application, organization size, industry vertical, and region. On the basis of component, the market is divided into solution and service. By application, the market is classified into network security, endpoint security, application security, cloud security, and others. On the basis of organization size, the market is categorized into large enterprises, small and medium-sized enterprises smes. By industry vertical, the market is segregated into BFSI, government & defense, retail & e-commerce, healthcare & life sciences, IT & telecom, energy & utilities, manufacturing, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By component, the solution segment acquired a major share in 2022, owing to an increase in cyber threats, the need for robust digital security, and the shift towards cloud-based services. However, the service segment is expected to be the fastest-growing segment during the forecast period. This is attributed to the individuals, SMEs, and large companies, that are concerned about securing access to their network, endpoint, cloud, and applications.

Region-wise, North America dominated the security as a service market share in 2022, owing to the increase in demand for advanced security solutions in the region. Moreover, the rise in cyber threat incidents and the requirement for strong security measures propelled enterprises to adopt SECaaS models, which provide them with scalable and cost-effective security solutions. However, Asia-Pacific is considered to be the fastest-growing region during the forecast period. This is attributed to the diverse and evolving threat landscape in Asia-Pacific that has increased the awareness of organizations regarding the importance of robust security measures, driving the adoption of security as a service models.

Top Impacting Factors

The Need for Advanced Security Solutions

With the rising complexity of cyber threats, there is a growing demand for advanced security solutions, propelling the expansion of the market. Traditional security measures tend to be insufficient to protect against scammers' shifting techniques, pushing firms to seek more complex and dynamic ways. In addition, key players cater to this demand by introducing new security services. For instance, in May 2021, IBM Security introduced a new Software as a Service (SaaS) version of IBM Cloud Pak for security, designed to simplify how organizations deploy a zero-trust architecture across the enterprise. The company also announced an alliance partnership with leading cloud and network security provider, Zscaler, and new blueprints for common zero-trust use cases.

Furthermore, the rise of remote work and the increased interconnectedness of digital systems have expanded the attack surface for potential cyber threats. As businesses embrace cloud services and mobile technologies, the need for security solutions that can adapt, and scale accordingly becomes paramount. Security as a service caters to this demand by offering flexible and scalable security measures that can keep pace with the evolving nature of cyber risks. This adaptability, combined with the expertise of dedicated security professionals, positions security as a service as a vital component in the contemporary landscape, driving its security as a service market growth as organizations prioritize robust and advanced security solutions.

Rising Adoption of Cloud-based Services

As businesses migrate their operations to the cloud for enhanced flexibility and efficiency, they are faced with new security challenges. Cloud environments introduce unique vulnerabilities that require specialized protection against data breaches and cyber threats. Moreover, the dynamic nature of cloud computing, with its constant updates and scalability, requires security solutions that can seamlessly integrate and evolve alongside these changes. To cater to this demand, key players in the market launched new products and services.

For instance, in November 2022, HCLTech, a leading global technology company, launched a suite of cyber security offerings hosted on Amazon Web Services (AWS). This strengthens and expands HCLTech’s Cloud Security-as-a-Service (CSaaS) offerings for enterprises on AWS. Therefore, these factors drive the growth of the market, meeting the security demands of modern enterprises operating in a digitally connected world.

Challenges Associated with Integrating SECaaS solutions

The integration of security as a service (SECaaS) solutions faces hurdles that impact the overall growth of market. One key challenge is the complexity of seamlessly incorporating SECaaS into existing IT infrastructure. Many organizations face difficulties in integrating these security solutions with their current systems, leading to operational disruptions and compatibility issues. This integration challenge often deters businesses from fully embracing SECaaS, as they struggle with the need to ensure a smooth and efficient transition without compromising the functionality of their existing technologies.

Competition Analysis

Competitive analysis and profiles of the major players in the market include Oracle Corporation, Proofpoint, Inc., Qualys, Inc., Okta, Sophos Ltd., Microsoft Corporation, IBM Corporation, Trend Micro Incorporated, Cisco Systems, Inc., and Forcepoint. These players have adopted various strategies to increase their market penetration and strengthen their position in the security as a service industry.

Regional Insights

The Security as a Service (SECaaS) market is witnessing significant growth across different regions due to increasing awareness of cybersecurity threats and the need for cost-effective, scalable security solutions.

North America dominates the global SECaaS market, driven by the high adoption of cloud technologies, the presence of leading cybersecurity companies, and stringent data protection regulations like the General Data Protection Regulation (GDPR) and California Consumer Privacy Act (CCPA). The U.S. and Canada lead in implementing SECaaS solutions, particularly in industries such as banking, financial services, and healthcare, where data security is critical. The region's mature IT infrastructure and widespread digital transformation initiatives further contribute to market growth.

Europe is another significant player, with the demand for SECaaS increasing due to rising cyberattacks and government regulations. The GDPR has been a major driver of cybersecurity investments, pushing organizations to adopt cloud-based security solutions. Countries like the U.K., Germany, and France are at the forefront of SECaaS adoption, especially in industries such as finance, retail, and government services.

Asia-Pacific is experiencing rapid growth in the market, fueled by the increasing adoption of cloud computing, the rise of the Internet of Things (IoT), and the proliferation of smartphones and other connected devices. Countries like China, India, Japan, and Australia are key markets where businesses are increasingly turning to SECaaS to secure their digital assets. The region's growing e-commerce sector and expanding digital infrastructure are also driving demand for cloud-based security solutions. Additionally, governments in this region are introducing cybersecurity laws, which further boost SECaaS adoption.

Latin America and the Middle East & Africa are emerging markets for SECaaS. In Latin America, rising digitalization and increasing cybercrime are encouraging organizations to invest in cloud-based security. In the Middle East and Africa, countries like the UAE and South Africa are seeing growth in SECaaS adoption, driven by increasing cybersecurity awareness and government initiatives to protect critical infrastructure.

Recent Product Launch in the Market

In November 2023, Skyhawk Security, the originator of cloud threat detection and response announced a paradigm shift in cloud security with Continuous Proactive Protection. The new offering continuously analyzes customer cloud infrastructure, proactively runs attack simulations against it, and uses the results to prepare verified detections, validated automated responses, and remediation recommendations to ensure the cloud has the most up-to-date security defenses in place.

In January 2023, OTAVA, a global leader in custom and compliant multi-cloud solutions, launched Security as a Service (SECaaS) for businesses that need external resources or added expertise to maintain a comprehensive cybersecurity practice. OTAVA's purpose-built security as a service solutions cut through the noise of automated alerting and protect against all vectors of attack.

In November 2022, HCLTech, a leading global technology company, launched a suite of cybersecurity offerings hosted on Amazon Web Services (AWS). This strengthens and expands HCLTech’s Cloud Security-as-a-Service (CSaaS) offerings for enterprises on AWS.

Market Landscape and Trends

According to a research report published in November 2022 by Information Services Group (ISG), a leading global technology research and advisory firm, overlapping crises and technology trends heightened cybersecurity concerns in Germany, leading enterprises to increase their investments in security products and services. The 2022 ISG Provider Lens Cybersecurity - Solutions and Services report for Germany found that cyber threats caused by the war in Ukraine, along with disruptions from the COVID-19 pandemic and increasing digitization of enterprises, have resulted in more cybersecurity breaches in Germany. As companies bring more data, communications and processes into the digital realm, cybersecurity is becoming a higher priority, which drives the adoption of security as a service offerings in the region.

Key Benefits for Stakeholders:

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the security as a service market analysis from 2022 to 2032 to identify the prevailing market opportunity.

Market research is offered along with information related to key drivers, restraints, and opportunities.

The Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as security as a service market trends, key players, market segments, application areas, and market growth strategies.

Security as a Service Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 75 billion |

| Growth Rate | CAGR of 19.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 315 |

| By Component |

|

| By Application |

|

| By Organization Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Proofpoint, Inc., Okta, Oracle Corporation, IBM Corporation, Forcepoint, Trend Micro Incorporated, Qualys, Inc., Cisco Systems, Inc., Microsoft Corporation, Sophos Ltd. |

Analyst Review

Security as a Service (SECaaS) operates within the cloud, delivering security services over the internet. This model lets users access high-quality security tools via a web interface from their SECaaS provider, bypassing the need for local software installation and maintenance. It offers a broad range of services, from identity and access management (IAM) to security information and event management (SIEM), email security, intrusion detection, vulnerability scanning, and data loss prevention. Furthermore, the SECaaS provider handles updates and maintenance, ensuring users always benefit from the latest security technologies and threat intelligence.

Key players in the security as a service market adopt partnership, acquisition, and product launch as their key development strategy to sustain their growth in the market. For instance, in January 2023, OTAVA, a global leader in custom and compliant multi-cloud solutions, announced that it has launched Security as a Service (SECaaS) for businesses that need external resources or added expertise to maintain a comprehensive cybersecurity practice. OTAVA's purpose-built security as a service solutions cut through the noise of automated alerting and protect against all vectors of attack. Therefore, such strategies adopted by key players propel the growth of the security as a service market.

The COVID-19 pandemic had a notable impact on the security as a service market size. Initially, businesses faced uncertainties, leading to a heightened awareness of cybersecurity threats as remote work surged. This prompted increased adoption of security services to protect sensitive data and networks. As companies adapted to remote work models, the demand for cloud-based security solutions, a key component of security as a service, witnessed significant growth.

The key players in the security as a service market include Oracle Corporation, Proofpoint, Inc., Qualys, Inc., Okta, Sophos Ltd., Microsoft Corporation, IBM Corporation, Trend Micro Incorporated, Cisco Systems, Inc., and Forcepoint. Major players operating in the market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With an increase in awareness and rise in demand for security as a service across the globe, major players are collaborating their product portfolio to provide differentiated and innovative products.

The security as a service market is segmented into component, application, organization size, industry vertical, and region. On the basis of component, the market is classified into solution and service. By application, the market is segregated into network security, endpoint security, application security, cloud security, and others. On the basis of organization size, the market is categorized into large enterprises, and small & medium-sized enterprises. By industry vertical, the market is divided into BFSI, government & defense, retail & e-commerce, healthcare & life sciences, IT & telecom, energy & utilities, manufacturing, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

North America is the largest regional market for Security as a Service.

The security as a service market size was valued at $12,982.20 million in 2022 and is projected to reach $74,954.16 million by 2032, growing at a CAGR of 19.4% from 2023 to 2032.

The key players operating in the security as a service market include Oracle Corporation, Proofpoint, Inc., Qualys, Inc., Okta, Sophos Ltd., Microsoft Corporation, IBM Corporation, Trend Micro Incorporated, Cisco Systems, Inc., and Forcepoint.

Loading Table Of Content...

Loading Research Methodology...