Smart Air Purifier Market Research: 2032

The Global Smart Air Purifier Market was valued at USD 5.5 billion in 2020, and is projected to reach USD 17.7 billion by 2032, growing at a CAGR of 10.1% from 2023 to 2032. In the air purifier sector, technologically advanced products designed to improve indoor air quality are known as smart clear purifiers. With the help of smartphone apps, voice assistants, or other smart home devices, customers can monitor and manage smart air purifier remotely via connectivity features, sensor, integration with smartphones. In addition, these devices efficiently use cutting edge filtration technology including high efficiency particulate air filter technology, activated carbon filter technology, and occasionally extra functions such as UV germicidal irradiation or ionization.

Smart Air Purifier Market highlights

An smart air purifier with smart technology is a highly sophisticated device aimed at improving the quality of air inside the given space by removing such contaminants as dust, pollen, animal hair, and toxic compounds (VOCs) from the air. In contrast to classic air purifiers, smart air purifiers are equipped with sensors and data communication capabilities. Thanks to these features, they can identify signs of poor air quality in the surrounding environment and accordingly adjust their operation They do not only ensure safe air generation, but as well as provide reminders via smartphone apps or voice assistants of the deteriorating air condition of the indoors once air quality levels are too leniency. Another function of the smart air purifiers is their remote control feature that many have; this enables the users control the air quality even when they are away from home. Such attributes give such devices added convenience and efficiency, hence making them ideal options for the people who value fresh and health air houses.

The smart air purifier market size is segmented on the basis of type, technique, end user, and region. By type, the smart air purifier market is segmented into dust collectors, fume & smoke collectors, and others. On the basis of technique, the smart air purifier market is categorized into high-efficiency particulate air (HEPA), thermodynamic sterilization system (TSS), ultraviolet germicidal irradiation, ionizer purifiers, activated carbon filtration, and others. By end user, the smart air purifier market share is segmented in residential, commercial, and others. Region wise, the smart air purifier market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, South Korea, India, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

The smart air purifier market, is mainly driven by the fact that there is an augmentation with the number of consumers observing healthy indoor air across the world. It is becoming increasingly necessary to bring forward the adequate number of strategies in order to solve the amount of pollutants which increases as a result of the time people spend indoors, especially in urban areas, where the air quality is often poor. For instance, in April 2022 where Israel-based Aura Air revealed smart air purifiers with Internet of Things (IoT) enabled to display live and real data of the air quality index both indoors and outdoors. Its large-scale implementation in the country has been also planned. According to the company the purifiers have proved themselves during the clinical trials of the coronavirus and the company had at that date already started an application for Food and Drug Administration, as a US governmental regulator.

High-tech purifiers come with quite a lot of modern features like automatic real-time monitoring of air conditions, mobile application control from smartphones and smart home systems interaction for the users' comfort. Moreover, the expansion in the acceptance of smart home technologies and the Internet of Things (IoT) too, in turn, bring up the smart air purifier market size. It is also worth noting that government endeavors focusing on strict indoor air quality standards and the health advantages of clean air play vital roles when it comes to fostering of smart air purifier market growth.

Smart Air Purifier Market Dynamics

Owing to increase income sources from developing economic such as Brazil, South Africa, China, and India. For instance, in Febuary 2020, CNBS(Chinese National Bureau of Statistics) has published report on chinese economy. According to the report, real disposable income per person increased by 5.0% from 2021 and 2022. due to increase in health related expenditure that is anticipated to follow from this rise in disposable income is another factor contributing to the future growth of the smart air purifier market for smart air purifiers.

However, copper, plastic, and carbon fiber are used as raw materials in the construction and manufacturing industries for production of electrical chips, motors, fans, and filters that make up smart air purifiers. Regular fluctuations in price of raw materials have significantly impact on the profitability of industries. For instance, according to the Chicago Mercantile Exchange (CME), the price of copper has increased by 7.43% in between 2020 and 2021. hence, such raise in price of copper can increased the cost of electrical components like transistors, integrated chips, and resistors which hinder the growth of the smart air purifier market for smart air purifiers.

Furthermore, to increase their market share, competitors in the smart air purifier space are implementing cutting-edge technologies such as nanotechnology and artificial intelligence (AI). For instance, Samsung, a South Korean technology company, introduced the newest line of loT-enabled air purifiers in India in November 2022. Samsung.com and Samsung-only retail locations will sell the Samsung AX46 and AX32 air purifiers in Beige and Grey. New air purifiers, the AX46 and AX32, were designed to get rid of 99.97% of bacteria, allergens, ultrafine dust, and nanoparticles. The latest air purifiers from Samsung can eliminate formaldehyde and other potentially dangerous volatile organic compounds. Such kinds of developments are expected to provide lucrative opportunities for the growth of the smart air purifier market during the forecast period.

Furthermore, several commodities, including food items, oil, and gas, witnessed a surge in price due to the Russia-Ukraine conflict. Therefore, due to supply chain interruptions, there are now more expensive shipping costs, fewer available containers, and less warehouse space. Since there have been delays in shipments and congestion, certain ports have been closed, and orders are being retracted, which influences industry and consumers globally. The decline in investor confidence has also increased stock market volatility. In addition, economic instability has risen due to the strained commercial ties between Russia, Ukraine, and their different trading partners. Hence, all such factors have reduced export possibilities.

Smart Air Purifier Segmental Overview

The smart air purifier market size is segmented on the basis of type, technique, end user, and region. By type, the market is segmented into dust collectors, fume & smoke collectors, and others. On the basis of technique, the smart air purifier market is categorized into high-efficiency particulate air (HEPA), thermodynamic sterilization system (TSS), ultraviolet germicidal irradiation, ionizer purifiers, activated carbon filtration, and others. By end user, the smart air purifier market share is segmented in residential, commercial, and others.

Region wise, the smart air purifier market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, South Korea, India, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

By Type:

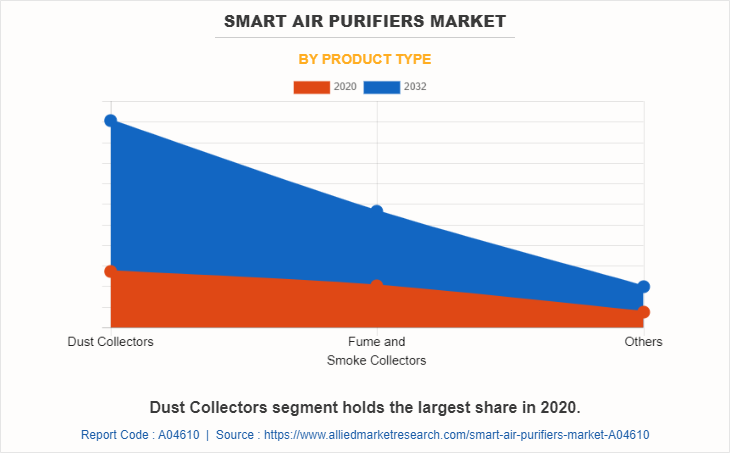

The smart air purifier market is divided into dust collectors, fume & smoke collectors, and others. Dust collecting smart air purifier demand has increased due to their attributes, including excellent filtering effectiveness and low maintenance requirements. In addition, as a result, there is a demand for intelligent air purifiers that can remove smoke and toxins from the environment. In addition, market participants in the smart air purifier space provide smart air purifiers that address smoke and fumes. Moreover, smart air purifiers are used for removal of germs & bacteria and bad odor also falls under this segment.

The dust collectors segment is expected to be the largest revenue contributor during the forecast period and is expected to exhibit the highest CAGR share in the product type segment in the smart air purifier market growth during the forecast period.

By Technique:

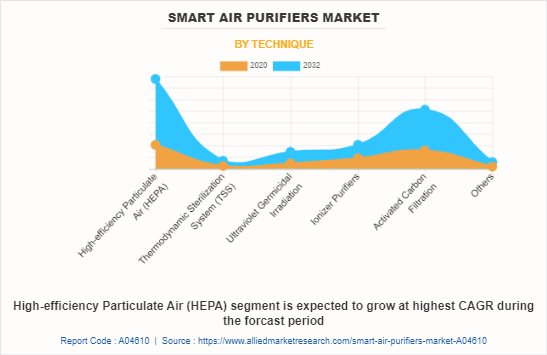

The smart air purifier market is divided into high-efficiency particulate air (HEPA), thermodynamic sterilization system (TSS), ultraviolet germicidal irradiation, ionizer purifiers, activated carbon filtration, and others. Rise in adoption of HEPA filtration technology in smart air purifiers can be attributed to its features, such as high filtering efficiency (about 99.5%) and ability to filter pollutants as small as 0.3 microns. In addition, due to its benefits, such as cheap maintenance costs, a high germ-killing rate (of roughly 99.99%), and noiseless operation, TSS technology is widely used in smart air purifiers. In addition, since smart air purifiers with TSS don't need filters to clean the air in the room, they are less expensive to maintain, which encourages their adoption. Moreover, bacteria, fungi, mold, and yeast spores can all be killed by UV radiation very effectively. UVGI technology is therefore an extremely efficient technology for smart air purifiers.

Furthermore, the advantages of ionizer purifiers, such as ease of maintenance, excellent lint & germ removal, and prevention of airborne pollens, can be credited to the increase in usage of ionizer purifier technology in smart air purifiers. In addition, activated carbon filters can absorb fumes, volatile chemicals, formaldehyde, and others. The high-efficiency particulate air segment is expected to be the largest revenue contributor during the forecast period and is expected to exhibit the highest CAGR share in the technique segment in the smart air purifier market during the forecast period.

By End User:

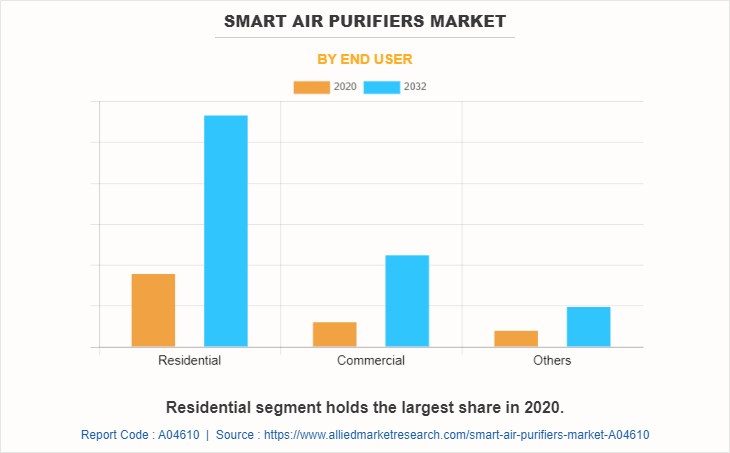

The smart air purifier market is divided into residential, commercial, and others. Rise in adoption of smart air purifiers in the residential segment is expected to increase in the future, owing to rise in pollution levels in urban areas of countries, such as India and China. In addition, rise in demand for smart air purifiers in commercial spaces can be attributed to rise in health issues, owing to poor quality of ambient air. Moreover, the rise in outdoor pollution, owing to smoke and harmful emissions from vehicles and industries pose danger of bronchitis, lung cancer, and throat cancer to public. Hence, these factors are expected to drive the growth of the smart air purifier market trends in the current scenario and in the years to come.

Residential segment is expected to be the largest revenue contributor during the forecast period, and commercial segment is expected to exhibit the highest CAGR share in the end user industry segment in the smart air purifier market analysis during the forecast period.

By Region:

The smart air purifier market is analysed across North America, Europe, Asia-Pacific, and LAMEA. In 2022, North America held the highest revenue in market share. and Asia-Pacific is expected to exhibit the highest CAGR during the forecast period.

Competition Analysis

The major players profiled in the smart air purifier market include Coway Co., Ltd., Dyson Technology Limited, Honeywell International Inc., Levoit, LG Electronics Inc., Xiaomi Corporation, Koninklijke Philips N.V., Sharp Corporation, Unilever PLC (Blueair AB), and Winix Inc. Major companies in the smart air purifier market have adopted acquisition, product launch, business expansion, and others, as their key developmental strategies to offer better products and services to customers in the smart air purifier market opportunity.

Some examples of product launches on the market.

In March 2023- Xiaomi Corp. launched the MIJIA full-effect air purifier for the Chinese market. The machine has a 12,500 liters per minute air volume production capability, and its capacity to remove viruses is believed to be over 99%.

In December 2022, LG Electronics Co., Ltd. recently launched a face mask that features a built-in, battery-operated air purifier to provide filtered air both inside and outside. Two H13 HEPA filters are included with the air purifier. In addition, due to a lack of safety requirements, the mask's introduction in South Korea was postponed by more than two years.

In September 2022, Coway Co. Ltd. launched a range of home appliances, For the European market, IFA 2022 will feature a new line of air purifiers. The company has offered updated goods in addition to a new line of air purifiers in its current product selection.

Key Benefits for Stakeholders

The report provides an extensive analysis of the current and emerging smart air purifier market trends and dynamics.

In-depth Iindustry analysis is conducted by constructing market estimations for key market segments between 2022 and 2032.

Extensive analysis of the smart air purifier market is conducted by following key product positioning and monitoring of top competitors within the market framework.

A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

The smart air purifier market forecast analysis from 2023 to 2032 is included in the report.

The key players within the market are profiled in this report and their strategies are analyzed thoroughly, which helps understand the competitive outlook of the smart air purifiers industry.

Smart Air Purifiers Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 17.7 billion |

| Growth Rate | CAGR of 10.1% |

| Forecast period | 2020 - 2032 |

| Report Pages | 220 |

| By Product Type |

|

| By Technique |

|

| By End User |

|

| By Region |

|

| Key Market Players | Dyson Technology Limited, Sharp Corporation, Coway Co. Ltd., Xiaomi Corporation, Unilever PLC, Winix Inc, LG Electronics Inc., Honeywell International Inc, Levoit, Koninklijke Philips N.V |

Analyst Review

The Asia-Pacific region is the major adopter of smart air purifiers, owing to rise in awareness regarding effect of air pollution on human health. Rapid industrialization and urbanization in developing countries such as India, China, and Brazil, have resulted into increase in industrial and construction activities, which has resulted into rise in air pollution level. This is expected to propel growth of the smart air purifiers market during the forecast period.?

In addition, growth in population around the globe is expected to result into the need for residential accommodations, which is expected to lead to air pollution, owing to increase in construction activities, which further leads to rise in demand for smart air purifiers during the forecast period. Further, rise in disposable income in countries such as India, China, Brazil, and Sri Lanka, has resulted into improved standards of living, which has made people to invest more in high-end products such as smart air purifiers. This is expected to accelerate growth of the smart air purifiers market during the forecast period. Furthermore, players in the smart air purifiers market are working to develop cost effective and efficient smart air purifiers to capture the market, which is expected to boost growth of smart air purifiers during the forecast period.?

The global smart air purifiers market was valued at $5,475.0 million in 2020, and is projected to reach $17,656.3 million by 2032, registering a CAGR of 10.1% from 2023 to 2032.

The forecast period considered for the global smart air purifiers market is 2022 to 2031, wherein, 2022 is the base year, and 2032 is the forecast year.

The latest version of global smart air purifiers market report can be obtained on demand from the website.

The base year considered in the global smart air purifiers market report is 2022.

The major players profiled in the smart air purifiers market include Coway Co., Ltd., Dyson Technology Limited, Honeywell International Inc., Levoit, LG Electronics Inc., Xiaomi Corporation, Koninklijke Philips N.V., Sharp Corporation, Unilever PLC (Blueair AB), and Winix Inc.?

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Based product type the dust collectors' segment was the largest revenue generator in 2022

Loading Table Of Content...

Loading Research Methodology...