Storage Area Network (SAN) Market Overview

The global storage area network (san) market was valued at USD 19.4 billion in 2022, and is projected to reach USD 52.3 billion by 2032, growing at a CAGR of 10.7% from 2023 to 2032.

The storage area network (SAN) market is a dynamic sector within the broader data storage market, defined by the increasing demand for efficient, scalable, and high-performance storage solutions. Organizations may effectively manage large volumes of data across networks owing to SANs, which act as centralized repositories for data storage and retrieval. The exponential growth of data generated by individuals and organizations, the spread of cloud computing, and the emergence of data-intensive applications like big data analytics, machine learning, and artificial intelligence are the main factors influencing the storage area network market.

Moreover, the new technological developments such as artificial intelligence highlight how important it is to have a solid storage infrastructure that can manage a variety of workloads and guarantee data security, availability, and integrity. The storage area network market is transforming as a result of technological breakthroughs such as the adoption of software-defined storage (SDS), hyper-converged infrastructure (HCI), and flash-based storage. As compared to conventional disk-based systems, flash storage arrays give better performance and dependability, and SDS solutions offer more scalability and flexibility by separating storage hardware from software administration. To extract useful insights from stored data, the storage area network market is witnessing rise in investments in sophisticated data management and analytics technologies, which is encouraging industry participants to become more innovative and competitive.

In addition, enterprises are investing in SAN systems with strong security features and data encryption capabilities due to rise in focus on data privacy and regulatory compliance. The SAN market is expected to grow and innovate further as companies look to maximize storage efficiency, lower operating costs, and improve overall performance. Vendors are concentrating on offering scalable, robust, and feature-rich solutions that are designed to satisfy changing customer demands and technological trends.

Surge in digital revolution, data growth, hybrid IT environments, and cloud adoption primarily drive the growth of the storage area network market. However, cost constraints, budgetary limitations, legacy system integration, and compatibility issues hamper the market growth. On the contrary, rise in demand for storage solutions is expected to provide lucrative opportunities for the market growth during the forecast period.

Key Takeaways

- By component, the hardware segment accounted for the storage area network market share in 2022.

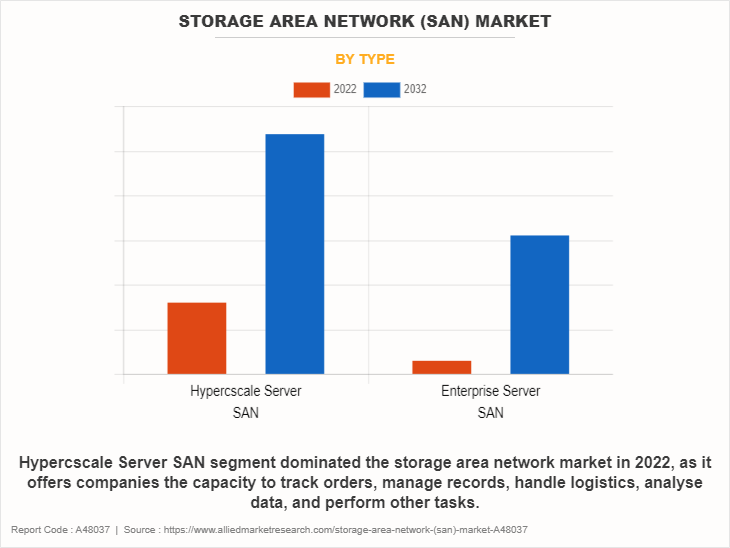

- By type, the hypercscale server SAN segment accounted for the storage area network market share in 2022.

- By technology, the fiber channel (FC) segment accounted for the storage area network market share in 2022.

- On the basis of end user, the BFSI segment generated the highest revenue in 2022.

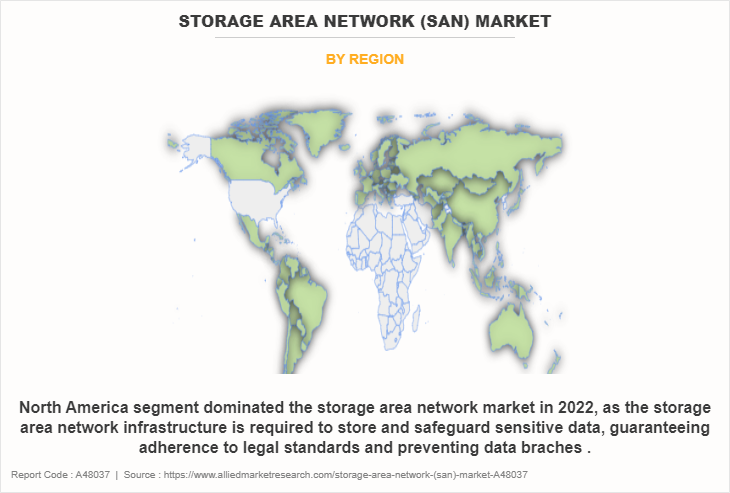

- According to the storage area network market analysis, region-wise, North America generated the highest revenue in 2022.

Top Impacting Factors

Digital Revolution and Data Growth:

An important factor propelling the storage area network (SAN) industry is the exponential rise in data created by businesses globally. The adoption of emerging technologies such as IoT, AI, and big data analytics, as well as the proliferation of digital devices and rise in internet traffic, are causing businesses in a variety of industries to face an unprecedented spike in data quantities. Strong storage infrastructure that can effectively manage, store, and retrieve enormous volumes of data in real-time is required due to the data explosion. To support mission-critical operations and strategic objectives, SAN solutions provide centralized storage architectures that allow organizations to increase their storage capacities effortlessly. This ensures excellent performance, reliability, and data availability. Moreover, the need for SAN technologies is also fueled by businesses' continual efforts to undergo digital transformation. These businesses need scalable and agile storage solutions to update their IT infrastructures, maximize resource efficiency, and maintain their competitiveness in the digital era.

Hybrid IT Environments and Cloud Adoption:

The swift adoption of cloud computing and the development of hybrid IT environments is another major factor propelling the SAN market. Businesses are using cloud services commonly to manage their IT workloads and storage needs cost-effectively, flexibly, and scalable. SAN solutions are essential for providing smooth interaction between cloud platforms and on-premises infrastructure. This allows businesses to take advantage of hybrid cloud architectures and keep control over their data and applications. By enabling data mobility, replication, and synchronization across dispersed settings, SAN technologies enable enterprises to distribute workloads among public and private clouds according to cost, performance, and compliance factors. The need for SAN solutions that provide interoperability, security, and data management capabilities across various cloud and on-premises environments is anticipated to fuel the market growth and innovation in the upcoming years as businesses continue to adopt cloud-first strategies and hybrid IT models.

Segment Review

The global storage area network market is segmented on the basis of type, component, technology, end user, and region. On the basis of component, the market is divided into hardware, software and services. Depending on type, it is divided into hypercscale server SAN and enterprise server SAN. Depending on technology, it is fragmented into fiber channel (FC), fiber channel over ethernet (FCoE), InfiniBand, and iSCSI Protocol. On the basis of end user, the market is divided into BFSI, it and telecom, government, e-commerce, government, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

On the basis of type, the hypercscale server SAN segment dominated the storage area network market in 2022 and is expected to maintain its dominance in the upcoming years as it offers companies the capacity to track orders, manage records, handle logistics, analyze data and other tasks, which propels the market growth significantly. However, the enterprise server SAN segment is expected to witness the highest growth, as it helps organizations leverage the data generated by the global storage area network to optimize their operations, gain valuable insights, and make informed decisions.

Region-wise, North America dominated the storage area network market in 2022 and is expected to retain its position during the storage area network market forecast period, owing to rise in focus on technological advancements and infrastructure development aiding the growth of the storage area network market. However, Asia-Pacific is expected to witness significant growth during the forecast period, due to rise in demand for digitalization and data-driven decision making.

Competition Analysis

The key players operating in the storage area network industry include Hewlett Packard Enterprise Development LP, Dell Inc., IBM Corporation, Broadcom Inc, NetApp, Cisco System Inc., NEC Corporation, Fujitsu, Huawei Technologies Co., Ltd., and Citrix Systems, Inc. The report highlights the strategies of the key players to improve the market share and sustain competition.

Recent Developments in the Storage Area Network Industry:

In February 2022, NetApp, a global, cloud-led, data-centric software company, collaborated with Cisco, and announced the evolution of FlexPod with the introduction of FlexPod® XCS, providing one automated platform for modern applications, data, and hybrid cloud services. FlexPod is composed of pre-validated storage, networking, server technologies from Cisco and NetApp. The new FlexPod XCS platform is designed to accelerate the delivery of modern applications and data in a hybrid cloud environment. FlexPod XCS is the first and only hybrid cloud solution natively integrated across all three major public cloud providers. In addition, organizations have the option to use FlexPod-as-a-Service, a pay-as-you-grow pricing model for financial and operational flexibility.

In May 2023, NetApp unveiled its first-ever block storage-only appliance to simplify its storage array offerings for its SAN customers who currently use the company’s unified storage arrays for block storage. NetApp also introduced the NetApp Ransomware Recovery Guarantee with a promise that if data copies cannot be recovered from a ransomware attack, the company will compensate the victims.

In March 2020, Nutanix, a leader in enterprise cloud computing, extended the Nutanix platform with new features for big data and analytics applications, as well as unstructured data storage. These capabilities, part of Nutanix Objects 2.0, include the ability to manage object data across multiple Nutanix clusters for achieving massive scale, increased object storage capacity per node, and formal Splunk SmartStore certification. The enhancements add to a cloud platform that is already optimized for big data applications, to deliver performance and incredible scale, while also reducing cost by maximizing existing, unused resources.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the storage area network market size segments, current trends, estimations, and dynamics of the storage area network (san) market analysis from 2022 to 2032 to identify the prevailing storage area network (san) market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the storage area network (san) market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global storage area network market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global storage area network market trends, key players, market segments, application areas, and storage area network market growth strategies.

Storage Area Network (SAN) Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 265 |

| By Technology |

|

| By Type |

|

| By Component |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Cisco System Inc., Dell Inc., NEC Corporation, Fujitsu, Broadcom Inc., Citrix Systems, Inc., Huawei Technologies Co., Ltd., IBM Corporation, Hewlett Packard Enterprise Development LP, NetApp, Inc. |

Analyst Review

A vital component of the global IT infrastructure, the storage area network (SAN) market offers centralized storage solutions to businesses in a variety of industries. Accelerated data expansion, digital transformation programs, and the use of cutting-edge technologies like cloud computing and artificial intelligence are some of the reasons propelling the SAN market. The growing need for high-performance storage solutions, use of flash-based storage arrays, and introduction of software-defined storage (SDS) and hyper-converged infrastructure (HCI) technologies are some of the major trends influencing the SAN industry. These technologies optimize resource utilization and reduce total cost of ownership while enabling organizations to improve storage efficiency, scalability, and agility. The COVID-19 pandemic expedited endeavors towards digital transformation and underscored the significance of a dependable and secure storage infrastructure in facilitating remote work, data analytics, and business continuity programs. However, obstacles including financial limitations, integrating old systems, and incompatibilities with newer technology still hinder the uptake of SANs and the expansion of the market. The SAN industry is full of opportunities, especially for workloads related to machine learning, artificial intelligence, and data analytics. The need for SAN systems optimized for advanced analytics and AI/ML applications is anticipated to fuel market expansion and stimulate innovation in storage technologies, as organizations increasingly rely on data-driven insights to achieve competitive advantage and drive innovation.

For instance, in June 2023, Hewlett Packard Enterprise’s (HPE) launched their Storage as a Service (SaaS) lineup with 32Gb Fibre Channel connectivity. HPE GreenLake for Block Storage MP powered by HPE Alletra Storage MP hardware features a next-generation platform connected to the storage area network (SAN) using either traditional SCSI-based FC or NVMe over FC connectivity. This innovative solution not only provides customers with highly scalable capabilities but also delivers cloud-like management, allowing HPE customers to consume block storage any way they desire – own and manage, outsource management, or consume on demand.

The global storage area network market was valued at USD 46,687 million in 2022 and is estimated to reach USD 825,136.26 million by 2032

The Storage Area Network (SAN) market is projected to grow at a compound annual growth rate of 10.7% from 2023-2032 reach USD 825,136.26 million by 2032

Hewlett Packard Enterprise Development LP, Dell Inc., IBM Corporation, Broadcom Inc, NetApp, Cisco System Inc., NEC Corporation, Fujitsu, Huawei Technologies Co., Ltd., and Citrix Systems, Inc. are the top companies to hold the market share in Storage Area Network (SAN)

North America is the largest regional market for Storage Area Network (SAN).

Digital revolution and data growth and hybrid IT environments and cloud adoption are the upcoming trends of Storage Area Network (SAN) Market in the world.

Loading Table Of Content...

Loading Research Methodology...