Subscription Billing Management Market Overview

The global subscription billing management market size was valued at USD 6.9 billion in 2022, and is projected to reach USD 47.7 billion by 2032, growing at a CAGR of 21.7% from 2023 to 2032.

A subscription service provider or retailer of subscription-based products can bill clients on a recurrent basis and according to a set schedule for a certain period of time using the subscription billing model. The subscription billing model is also known as subscription pricing, recurring billing, or recurring revenue model.

The practice of charging clients on a recurrent basis for a predetermined amount of time after a specific duration in order to gain access to a product or service that is offered as a subscription is known as subscription billing. To manage subscription effectively, businesses often use specialized software platforms or services that automate these processes, reduce errors, enhance customer experiences, and provide insights. These tools can range from standalone subscription billing systems to integrated solutions within large enterprises resource planning (ERP) or customer relationship management (CRM) software.

Customer retention is referred to as subscription retention in the subscription industry. Businesses that provide recurrent products or services depend heavily on their consumers to maintain subscriptions for extended periods of time. Client satisfaction leads to client retention, which is unquestionably the key emphasis for industries like SaaS with the help of cloud infrastructure maintenance, subscription retail, subscription box businesses, rentals, and others. The tendency has evolved into the ultimate business growth objectives for subscription firms after the COVID-19 pandemic. The goal of subscription-based businesses is to convert every single lead into a recurring subscriber that is expected to become a loyal customer. The companies operating in the market are ready to spend money on products that improve customer experiences.

These products include automated recurring billing and AI-powered subscription management, automated sales and marketing management, proactive customer support, seamless checkout operations, and others. Subscription-based companies, like SaaS and subscription video-on-demand platforms, not only embraced the subscription pricing model but also switched their attention to enhancing the customer experience. Therefore, they are able to attract more customers and maintain their subscriptions for a long time and would simultaneously support subscription billing management market forecast.

Cybersecurity dangers or breaches and security vulnerabilities in the infrastructure or services of the subscription billing software or those of third-party partners could significantly impact business operations, products, and service delivery. Looking at the statistics of the increasing number of cyber issues across the globe, the potential risk to the customer's secure payments can be recognized. The danger of breaches in the subscription imposes a great amount of doubt in the minds of the customers about whether to go for subscription-based services or not. Subscription management software companies provide a full portfolio of solutions, host or manage elements of customers’ businesses in the cloud, process large amounts of data, and provide mobile solutions to users.

Therefore, the sector is still dealing with a challenging and complicated cybersecurity environment that poses a severe threat to both service providers and customers. Companies that operate in a sophisticated and malicious global landscape face an increase in cyber security threats. This involves the incorporation of third-party data, goods, and services, as well as local cyber security threats. Security risks could also be caused by inadequate or delayed responses to problems that have been recognized by other interdependencies like cloud service providers and other parties beyond the purview of the cybersecurity architecture and procedures of the service provider. In addition, network systems acquired through acquisitions by service providers might lose the confidentiality and integrity of data as well as system availability if cybersecurity architecture and standards are not integrated or maintained.

Subscription billing management in the healthcare industry presents a significant opportunity for improving patient care, operational efficiency, and revenue streams. Subscription billing management involves charging customers, in this case, patients or healthcare consumers, on a recurring basis for services or products. This could apply to medical services like telemedicine consultations, fitness programs, prescription distribution, and other related things. The payment process is made simpler, and subscription-based business models provide a reliable revenue stream.

Furthermore, patients' payment processes can be streamlined with the use of subscription-based business models, making it simple for them to frequently access and pay for healthcare services. Patient participation and adherence to treatment strategies may rise as a result. In order to assess trends, pinpoint patient requirements, and decide on service enhancements, healthcare providers might use subscription models, which produce data over time. However, to capitalize on this opportunity, healthcare organizations should consider factors such as data security and privacy, regulatory compliance (such as HIPAA in the U.S.), user experience design, interoperability with existing systems, and effective communication strategies to educate patients about the benefits of subscription-based healthcare services. As with any innovative approach, challenges will arise, and careful planning and execution are essential to ensure that the subscription billing management integration enhances patient care and experiences.

Segment Overview

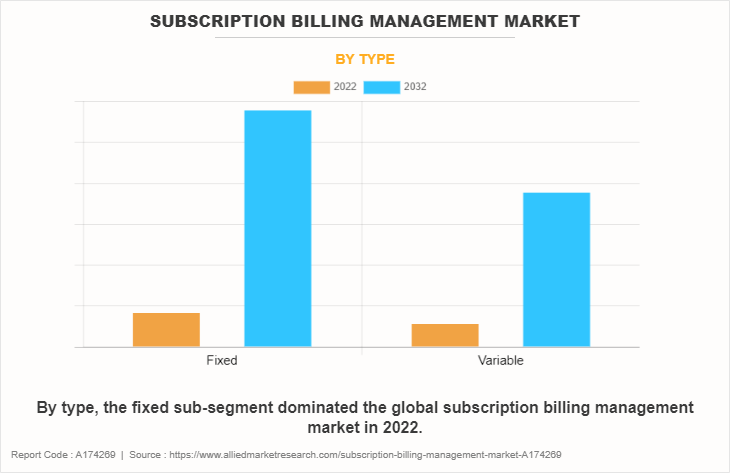

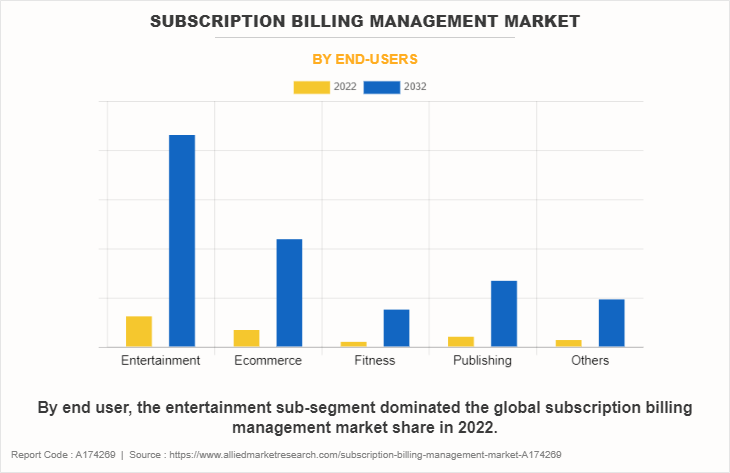

The subscription billing management market is segmented on the basis of type, end user, and region. By type, the market is divided into fixed and variable. By end user, the market is classified into entertainment, ecommerce, fitness, publishing, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By type, the fixed sub-segment dominated the global subscription billing management market in 2022. The growth in fixed subscribers has subsequently necessitated efficient subscription billing management systems. Companies are recognizing the importance of streamlining and automating billing processes to manage the growing customer base effectively. These systems not only handle recurring payments but also offer other benefits, such as tracking customer preferences, managing upgrades and downgrades, and providing personalized offers. The benefits offered by subscription-based model to both customers and companies, is encouraging more industries to shift towards subscription-based services.

A notable trend contributing to the growth of subscription billing management is the significant increase in fixed subscribers across various sectors. As consumers seek convenience and flexibility, companies have adapted by offering subscription plans for products and services ranging from software, entertainment, healthcare, and even household essentials. This shift has resulted in an increase in fixed subscribers, wherein individuals commit to recurring payments for a specified period. Hence, this is expected to escalate the subscription billing management market growth during the forecast period.

By end user, the entertainment sub-segment dominated the global subscription billing management market share in 2022. The progressive growth of subscribers in the entertainment industry is an outcome of numerous factors. One of the major factors is the convenience and flexibility offered by streaming platforms that have attracted millions of viewers globally. Furthermore, the COVID-19 pandemic also augmented this trend, with people turning to streaming services for entertainment while staying at home.

In addition, implementing robust subscription billing management software is expected to benefit both providers and consumers. For companies, it minimizes the risk of revenue leakage due to failed transactions, improves customer retention through personalized subscription plans, and optimizes overall financial operations. For consumers, it ensures a hassle-free payment process, easy upgrades or downgrades of subscription plans, and clear visibility of billing cycles.

By region, North America dominated the global subscription billing management market in 2022. The subscription billing management industry in North America is growing as the rising adoption of subscription progressively. With the advent of various streaming services, e-learning portals, software platforms, and digital content providers, consumers are progressively embracing the convenience and flexibility of subscription-based services. In addition, the advent of the pandemic further accelerated the adoption of digital services as people pursued education, entertainment, and remote work solutions from the comfort of their homes. This rapidly growing trend has not only transformed the way individuals access products and services but has also presented new challenges for businesses in managing their billing processes.

As the number of subscribers increases, businesses face the complex task of managing an ever-expanding customer base, diverse subscription plans, and varying billing cycles. This led to an increase in the need for robust subscription billing management solutions that can streamline operations and ensure a seamless customer experience.

Key Market Players

Some of the leading subscription billing management market players are SAP SE, Aria Systems, Inc., Oracle, BluSynergy, Conga, Recurly, Inc., cleverbridge, Zuora Inc., LogiSense Corporation, and Apttus Corporation. In March 2022, SAP acquired a majority stake in Taulia, a leading provider of working capital management solutions. On August 17, 2022, SAP and Francisco Partners (FP) announced that FP signed a definitive agreement with SAP America, Inc. under which FP would acquire SAP Litmos from SAP. These strategic mergers and acquisitions can help the companies to expand their business and impact on the competitor’s customer base.

Top Impacting Factors

Rise of the Subscription Economy: As more businesses shift from one-time purchases to subscription-based models, the demand for efficient billing management systems has surged. Industries such as SaaS, media, entertainment, and e-commerce are heavily adopting subscription models to drive recurring revenue, pushing the need for advanced billing solutions.

Digital Transformation: Companies are increasingly digitizing their operations, and automated billing management systems help streamline recurring payments, manage customer data, and ensure compliance with evolving tax regulations. This transformation supports operational efficiency and enhances customer experiences.

Complex Pricing Models: The growing complexity of pricing strategies—like tiered, freemium, and usage-based billing—requires robust subscription billing management systems. These systems allow businesses to manage dynamic pricing structures, track customer usage, and ensure accurate invoicing.

Regulatory Compliance: As global regulations, such as GDPR and local tax requirements, evolve, businesses must adopt billing management solutions that help ensure compliance. Automated billing platforms are crucial for avoiding penalties related to inaccurate billing and ensuring compliance with regional tax laws.

Growing Demand for Customization: Businesses are seeking customizable billing solutions that can be tailored to unique business needs, enhancing scalability and flexibility across industries.

Regional Insights

North America dominates the Subscription Billing Management Market due to the widespread adoption of subscription-based business models, particularly in the U.S. The region’s strong digital infrastructure and the presence of leading subscription billing platform providers, such as Zuora and Recurly, further bolster market growth.

In Europe, the market is driven by the rapid adoption of subscription models across industries like e-commerce, media, and telecommunications. Countries like the UK, Germany, and France are seeing a surge in demand for billing management solutions to address complex tax laws and evolving regulatory landscapes.

Asia-Pacific is experiencing the fastest growth, fueled by the expanding digital economy and increased subscription-based services in sectors like OTT (Over-the-top) media, telecommunications, and e-commerce. Countries such as China, India, and Japan are adopting these solutions to handle high-volume subscriptions and dynamic pricing.

Key Industry Developments

In July 2023, Zuora launched a new AI-powered billing automation feature to enhance accuracy and scalability for subscription businesses, improving real-time invoice generation and financial reporting capabilities.

In August 2023, Chargebee introduced new integrations with leading CRM platforms to improve customer lifecycle management and billing efficiency for subscription-based enterprises. Additionally, in September 2023, Paddle acquired ProfitWell, a leading subscription analytics platform, to enhance subscription revenue management capabilities for its customers.

Impact of COVID-19

The COVID-19 pandemic has had a significant impact on various industries, including the subscription-based model. The pandemic has led to an increase in the number of subscribers globally, which has positively supported the market growth.

People had to stay at home due to lockdowns, travel bans, and economic unpredictability, which led to an increase in the customer base for different subscription models. In addition, the establishment of new subscription-based models in healthcare and entertainment sector also resulted in an increase in the market expansion.

However, the economic uncertainty caused by the pandemic made it difficult for small scale subscription companies to secure financing. Investors became more cautious, leading to a decrease in funding for new projects or expansion of existing ones. This uncertainty affected the long-term planning and investment decisions of subscription billing management companies.

Renewal patterns were disrupted as customers evaluated the ongoing value of their subscriptions in light of the pandemic's impact on their lives. Companies had to proactively engage with subscribers, showcase the benefits of their services, and adjust their offerings to remain relevant.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the subscription billing management market analysis from 2022 to 2032 to identify the prevailing subscription billing management market opportunities.

The subscription billing management market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the subscription billing management market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global subscription billing management market trends, key players, market segments, application areas, and market growth strategies.

Subscription Billing Management Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 47.7 billion |

| Growth Rate | CAGR of 21.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 29 |

| By Type |

|

| By End-users |

|

| By Region |

|

| Key Market Players | Salesforce, Inc., Recurly Inc., SAP SE, Zuora Inc., Chargebee Inc., Chargify LLC., Apttus Corporation, ZOHO Corporation., Oracle Corporation, 2Checkout |

The global subscription billing management market size was valued at $6.9 billion in 2022, and is projected to reach $47.7 billion by 2032.

The subscription billing management market is projected to grow at a compound annual growth rate of 21.7% from 2023 to 2032.

Zuora Inc., Salesforce, Inc., SAP SE, Oracle Corporation, ZOHO Corporation., Chargebee Inc., Chargify LLC., Recurly Inc., 2Checkout, and Apttus Corporation are the major players in the subscription billing management market.

Asia-Pacific will provide more business opportunities for the global subscription billing management market in the future.

As the digital environment continues to evolve, businesses are witnessing a significant shift towards subscription-based models. From streaming services and software platforms to e-commerce and SaaS companies, subscriptions have become a favored choice for both consumers as well as businesses. This rise in subscription-based services has created an urgent need for effective subscription billing management solutions, which is expected to create opportunities in market.

Loading Table Of Content...

Loading Research Methodology...