Sucralose Market Summary

The global sucralose market size was at $518 million in 2021 and is projected to reach $693.6 million by 2031, growing at a CAGR of 3% from 2022 to 2031.

Key Market Trends and Insights

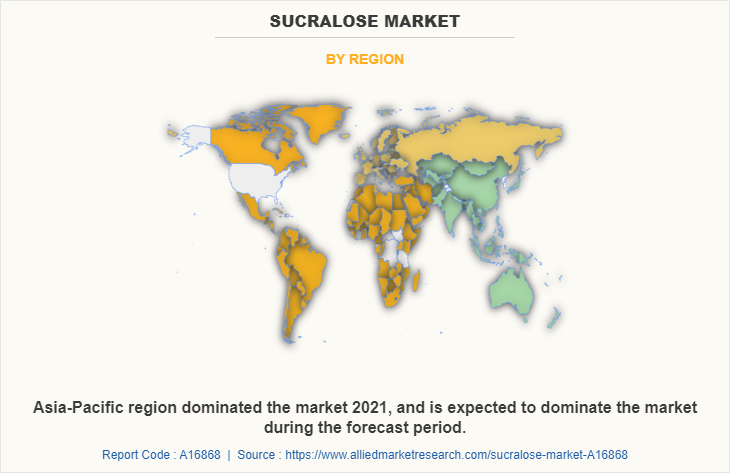

Region wise, Asia-Pacific generated the highest revenue in 2021.

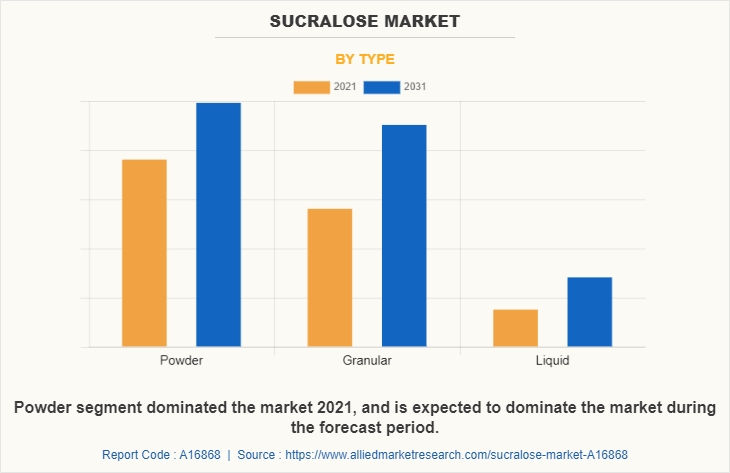

The global sucralose market share was dominated by the powder segment in 2021 and is expected to maintain its dominance in the upcoming years

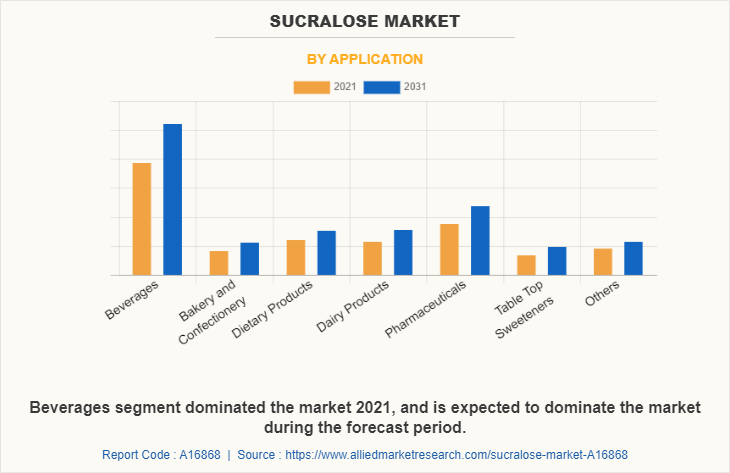

The beverages segment is expected to witness the highest growth during the forecast

Market Size & Forecast

- 2021 Market Size: USD 518 Million

- 2031 Projected Market Size: USD 693.6 Million

- Compound Annual Growth Rate (CAGR) (2022-2031): 3%

- Asia-Pacific: Generated the highest revenue in 2021

Market Dynamics

Sucralose is frequently used as a sugar alternative due to its low-calorie count. Sucralose sweeteners are also excellent substitutes for sugar and other calorie-dense sweeteners like high-fructose corn syrup. The COVID-19 pandemic had both positive and negative impacts on the global sucralose market due to supply chain disruptions. However, the upliftment of lockdowns is expected to boost the growth of the market in the coming years.

Sucralose is in demand for a variety of reasons, including its desirable sweetness, low cost, bulkiness, preservation properties, heat resistance, and blending capabilities. In addition, the sucralose market is experiencing growth with rising health concerns and an increase in the number of people with diabetes and obesity. Furthermore, the rise in obesity rates, in developing nations, and a surge in demand for low-calorie sweeteners boost the market growth.

Sucralose consists of lower calories and has high sweetness as compared to normal sugar hence it is required in lower quantities as compared to normal sugar. In addition, a variety of studies have indicated that using artificial Sucralose detaches the sweet flavor from calories, which might result in consuming too many high-calorie foods with a sweet flavor when combined with artificial sweeteners, which further contributes to weight gain. Further evidence that artificial, or nonnutritive, Sucralose may counteract impacts on metabolism, gut bacteria, and hunger comes from the extensive and rising consumption of artificial sweeteners like sucralose. Because it contains no calories, high-intensity Sucralose is now becoming acknowledged as a viable strategy for reducing the rise in prevalence of obesity and overweight in humans. Sucralose is regarded as a low-calorie sweetener because it has few or no calories. It reduces the number of calories and carbohydrates in food and beverages by substituting sugar. In addition, low-calorie sweeteners have a stronger sweetness than table sugar and are therefore used in much fewer amounts. One of the low-calorie sucraloses approved for use in the food supply as an additive by the European Food Safety Authority (EFSA) and Food and Drug Administration (FDA) is a high-intensity sweetener like Ace-K. In addition, the consumption of this sucralose is significantly influenced by the growing number of diabetic patients and consumer awareness. The rise in population and health awareness among consumers are the key drivers for the sucralose market in the Asia-Pacific, Latin America, and Africa regions. According to WHO projections, by 2050 Asia and Africa is projected to host more than 75% of the world’s population. The majority of the nations in these two zones are developing nations that are going through rapid expansion. The demand for low-calorie sweeteners is increasing as quick-service restaurants, fast-food chains, the beverage industry, and food processing businesses become more prevalent. In addition, the growth of developing regions is fueled by a notable increase in the consumption of soft drinks and fruit juice concentrates. In developing countries, there is a higher demand for processed food, soft drinks, and confectionery due to the presence of a big population and their consumption habits. This is anticipated to increase the demand for sweeteners among food & beverage producers in emerging countries.

Sucralose is a key ingredient used to provide sweetness to processed food & beverages. Since prolonged consumption of sugar has been linked to dental problems in consumers, increased sucralose consumption restricts the expansion of the sweetener industry. The American Dental Association claims that eating sucralose has been linked to a higher risk of getting dental caries. One of the main factors increasing the fatality rate is the prevalence of obesity and diabetes in people. Approximately 2,000 million people will be overweight or obese in 2020, and 463 million people will have diabetes, according to worldobesity.org. As a result, consumers are becoming aware of their sucralose intake and gravitating toward goods with great nutritional value. Thus, there is a growing global demand for products without added sweeteners. Overall, consumers are becoming aware of the value of keeping excellent health, which is stopping them from consuming sucralose-containing food and beverages.

Manufacturers in the sweetener sector are consistently investing in R&D to diversify their product offerings and increase their market share. The demand for low-cost production processes for sweeteners will help to reduce the final cost of the product and drive the sucralose market size. ERYSTA, the first polyol sweetener produced by Ingredion EMEA, for instance, will enable producers to reduce or replace sugar to satisfy a number of nutritional claims, such as no added sugar or calorie-reduced, starting in April 2020.

In addition, in 2020, Cargill, Inc. unveiled TruSweet 01795, their newest label-friendly sweetener, which enables a 30% reduction in sugar and calories in beverages and other food applications through decreased consumption levels. Further, concerns about health issues like obesity and diabetes caused by the consumption of normal sugar and an increase in health awareness among consumers, which is prompting them to reevaluate their lifestyles and opt for a healthy alternative such as sucralose are expected to drive market growth. Thus, it is anticipated that the aforementioned variables will have a positive impact on the sucralose market share.

Segment Overview

By type, the sucralose market is fragmented into powder, granular, and liquid. The powder segment was the highest revenue contributor in 2021, and the granular segment is expected to experience the highest growth during the sucralose market forecast period. Sucralose powders are intended to benefit health issues including boosting the body's inflammatory response and enhancing skin issues like wrinkles, acne pigmentation, and blemishes, making it easier for skin care products to use sucralose powder as an ingredient. Sucralose powder can also provide sweetness to a food product and drink without increasing the calorie intake. Sucralose in powder form does not raise the risk of dental cavities because it is neither cariogenic nor fermentable like sugars. In recent decades, efforts to reduce the use of added sugars have led to an increase in the number of food and beverage products that contain low-calorie sweeteners. There is an increase in the usage of sucralose powder in the personal care and cosmetics sectors, while the demand for the food and beverage sector is anticipated to expand quickly and drive the market during the forecast period. There is a rise in the demand for sucralose powder in alcoholic beverages and juices, as it is easy to mix and does not form any lump formation. In addition, the surge in health-conscious consumers has also led to rising demand for sucralose powder in the retail market thus further boosting sucralose market growth. The rise in skincare applications in the personal care and the cosmetic sector is anticipated to provide new growth avenues for the market during the forecast period.

By application, the sucralose market is fragmented into beverages, bakery & confectionery, dietary products, dairy products, pharmaceuticals, tabletop sweeteners, and others. The tabletop sweeteners sucralose segment held the highest market position in 2021, owing to the fact that consumers prefer tabletop sweeteners sucralose due to the ease of purchase owing to availability in the retail market, cost-effectiveness as compared to sugar, and easy consumption. Tabletop sweeteners are prepared sweeteners that may also contain additional food additives and are intended for sale to the retail consumer as a substitute for regular sugar. They are suitable for those with sugar-related medical illnesses like diabetes or obesity because they have low zero calories and high or medium sweetness. Tabletop sweeteners are also recommended for people with various health conditions, such as weight loss plans, and for people who want to lose weight by reducing their caloric intake. They are extensively used in households to prepare sweets, baked food, frozen desserts, ice cream products, and others. The surge in consumer awareness regarding the ill effects of normal sugar has helped to boost the sales of tabletop sucralose, with stevia leaf being the main ingredient. In addition, companies are spending huge on to developing alternate sources of sucralose sweeteners and reducing the product cost so that it becomes competitive to regular sugar, and hence such factors are expected to boost the growth of the sucralose market during the forecast period. The rise in consumer awareness for calorie intake via regular sugar has let them to opt for sucralose products and hence companies are introducing various products in this category. For instance, Zydus Wellness unveiled the SugarLite product in 2019. SugarLite combines sugar and stevia, is intended to reduce consumers' calorie intake by half and this product has become a market leader in India.

Region-wise, the sucralose market is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Italy, Germany, France, Spain, Netherlands, Switzerland, Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, Thailand, Rest of Asia-Pacific), and LAMEA (Latin America, Middle East, Africa). Asia-Pacific was the highest revenue contributor with $24.3 million in 2021 and is estimated to reach $28.1 million by 2031, with a CAGR of 1.5%. Customers in the Asia-Pacific region recognize the advantages of sucralose and express interest in buying and using a product that contains sweetness coupled with low calories. sucralose industry players advertise their items online to increase consumer product knowledge. This is expected to positively impact market growth. The market in the Asia-Pacific region is anticipated to expand during the forecast period owing to the rise in changing demand for better products with low calories and no comprise for taste. The rise in obesity and its impact on consumer health due to regular sugar is the main reason for consumers to opt for sucralose and thus is expected to drive the market growth during the forecast period. In addition, the surge in consumer awareness for naturally derived sucralose sweeteners such as stevia is increasing and further driving the sucralose market demand. Also, the adoption by food and beverage manufacturers to introduce healthy products comprising of sugar is projected to drive the growth of the sucralose industry in the region. Rise in population and changes in consumer food habits in the region are expected to drive the sucralose market growth.

Competitive Landscape

The key players in the sucralose market include Tate and Lyle, Plc., Celanese Corporation, Whole Earth Brands, Ajinomoto Co., Inc., Hermes Sweeteners Ltd., JK Sucralose Inc., Heartland Food Products Group, Ingredion Incorporated, Cargill Incorporated, Roquette Freres, PureCircle Ltd, Manus Bio, Stevia First Corporation, Cumberland Packing Corporation, Hyet Sweet.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the sucralose market analysis from 2021 to 2031 to identify the prevailing sucralose market Opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the sucralose market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global sucralose market trends, key players, market segments, application areas, and market growth strategies.

Sucralose Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 693.6 million |

| Growth Rate | CAGR of 3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 253 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Roquette Freres, Radiant International, Ajinomoto Co., Inc., PureCircle Ltd, Viachem Ltd., JK Sucralose Inc., Cargill Incorporated, GELERIYA PRODUCTS, Hermes Sweeteners Ltd., Heartland Food Products Group, Tate and Lyle, Plc., Celanese Corporation, Ingredion Incorporated, Whole Earth Brands, Manus Bio |

Analyst Review

Sucralose, often known as Splenda, is a structurally varied group of substances that is sweeter than table sugar and can be used as a sugar substitute. A sugar substitute is a substance used as a food additive that gives food a sweet taste while releasing less energy. Since Splenda is a noncaloric and noncariogenic chemical, it does not cause dental caries as sugar does. High-intensity sweeteners have gained popularity in recent years in dairy products, snack food, and other food categories due to the rise in demand for low-sugar beverages, dairy products, and snack food. The introduction of natural sweeteners in soft drinks and other food in the U.S. by key players has led to increase in penetration of natural sweeteners such as sucralose in food and beverage sector.

In 2021, Asia-Pacific has the highest sucralose market share. This region presents the profitable potential for important manufacturers due to the presence of a diverse range of suppliers and manufacturers. High economic growth rates, rise in purchasing power, and the emergence of new eating habits like the use of low-calorie diet drinks and sodas further drive the market growth

The global Sucralose Market Size was at $518 million in 2021 and is projected to reach 3% from 2022 to 2031

The global Sucralose market is projected to grow at a compound annual growth rate of 3% from 2022 to 2031 3% from 2022 to 2031

Cargill Incorporated, Ajinomoto Co., Inc., Roquette Freres, PureCircle Ltd, Viachem Ltd., Heartland Food Products Group, GELERIYA PRODUCTS, JK Sucralose Inc., Whole Earth Brands, Radiant International, Hermes Sweeteners Ltd., Ingredion Incorporated, Celanese Corporation, Tate and Lyle, Plc., Manus Bio

Asia-Pacific was the highest revenue contributor

Factors including its desirable sweetness, low cost, bulkiness, preservation properties, heat resistance, and blending capabilities, Surge in obesity rates, The growing number of diabetic patients

Loading Table Of Content...