Time and Attendance Software Market Overview

The global time and attendance software market was valued at USD 2.7 billion in 2022, and is projected to reach USD 8.3 billion by 2032, growing at a CAGR of 12.1% from 2023 to 2032.

The factors such as rise in need for efficiency and productivity of employees and increase in shift toward cloud-based time and attendance software primarily drives the growth of the global time and attendance software market share. In addition, wide ranging features and benefits of time and attendance software along with the surge in adoption of automation tools in HRM systems fuel the demand for time and attendance software. However, security concerns and high installation cost associated with the software may hamper the time and attendance software market growth to some extent. On the other hand, upsurge in demand for time and attendance software from small and medium sized organizations is expected to provide lucrative opportunities for the market growth during the forecast period. Also, ongoing technological advancements in the field of time and attendance systems is anticipated to be opportunistic for the market growth during the forecast period.

Key Market Insights

- By organization size, small and medium-sized businesses are anticipated to be the fastest-growing segment during the forecast period.

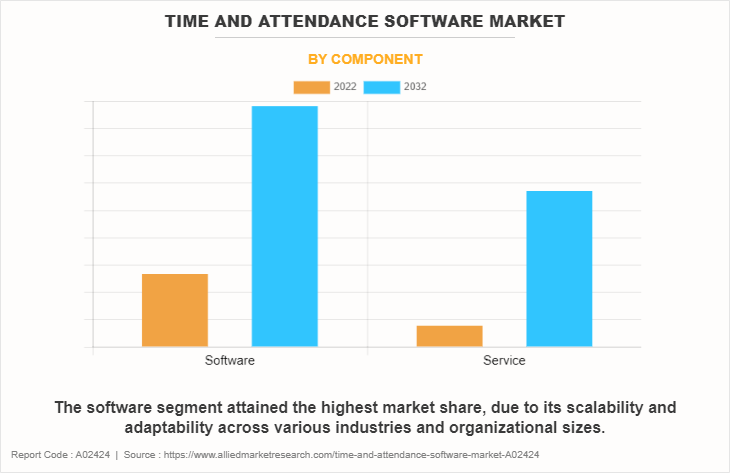

- By component, the software segment led the time and attendance software market in terms of revenue in 2022.

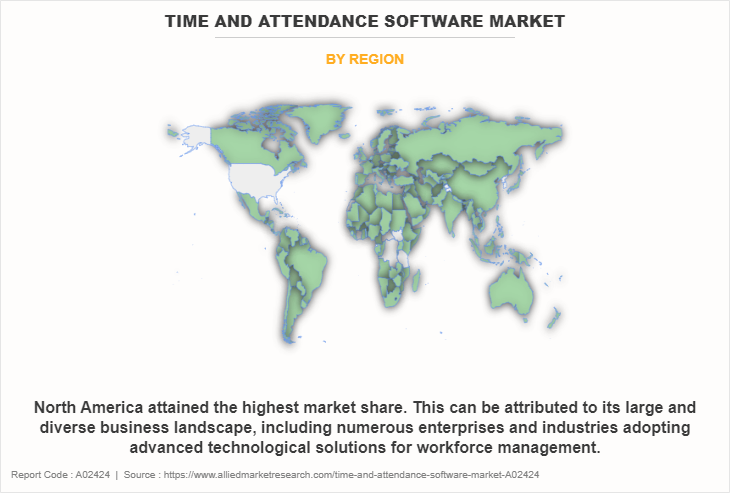

- By region, Asia-Pacific region is anticipated to be the fastest-growing region during the forecast period.

Market Size & Forecast

- 2032 Projected Market Size: USD 8.3 Billion

- 2022 Market Size: USD 2.7 Billion

- Compound Annual Growth Rate (CAGR) (2023-2032): 12.1%

What is Time and Attendance Software

Time and attendance software is a kind of business application which is designed for tracking as well as optimizing the hours that employees spend on the job and keeping records of salaries and wages paid. HR departments and companies mainly use it to simplify time tracking. It is rapidly being used by businesses of all sizes. It offers management personnel with varied tools to help maximize cash flow and minimize waste. In addition, such software programs are designed for generation, maintenance, and archiving of important tax and payroll information.

The report focuses on growth prospects, restraints, and trends of the time and attendance software market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the time and attendance software market size.

Time and Attendance Software Market Segment Review

The time and attendance software market is segmented on the basis of component, deployment mode, organization size, industry vertical, and region. On the basis of the component, the market is bifurcated into software and service. On the basis of the deployment mode, the market is bifurcated into on-premise, cloud and hybrid. Based on the organization size, the market is segmented into large enterprises and small and medium-sized enterprises. By industry vertical, it is bifurcated into BFSI, manufacturing, healthcare, government, retail and E-commerce, IT and telecom, education, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By component, the software segment held the highest market share. This was attributed to rise in the shift toward cloud-based time and attendance software among the SMEs and the surge in emphasis on workforce optimization as well as mobile applications. Meanwhile, the services segment is anticipated to be the fastest-growing segment. This is attributed to the need to optimize performance, stay current on updates, and reduce IT costs fuels the demand for managed services in time and attendance software market. Also, the growing demand to improve the reliability and performance of time and attendance software while keeping the costs under control fuels the adoption of managed services from the services provider.

Based on region, North America attained the highest market share in the time and attendance software market. This can be attributed to the surge in demand for time and attendance software, which has been steadily increasing in North America. Employees are aware of the importance of financial well-being, and they expect their employers to provide resources and support to help them manage their finances effectively. However, the Asia-Pacific region is anticipated to be the fastest-growing segment in the time and attendance software market. The Asia-Pacific region is witnessing a digital transformation in financial services. Fintech companies are playing a significant role in delivering time and attendance software. Mobile apps and online platforms are increasingly being used to provide financial education, budgeting tools, and access to investment options. Therefore, such factors foster the growth of the market in the region.

What are the Top Impacting Factors in Market

Market Drivers

Increased Focus on Employee Productivity and Well-being

The increased emphasis on employee productivity and well-being is propelling the growth of the time and attendance software industry in significant ways. In today's fast-paced business landscape, companies recognize that a happy and engaged workforce is not only more productive but also more loyal. Time and attendance software plays a pivotal role in achieving this balance. In addition, it streamlines and automates the tracking of employee work hours, reducing administrative burdens and errors. This leads to more accurate payroll processing, ensuring employees are compensated fairly and on time, contributing to their overall well-being.

Furthermore, these software solutions often include features like self-service portals and mobile apps, allowing employees to easily request time off, check schedules, and manage their work-life balance. This empowerment fosters a sense of control and well-being among employees. Moreover, these systems provide data-driven insights into employee attendance patterns, helping companies identify potential burnout or overworking issues. Employers can prioritize employee well-being and create a healthier work environment by addressing these concerns promptly.

Restraints

Data Privacy Concerns and Compliance

Data privacy concerns and compliance regulations have become significant hurdles for the growth of the time and attendance software market. As organizations increasingly adopt these tools to streamline workforce management, they collect and store vast amounts of employee data. This data often includes sensitive information like biometrics, schedules, and personal details.

However, increased awareness of data privacy issues, spurred by incidents of data breaches and misuse, has led to stricter regulations such as GDPR in Europe and CCPA in California. To comply with these regulations, time and attendance software providers must invest in robust data protection measures, including encryption, secure storage, and access controls. They also face challenges in obtaining explicit consent from employees for data collection and managing the right to be forgotten requests.

This increases the cost of development and maintenance, which can ultimately result in higher prices for customers. Moreover, concerns over data privacy can deter potential clients from adopting these solutions, especially in industries with stringent regulations like healthcare or finance. Organizations fear the consequences of non-compliance, including hefty fines and damage to their reputation. As a result, the time and attendance software market faces a dual challenge of meeting regulatory requirements while convincing customers of their commitment to data privacy, making growth a complex industry in privacy-focused landscape.

Opportunity

Integration with HR Ecosystem and Cloud Solutions

Integration with the HR ecosystem and cloud solutions is driving significant growth opportunities in the time and attendance software market. Traditional time tracking systems are being replaced by modern, cloud-based solutions that seamlessly integrate with HR software, creating a more efficient and streamlined workforce management process. Cloud-based time and attendance software allows companies to access their data from anywhere, making it easier to manage remote or geographically dispersed teams. This flexibility aligns with the modern work environment, where remote and flexible work arrangements are increasingly common.

Furthermore, integration with HR systems means that time and attendance data can be automatically synced with payroll, benefits, and other HR functions. This reduces manual data entry and the risk of errors, saving time and ensuring accuracy in payroll processing. In addition, cloud-based solutions offer scalability, making it easy for businesses to adapt as they grow.

They can easily add new employees, locations, or features without the need for major IT investments or disruptions. Moreover, the ability to collect and analyze data in real time enables companies to make data-driven decisions, optimize staffing levels, and identify trends in attendance and productivity. This data-driven approach is crucial for businesses looking to improve efficiency and reduce labor costs. Thus, the integration of time and attendance software with HR ecosystems and cloud solutions provides businesses with the tools they need to efficiently manage their workforce, adapt to changing work environments, and make informed decisions, all of which are essential for growth and competitiveness in business landscape.

Which are the Leading Companies in Time and Attendance Software

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the time and attendance software market.

ADP, Inc.

Ceridian HCM, Inc.

Interflex

Oracle

Paychex Inc.

SAP SE

UKG Inc.

Workday, Inc.

WorkForce Software

LLC.

Zebra Technologies Corp.

Market Landscape and Trends:

The time and attendance software industry has seen significant evolution and trends in recent years. With the increasing emphasis on workforce management and productivity, businesses are adopting advanced solutions to track employee attendance and time-related data efficiently. Cloud-based time and attendance systems have gained prominence, offering scalability, accessibility, and real-time data synchronization across devices and locations. Moreover, the integration of biometric authentication methods like fingerprint or facial recognition enhances security and accuracy. Another notable trend is the incorporation of AI and machine learning into time and attendance software. These technologies enable predictive analytics, helping companies optimize scheduling, reduce absenteeism, and forecast labor needs accurately. In addition, mobile apps have become integral, allowing employees to clock in/out remotely and granting managers instant oversight.

What are the Key Benefits for Stakeholders:

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the time and attendance software market forecast from 2022 to 2032 to identify the prevailing time and attendance software market opportunities.

Market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the time and attendance software market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes an analysis of the regional as well as global time and attendance software market trends, key players, market segments, application areas, and market growth strategies.

Time and Attendance Software Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 8.3 billion |

| Growth Rate | CAGR of 12.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 330 |

| By Component |

|

| By Deployment Mode |

|

| By Organization Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Interflex (Allegion), Zebra Technologies Corp., Oracle, Paychex Inc., ADP, Inc., SAP SE, Ceridian HCM, Inc., Workday, Inc., UKG Inc., WorkForce Software, LLC. |

Analyst Review

Companies around the globe are looking for robust time and attendance software that can offer flexibility as well as the ability to solve a range of challenging tasks associated with HR departments to gain more productivity. Hence, there is a significant shift toward automated time and attendance software that is designed to help supervisors analyze, measure, and manage the working time of employees, and deploy human resources more effectively.

Moreover, mobile time tracking has become an emerging need for businesses around the globe to manage a decentralized workforce. Hence, the recent trend of mobile time and attendance tracking has created lucrative opportunities for the growth of the global time and attendance software market. The mobile applications are being connected to online time management systems which turn the mobile phone of an employee into robust, handheld time tracking devices. It has helped businesses to track employees’ time and attendance in real-time while also ensuring employees are being paid accurately and stay compliant.

Furthermore, market players are adopting various strategies for enhancing their services in the market and improving customer satisfaction. For instance, in April 2022, Rochester, U.S.-based Paychex, a human resources and payroll company, launched its iris and face biometric time and attendance device named the ‘Iris Time Clock’ to perform a range of services for workforce management. The biometric capabilities are provided by Iris ID. This helps to minimize time spent on HR requests because of its integration with Paychex’s HR software. It can also provide personalized messages to employees and eliminate buddy-punching. It can also provide accurate identification of employees wearing masks.

Some of the key players profiled in the report include ADP, Inc., Ceridian HCM, Inc., Interflex, Oracle, Paychex Inc., SAP SE, UKG Inc., Workday, Inc., WorkForce Software, LLC., and Zebra Technologies Corp. These players have adopted various strategies to increase their market penetration and strengthen their position in the time and attendance software market.

The time and attendance software market has seen significant evolution and trends in recent years. With the increasing emphasis on workforce management and productivity, businesses are adopting advanced solutions to track employee attendance and time-related data efficiently.

HR departments and companies mainly use it to simplify time tracking. It is rapidly being used by businesses of all sizes. It offers management personnel with varied tools to help maximize cash flow and minimize waste.

North America is the largest regional market for Time and Attendance Software

The global time and attendance software market was valued at $2,714.98 million in 2022

ADP, Inc., Ceridian HCM, Inc., Interflex, Oracle, Paychex Inc., SAP SE, UKG Inc., Workday, Inc., WorkForce Software, LLC., and Zebra Technologies Corp

Loading Table Of Content...

Loading Research Methodology...