Unified Communications as a Service Market Insights, 2031

The global unified communications as a service market size was valued at USD 27 billion in 2021, and is projected to reach USD 118.8 billion by 2031, growing at a CAGR of 16.3% from 2022 to 2031.

Increase in demand for 5G high speed network and surge in trend of bring your own device (BYOD) and mobility is driving the global unified communication as a service ucaas market. In addition, the growth in migration from legacy systems to cloud-based communication services is fueling the growth of UcaaS market. However, security concerns and interoperability issues associated with the system and the high initial cost of unified communication as a service limit the growth of the market. Conversely, the rise in integration of advanced technologies in unified communication as a service is anticipated to provide numerous opportunities for the expansion of the Ucaas market size during the forecast period.

Unified communications as a service developed a broad range of technologies and applications that are designed, sold, and supported as a single communications platform. It enables companies to use integrated data, video, and voice in a single supported product. In addition, unified messaging, collaboration, and interactive technologies can often be integrated with unified communications in real time. For example, through a single-user mailbox, a single user can access numerous communication applications such as email, short message service (SMS), video, fax, and audio. These features increase the demand for better communication services, which in turn, boosts the growth of unified communication as a service market.

The report focuses on growth prospects, restraints, and analysis of the global unified communications as a service market trend. The study provides Porter’s five forces analysis to understand the impact of various factors, such as the bargaining power of suppliers, competitive intensity of competitors, the threat of new entrants, the threat of substitutes, and bargaining power of buyers on the global unified communications as a service market share.

Segment Review

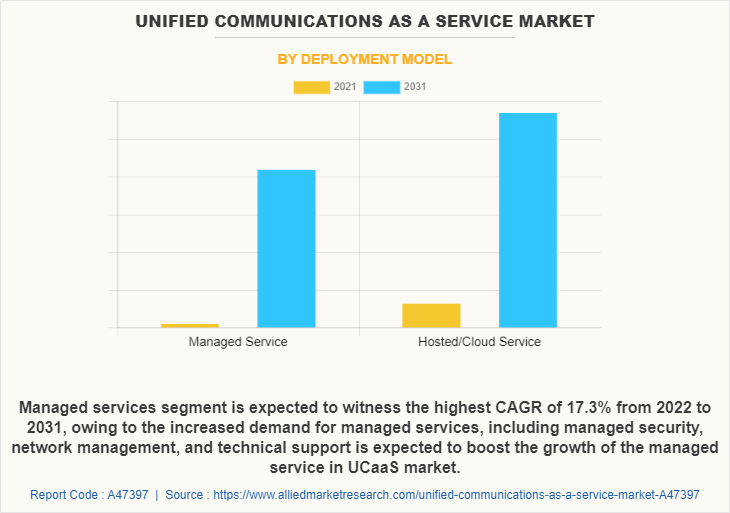

The global market are segmented into component, delivery model, organization size, industry verticals, and region. Depending on the component, the market is divided into telephony, unified messaging conferencing, and collaboration platforms, & application. By delivery model, it is divided into managed services and cloud services. Based on organization size, it is categorized into large enterprises and small & medium-sized enterprises. Based on industry verticals, it is bifurcated into media and entertainment, BFSI, IT and telecom, healthcare, automotive & transformation and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Depending on delivery model, the managed services segment dominated the unified communications as a service market growth in 2022 and is expected to remain dominant during the forecast period, owing to increased demand for managed services, including managed security, network management, and technical support. This is expected to boost the managed service in UCaaS market growth. However, the cloud services segment is expected to witness the highest growth in the upcoming years, owing to industry regulations and data privacy laws driving businesses to seek managed services to ensure compliance and reduce risk. This is expected to drive the growth of the market.

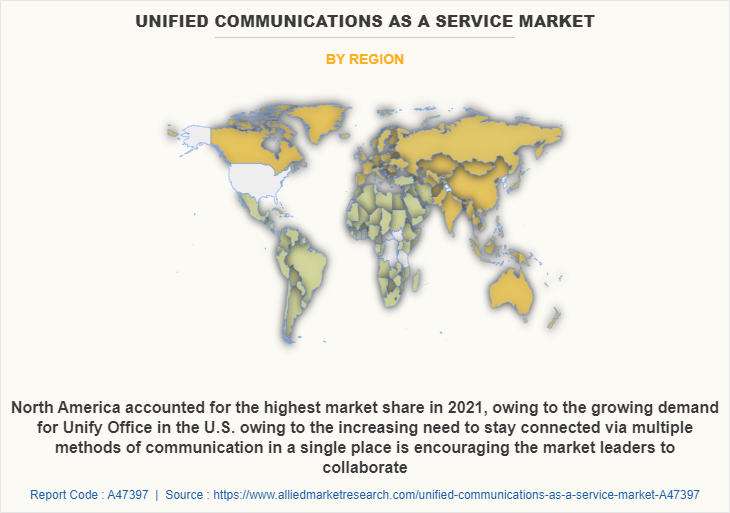

Region-wise, the market analysis was dominated by North America in 2021 and is expected to retain its position during the forecast period, owing to increase in demand for connected interfaces, growth associated with cloud technology, and penetration of bring your own devices (BYOD) in the U.S. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to surge in trend toward the mobilization of the enterprises and adaption of artificial intelligence and machine learning.

The global unified communications as a service industry is dominated by key players such as Avaya, Inc., BroadSoft, Inc, BxB, Inc, Cisco Systems, Inc., Genesys, Microsoft Corporation, Mitel Networks Corp., NEC Corporation, RingCentral, Inc., Zoom Video Communications, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Top Impacting Factors

Surge in Trend of Bring Your Own Device (BYOD) and Mobility

Surge in transformation in the communication sector fosters the market growth. In addition, surge in demand for mobile workforce along with the rising trend of bring your device (BYOD) method and hybrid workplace model drives the growth of the unified communication as a service market. This is attributed to the features of the unified communications as a service industry experience that have evolved and been developed to meet the unique needs of an increasingly distributed workforce. For example, presence cues that indicate whether a colleague is away, in a meeting or on a call have become paramount when everyone is working remotely and can no longer rely on the visual cues that came with sitting next to someone in a traditional office setting.

In addition, smart appliances such as laptops and tablets replace the traditional work culture using desktops and personal computers (PC) as primary means of business communication. This is because mobile devices that support unified communication as a service, allow employees to stay connected from anywhere at any time. Hence, employees expand the work choice beyond a single desktop workstation and work remotely, assuring high productivity. Implementing a BYOD and mobility policy also signals to employees that management trusts their work initiatives.

For instance, employees can use a mobile soft phone app to get their work calls forwarded to their mobile device, access work email, and collaborate on files from their mobile device for a seamless experience when working remotely. Key players in the market have upgraded the product portfolio to provide better unified communication as a service. For instance, in July 2021, Verizon Business released a new Blue Jeans Meetings feature for iPadOS, iOS and Android to support the reality of mobile workforce, as well as new device partnerships and applications which is used for unlocking the power of Verizon Mobile Edge Compute for real-time video collaboration on the go. Such enhancements resulted in the growth of unified communication as a service market.

Growth in Migration from Legacy Systems to Cloud-based Communication Services

Businesses are seeking for ways to manage complexity, limit expenses, and boost overall productivity as business communications increase. Due to this, the use of unified communication as a service, a cloud-based concept, has increased. Businesses are updating their strategies to increase their adaptability, productivity, and agility. In order to accommodate employees across devices, departments, and time zones, more businesses have adapted to flexible and hybrid working methods and turned to cloud-based solutions. Furthermore, cloud-based solution for unified communication as a services are typically more cost effective since they don’t require onsite hosting infrastructure, are easier to scale, and have the most up-to-date features and security.

The need to invest in cloud security increased due to high-profile breaches that make cloud security one of the most important considerations for all businesses. For instance, in October 2021, Microsoft Corporation introduced Microsoft Teams Phone that is a complete, cloud-based calling solution that is uniquely positioned to add calling into the flow of work. 80 million monthly active users rely on Teams Phone to stay connected, placing over a billion calls every month. Customers such as ZF Group and Ferguson Enterprises rely on Teams Phone to communicate, collaborate, and solve problems from anywhere, at any time, to better serve their customers. Thus, launching new features for cloud-based unified communication as a service has resulted in market growth.

Digital Capabilities:

Unified communications as a service include group collaboration and other interactive tools like voice response, workflow, scheduling, and instant messaging. As a result, unified communications solutions encourage cross-functional communication, which is anticipated to benefit UCaaS market growth in the years to come. In addition, to accommodate employees across devices, departments, and time zones, more businesses have adapted to flexible and hybrid working methods and turned to cloud-based solutions. Key players in the market adopted various strategies such as acquisition, collaboration, and partnership for strengthening the market position.

For instance, in January 2020, Comcast acquired Blueface, a multinational technology business established in Ireland that provides unified communications services. Blueface’s patented and fully customized cloud voice unified communications technology is added to Comcast business’s portfolio of business-grade products, allowing enterprises to communicate more easily.

Moreover, cloud-based solutions are adapted for unified communications as a service as they are more cost-effective since they don’t require onsite hosting infrastructure, are easier to scale and have the most up-to-date features and security. The UCaaS market is expanding as a result of numerous technological advancements, such as machine learning (ML) and artificial intelligence (AI). This is because AI and ML for unified communications as a service enhances operations by spotting trends in tasks that are carried out by gathering the necessary data and using the data to schedule meetings.

For instance, in July 2021, Tata Communications adopted AI and ML to deliver ubiquitously seamless customer services and improve operational efficiency through unified communication as a service. Exploring the three main areas the focus was on customer service, capital efficiency, and improving productivity and operational efficiency with end-to-end network management.

End-User Adoption:

With business communications becoming more complex, managing all the different channels becomes challenging. Therefore, end-users such as businesses and employers are adopting unified communications leading to having one platform that allows to manage and monitor communications. In addition, from service provider to product-based company, communication with a team of employees is necessary to increase productivity. As a result, unified communications integrate with various applications and software to make it easy for employees to communicate with each other. In the recent trend, employees use their own mobile devices, such as smartphones and tablets, for work purposes. It is, therefore, crucial that any unified communication solution has mobile device support. This way, employees can access the tools and information they need regardless of where and on which device they’re working.

Furthermore, unified communication as a service tools helps businesses keep in touch with their customers. From live chat software to customer relationship management (CRM) software, businesses can use unified communications as a service that provides a better customer experience. Moreover, organizations can save money on travel costs by using unified communication as a service tool to hold meetings and conferences virtually. For instance, in December 2020, Communications service provider PCCW Global partnered with RingCentral to provide on-demand private network connections to the latter’s global unified communication services. With Pacific Century CyberWorks Limited (PCCW) Global’s Console Connect technology, RingCentral enables customers to utilize private network connections for unified communications as a service with additional control and management capabilities. It provides services to industries such as healthcare, financial services, and education with high availability and superior quality to access its services and ensure business continuity.

Government Initiatives:

The growth of the global unified communications market is attributed to the growing government initiatives and activities for the deployment of unified communications platforms across diverse sectors. The government is taking constant efforts the deployment of unified communications in remote offices and branches. The adoption of unified communications solutions in government sector has tried to remove the communication gap. The government is also investing heavily in the adoption of unified communications platforms and solutions across the globe.

For instance, Microsoft unified communications brings extremely cost-effective new efficiencies to government services that, by working with existing investments in office productivity software and telephony service delivery. Microsoft Unified Communications improves collaboration across agencies and between organizations. It gives civil servants a single inbox for voice mails, e-mails, and instant messages, and alerts users to the availability and status of co-workers through presence awareness.

Furthermore, government across the globe took an initiative to provide better-unified communications. For instance, in March 2020, the European Commission which is operated as a cabinet government, with 27 members of the Commission headed by a President started taking more decisive steps toward secure, encrypted communications. Staff members for the EU Commission need a secure messaging tool for unified communication to ensure greater mobility with collaboration, centralize information, and boost overall efficiency. This offers an opportunity for companies to roll out innovative products.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the global unified communications as a service market forecast along with current & future trends to explain the imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on global unified communications as a service market trends is provided in the report.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The quantitative analysis of the market from 2022 to 2031 is provided to determine the UCaaS market potential.

Unified Communications as a Service Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 118.8 billion |

| Growth Rate | CAGR of 16.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 250 |

| By Component |

|

| By Deployment Model |

|

| By Organization Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Microsoft Corporation, NEC Corporation, Avaya Inc., Mitel Networks Corp., 8x8, Inc., Zoom Video Communications, Inc., Genesys, Google LLC (Alphabet), Cisco Systems Inc., RingCentral, Inc. |

Analyst Review

According to CXOs, Unified Communications as a Service (UCaaS) is gaining a significant application in various communication and collaboration tools and services, such as voice, and video conferencing, instant messaging, presence information, and more. This is attributed to rise in organization's communication requirements, as it allows enterprises to simplify their communication processes and increase business productivity. Also, UCaaS eliminated the requirement for separate infrastructure, software, and hardware, resulting in lower capital and operating expenses.

Major key providers in the unified communications as a service market are Microsoft Corporation, 8X8 Inc., Cisco Systems, Inc., and Zoom Communication. With the growth in demand for UCaaS services, various companies have established partnerships to increase their solutions offerings in 5G network. For instance, in October 2021, Lumen partnered with Cisco, to assist companies in upgrading to the most cutting-edge innovative collaboration solutions. The partnership further includes a new offering: Lumen Solutions for Cisco Unified Communications Manager Cloud (UCMC) which further drives the market growth.

In addition, with the surge in demand for UCaaS solutions, various companies have expanded their current product portfolio to continue with the rising demand in the market. For instance, in November 2022, Zoom unveiled a new of features for its UCaaS platform at Zoomtopia, which includes calling, chat, whiteboard, and video conferencing services. Such innovations further contribute toward the growth of the market.

For instance, in April 2022, 8x8, Inc., a leading unified cloud communications platform, and Genesys, a cloud leader in customer experience orchestration, collaborated for product integration of 8x8 Work with Genesys Cloud CX. With the new integration, organizations can align agents and the appropriate subject matter experts to quickly collaborate for better customer outcomes. Such strategic launches and partnerships are expected to drive market growth.

The global unified communications as a service market size was valued at USD 27 billion in 2021, and is projected to reach $118.8 billion by 2031

The unified communications as a service market is projected to grow at a compound annual growth rate of 16.3% from 2022 to 2031.

The key players profiled in the report include Avaya, Inc., BroadSoft, Inc, 8x8, Inc, Cisco Systems, Inc., Genesys, Microsoft Corporation, Mitel Networks Corp., NEC Corporation, RingCentral, Inc., and Zoom Video Communications, Inc.

Region-wise, the market analysis was dominated by North America

Increase in demand for a 5G high-speed network, the surge in the trend of bring your own device (BYOD) & mobility, and the growth in migration from legacy systems to cloud-based communication services contribute toward the growth of the market.

Loading Table Of Content...