Warehousing And Distribution Logistics Market Overview

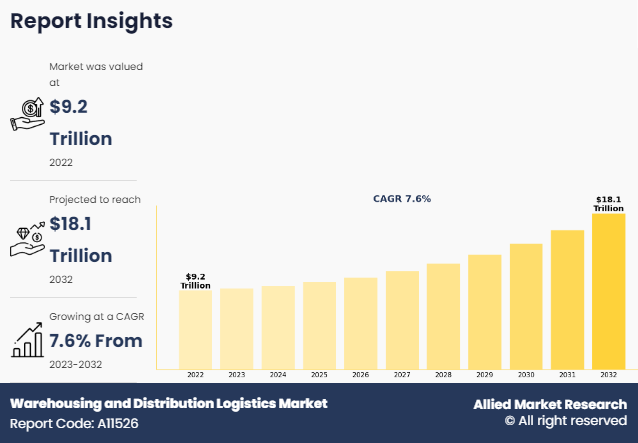

The global warehousing and distribution logistics market size was valued at USD 9.2 trillion in 2022, and is projected to reach USD 18.1 trillion by 2032, growing at a CAGR of 7.6% from 2023 to 2032. The warehousing and distribution logistics industry is transforming with e-commerce growth, driving demand for faster, efficient, and tech-driven solutions. Automation, AI, and omnichannel systems are streamlining operations, cutting costs, and enhancing inventory accuracy.

Key Market Trend & Insights

- E-commerce Growth – Driving need for advanced warehousing and faster fulfillment.

- Warehouse Expansion – Rising demand for larger, more efficient storage facilities.

- Tech Adoption – Increased use of automation, tracking, and smart inventory systems.

- Omnichannel Shift – Integration of online and offline sales logistics.

- Supply Chain Complexity – Boosting investment in modern logistics infrastructure.

Market Size & Forecast

- 2032 Projected Market Size: USD 18.1 trillion

- 2022 Market Size: USD 9.2 trillion

- Compound Annual Growth Rate (CAGR) (2023-2032): 7.6%

Market Introduction and Definition

Warehousing, also referred as storage, is a system that is utilized to store goods that need to be sold or distributed later. A distribution logistics is referred as a service, which includes end-to-end movement of goods. Warehousing and distribution logistics deals with packaging, storage, transportation, stock control, and inventory management services. Warehousing and distribution logistics services are used to reduce the cost of supplying finished products to customers, thus maintaining or improving the level of service provided.

The growth of the global warehousing and distribution logistics industry is majorly driven by rise in demand for efficient and cost-effective supply chain with reduced lead time. Various companies across the globe are building warehouses and distribution center to create efficient supply chain infrastructure. For instance, in April 2022, Abrdn’s AIPUT fund (Airport Industrial Property Unit Trust) completed construction of its 360,000 sq ft dnata City East warehouse campus opposite Heathrow’s Cargo Terminal. The new warehouse campus is expected to strengthen logistics infrastructure, ensuring high value time-critical products are moved more quickly, safely, and sustainably from gateway location.

The warehousing and distribution logistics industry is evolving rapidly, driven by the growth of e-commerce, particularly in emerging markets, is significantly increasing demand for efficient warehousing solutions and faster distribution networks. Companies are turning to automation and smart technologies, such as robotics, AI, and real-time data analytics, to optimize operations, reduce costs, and improve accuracy in inventory management. The rise of omnichannel retailing is also pushing businesses to adopt integrated logistics systems that seamlessly manage inventories across various sales channels.

In addition, the outsourcing of logistics functions to third-party providers is gaining traction, allowing businesses to focus on core operations while benefiting from specialized logistics expertise. Governments in key regions are investing heavily in logistics infrastructure, further driving market growth. Together, these trends are shaping a more agile, technology-driven warehousing and distribution landscape that meets the demands of modern commerce.

For instance, in January 2021, DB Schenker collaborated with Microsoft to develop solutions for enhanced supply chain performance on the Azure platform. This is expected to make the DB Schenker's supply chain offerings more efficient and data driven.

For instance, in April 2022, Abrdn’s AIPUT fund (Airport Industrial Property Unit Trust) completed construction of its 360,000 sq ft dnata City East warehouse campus opposite Heathrow’s Cargo Terminal. The new warehouse campus is expected to strengthen logistics infrastructure, ensuring high value time-critical products are moved more quickly, safely, and sustainably from gateway location.

Market Dynamics

The expansion of the e-commerce industry is significantly driving demand for the warehousing and distribution logistics market size. As online shopping grows, companies require efficient storage, inventory management, and fast delivery systems to meet customer expectations. This surge in e-commerce is pushing businesses to invest in advanced logistics solutions, including automated warehousing and optimized distribution networks, to ensure timely and accurate order fulfillment. Furthermore, surge in demand for warehouses has driven the demand for the warehousing and distribution logistics market share.

However, the warehousing and distribution logistics market faces challenges due to manufacturers' limited control over logistics services and poor infrastructure. Inadequate infrastructure leads to inefficiencies, delays, and increased costs, while the lack of direct control over logistics hampers manufacturers' ability to ensure timely and reliable delivery. These issues reduce overall operational efficiency, deterring businesses from fully investing in advanced logistics solutions. Moreover, high initial cost of automated warehouses are major factors that hamper the growth of the warehousing and distribution logistics market share.

On the contrary, the growing trend of automation in warehouses presents a lucrative opportunity for the warehousing and distribution logistics market forecast. Automated systems, including robotics and AI-driven processes, enhance efficiency, accuracy, and speed in inventory management and order fulfillment. As businesses seek to reduce labor costs and meet increasing demand, investment in automated warehousing solutions is becoming a critical competitive advantage, driving market growth.

What are the Top Impacting Factors

Key Market Driver

Expansion of the E-commerce Industry

The expansion of the e-commerce industry is significantly increasing the demand for the warehousing and distribution logistics market. As online shopping continues to grow, retailers and manufacturers are faced with the need to manage vast inventories and fulfill orders quickly and accurately. This surge in e-commerce activities requires advanced warehousing solutions to handle large volumes of goods, optimize storage, and streamline order processing.

In addition, the need for rapid delivery and efficient distribution networks has intensified, pushing companies to invest in state-of-the-art logistics technologies such as automated sorting systems, real-time tracking, and smart inventory management. The rise of omnichannel retailing further compounds this demand, as businesses must integrate their physical and online sales channels seamlessly. Consequently, the warehousing and distribution logistics market is experiencing heightened growth as businesses seek to enhance their supply chain efficiency and meet the evolving expectations of the modern consumer. Therefore, expansion of e-commerce industry drive the demand for warehousing and distribution logistics market.

Suge in Demand for Warehouses

The surge in demand for warehouses is driving significant growth in the warehousing and distribution logistics market. As e-commerce continues to expand, businesses require more extensive warehousing facilities to manage increasing inventory levels and ensure efficient order fulfillment. This heightened demand for storage space is fueled by the need for quicker delivery times and the ability to handle a diverse range of products. Consequently, companies are investing in modern warehousing solutions that incorporate advanced technologies, such as automated systems and real-time data analytics, to optimize space utilization, streamline operations, and reduce costs.

In addition, the trend toward omnichannel retailing necessitates sophisticated warehousing strategies to support both online and in-store sales, further amplifying the need for robust logistics infrastructure. The growing complexity of supply chains and the need for timely distribution are driving the expansion of warehousing capabilities, thus propelling the overall demand for warehousing and distribution logistics services. Therefore, surge in demand for warehouse is driving the demand for warehousing and distribution logistics market.

Restraints

Lack of Control of Manufacturers on Logistics Service and Poor Infrastructure

The lack of control manufacturers have over logistics services and poor infrastructure are significant factors hampering the demand for the warehousing and distribution logistics market. Manufacturers often rely on third-party logistics providers, which can lead to inefficiencies and challenges in managing inventory, ensuring timely deliveries, and maintaining service quality. Limited control over these logistics functions can result in delays, increased costs, and a lack of flexibility in responding to market changes.

In addition, inadequate infrastructure, such as outdated warehousing facilities and inefficient transportation networks, exacerbates these issues by causing bottlenecks and operational disruptions. Poor infrastructure hampers the ability to implement advanced technologies and optimize logistics processes, further impacting efficiency and reliability. These challenges deter investments in logistics solutions and infrastructure improvements, slowing overall market growth and affecting the ability of businesses to meet evolving consumer demands effectively. Therefore, lack of control of manufacturers on logistics service and poor infrastructure is hampering the growth of the market.

Opportunity

Increase in Trend of Automation in Warehouses

The increase in automation trends in warehouses presents a lucrative opportunity for the warehousing and distribution logistics market. Automation technologies, such as robotics, conveyor systems, and artificial intelligence, are revolutionizing warehousing operations by enhancing efficiency, accuracy, and speed. Automated systems streamline inventory management, reduce human error, and optimize space utilization, leading to faster order processing and improved supply chain performance. As businesses seek to meet the growing demands of e-commerce and global trade, automation becomes essential for maintaining competitive advantage. This trend not only reduces operational costs but also improves scalability and flexibility, allowing warehouses to adapt quickly to changing market conditions.

Consequently, the demand for advanced automation solutions is driving significant investments and innovations within the logistics sector. The ongoing development and adoption of these technologies present substantial growth opportunities for companies specializing in warehousing and distribution logistics, making automation a key driver of market expansion. Therefore, increase in trend of automation in warehouses are lucrative opportunity for warehousing and distribution logistics market.

Segment Review

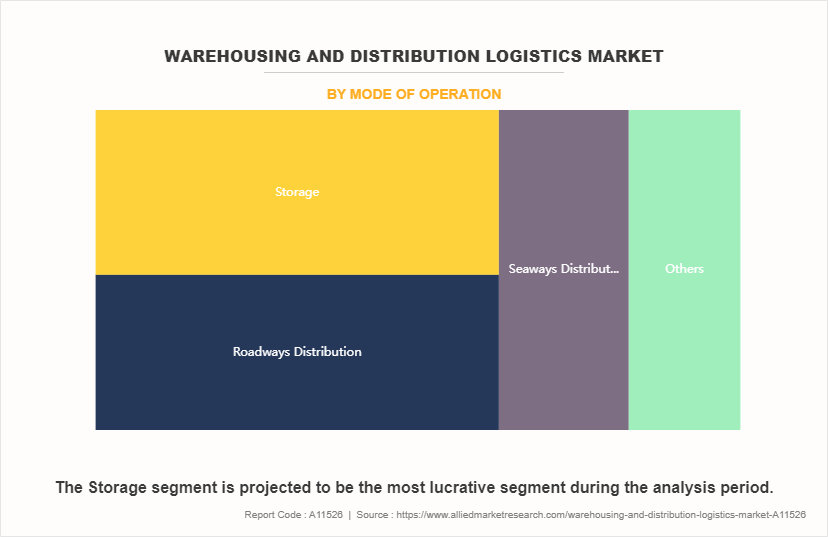

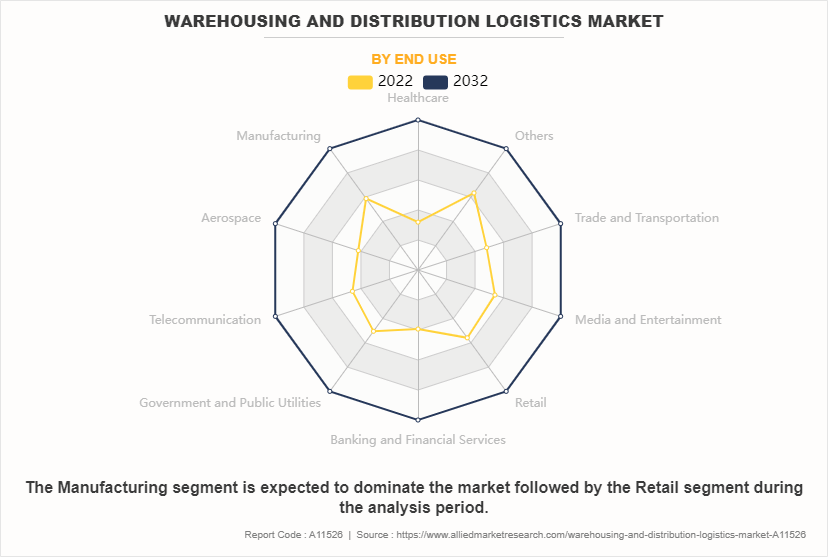

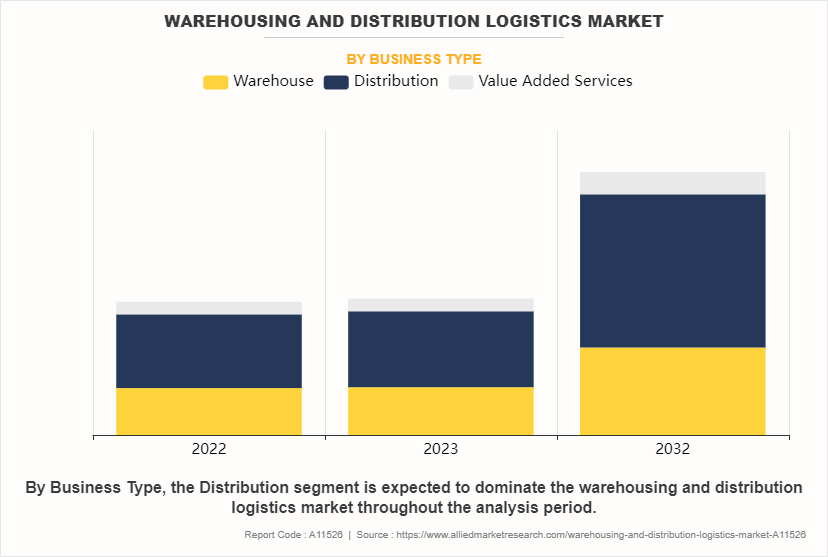

The Warehousing and Distribution Logistics market is segmented by type, mode of operation, end use, business type, and region. On the basis of type, the market is divided into solution and services. By mode of operation, the market is categorized into storage, roadways distribution, seaways distribution, and others. As per end use, the market is segmented into healthcare, manufacturing, aerospace, telecommunication, government & public utilities, banking & financial services, retail, media & entertainment, trade & transportation, and others. By business type, the market is analyzed across warehouse, distribution, and value-added services. On the basis of region, it is analysed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

By Type

On the basis of type, the solution segment attained the highest market share in 2022 in the warehousing and distribution logistics market growth. This was due to the growing demand for advanced technologies, such as automation, real-time tracking, and inventory management systems, which enhance operational efficiency and streamline supply chain processes.

Meanwhile, the solution segment is projected to be the fastest-growing segment during the forecast period. This is attributed to the fact that increasing adoption of advanced technologies like automated sorting systems, real-time tracking, and route optimization software. These solutions enable companies to enhance delivery speed, reduce costs, and improve overall efficiency. The growing e-commerce sector and the need for seamless supply chain integration further drive demand for these innovative distribution solutions.

By Mode of Operation

On the basis of mode of operation, the sotrage segment attained the highest market share in 2022 in the warehousing and distribution logistics market. This be attributed to the fact that the critical need for efficient warehousing to manage inventory, particularly with the rise of e-commerce. As businesses expand their product offerings and reach, demand for well-organized, strategically located storage facilities increases. Effective storage solutions ensure product availability, streamline distribution, and reduce lead times, making them essential in the logistics chain.

Meanwhile, the storage segment is projected to be the fastest-growing segment during the forecast period. This is due to the growing need for efficient inventory management, driven by the surge in e-commerce and global trade. As companies strive to meet consumer demand and reduce delivery times, investment in advanced storage solutions, including automated warehousing and smart inventory systems, has accelerated, making storage a rapidly expanding segment.

By End-Use

On the basis of end-use, the manufacturing segment attained the highest market share in 2022 in the warehousing and distribution logistics market. This is due to its reliance on efficient logistics to manage complex supply chains. Manufacturers require extensive warehousing for raw materials, components, and finished goods, along with precise distribution networks to ensure timely delivery. The need for streamlined operations, cost efficiency, and just-in-time production drives the demand for robust warehousing and logistics solutions in this sector.

Meanwhile, the healthcare segment is projected to be the fastest-growing segment during the forecast period. This is due to the increasing demand for efficient storage and distribution of pharmaceuticals and medical supplies. The need for temperature-controlled environments, regulatory compliance, and rapid delivery of critical products drives investment in specialized logistics solutions, leading to accelerated growth in this sector.

By Business Type

On the basis of business type, the distribution segment attained the highest market share in 2022 in the warehousing and distribution logistics market. This is due to its pivotal role in managing the flow of goods from warehouses to end customers. With the growth of e-commerce and global trade, efficient distribution systems became essential for meeting consumer demands and optimizing supply chains, driving significant market investment and expansion.

Meanwhile, the distribution segment is projected to be the fastest-growing segment during the forecast period. This is due to the increasing emphasis on optimizing delivery networks to meet the rising demand for rapid and efficient order fulfillment. Advances in technology, such as real-time tracking and route optimization, coupled with the growth of e-commerce, are driving significant investments and innovations in distribution logistics.

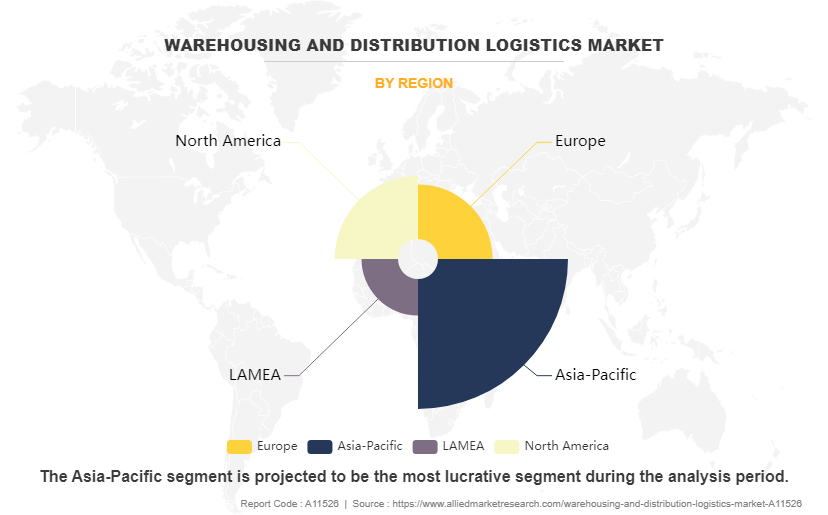

By Region

On the basis of region, North America attained the highest market share in 2022 and emerged as the leading region in the Warehousing and distribution logistics market. This is due to its advanced infrastructure, technological innovation, and high demand for efficient supply chain solutions. The region's robust e-commerce growth, coupled with substantial investments in automated warehousing and logistics technologies, strengthened its position as a key hub for warehousing and distribution activities.

On the other hand, the Asia-Pacific region is projected to be the fastest-growing region for the Warehousing and distribution logistics market during the forecast period. This due to rapid industrialization, booming e-commerce, and increasing investments in logistics infrastructure. The region's expanding middle class and rising consumer demand are driving the need for efficient warehousing and distribution solutions. Additionally, government initiatives to improve supply chain efficiency further boost the growth prospects in this dynamic market.

The report focuses on growth prospects, restraints, and trends of the warehousing and distribution logistics market. The study provides Porter’s five forces analysis to understand the impact of numerous factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the Warehousing and distribution logistics market.

Which are the Top Warehousing and Distribution Logistics companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the warehousing and distribution logistics industry.

- Agility

- Ceva Logistics

- CJ Century Logistics

- CWT Ltd.

- DB Schenker

- DHL Supply Chain

- Gemadept

- Keppel Logistics

- Kerry Logistic

- Kuehne+Nagel

- Singapore Post

- Tiong Nam Logistics

- WHA Corp.

- YCH Group

- Yusen Logistics

- Manhattan Associates

- Blue Yonder

- Easy Metrics

- TZA (Supply Chain 24/7)

- SAP SE

- NextView

- Tecsy

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the warehousing and distribution logistics market analysis from 2022 to 2032 to identify the prevailing Warehousing and distribution logistics market opportunity.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the Warehousing and distribution logistics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global Warehousing and distribution logistics market trends, key players, market segments, application areas, and market growth strategies.

Warehousing and Distribution Logistics Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 18.1 trillion |

| Growth Rate | CAGR of 7.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 410 |

| By Business Type |

|

| By Type |

|

| By Mode of Operation |

|

| By End Use |

|

| By Region |

|

| Key Market Players | DHL GROUP (DHL Supply Chain), TECSYS, Yusen Logistics, YCH Group, WHA Corporation PCL, SAP SE, CWT Pte. Limited, Next View Software, DB Schenker, CEVA Logistics, Easy Metrics, Singapore Post Limited, CJ Century Logistics, Agility, Blue Yonder, Inc., KERRY LOGISTICS NETWORK LIMITED, Supply Chain 24/7, KuehneNagel, Tiong Nam Logistics, GEODIS, GEMADAPT, Manhattan Associates |

The global warehousing and distribution logistics market size was valued at $9.2 trillion in 2022, and is projected to reach $18.1 trillion by 2032, growing at a CAGR of 7.6% from 2023 to 2032.

GEODIS, TECSYS, WHA Corporation PCL, KuehneNagel, YCH Group, GEMADAPT, CJ Century Logistics, Supply Chain 24/7, CWT Pte. Limited, Blue Yonder, Inc., DHL GROUP (DHL Supply Chain), Next View Software, KERRY LOGISTICS NETWORK LIMITED, Tiong Nam Logistics, CEVA Logistics, Easy Metrics, SAP SE, Manhattan Associates, Singapore Post Limited, Yusen Logistics, Agility, DB Schenker.

North America attained highest market share for the Warehousing and Distribution Logistics market

Increased adoption of automated systems and robotics for efficient handling, sorting, and packaging of goods, leading to faster and more accurate operations.

Retail and E-commerce leading application of Warehousing and distribution logistics market

Loading Table Of Content...

Loading Research Methodology...