Whey Protein Ingredients Market Research, 2031

The global Whey Protein Ingredients Market Size was valued at $12,014.42 million in 2020, and is projected to reach $25,710.50 million by 2031, growing at a CAGR of 7.39% from 2022 to 2031. Whey protein ingredients are globular proteins isolated from whey-the liquid material obtained as a byproduct of cheese production. Consumers are embracing these ingredients for high protein content as compared to soy, egg, and other milk-based proteins. Whey proteins are consumed globally as dietary supplements owing to various health claims associated with them. For instance, whey protein is generally used to improve lipid profile glucose levels and insulin response, thereby promoting arterial stiffness and a reduction in blood pressure. Moreover, whey protein concentration is regulated by the addition of denatured powder to provide balanced nutrition for the infants. In addition, these ingredients reduce hepatic cholesterol levels among the elderly. Growth in popularity of whey supplements among youngsters and emergence of whey protein-based pediatric milk formulations coupled with advancements in production technologies are some of the key factors that drive the Whey Protein Ingredients Market Growth.

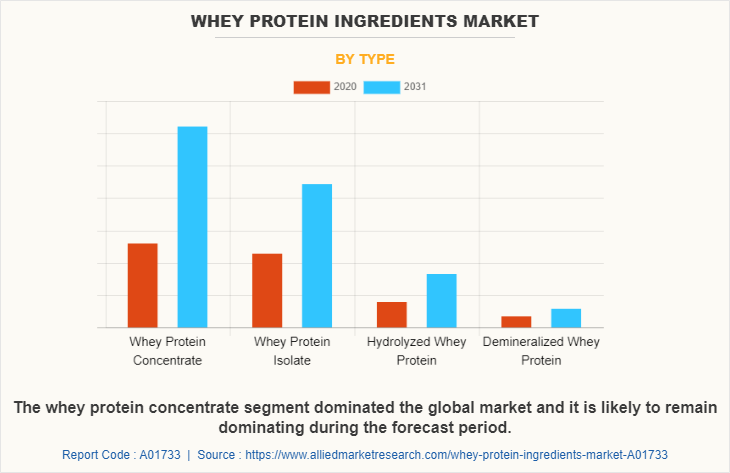

The demand for whey protein concentrates has increased especially in the personal care industry owing to its characteristics of mass gain, improved immunity, increase in strength, and fat loss. Factors such as potential health benefits of dairy nutritional and nutraceutical ingredients, high demand for milk-based ingredients in skin and hair care cosmetics, and easy availability of caseins and caseinate drive the global whey protein ingredients market. Moreover, the demand for nutraceutical ingredients from the food processing sector is on a significant increase, thus acting as a promising opportunity for the growth of the global whey protein ingredients market. Body builders often consume concentrated whey protein to increase their muscle mass. Furthermore, senior citizens with poor appetites consume protein shakes to ensure efficient nutrition. Thus, whey protein concentrate segment is expected to witness the highest growth rate in the market during the Whey Protein Ingredients Market Forecast period.

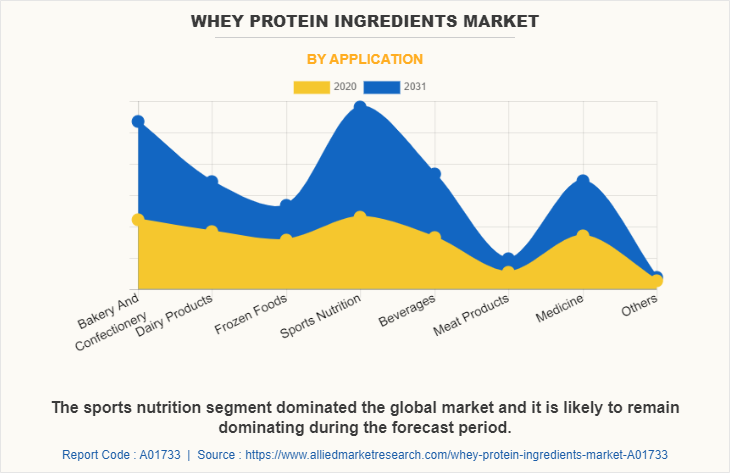

The global whey protein ingredients industry offers various opportunities to the market players, owing to rapid growth in the global economy and disposable incomes. Increase in use of whey protein ingredients as wellness trend, demand for dairy ingredients, increase in number of working women and health conscious population are some prominent aspects that augment the growth of the market. In addition, whey protein isolates are expected to witness rapid adoption in sports nutrition (protein shakes), frozen foods (processed meat), packaging, and bakery & confectionery (bakery muffins) applications. However, undefined regulatory guidelines, fluctuating milk prices, as well as issues associated with increase in number of diseases among animals are some of the key elements anticipated to hamper the growth of the market during the forecast period.

Growth in demand for hydrolyzed whey proteins as nutritional supplement among infant formulas and sports and medical nutrition products especially in North America and Europe is expected to drive the overall market growth. Moreover, increase in per capita disposable incomes in developing countries such as China, India, and Korea has led to an upsurge in the use of whey protein ingredients, thereby leading to unprecedented increase in demand for the ingredients globally. In addition, surge in demand for the ingredients in meat products, poultry, and fish on account of its water binding capacity further drives the market growth.

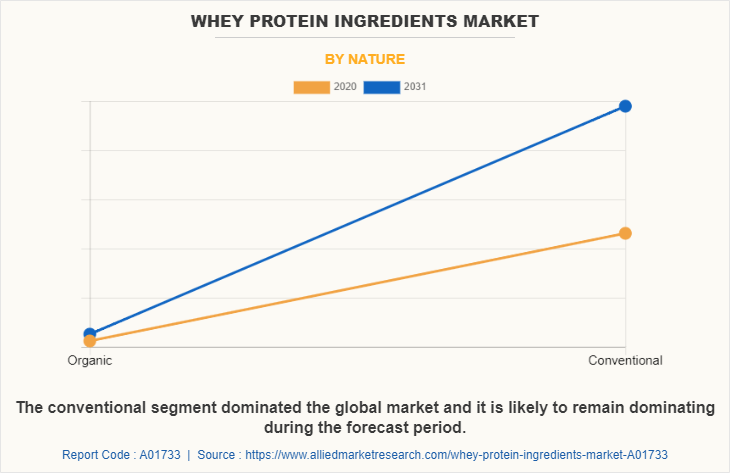

The global whey protein ingredients market is segmented based on nature, type and application. On the basis of nature the market is categorized into organic and conventional whey protein ingredients. On the basis of type, the market is classified into whey protein concentrates, whey protein isolates, demineralized whey, and hydrolyzed whey protein. The whey protein concentrates segment is further sub-categorized into whey protein concentrate 80 and whey protein concentrate 35. By application, the market is categorized into bakery & confectionery, dairy products & frozen foods, sports nutrition, beverages, meat products, medicine, and others (infant nutrition and personal care products). The market is analyzed based on region into North America, Europe, Asia-Pacific, and LAMEA.

The players operating in the global whey protein ingredients market have adopted various developmental strategies to increase their Whey Protein Ingredients Market Share, gain profitability, and remain competitive in the market. The key players operating in the sunflower protein market include - Arla Foods, Cargill Incorporation, Hilmar Cheese Company, Fonterra Co-Operative Group Ltd., Carberry Food Ingredients, Glanbia plc, Davisco Food International, Maple Island Incorporation, and Dairy Farmers of America.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the whey protein ingredients market analysis from 2020 to 2031 to identify the prevailing whey protein ingredients market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the whey protein ingredients market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global whey protein ingredients market trends, key players, market segments, application areas, and market growth strategies.

KEY MARKET SEGMENTS

By Nature

- Organic

- Conventional

By Type

- Whey Protein Concentrate (WPC)

- WPC 80

- WPC 35

- Whey Protein Isolate (WPI)

- Hydrolyzed Whey Protein (HWP)

- Demineralized Whey Protein (DWP)

By Application

- Bakery and Confectionery

- Dairy Products and Frozen Foods

- Sports Nutrition

- Beverages

- Meat Products

- Medicine

- Others (Personal Care and Infant nutrition)

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Spain

- Italy

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Brazil

- South Africa

- Saudi Arabia

- Argentina

- Rest of LAMEA

Whey Protein Ingredients Market Report Highlights

| Aspects | Details |

| By Nature |

|

| By Application |

|

| By Type |

|

| By Region |

|

| Key Market Players | carbery group, maple island inc., DAVISCO FOOD INTERNATIONAL, GLANBIA PLC, CARGILL CORPORATION, dairy farmers of america, FONTERRA CO-OPERATIVE GROUP LTD, arla foods amba, MILK SPECIALTIES GLOBAL, HILMAR CHEESE COMPANY, INC. |

Analyst Review

According to the perspectives of CXOs of leading companies in the global whey protein ingredients market, increase in demand for whey protein ingredients in developing regions, rapid growth of the functional beverages industry, rise in demand for infant formula nutrition and sports drinks, and rise in number of working women majorly drive the market. However, health and safety concerns related to the consumption of whey proteins pose threat to the growth of the global whey protein ingredients market. In 2020, North America occupied the highest market share in the global market, and is the expected to be the fastest growing region in future. This is due to rapid growth of personal care and food & beverage industry, increase in demand for whey protein ingredients from sports industry, and rise in investments by key players in Asia-Pacific countries. Furthermore, CXOs are optimistic about the adoption of whey protein ingredients by consumers toward healthy diet and consumption of dairy and frozen foods. Use of whey protein ingredients in personal care industry is another key factor that fuels the growth of the market. As per the CXOs, China occupies approximately one-third share of the Asia-Pacific Whey Protein Ingredients market; however, the market in India is expected to grow at a rapid rate in the near future.

The global Whey Protein Ingredients Market Size was valued at $12,014.42 million in 2020, and is projected to reach $25,710.50 million by 2031

The global Whey Protein Ingredients market is projected to grow at a compound annual growth rate of 7.39% from 2022 to 2031 $25,710.50 million by 2031

dairy farmers of america, CARGILL CORPORATION, DAVISCO FOOD INTERNATIONAL, arla foods amba, maple island inc., carbery group, FONTERRA CO-OPERATIVE GROUP LTD, GLANBIA PLC, HILMAR CHEESE COMPANY, INC., MILK SPECIALTIES GLOBAL

North America

Growth in popularity of whey supplements among youngsters and emergence of whey protein-based pediatric milk formulations coupled with advancements in production technologies are some of the key factors that drive the Whey Protein Ingredients Market Growth.

Loading Table Of Content...