Wireless Backhaul Equipment Market Research, 2031

The global wireless backhaul equipment market was valued at $31.9 billion in 2021 and is projected to reach $104.8 billion by 2031, growing at a CAGR of 12.9% from 2022 to 2031.

Wireless backhaul equipment refers to the technology and infrastructure used to transmit data wirelessly between multiple locations, typically between base stations and core networks in cellular networks, or between access points and distribution systems in wireless LANs. It includes components such as microwave and millimeter-wave radios, antennas, routers, switches, and network management systems. The purpose of wireless backhaul is to provide high-speed, reliable data transmission over long distances, bypassing the need for physical cabling and enabling network expansion and modernization. The components used in wireless backhaul equipment can be broadly categorized into hardware and software components.

Hardware components include antennas, radio frequency (RF) transceivers, modems, power amplifiers (PAs), frequency converters, filters, switching and routing devices, power supply, and mounting hardware. Antennas are used to transmit and receive signals in the desired frequency band, and RF transceivers are responsible for converting digital signals into radio waves for transmission and vice versa for reception. Modems provide an interface between the radio and digital network, performing various functions such as modulation, demodulation, error correction, and data compression. PAs amplify the transmitted signals to increase their range and penetration through obstacles, and frequency converters are used to convert signals from one frequency band to another. Filters prevent interference from other devices operating in the same or adjacent frequency bands, and switching and routing devices manage the flow of data between the backhaul equipment and other network devices. The power supply provides power to the backhaul equipment and may include backup batteries for power redundancy, while mounting hardware is used to securely mount the backhaul equipment to poles, towers, or buildings.

Software and management tools are also an important component of wireless backhaul equipment. They are used to monitor and manage the performance of the backhaul equipment and ensure that it operates reliably and efficiently. These tools can help diagnose and resolve issues, configure and update the equipment, and provide real-time performance monitoring. In conclusion, wireless backhaul equipment is a complex system that requires a combination of hardware and software components to provide reliable and efficient wireless communication.

There are several types of wireless backhaul equipment. These include:

Microwave Radios: These are the most commonly used type of wireless backhaul equipment, providing high-speed connectivity over short and medium distances.

Millimeter Wave Radios: These radios provide high-speed connectivity over short distances and are capable of handling large amounts of data.

Fiber Optic Systems: Fiber optic systems provide high-speed and reliable connectivity over long distances and are often used for backhauling in urban areas.

Satellite Systems: These systems provide wireless backhaul connectivity to remote and rural areas where terrestrial systems are not feasible.

Base Station Controllers (BSCs): These are used to manage and control the operation of base stations in a wireless network.

Ethernet Bridges: These devices provide a high-speed Ethernet connection between two or more remote sites.

Point-to-Point (PTP) and Point-to-Multipoint (PTMP) Radios: These radios are used to provide wireless backhaul connectivity to small cells and other remote sites.

Wireless backhaul equipment typically uses microwave, millimeter wave, and fiber optic technologies to provide high-speed connectivity. The choice of technology depends on various factors such as the distance between two points, the amount of data to be transmitted, the cost and feasibility of deploying the technology in a particular location, and the available spectrum resources. Wireless backhaul equipment also plays a crucial role in supporting the deployment of new technologies such as 5G, IoT, and M2M communications, which require high-speed, low-latency, and highly reliable connectivity.

In addition to providing high-speed connectivity, wireless backhaul equipment must also be secure, reliable,e and easy to manage. To meet these requirements, wireless backhaul equipment is often equipped with advanced features such as encryption, Quality of Service (QoS) management, and network management capabilities. Overall, wireless backhaul equipment plays a vital role in ensuring the efficient and reliable functioning of wireless communication networks and supporting the delivery of new and innovative services to end-users.

Segment Overview

The wireless backhaul equipment market outlook is segmented into Offering, Frequency Band, and End Use Industry.

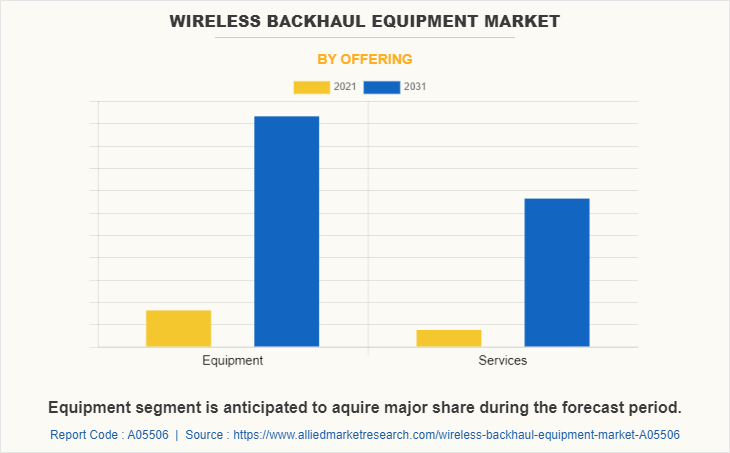

On the basis of offering, the market is divided into equipment and services. In 2021, the equipment segment dominated the market in terms of revenue and will acquire major market share by 2031.

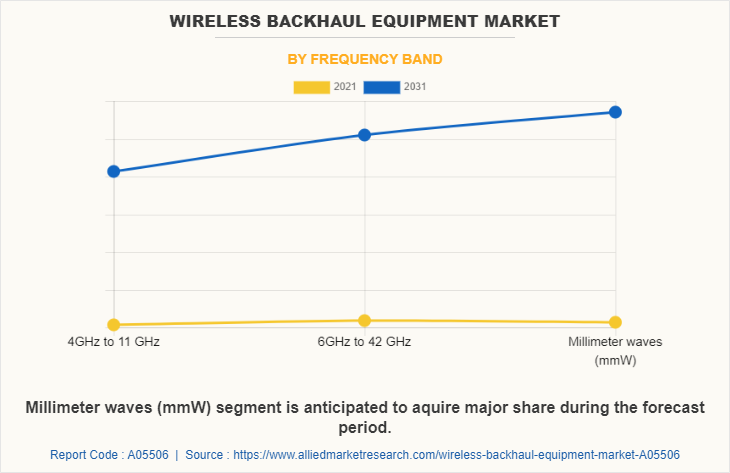

On the basis of frequency band, the market is segregated into 4 GHz to 11 GHz, 6 GHz to 42 GHz, and millimeter waves (mmW). The 6GHz to 42 GHz segment acquired the largest share in 202,1, and the Millimeter waves (mmW) segment is expected to grow at a significant CAGR from 2022 to 2031.

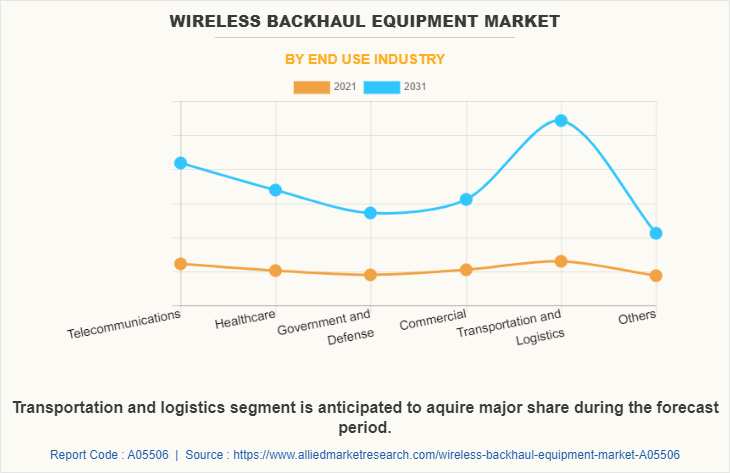

On the basis of end use industry, the market is segregated into telecommunications, healthcare, government and defense, commercial, transportation and logistics, and others. The transportation and logistics segment acquired the largest share in 2021 and is expected to grow at a significant CAGR from 2022 to 2031.

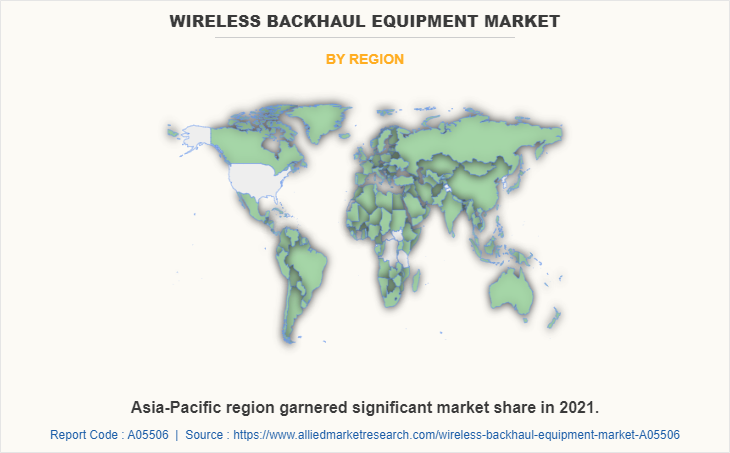

Region-wise, the wireless backhaul equipment market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, Germany, France, Italy, and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Taiwan, and Rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa). Asia-Pacific and North America remain significant participants in the wireless backhaul equipment market growth.

Top Impacting Factors

The wireless backhaul equipment market size is anticipated to expand significantly during the forecast period owing to an increase in testing of 5G technology in the U.S., Japan, South Korea, and China, the surge in use of millimeter wave technology-based scanner systems in transportation and airports, and rise in demand for smart devices. Additionally, during the forecast period, the wireless backhaul equipment market opportunity is anticipated to benefit from the expansion of 5G networks and increasing deployment of IoT applications, and government support and initiatives to promote rural connectivity and digitalization. On the other hand, growth in the wireless backhaul equipment market share is expected to be restrained by stringent government regulations and standards for wireless spectrum usage, and competition from alternative backhaul technologies, such as fiber optic networks.

Competitive Analysis

Competitive analysis and profiles of the major global Wireless backhaul equipment market players that have been provided in the report include Ceragon Networks, Cisco, Huawei Technologies Co., Ltd., Juniper Networks, Inc., MikroTik, Qorvo, Inc, Qualcomm, RADWIN, Siklu Communication, and ZTE Corporation.

Key Developments/ Strategies

Ceragon Networks, Cisco, Huawei Technologies Co., Ltd., Juniper Networks, Inc., MikroTik, Qorvo, Inc., Qualcomm, RADWIN, Siklu Communication, and ZTE Corporation are the top companies holding a prime share in the wireless backhaul equipment market forecast. Top market players have adopted various strategies, such as product development, acquisition, innovation, partnership, and others, to expand their foothold in the wireless backhaul equipment industry.

- In February 2023, RADWIN TerraBridge mmWave gigabit radio successfully tested for innovative train-to-train communication redundancy in Madrid Metro. The test results proved that TerraBridge can provide a reliable connection between trains for many different use cases. This TerraBridge is the most suitable solution for the railway environment.

- In November 2022, RADWIN, a leading global wireless broadband solutions provider, announced a partnership with leading UK distributor and partner to resellers, system integrators, OEMs, and mobile network operators, Cogent Distribution. This new partnership will extend the reach of RADWIN’s products to the UK market while delivering on Cogent’s promise to add continuous value. Cogent Distribution will offer an extensive collection of RADWIN’s wireless broadband solutions for Point-to-MultiPoint and Point-to-Point connectivity.

- In November 2022, Qorvo announced its collaboration with MediaTek to enable the power of connectivity with the help of wireless backhaul technology in a new generation of 5G smartphones, Wi-Fi equipment, and cars. Qorvo will work closely with MediaTek to accelerate innovation and deliver cutting-edge performance to leading customers in mobile, networking, automotive,e and other markets.

- In July 2022, Cisco announced its first outdoor Wi-Fi 6E-ready access point and enhancements for industrial remote operations using Cisco's ultra-reliable wireless backhaul system.

- In October 2022, Huawei announced the launch of the Maxwell Platform and X2 Antenna for efficient 5G deployment. The new solutions further improve antenna integration and configuration capabilities, helping carriers deploy 5G more efficiently with proper wireless backhaul equipment systems.

- In February 2020, Huawei announced the launch of the RuralStar Pro Solution. This solution integrates baseband, radio frequency (RF), and wireless backhaul functions into one base station, significantly reducing site deployment costs.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the wireless backhaul equipment market from 2021 to 2031 to identify the prevailing wireless backhaul equipment market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the wireless backhaul equipment market segmentation helps determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global wireless backhaul equipment market trends, key players, market segments, application areas, and market growth strategies.

Wireless Backhaul Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 104.8 billion |

| Growth Rate | CAGR of 12.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 426 |

| By Offering |

|

| By Frequency Band |

|

| By End Use Industry |

|

| By Region |

|

| Key Market Players | Huawei Technologies Co., Ltd., Ceragon Networks Ltd., ZTE Corporation, Qorvo, Inc., Cisco Systems Inc., RADWIN, Juniper Networks Inc., Qualcomm Incorporated, siklu communication, mikrotik |

Analyst Review

The market is expected to grow significantly in the coming years due to rise in demand for 5G networks, expansion of IoT, increase in video streaming and online gaming, rise in demand for wireless broadband services, and government support for improving connectivity.

Advancements in technology, rise in demand for high-capacity networks, increase in adoption of cloud computing, surge in demand for fixed wireless access (FWA) solutions, increase in investment in network modernization, and rise in demand for high-speed wireless broadband are other factors contributing toward the growth of the wireless backhaul equipment market. Increase in adoption of cloud computing drives the demand for high-speed and reliable connectivity, which is provided by wireless backhaul equipment.

In addition, growth of smart cities, increase in deployment of small cell networks, and rise in demand for broadband services in rural areas contribute toward the growth of the wireless backhaul equipment market. Increase in demand for wireless backhaul solutions that can support high-speed and low-latency connectivity is also driving the market growth. The development of new wireless backhaul technologies, such as high-frequency millimeter wave technology and low-earth orbit satellites, is expected to create new opportunities for the wireless backhaul equipment market.

Furthermore, surge in demand for high-capacity networks to support data-intensive applications, such as virtual and augmented reality, artificial intelligence, and machine learning drive the growth of the wireless backhaul equipment market. Increase in demand for wireless backhaul solutions that can support high-speed and low-latency connectivity fosters the growth of the market.

The upcoming trends in the wireless backhaul equipment market includes increased adoption of 5G networks, growth in small cell deployments, greater use of cloud-based solutions, and a shift towards virtualization and automation of network operations.

Transportation and logistics is the leading application of Wireless Backhaul Equipment Market

Asia-Pacific is the largest regional market for Wireless Backhaul Equipment.

The global wireless backhaul equipment market was valued at $31,901.35 million in 2021.

Ceragon Networks, Cisco, Huawei Technologies Co., Ltd., Juniper Networks, Inc., MikroTik, Qorvo Inc, Qualcomm, RADWIN, Siklu Communication, and ZTE Corporation are the top companies to hold the market share in Wireless Backhaul Equipment.

Loading Table Of Content...

Loading Research Methodology...