Alcohol Ingredients Market Research, 2032

The global alcohol ingredients market size was valued at $2.6 billion in 2022, and is projected to reach $4.1 billion by 2032, growing at a CAGR of 4.5% from 2023 to 2032.

The market deals with sourcing, supplying, and distributing a diverse range of components used in the production of alcoholic beverages. These components range from ingredients like yeast, enzymes, and botanicals to specialized additives and flavor enhancers.

Market Dynamics

According to the Brewers Association, there has been an increase in several operating craft breweries since 2022, reaching an all-time high of 9,552, including 2,035 microbreweries, 3,418 brewpubs, 3,838 taproom breweries, and 261 regional craft breweries. The total U.S. operating brewery count was 9,709 in 2022, increased from 9,384 in 2021. The rise in global demand for alcoholic beverages led to a significant surge in the market demand for alcohol ingredients. Manufacturers are increasingly seeking high-quality ingredients to create innovative and appealing beverages with the change in consumer preferences for diverse tastes. This surge in demand for a wide range of alcoholic drinks, including beer, wine, spirits, and cocktails, directly fuels the expansion of the market to meet the growing need for diverse and captivating flavor profiles.

The surge in craft and premium alcohol is driving the demand for the market. Manufacturers are innovating by sourcing unique ingredients as consumers seek distinctive, high-quality beverages. Emphasizing craftsmanship and authenticity appeals to consumers, encouraging them to explore distinct flavors and experiences. This increased demand for craft and premium drinks is propelling the alcohol ingredients market share, compelling suppliers to cater to the increasing desire for exceptional taste and quality, such factors surge the market size.

Innovation in flavor profiles is propelling the alcohol ingredients market demand. The evolving tastes of consumers are driving manufacturers to use diverse ingredients, resulting in creative and unique beverage experiences. The industry captivates the interest of consumers by crafting enticing flavor combinations with ingredients like fruits, herbs, and spices. This pursuit of exciting tastes boosts the market growth, as suppliers adapt to fulfill the growing demand for innovative and flavorful alcoholic beverages.

Regulatory factors play a pivotal role in boosting the alcohol ingredients market growth by shaping product composition and quality standards. Compliance with evolving regulations ensures consumer safety and instills confidence, driving the demand for ingredients that meet these standards. As regulations change, manufacturers adapt, enhancing ingredient innovation and product offerings to align with legal requirements. This dynamic interaction between regulations and industry fuels the market growth and sustains consumer trust in alcoholic beverages. Preferences of health-conscious consumers for natural and organic alcohol surge the market demand for the alcohol ingredients industry.

The appeal of a more natural profile, free from artificial additives, resonates with modern consumers. This shift toward nature-aligned ingredients has propelled the market growth, prompting manufacturers to embrace authenticity and tap into the growing demand for healthier and sustainable alcoholic beverages. Globalization and international trade are the factors that boost the alcohol ingredients market by introducing diverse flavors and materials from around the world, catering to different consumer preferences. This surge in cross-border exchange stimulates innovation, enhances product offerings, and fosters market growth. The interplay of ingredients across regions enriches the alcohol industry, increasing demand for unique and authentic beverages, which in turn, propels the market growth. Sustainability and ethical sourcing drive the growth of the alcohol ingredient market by aligning with conscientious consumer choices.

Embracing eco-friendly practices, such as organic sourcing and fair trade, resonates with socially responsible values. This surge in ethical awareness encourages producers to adopt sustainable approaches, attracting environment-conscious consumers. As mixologists craft innovative drinks, the need for unique ingredients rises, propelling producers to offer a wide array of options. This trend enhances the market, inspiring experimentation, and creativity, as consumers seek distinct taste experiences. The surge in cocktail culture fuels ingredient innovation, fostering growth and catering to evolving preferences in the alcohol industry. E-commerce and online sales boost the growth of the alcohol ingredients market by enabling broader access and exposure. This digital landscape facilitates the discovery of unique ingredients, giving smaller suppliers a global platform. Consumers can conveniently explore and purchase a wide range of alcohol ingredients.

Segmental Overview

The alcohol ingredients market forecast into ingredient type, beverage type, and region. By ingredient type, the market is divided into yeast, enzymes, flavor enhancers, colorants & stabilizers, and others. By beverage type, the market is categorized into beer, spirits, wine, and others. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, UK, France, Italy, Spain, Russia, and the rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Australia, and rest of Asia-Pacific), and LAMEA (Brazil, Argentina, Chile, South Africa, and rest of LAMEA).

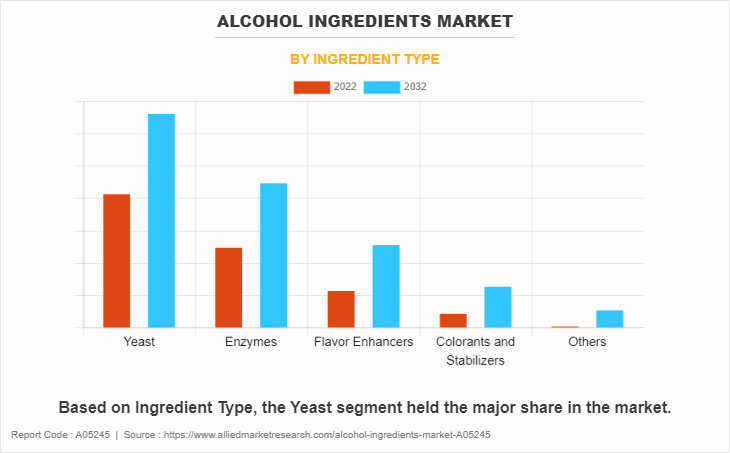

By Ingredient Type

The yeast segment held the major share in the alcohol ingredients market in 2022. Yeast trends in the market include the exploration of unique yeast strains to create unique flavor profiles. Moreover, the flavor enhancers segment is expected to grow with the highest CAGR during the forecast period. Flavor enhancer trends in the market involve the exploration of unique botanicals, fruits, and spices to create innovative taste experiences.

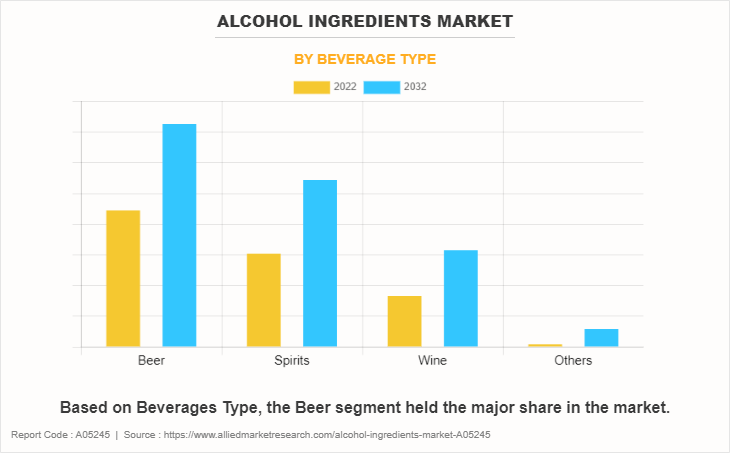

By Beverage Type

The beer segment held the major share in the market in 2022. Beer trends in the alcohol ingredients market include the surge in craft and artisanal brewing, driving demand for unique ingredients and flavors. Moreover, the spirits segment is expected to grow with the highest CAGR during the forecast period. Spirits trends in the market include the surge in craft distilling, focusing on unique flavors and small-batch production.

By Region

Europe held the major share in the alcohol ingredients market in 2022. In the market, Europe includes the processing of craft distillation and artisanal winemaking, with a focus on preserving traditional techniques while incorporating modern innovation. Sustainability practices are gaining momentum, along with an increasing demand for organic and locally sourced ingredients. However, Asia-Pacific is expected to grow with the highest CAGR during the forecast period. The Asia-Pacific market trends feature a rise in demand for traditional ingredients like yeast, enzymes, and exotic fruits to cater to regional preferences. Health-consciousness is driving the growth of low-alcohol and herbal-infused beverages.

Competition Analysis

The players in the alcohol ingredients market have adopted acquisition, business expansion, partnership, collaboration, and product launch as their key development strategies to increase profitability and improve their position in the market. Some of the key players profiled in the market analysis include Chr. Hansen Holding A/S, Cargill, Incorporated, Kerry Group plc, Carbery Creameries Limited, Ashland Inc., Döhler GmbH, Sensient Technologies Corporation, Archer-Daniels-Midland Company, and Greenfield Global Inc.

Recent Developments in the Market

- In 2023, Greenfield Global Inc., expanded its production capability with new warehouse at Toronto, Canada. This will allow company to meet the growing demand for its various materials including Methanol, Acetone and Acetonitrile

- In 2022, Chr. Hansen Holding A/S and Novozymes A/S a biosolutions provider announced merger, to strengthen their business position.

- In 2022, Carbery Creameries Limited expanded its flavors innovation and research focus by opening new R&D facility under its Synergy Flavors division.

- In 2020, Kerry Group plc introduced new technology for extraction of citric acids. This New! Citrus Extract technology allows extraction for alcohol beverages, teas, and juice drinks and can be labeled as Natural Extract. This will strengthen its business position in the market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the alcohol ingredients market analysis from 2022 to 2032 to identify the prevailing alcohol ingredients market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the alcohol ingredients market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global alcohol ingredients market trends, key players, market segments, application areas, and market growth strategies.

Alcohol Ingredients Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 4.1 billion |

| Growth Rate | CAGR of 4.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Ingredient Type |

|

| By Beverage Type |

|

| By Region |

|

| Key Market Players | Kerry Group plc, Archer-Daniels-Midland Company, Sensient Technologies Corporation, Greenfield Global Inc., Carbery Creameries Limited, Döhler GmbH, Cargill, Incorporated, Ashland Inc., Chr. Hansen Holding A/S |

Analyst Review

According to CXOs, the rise in global demand for alcoholic beverages, driven by changes in lifestyles, social trends, and higher disposable income, is a significant growth driver. The emergence of craft beverages and artisanal spirits increases the demand for premium and unique ingredients. In addition, the trend toward healthier options, sustainability, and organic products is encouraging the development of innovative ingredients. Personalization and customization are crucial dynamics, as consumers seek tailored experiences through flavor extracts, mixers, and infusion kits. Transparency and clear labeling are gaining importance as consumers seek information about ingredients and sourcing. Thus, the interplay of evolving consumer preferences, health-consciousness, sustainability, and cross-industry collaborations significantly shape the growth trajectory of the alcohol ingredients market.

The global alcohol ingredients market was valued at $2.6 billion in 2022, and is projected to reach $4.1 billion by 2032

The global Alcohol Ingredients market is projected to grow at a compound annual growth rate of 4.5% from 2023 to 2032 $4.1 billion by 2032

The players in the alcohol ingredient market have adopted acquisition, business expansion, partnership, collaboration, and product launch as their key development strategies to increase profitability and improve their position in the market. Some of the key players profiled in the market analysis include Chr. Hansen Holding A/S, Cargill, Incorporated, Kerry Group plc, Carbery Creameries Limited, Ashland Inc., Döhler GmbH, Sensient Technologies Corporation, Archer-Daniels-Midland Company, and Greenfield Global Inc.

Europe held the major share in the alcohol ingredient market in 2022.

Increasing Demand for Alcoholic Beverages, Personalization and Customization

Loading Table Of Content...

Loading Research Methodology...