Alternative Investment Funds (AIFs) Market Research, 2032

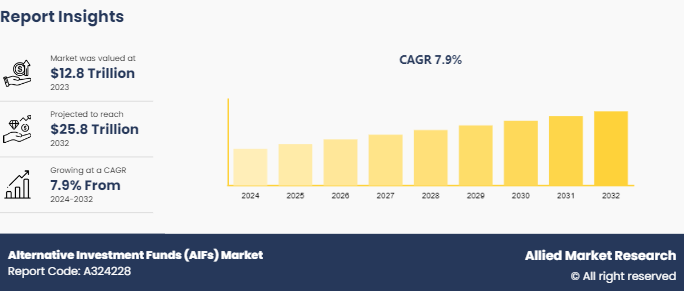

The global alternative investment funds (AIFs) market was valued at $12.8 trillion in 2023, and is projected to reach $25.8 trillion by 2032, growing at a CAGR of 7.9% from 2024 to 2032.

The market has experienced significant growth driven by increasing investor interest in diversifying portfolios beyond traditional assets, with private equity, hedge funds, and real estate emerging as popular investment avenues. Regulatory developments and the search for higher returns amid market volatility have further accelerated AIF adoption globally.

Market Introduction and Definition

Alternative Investment Funds (AIFs) refer to pooled investment vehicles that invest in assets beyond traditional stocks, bonds, and cash. These funds encompass a broad range of asset classes, including private equity, hedge funds, real estate, commodities, and infrastructure. AIFs are typically structured to provide investors with diversification benefits and opportunities for higher returns that are not correlated with conventional markets. They are often tailored for sophisticated or institutional investors due to their complex nature and higher risk profiles. Unlike traditional investments, AIFs operate with fewer regulatory restrictions, offering fund managers greater flexibility in their investment strategies. This flexibility, however, also entails higher risks and less liquidity. Regulatory frameworks for AIFs vary across jurisdictions, but they generally require disclosure of investment strategies, risks, and performance metrics to ensure transparency and protect investors.

The future opportunities for Alternative Investment Funds (AIFs) are promising, driven by several key trends and market dynamics. With traditional asset classes often delivering modest returns, investors are increasingly seeking higher yield and diversified portfolio options, positioning AIFs as attractive alternatives. The growing interest in private equity, venture capital, real estate, and hedge funds is expected to fuel the demand for AIFs.

Key Takeaways

The alternative investment funds (AIFs) market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major alternative investment funds (AIFs) industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key market dynamics

Alternative Investment Funds (AIFs) represent a diverse class of investment vehicles that pool funds from sophisticated investors to invest in assets beyond traditional stocks, bonds, and cash. The key market dynamics of AIFs are influenced by several factors. Firstly, regulatory frameworks, such as the Alternative Investment Fund Managers Directive (AIFMD) in Europe, shape the operational, reporting, and transparency standards, impacting fund management strategies and investor confidence. Secondly, the surge in need for diversification drives the demand for AIFs, as they offer exposure to non-traditional asset classes like private equity, real estate, hedge funds, and commodities, potentially delivering higher returns and risk-adjusted performance. Thirdly, market trends, including economic cycles and interest rate environments, affect asset valuations and investment strategies within AIFs. Additionally, technological advancements, such as the integration of AI and big data analytics, enhance due diligence, risk management, and operational efficiency in managing these funds. Finally, investor demographics, with a rising number of high-net-worth individuals and institutional investors seeking tailored investment solutions, further propel the growth and evolution of the Alternative Investment Funds (AIFs) market.

Public Policies of Global Alternative investment funds (AIFs) Market

Government policies governing Alternative Investment Funds (AIFs) vary by region but generally aim to ensure market integrity, protect investors, and promote financial stability. Key policies typically include regulatory frameworks such as the Alternative Investment Fund Managers Directive (AIFMD) in the European Union, which sets comprehensive rules on fund registration, disclosure, and reporting requirements. These regulations mandate that AIF managers obtain appropriate licenses, adhere to risk management standards, and provide detailed information on their investment strategies, risks, and performance to both regulators and investors. In the United States, the Securities and Exchange Commission (SEC) oversees AIFs, requiring them to register under the Investment Advisers Act of 1940, comply with anti-fraud provisions, and follow specific advertising rules. Additionally, tax policies can influence the structure and appeal of AIFs, with certain jurisdictions offering favorable tax treatments to attract fund managers and investors. Other policies may include restrictions on leverage, requirements for independent valuation of assets, and rules ensuring the segregation and safekeeping of investor assets.

Market Segmentation

The alternative investment funds (AIFs) market is segmented into type of funds, investor type, and region. On the basis of type of funds, the market is divided into private equity funds, hedge funds, real estate funds, infrastructure funds, venture capital funds, private debt funds, and others. On the basis of investor type, the market is classified into institutional investors, high-net-worth individuals (HNWIS) , retail investors, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The regional outlook of Alternative Investment Funds (AIFs) varies significantly across different markets, driven by local regulatory environments, investor preferences, and economic conditions.

In North America, particularly the U.S., AIFs have a mature and expansive market, characterized by a strong presence of hedge funds, private equity, and venture capital. The regulatory landscape, governed by the SEC, emphasizes investor protection and transparency, contributing to robust growth and innovation in this sector.

In Europe, AIFs are experiencing dynamic growth, propelled by the Alternative Investment Fund Managers Directive (AIFMD) , which harmonizes regulations across EU member states, enhancing cross-border fund distribution and investor protection. The UK, despite Brexit, remains a key hub for AIFs due to its established financial infrastructure and expertise.

In Asia-Pacific, the AIF market is rapidly expanding, with countries like China, India, and Singapore emerging as significant players. This growth is fueled by increasing wealth, a growing base of high-net-worth individuals, and supportive regulatory frameworks aimed at attracting foreign investment.

In regions like the Middle East and Africa, the AIF sector is in earlier stages of development but shows potential due to rising economic diversification efforts and infrastructure investments.

Industry Trends

The industrial trends of alternative investment funds (AIFs) are shaped by several key developments and shifts in the investment landscape. One significant trend is the increasing institutionalization of AIFs, with more pension funds, endowments, and insurance companies allocating substantial portions of their portfolios to alternative investments. This is driven by the quest for higher returns and diversification benefits. Further, there is a growing emphasis on Environmental, Social, and Governance (ESG) criteria, with many AIFs incorporating ESG factors into their investment strategies to attract ethically conscious investors and meet regulatory requirements. The rise of technology and data analytics is another major trend, enabling fund managers to enhance their investment processes, risk management, and operational efficiency.

Moreover, there is a noticeable shift towards illiquid assets, such as private equity, real estate, and infrastructure, as investors seek long-term value and stability. The industry is also witnessing increased regulatory scrutiny and standardization efforts to ensure transparency and protect investors. These trends collectively highlight a dynamic and evolving AIF landscape, characterized by innovation, increased investor interest, and a focus on sustainable and responsible investing. As per the report by World Health Report by Capgemini in 2021, the U.S. accounted for the most number of HNWIs people, with over 7.54 million. In addition, the percentage of HNWIs has gone up to 13.5% over the previous year in the U.S.

Competitive Landscape

The major players operating in the Alternative investment funds (AIFs) market include Blackstone Inc., The Carlyle Group, Apollo Global Management, Inc., KOHLBERG KRAVIS ROBERTS & CO. L.P., Brookfield Corporation, Tarrant Capital IP, LLC, Ares Management LLC, Bain Capital, LP, Oaktree Capital Management, L.P., and CVC Capital Partners SICAV-FIS S.A.

Recent Key Strategies and Developments

In July 2023, Franklin Templeton, a prominent global fund manager, introduced the Franklin Sealand China A-shares fund, aiming to provide retail investors in Singapore with an opportunity to invest in the China A-shares market. The fund's primary focus is on investing in China A-shares and equity securities of Chinese companies listed on the local stock exchange, with the objective of achieving long-term capital appreciation. The fund portfolio will comprise approximately 35 to 55 stocks, encompassing various industries, sectors, and market capitalizations.

In July 2022, a Middle Eastern industry alliance for investment management has been established. The Middle East Investment Management Association (MEIMA) will be the region's first regional institution of its kind, serving as the legitimate representative and insights hub for an industry that is a cornerstone of the Middle East economy.

in March 2021, eToro Ltd announced to take the company public. This announcement comes after the acquisition of Corp V. In addition, numerous institutional investors would become new eToro investors. Softbank Vision Fund 2, ION Investment Group, Fidelity Management & Research Company LLC, and Wellington Management are among them.

Key Sources Referred

U.S. Securities and Exchange Commission (SEC)

Commodity Futures Trading Commission (CFTC)

European Securities and Markets Authority (ESMA)

Financial Conduct Authority (FCA)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the alternative investment funds (AIFs) market analysis from 2024 to 2032 to identify the prevailing alternative investment funds (AIFs) market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the alternative investment funds (AIFs) market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global alternative investment funds (AIFs) market trends, key players, market segments, application areas, and market growth strategies.

Alternative Investment Funds (AIFs) Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 25.8 Trillion |

| Growth Rate | CAGR of 7.9% |

| Forecast period | 2024 - 2032 |

| Report Pages | 200 |

| By Type Of Funds |

|

| By Investor Type |

|

| By Region |

|

| Key Market Players | Apollo Global Management, Inc., KOHLBERG KRAVIS ROBERTS & CO. L.P., Bain Capital, LP, CVC Capital Partners SICAV-FIS S.A., Brookfield Corporation, Blackstone Inc., Tarrant Capital IP, LLC,, Oaktree Capital Management, L.P., Ares Management LLC, The Carlyle Group |

The global Alternative Investment Funds (AIFs) Market in 2023 was valued at $12.8 trillion.

Based on investor type, the institutional investors segment is expected to experience the fastest growth rate throughout the forecast period.

North America was the largest regional market for Alternative Investment Funds (AIFs) in 2023.

The global Alternative Investment Funds (AIFs) is expected to reach $25.8 trillion by 2032.

The major players operating in the Alternative investment funds (AIFs) market include Blackstone Inc., The Carlyle Group, Apollo Global Management, Inc., KOHLBERG KRAVIS ROBERTS & CO. L.P., Brookfield Corporation, Tarrant Capital IP, LLC, Ares Management LLC, Bain Capital, LP, Oaktree Capital Management, L.P., and CVC Capital Partners SICAV-FIS S.A.

Loading Table Of Content...