Alternative Sweeteners Market Research, 2031

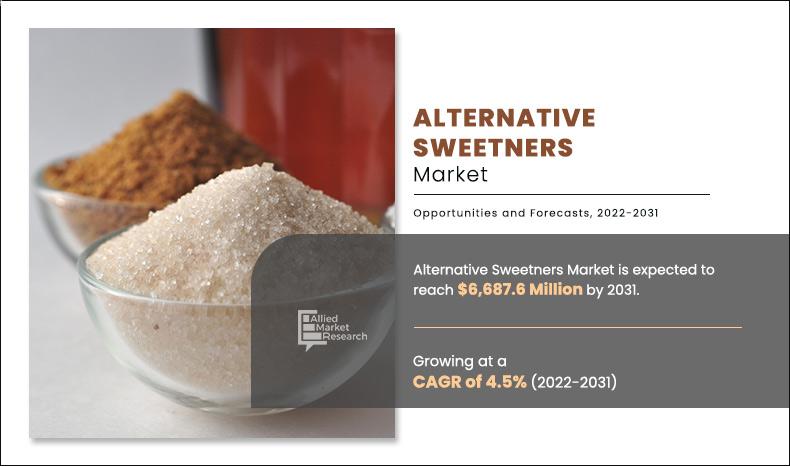

The global alternative sweeteners market size was valued at $4,156.7 million in 2020, and is projected to reach $6,687.6 million by 2031, growing at a CAGR of 4.5% from 2022 to 2031.

Alternative sweetener is an alternative to sugar to enhance and sweeten various foods & beverages. Moreover, alternative sweeteners are used in reduced concentration, as their level of sweetness is high as compared to regular sugar. These sweeteners are used as replacements to sucrose (sugar) due to the overall taste and low-calorie content.

Market Dynamics

Rise in consumer preference for natural and plant-based sweeteners has driven alternative sweeteners market demand, as health-conscious individuals seek reduced sugar intake without compromising on taste. Increased awareness of health concerns associated with sugar has led to a shift toward naturally derived options such as stevia, monk fruit, and allulose. Food and beverage manufacturers have responded by incorporating these ingredients into a wide range of products, including beverages, confectionery, dairy, and baked goods. The clean-label trend has further fueled this shift, as consumers increasingly favor products with transparent ingredient lists and minimal processing.

The growing availability of plant-based alternative sweeteners, supported by technological advancements and improved extraction methods, is expanding product innovation. Brands are formulating blends that enhance sweetness profiles while maintaining stability across different applications. Regulatory support for sugar reduction, combined with increasing adoption in functional foods and nutraceuticals, is further strengthening market growth. As consumers prioritize wellness and natural ingredients, manufacturers are focusing on expanding product portfolios with plant-based alternatives that align with evolving dietary preferences. The continued rise in demand for clean-label, plant-derived sweeteners is expected to support sustained alternative sweeteners market expansion in the coming years.

Moreover, the increase in prevalence of diabetes and obesity has significantly influenced consumer dietary preferences, driving demand for alternative sweeteners. Individuals managing diabetes seek sugar substitutes that do not cause rapid spikes in blood glucose levels, leading to higher adoption of low-glycemic and non-nutritive sweeteners. Similarly, those aiming to control or reduce body weight opt for sugar alternatives to lower calorie intake without sacrificing sweetness. This shift has encouraged food and beverage manufacturers to reformulate products with alternative sweeteners, expanding their use in categories such as beverages, dairy, bakery, and confectionery, thus driving alternative sweeteners market growth.

Rising health consciousness has further boosted alternative sweeteners market size, with consumers actively seeking sugar-free and reduced-sugar options. The availability of plant-based and naturally derived sweeteners, such as stevia and monk fruit, aligns with the preference for clean-label products. Advances in formulation technologies have improved taste profiles, which has made alternative sweeteners more appealing for widespread application. As consumers prioritize healthier lifestyles, manufacturers are expanding product portfolios with reduced-sugar and sugar-free options, strengthening the global alternative sweeteners market.

However, stringent regulatory approvals and labeling requirements present significant challenges for the alternative sweeteners market. Regulatory bodies impose strict safety evaluations and testing procedures before approving sweeteners for commercial use. Each alternative sweetener must undergo extensive research to determine its impact on human health, metabolic effects, and long-term safety, which can delay product launches and increase compliance costs for manufacturers. In addition, variations in approval standards across different regions create complexities for companies operating in multiple markets, requiring them to navigate diverse regulations before introducing products globally. These stringent processes limit the number of sweeteners available for use, restricting innovation and formulation flexibility in the food and beverage industry.

Labeling requirements further complicate market expansion, as manufacturers must ensure transparency regarding ingredient sourcing, health claims, and recommended usage levels. Consumers are increasingly cautious about artificial ingredients, and regulatory mandates often require clear disclosures about whether a sweetener is synthetic, plant-derived, or chemically modified. Inconsistent labeling norms across regions can also create confusion, affecting consumer trust and product acceptance. Meeting regulatory and labeling requirements demands significant investment in research, development, and compliance, making it challenging for new entrants and slowing growth of the alternative sweeteners market share.

Furthermore, advancements in fermentation-based and enzymatic production methods are creating significant alternative sweetener market opportunities by improving efficiency, cost-effectiveness, and sustainability. Fermentation technology enables the production of high-purity sweeteners, such as stevia glycosides and rare sugars, without the limitations of traditional extraction methods. By using microbial fermentation, manufacturers can produce alternative sweeteners at a larger scale with greater consistency in taste and functionality. This approach reduces reliance on agricultural sources, ensuring stable supply chains and addressing concerns related to land use and crop variability. Enzymatic processes further enhance the extraction and modification of sweeteners, allowing for improved sweetness profiles, reduced aftertaste, and better compatibility with various food and beverage formulations.

These innovations align with alternative sweetener market trends, expanding the range of sugar substitutes available to food manufacturers while meeting consumer demand for healthier options. Fermentation-derived sweeteners, such as allulose and tagatose, are gaining attention for their low-calorie benefits and sugar-like properties. The ability to tailor sweetness intensity and improve stability in different applications enhances product versatility. As the alternative sweetener market size continues to grow, advancements in fermentation and enzymatic processes are enabling the development of next-generation sugar alternatives, supporting innovation and market expansion.

Segment Overview

The global alternative sweeteners market segmentation is done on the basis of product type, application, and region. Depending on product type, the market is classified into high fructose syrup, high-intensity sweetener, and low-intensity sweetener. On the basis of application, it is categorized into food, beverage, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Product Type

By product type, the high-intensity sweetener segment is expected to hold a significant share in the global alternative sweeteners market. High-intensity sweeteners (HIS) are food additives used as a sugar substitute to give the flavor of sugar. The calorie content for these sweeteners ranges from 0 to 4 Kcal/gm ingredients and are used as flavor enhancers for food & beverage products. HIS is used as a diet-sugar to meet the demand for health-conscious consumers. Moreover, it can be used as a food additive once it is regulated by the Food and Drug Administration (FDA). It can further be used commercially after getting approval from Generally Recognized as Safe (GRAS), especially in North America and Europe.

By Product Type

Low intensity sweetners segment would exhibit the highest CAGR of 5.7% during 2022-2031, owing to Rise in demand for low intensity sweeteners in various food & beverage applications

By Application

By application, the food segment is expected to hold a significant share in the global alternative sweeteners market. The application of alternative sweeteners is high in food products owing to increasing demand for reduced sugar and sugar-free options without compromising taste and texture. Food manufacturers use alternative sweeteners in bakery, confectionery, dairy, and processed foods to cater to health-conscious consumers and those managing diabetes or weight. Sweeteners such as stevia, monk fruit, and polyols provide sweetness with fewer calories while maintaining product quality. Their functional benefits, including heat resistance, stability, and compatibility with various formulations, make them suitable for a wide range of food applications. Moreover, advancements in formulation technologies have improved taste profiles, reducing the aftertaste often associated with some sugar substitutes. The growing preference for natural and plant-based ingredients has further encouraged food producers to integrate alternative sweeteners into product development, supporting the demand for healthier food choices during the alternative sweeteners market forecast period.

By Application

Others segment would exhibit the highest CAGR of 5.2% during 2022-2031, owing to increasing demand for sugar free or suagr alternative confectionary products

By Region

By region, Asia-Pacific is expected to grow at the highest rate during the forecast period. This region offers lucrative opportunities for key manufacturers, owing to the presence of a wide range of suppliers and manufacturers. In addition, high economic growth rate, increase in purchasing power, and development in new food habits, such as consumption of low-calorie diet drinks and sodas are the other supplementary factors that fuel market growth during the alternative sweeteners market analysis.

By Region

Asia-Pacific would exhibit the highest CAGR of 5.1% during 2022-2031, owing to owing to it offers lucrative opportunities for key manufacturers, owing to the presence of a wide range of suppliers and manufacturers. In addition, high economic growth rate, increase in purchasing power, and development in new food habits

Competitive Analysis

Some of the key players operating in the alternative sweeteners market are Ajinomoto Co., Inc., Archer-Daniels-Midland-Company, Cargill Incorporated, DuPont Nutrition & Health, GLG Life Tech Corporation, Ingredion Incorporated, Naturex S.A., Tate & Lyle Plc., PureCircle Limited, and Associated British Foods Plc.

Key Benefits for stakeholders

This report provides quantitative analysis of the current trends, estimations, and dynamics from 2020 to 2031, which assist to identify the prevailing alternative sweeteners market opportunities.

Major countries in each region have been mapped based on the revenue contribution to the global market.

Market player positioning of the industry has been provided to provide a clear understanding of their competitive strengths.

The Porter's five forces analysis is used to illustrate the potential of suppliers and buyers in the alternative sweeteners industry.

Comprehensive analysis of factors that drive and restrict the growth of alternative sweeteners is provided.

The alternative sweeteners market trends report focuses on the regional & global market, the key players, and market segments apart from a detailed study on the divisions and application areas.

Alternative Sweeteners Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Application |

|

| By Region |

|

Analyst Review

Alternative sweeteners comprise structurally diverse set of compounds with a high level of sweetness as compared to sucrose (table sugar) that can be used as a substitute for sugar. A sugar substitute is a food additive compound that imparts a sweet taste to food but releases lesser food energy. Unlike sugar, alternative sweeteners are noncaloric and noncariogenic compounds, and hence their consumption does not cause dental caries. These sweeteners, such as high fructose syrup, high-intensity sweetener, and low-intensity sweetener, produced from different natural as well as artificial sources, are used in various applications that include food in dairy products, bakery foods, beverage, and others.

Alternative sweeteners have gained popularity in dairy products and snack foods in the recent years, owing to their high demand in low-sugar beverages and other food products. The initiatives by the leading food & beverage industry players to introduce natural sweeteners in soft drinks and other food items in the U.S. have fueled the market growth. The Food and Drug Administration (FDA) regulates sweeteners that can be used as a food additive, and they are commercially utilized after getting approval from the Generally Recognized as Safe (GRAS) program, particularly in Europe and North America. Furthermore, recent government measures in various nations, such as the UK, which put a sugar tax on sugar-based soft drinks, are some of the market's primary driving forces. Furthermore, due to greater health awareness among the population, the usage of cyclamate sweetener has expanded in diet beverages and food, particularly in Asia-Pacific and Africa.

Asia-Pacific dominated the global market in 2020. This region offers lucrative opportunities for key manufacturers, owing to the presence of a wide range of suppliers and manufacturers. In addition, high economic growth rate, increase in purchasing power, and development in new food habits, such as consumption of low calorie diet drinks and sodas, are other factors that fuel the growth of the alternative sweeteners market.

The global alternative sweeteners market size was valued at $4,156.7 million in 2020, and is projected to reach $6,687.6 million by 2031

The global Alternative Sweeteners market is projected to grow at a compound annual growth rate of 4.5% from 2022 to 2031 $6,687.6 million by 2031

Some of the key players operating in the alternative sweeteners market are Ajinomoto Co., Inc., Archer-Daniels-Midland-Company, Cargill Incorporated, DuPont Nutrition & Health, GLG Life Tech Corporation, Ingredion Incorporated, Naturex S.A., Tate & Lyle Plc., PureCircle Limited, and Associated British Foods Plc.

By region, Asia-Pacific is expected to grow at the highest rate during the forecast period

Rise in new applications of alternative sweeteners in the food industry and increase in demand for low-calorie sweeteners drive the growth of the global alternative sweeteners market

Loading Table Of Content...