The global aspartame market was valued at $375.5 million in 2021, and is projected to reach $561.7 million by 2031, growing at a CAGR of 3.9% from 2022 to 2031.

Aspartame is a type of high-intensity sweetener that is approximately 200 times sweeter than sugar and is used to increase the experience of sweetness during consumption. It is used in many foods and beverages because it is much sweeter than sugar. So much less of it can be used to give the same level of sweetness. Aspartame is commonly used as a tabletop sweetener, as a sweetener in prepared foods and beverages, and in recipes that don’t require too much heating (since heat breaks down aspartame). It can also be found as a flavoring in some medicines.

COVIDIMPACTSTATEMENT]

The COVID-19 pandemic affected the aspartame industry as many countries have considered sweeteners as a non-essential item during the pandemic. For instance, according to the annual report of the Ingredion, Mexico declared one or more brewing producers as “non-essential” industries for a period of time during the pandemic. The government's action affected customers since they were unable to purchase items during the government-mandated closure, thus affecting customer demand for the products. Furthermore, due to limits on the functioning of restaurants, bars, and geographically specialized sales channels, government-enacted stay-at-home directives have significantly limited end-consumer’s ability to buy certain food or beverage commodities in the U.S. and other markets.

Processed food has a longer shelf life and is consumed on the move. In addition, these processed meals are gaining popularity due to the convenience offered, as they save time and some packaged meals do not require additional heating before consumption. Moreover, the availability of processed food has increased over the years, which has influenced the eating habits of consumers. According to United Nations Children's Fund (UNICEF) in 2019-2020, school-aged teenagers consumed processed foods: 42% consumed carbonated sugary sodas at least once a day, and 46% ate fast food at least once a week. In addition, roughly 100 major corporations control 77% of global processed food distribution. Packaged processed food/ready-to-eat processed foods are extremely convenient, less time-consuming, and cost-efficient, and fewer efforts are required for meal preparation. These benefits have increased the demand for processed food, particularly among the working population and students. The increased demand for processed packaged foods is driving the need for asprtame by food manufacturing companies to carry on the production of processed food. The rising preference for processed food is expected to fuel the global aspartame market growth.

Sugar-based food and beverages are known to have adverse health effects and are responsible for increasing overall public health costs for the treatment of diabetes, tooth decay, and cardiovascular diseases. In 2019, global diabetes expenditure was about USD 760 billion, which is 10% of total spending on adults. The mounting pressure on the healthcare infrastructure of the countries has compelled the government to take up initiatives to lower sugar consumption. As per the World Health Organization (WHO) estimations, on average, a single can of drink contains around ten teaspoons of sugar. According to the data published by the American Diabetes Association, in 2018, around 10.5% of the population, or 34.2 million Americans were diagnosed with diabetes. Moreover, the statistics presented by the International Diabetes Federation (IDF) state that more than 465 million people lived with diabetes in 2019, with the number rising to 700 million by 2045, further driving the aspartame market demand.

The rising demand for natural and organic food products has encouraged the players to innovate and develop natural stevia, and leaves-based sweeteners. Consumers are nowadays seeking organic, plant-based low-calorie sweeteners for their food and beverages. This factor is expected to limit the revenue potential for the aspartame market. Over the years, concerns have been raised relating to artificial sweeteners and the health problems caused by them. Experts claim that aspartame has the potential to cause cancer and damage genes in the long run. However, many regulatory bodies, such as the U.S. Food and Drug Administration (FDA) and the WHO, among others, favor the proportional consumption of aspartame.

The changing consumer lifestyle and rising health awareness is decreasing the consumption of corn syrup and sugar. Consumers are gaining knowledge about the benefits and availability of different kind of low-calorie/zero-calorie sweeteners, therefore the demand for low-calorie sweeteners is rising rapidly. Low-calorie sweeteners are used in food and beverages to replace sugar and lower the levels of calories and carbohydrates. In addition, the sweetness provided by low-calorie sweeteners are more intense as compared to table sugar and hence are used in very small quantity. Sugar and corn syrups used as a sweetener cause adverse effects on the body such as increasing the risk of developing type 2 diabetes, weight gain, skin aging, and others, thus for this reason consumers are looking for low-calorie sweeteners. Moreover, the rising number of patients suffering from diabetes and growing consumer awareness play a major role in the consumption of these sweeteners. Therefore, the food & beverage industries are now more inclined toward the production of low-calorie meals and energy drinks with an increased focus on millennials.

Consumers across the globe have become health conscious and are shifting toward healthier living. Today, the rising purchasing power of consumers and increased focus on aesthetics has led to higher spending on products with additional benefits. There is a tremendous demand for supplements and nutraceutical products for attaining the necessary nutritional level and avoiding health problems. Key manufacturers are trying to cash in on the new health trends by including aspartame in supplements for improved taste. Increasing supplement consumption is expected to fuel the demand for aspartame in the coming future. China’s pharmaceutical industry is booming, with the market reaching USD 242 billion in 2018, up by 6.3% from the previous year. In recent years, China’s pharmaceutical industry has witnessed constant growth and is estimated to reach USD 161 billion by 2023.

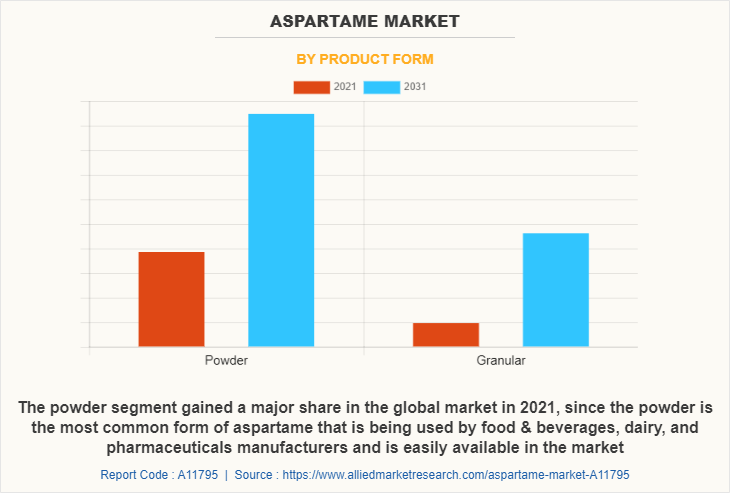

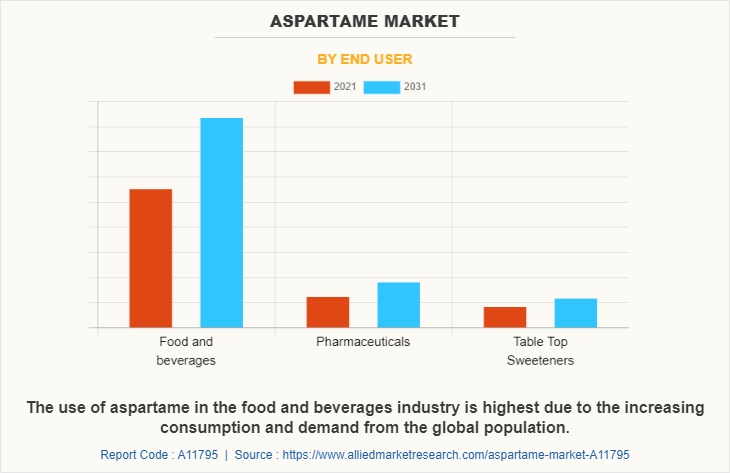

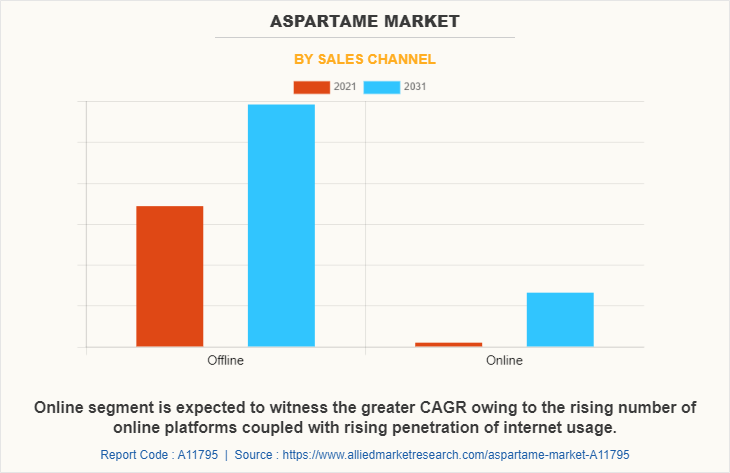

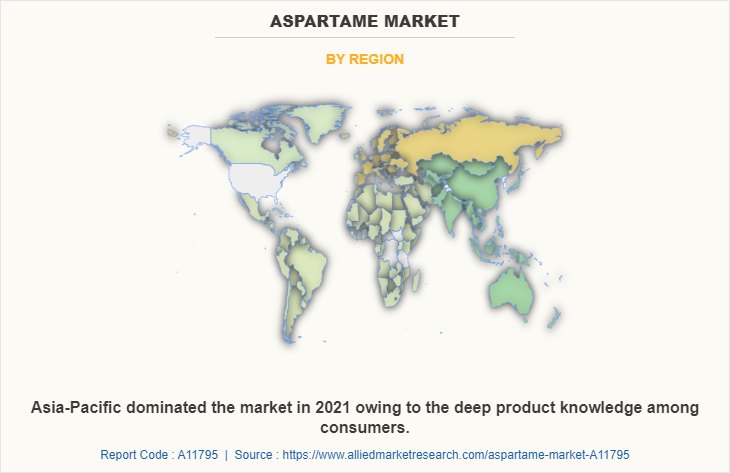

The aspartame market is segmented into product form, end-user, sales channel, and region. Depending on the form, the market is bifurcated into powder and granular. As per the end-user, it is segregated in food & beverages, pharmaceuticals, and tabletop sweeteners. Based on sales channels, it is categorized into offline and online sales channels. Region-wise, the market analysis is done across North America (the U.S., Canada, and Mexico), Europe (France, Germany, UK, Spain, Italy, and the rest of Europe), Asia-Pacific (India, China, Japan, Australia, New Zealand, and the Rest of Asia-Pacific), and LAMEA (Brazil, Argentina, Saudi Arabia, South Africa, and rest of LAMEA).

On the basis of product form, the powder segment gained a major share in the global market size in 2021 and is expected to sustain its market share during the forecast period as powder is the most common form of aspartame that is being used by the food & beverages, dairy, and pharmaceuticals manufacturers and is easily available in the market.

On the basis of end-user, the food & beverages segment gained a major share in the global market in 2021 and is expected to sustain its market share during the forecast period. The food and beverages segment is further bifurcated into beverages, bakery and confectionery, dietary products, and dairy products. The use of aspartame in the food and beverages industry is highest due to the increasing consumption and demand from the global population.

On the basis of sales channel, the offline segment dominated the global market and accounted for more than 70% of the global aspartame market share in 2021 and is expected to sustain its dominance during the forecast period whereas the online segment is expected to witness the greater CAGR owing to the rising number of online platforms coupled with rising penetration of internet usage.

On the basis of region, Asia-Pacific dominated the market in 2021 and is expected to remain dominant during the aspartame market forecast period. The dominance of the aspartame market in the region is largely due to the deep product knowledge among the consumers and the increase in the consumption of sugar by the local population.

Players operating in the global aspartame market have adopted various developmental strategies to expand their market share, increase profitability, and remain competitive in the market. The key players profiled in this report include Ajinomoto Co., Inc., Anant Pharmaceuticals, Changmao Biochemical Engineering Company Limited, Foodchem International Corporation, GELERIYA PRODUCTS, Global Calcium Pvt. Ltd., Hermes Sweeteners Ltd., HSWT, Ingredion Incorporated, Nantong Changhai Food Additive Co. Ltd., Prakash Chemicals Agencies, Taj Pharmaceuticals Limited, Vitasweet Co. Ltd., Whole Earth Brands, and Yogi Dye Chem Industries.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the aspartame market analysis from 2021 to 2031 to identify the prevailing aspartame market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the aspartame market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global aspartame market trends, key players, market segments, application areas, and market growth strategies.

Aspartame Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 561.7 million |

| Growth Rate | CAGR of 3.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 247 |

| By Product Form |

|

| By End user |

|

| By Sales Channel |

|

| By Region |

|

| Key Market Players | Ingredion Incorporated, Vitasweet Co. Ltd., Whole Earth Brands, Nantong Changhai Food Additive Co. Ltd., Foodchem International Corporation, Global Calcium Pvt. Ltd., GELERIYA PRODUCTS, Ajinomoto Co., Inc., Prakash Chemicals Agencies, Changmao Biochemical Engineering Company Limited, Yogi Dye Chem Industries, HSWT, Taj Pharmaceuticals Limited, Anant Pharmaceuticals, Hermes Sweeteners Ltd. |

Analyst Review

According to CXOs, the occurrence of obesity and weight-related concerns in individuals is rapidly growing, prompting people to change toward healthier eating options. Obesity raises an individual's risk of diabetes, cardiovascular mortality, and hypertension. Sugary products are not ideal for long-term consumption; therefore, the popularity of aspartame is expected to increase during the forecast period.

Hectic lifestyles of the urban population as well as a surge in the working population have reduced the time available for the consumption of cooked meals. This has encouraged the population to shift toward the consumption of processed food to fulfill hunger. As a result, to meet their calorie requirements, the population is migrating toward the consumption of sweet foods.

On the contrary, product awareness of high-intensity and low-calorie sweeteners is poor in rural regions, which acts as a barrier to the expansion of the aspartame market in emerging nations' rural areas. The development of urbanization in rural regions along with the availability of aspartame at an affordable price is predicted to flourish the market for aspartame in the upcoming years.

The global aspartame market was valued at $375.5 million in 2021, and is projected to reach $561.7 million by 2031

The global Aspartame market is projected to grow at a compound annual growth rate of 3.9% from 2022 to 2031 $561.7 million by 2031

Global Calcium Pvt. Ltd., Changmao Biochemical Engineering Company Limited, Taj Pharmaceuticals Limited, Foodchem International Corporation, Yogi Dye Chem Industries, Hermes Sweeteners Ltd., Vitasweet Co. Ltd., Ingredion Incorporated, Whole Earth Brands, HSWT, Prakash Chemicals Agencies, Anant Pharmaceuticals, GELERIYA PRODUCTS, Ajinomoto Co., Inc., Nantong Changhai Food Additive Co. Ltd.

On the basis of region, Asia-Pacific dominated the market in 2021

An increased awareness of aspartame’s health benefits, A rise in the number of people suffering from diabetes and obesity, The surging demand for low-calorie sweeteners in food and beverage products

Loading Table Of Content...

Loading Research Methodology...