Biotin Supplement Market Research, 2031

The global biotin supplement market size was valued at $583.4 million in 2021, and biotin supplement market forecast to reach $1.4 billion by 2031, growing at a CAGR of 9.1% from 2022 to 2031.

Biotin, a B vitamin, is an important nutrient that is naturally present in some food as well as available as a dietary supplement. Biotin helps turn the carbohydrates, fats, and proteins in the food into the energy needed. Vitamin B7 can be recognized by its popular name biotin. It is a water-soluble vitamin and is a cofactor for five carboxylases (propionyl-CoA carboxylase, pyruvate carboxylase, methyl crotonyl-CoA carboxylase [MCC], acetyl-CoA carboxylase 1, and acetyl-CoA carboxylase 2) which catalyze critical steps in the metabolism of fatty acid, glucose, and amino acids. Food that contain the most biotin include organ meats, eggs, fish, meat, seeds, nuts, and certain vegetables.

Biotin supplements are used to cure biotin deficiency. These are also used for hair loss, brittle nails, and other conditions. However, there is no good scientific evidence to support these. Biotin supplements might interfere with some lab tests. These supplements should be taken after consulting with the doctor. The adequate intake for biotin for men and women 19 years and older and pregnant women is 30 micrograms daily. Lactating women need 35 micrograms daily. There is no upper intake limit for biotin as it is a water soluble vitamin so extra biotin went out of the body with urine. The rise in awareness regarding biotin supplements and high inclination towards consumotion of such supplements are major biotin supplement market trends.

As per the report of the National Library of Medicine in the U.S., approximately 68% of adults used dietary supplements in 2019. Such huge usage of dietary supplements coupled with rise in awareness regarding the health benefits of dietary supplements is expected to drive the growth of the market. According to the Indian Journal of Medical Research (IJMR), around 33% of the population in the U.S. and several major nations of Europe like Denmark, the UK, and Sweden regularly consume dietary supplements and vitamin supplements which is expected to boost the biotin supplement market size.

As per an article by the National Library of Medicine, healthcare cost is directly affected by macroeconomic indicators since an increase in income levels of a country allows governments to increase their revenue through tax. Public healthcare costs are influenced by inflation as it affects the prices of goods and services including costs of health-related materials. The rise in healthcare costs, result in population’s limelight on biotin supplements so they can avoid healthcare expenses. According to the report of the Tennessee Advisory Commission on Intergovernmental Relations, in the U.S., healthcare is expensive. Healthcare costs have been increasing and are expected to continue rising over the next few years. From 2017 to 2018, healthcare spending increased by 4.6% to a total of $3.6 trillion, or $11,172 per person, and is expected to rise from 17.7% of gross domestic product (GDP) in 2018 to 19.7% in 2028, almost one of every five dollars spent in the U.S. These factors result in high healthcare costs which is expected to boost the biotin supplement industry.

Vitamins are needed to process functions such as growth, reproduction, and general well-being of a human. Rise in preference regarding vitamins in the daily diet for self-care has emerged as an important component of lifestyle among modern customers. There has been a rapid change in consumer food habits since consumers are focusing on health and immunity. There has been an expansion of the usage of vitamins, minerals, food that enhance immunity, organic goods, supplements, and other dietary aids.

According to the report of the National Library of Medicine, biotin deficiency leads to variable clinical presentations, mainly neurological and dermal abnormalities. Biotinidase deficiency is the most common etiology in many countries, including the U.S., and screening for biotinidase deficiency is a part of the newborn screening program. In addition, people have started focusing on their diet to improve their immunity due to COVID-19 pandemic. All such factors are projected to boost the growth of the biotin supplement market. However, interference of biotin supplements with certain lab tests can restrain the market growth. As biotin consumption can significantly interfere with certain lab tests and can result in incorrect test results which may go undetected. According to the report of the U.S. Food & Drug, the FDA has continued to receive adverse events reports indicating biotin interference caused falsely low troponin results.

Along with troponin, it can also interfere in immunoassays. Immunoassay is a procedure for detecting or measuring specific proteins or other substances through their properties as antigens or antibodies. According to the report of the National Library of Medicine, U.S., biotin interference can occur in immunoassays that employ streptavidin-biotinylated antibodies when high biotin levels in blood samples, resulting from the use of oral biotin supplements, interfere with the streptavidin-biotin binding, thus, distorting signal detection in these tests.

Along with this strict government regulation can also hamper the biotin supplement market growth since FDA regulates both finished dietary supplement products and dietary ingredients. FDA regulates dietary supplements under a different set of regulations than those covering "conventional" food and drug products. Manufacturers and distributors of dietary supplements and dietary ingredients are prohibited from marketing products that are adulterated or misbranded which means these firms are responsible for evaluating the safety and labeling of their products before marketing to ensure that they meet all the requirements of the Federal Food, Drug, and Cosmetic Act as amended by DSHEA and FDA regulations. FDA has the authority to take action against any adulterated or misbranded dietary supplement product after it reaches the market. Such regulation by the government can restrict the biotin supplement market demand.

Rise in demand for organic food can restrain the growth of the market as many food contain some biotin. Anyone can get recommended amounts of biotin by eating a variety of food, including meat, fish, eggs, and organ meats (such as liver), seeds, and nuts. Surge in demand for organic food is projected to hamper the growth of the biotin supplement market since according to the report of the National Institutes of Health Office of Dietary Supplements, biotin is an essential nutrient that is naturally present in some food so if a person consumes food, then that person does not require biotin supplements. Animal-based protein sources like beef liver, chicken liver, salmon, and eggs have a high biotin content. The rise in demand for organic animal-based protein coupled with increase in awareness regarding healthy food habits are encouraging consumers to choose organic food products, which is projected to restrain the growth of the market. Rise in consumption of alcohol among global population is expected to create an opportunity for the growth of the market as alcoholism can lead to biotin deficiency. As per the report of Harvard T.H. Chan School of Public Health, alcoholism can increase the risk of biotin deficiency and many other nutrients as alcohol can block their absorption, and also because alcohol abuse is generally associated with poor dietary intake. There is a huge population suffering from alcohol use disorder which is expected to increase the number of people suffering from biotin deficiency.

According to the report of the National Institute on Alcohol Abuse and Alcoholism, in the U.S., 14.5 million (nearly 15 million) people ages 12 and older (5.3 % of this age group) had alcohol use disorder (AUD). This number includes 9.0 million men (6.8 % of men in this age group) and 5.5 million women (3.9 % of women in this age group) in 2019. According to the report of Our World in Data organization globally, 107 million people are estimated to have an alcohol use disorder. Such a huge number of alcoholic disorders can lead to biotin deficiency in people which is expected to boost the biotin supplement market growth. Along with this, rise in number of online pharmacies is expected to create an opportunity for the growth of the market as it is easy for consumers to purchase biotin supplements online since it provides them with a home delivery facility and they can get the information about the product while sitting at home. There is a huge rise in the number of online pharmacies worldwide. Online pharmacies like Apollo, Netmeds, Pharmeasy, and others provide various offers and discounts to consumers to lure them. A surge in the number of online pharmacies is expected to create an opportunity for the market growth. According to the report of Invest India Indian e-Pharmacies, which emerged around 2015, have disrupted the market growth and gained traction rapidly. Currently, there are close to 50 e-Pharmacies in India and estimates peg the market size (2019) at $0.5B – approximately 2-3% of the total Indian pharmacy sales. The market is expected to grow at a compounded rate of 44% to reach $4.5B by 2025. Such rise in e-pharmacies is expected to create biotin supplement market opportunity.

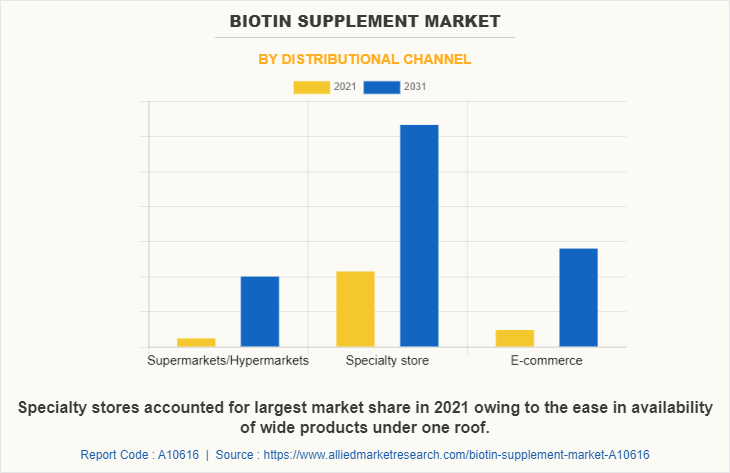

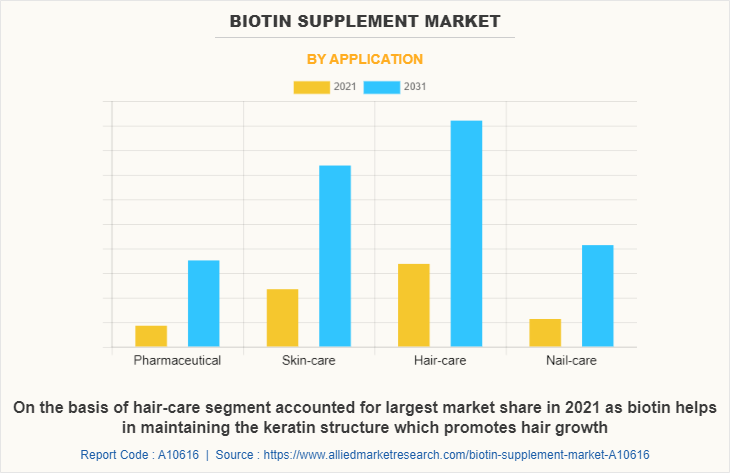

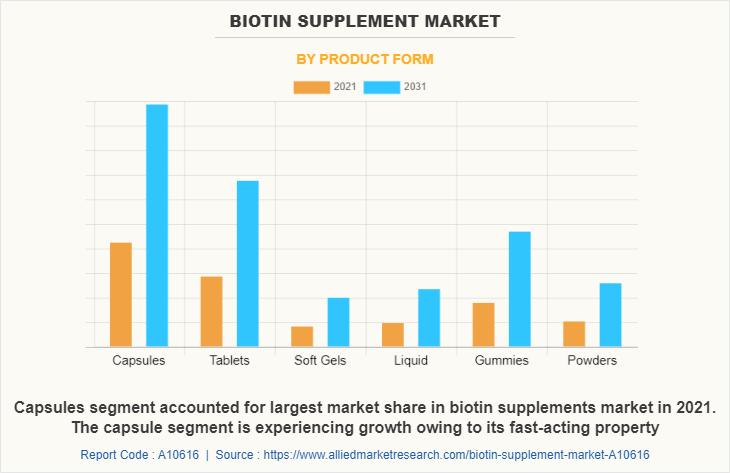

The biotin supplement industry is segmented into Distributional Channel, Application and Product Form. By product form, the market is divided into capsules, tablets, soft gels, liquid, gummies, and powders. By distributional channel, the market is further divided into supermarkets, specialty stores, and e-commerce. By application, the market is classified into pharmaceuticals, skin-care, health-care, and nail-care.

By distributional channel, the online segment is expected to register the highest growth with a CAGR of 9.2% owing to easy availability and the benefits such as knowledge about the attributes of the products, and time-saving features.

Hair-care is expected to dominate the market during the forecast period on the basis of application with a CAGR of 8.7% owing to the changing fashion trends and increased awareness of the availability of new, more effective, and safer hair care products.

By product form, the capsules segment dominated the market in 2021 and is expected to remain dominant during the forecast period registering a growth of 8.7%. This growth is owing to its fast-acting property as it is absorbed by the body faster compared to other forms of biotin supplements.

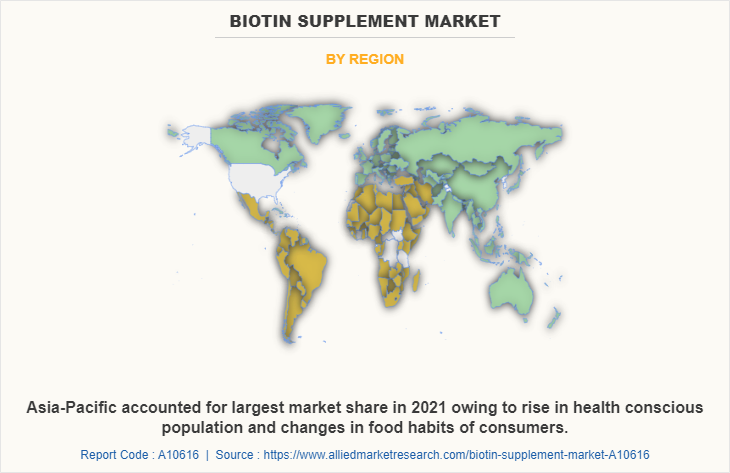

Asia-Pacific dominated the biotin supplement market share in 2021 and is expected to register a highest growth with a CAGR of 9.7% owing to its huge population coupled with rise in disposable income.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the biotin supplement market analysis from 2021 to 2031 to identify the prevailing biotin supplement market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the biotin supplement market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global biotin supplement market trends, key players, market segments, application areas, and market growth strategies.

Biotin Supplement Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1.4 billion |

| Growth Rate | CAGR of 9.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 240 |

| By Distributional Channel |

|

| By Application |

|

| By Product Form |

|

| By Region |

|

| Key Market Players | Doctor's Best, Inc., SolaGarden Naturals, Zenwise, LLC, Sports Research Corporation, Nestle S.A., Vytalogy Wellness, L.L.C., Designs for Health, Inc., NOW Health Group, Inc., Nutraceutical Corporation, SBR Nutrition, Church & Dwight Co., Inc., Life Extension |

Analyst Review

According to the CXO, the factors such as an increase in awareness regarding biotin supplement advantages, and increased preference regarding vitamins in daily diet are expected to propel the growth of the market. However, interference of biotin with certain lab tests and stringent regulatory structure & intervention is expected to hamper the market growth during the forecast period. CXOs further added, the rise in the number of alcoholic people is expected to create an opportunity for the growth of the market. Biosyntia a manufacturer of biotin introduced the world’s first natural and sustainable biotin from the fermentation process. Thus, rise in the number of alcoholic people and increase in innovations by the manufacturers are expected to drive the growth of the biotin supplements market. Conversely, an increase in R&D activities in the field of the biotin supplements market is expected to provide substantial growth opportunities for the industry players in the near future

The global biotin supplement market size was valued at $583.4 million in 2021, and biotin supplement market forecast to reach $1.4 billion by 2031

The global Biotin Supplement market is projected to grow at a compound annual growth rate of 9.1% from 2022 to 2031 $1.4 billion by 2031

Nutraceutical Corporation, NOW Health Group, Inc., Vytalogy Wellness, L.L.C., SolaGarden Naturals, Church & Dwight Co., Inc., Life Extension, Sports Research Corporation, SBR Nutrition, Nestle S.A., Zenwise, LLC, Designs for Health, Inc., Doctor's Best, Inc.

Asia-Pacific dominated the biotin supplement market share in 2021

Interference with certain lab tests, Increase in demand for organic food

Loading Table Of Content...