Car Security Systems Market Insights, 2034

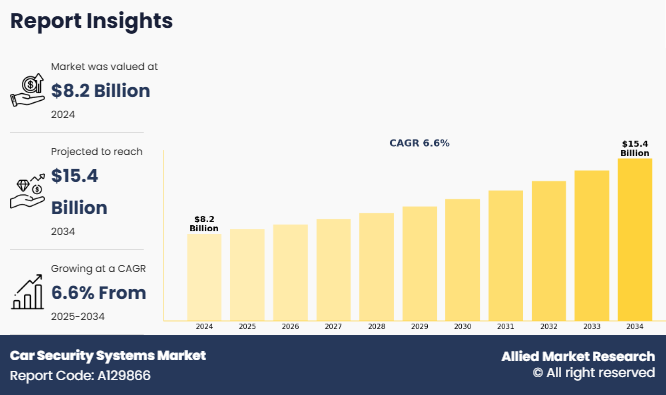

The global car security systems market size was valued at USD 8.2 billion in 2024, and is projected to reach USD 15.4 billion by 2034, growing at a CAGR of 6.6% from 2025 to 2034.

Report Key Highlighters:

- The car security systems market analysis covers 14 countries. The research includes regional and segment analysis of each country in terms of value ($million) for the projected period 2024-2034.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The car security systems market share is highly fragmented, into several players including HELLA GmbH & Co. KGaA, Robert Bosch GmbH, ZF Friedrichshafen AG, BorgWarner Inc., Continental AG, Denso Corporation, Valeo S.A., Cautio, Meta System SpA, and Kiramek. These companies have adopted strategies such as product launches, contracts, expansions, agreements, and others to improve their market positioning.

A car security system is a collaboration of hardware and software which are installed in a vehicle to enhance its safety by preventing unauthorized use, access, or theft. These systems can be factory-installed or can be installed aftermarket. Car security system includes range from basic lock mechanisms to advanced electronic modules. Key components include remote locking, car alarms, steering wheel locks, engine immobilizers, and real-time telematics. In newer vehicles models, car security systems are often connected to cloud-based services and mobile apps, enabling owners to remotely monitor and control their vehicle’s security status. These systems are crucial for safeguarding the vehicle but also for ensuring passenger safety while driving.

Factors such as stringent security regulations, increase in vehicle theft, and growth in advancements in connected vehicle technology drive the growth of the market. However, factors such as high cost of premium security features and potential failure of electronic components used in vehicle security hamper the growth of the market. On the contrary, factors such as growth in electric and autonomous vehicles and integration with smart homes & IoT technology offer lucrative market growth opportunities for the global car security systems market.

Government and regulatory bodies around the world are implementing strict regulatory measures to reduce vehicle theft and improve road safety. These regulations mandate the installation of advanced security features such as immobilizers, GPS tracking, biometric authentication, and alarm systems in new vehicles to improve car security. For instance, in September 2020, the European Union Regulation No. 2018/858, enforced vehicle manufacturers that all new manufactured vehicles must include anti-theft protection systems to enhance vehicle security.

Likewise, in the U.S., the Federal Motor Vehicle Safety Standard 114 mandates that all passenger cars must have an engine immobilizer to prevent unauthorized use. Similarly, Canada also implemented the Motor Vehicle Safety Regulations, which requires all new vehicles to be equipped with electronic immobilizers. These regulations have led automotive manufacturing companies and aftermarket car security system providers to develop and integrate advanced security technology, which can comply with legal requirements. These regulations have prompted automotive manufacturing companies and aftermarket car security system manufacturers to develop advanced security technologies that can comply with legal standards, which in turn is expected to propel the market growth throughout the forecast period.

Key Developments In The Car Security Systems Industry

The leading companies are adopting strategies such as acquisition, agreement, expansion, partnership, contracts, and product launches to strengthen their market position.

- On March 2024, HELLA GmbH andamp; Co. KGaA announced it has received series orders for the digital Smart Car Access system. The new digital smart access system allows hands-free vehicle access with a smartphone, thus avoiding relay attacks on vehicles. The system allows track signs such as breathing rate and movement patterns of the occupants to recognize whether children or infants have been left alone in the vehicle.

- On January 2024, Robert Bosch GmbH partnered with Qualcomm for the development of a new central vehicle computer for digital cockpit and driver assistance functions. The new cockpit and ADAS integration platform are based on the Snapdragon Ride Flex system-on-chip. The new technology will empower automakers to a unified central compute and software-defined vehicle architecture and will offer ADAS features such as object/traffic light/lane detection, automated parking, intelligent and personalized navigation, and voice assistance.

- On May 2024, Brogwarner Inc. announced it will be supplying its electric Torque Vectoring and Disconnect (eTVD) system for battery electric vehicles (BEVs) to Polestar and other major European OEMs. The eTVD is part of BorgWarner's electric torque management system (eTMS) solutions portfolio, which is designed to intelligently control wheel torque to increase stability, thus providing superior dynamic performance, and improved traction during launch and acceleration.

Segmental analysis

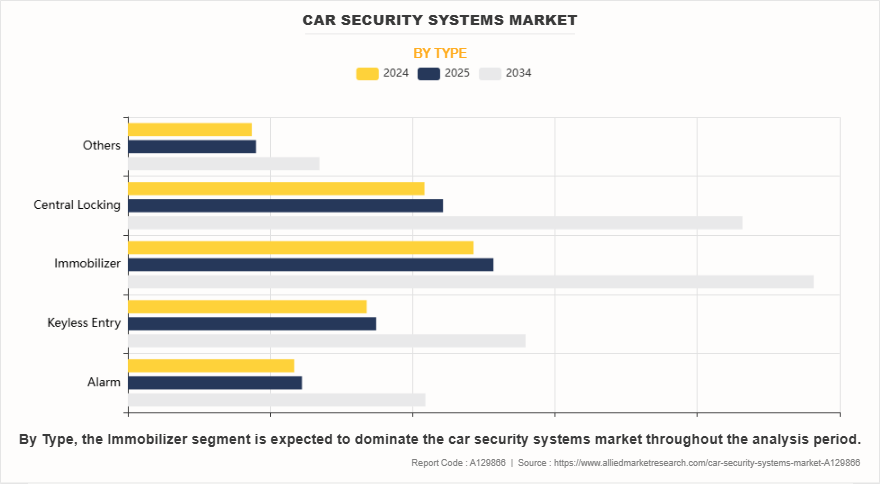

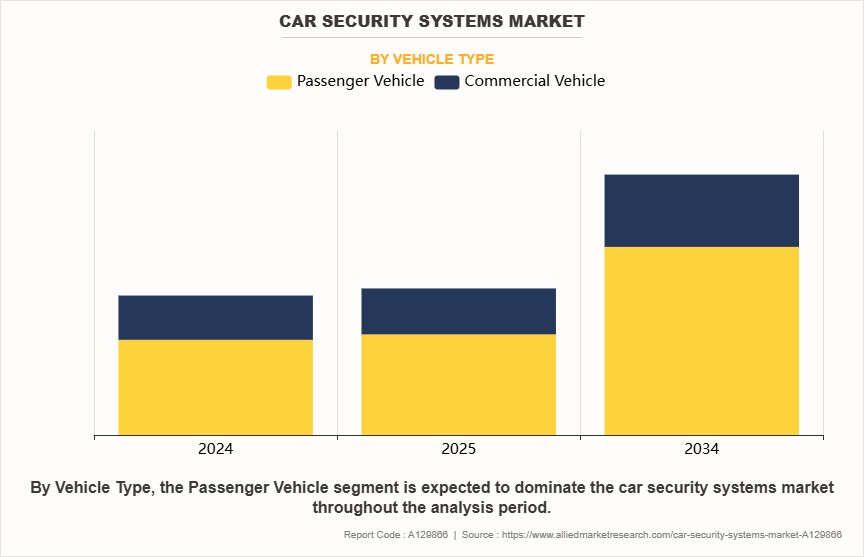

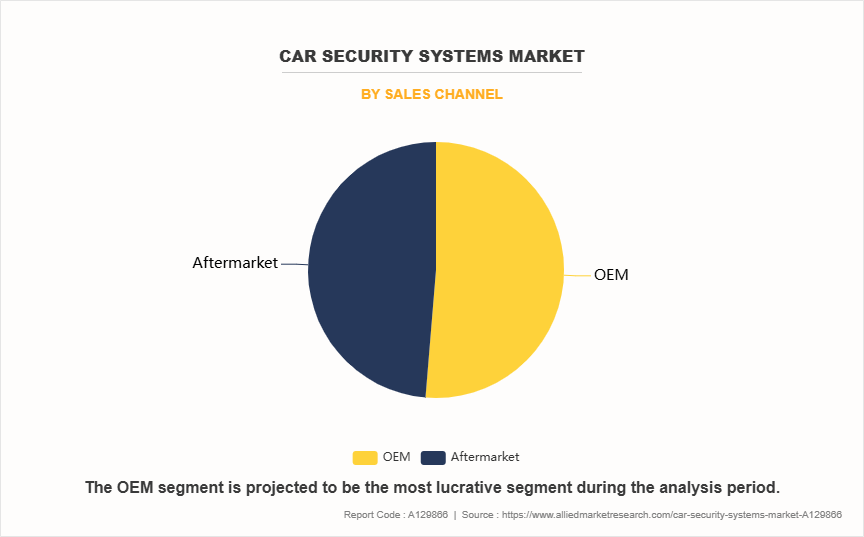

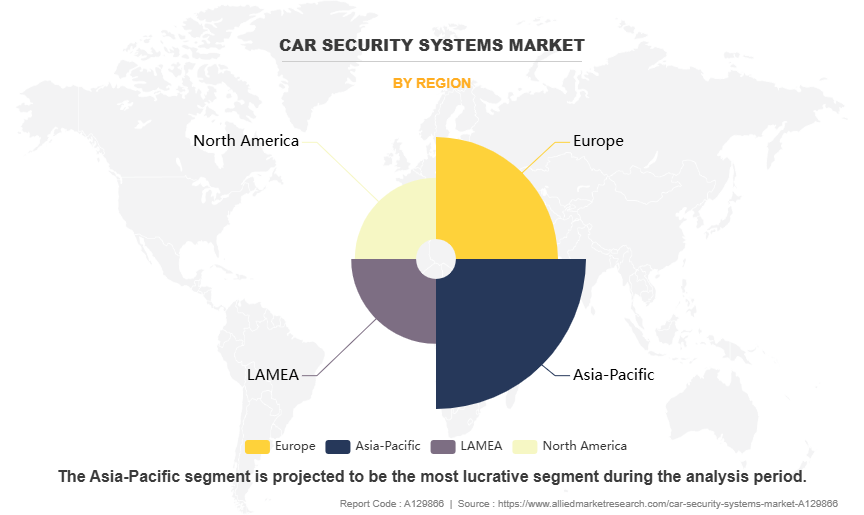

The global car security systems Industry is segmented into type, vehicle type, sales channel, and region. On the basis of type, the market is segregated into alarm, keyless entry, immobilizer, central locking, and others. By vehicle type, the market is segregated into passenger vehicles and commercial vehicles. On the basis of sales channel, the market is bifurcated into OEM and aftermarket. Region wise, the market is analysed across North America, Europe, Asia-Pacific, and LAMEA.

By Type

By type the car security systems market is categorized into alarm, keyless entry, immobilizer, central locking, and others. The immobilizer segment dominated the global market share in 2024, owing to their proven effectiveness in preventing vehicle theft. Moreover, governments and regulatory bodies around the world are mandating the inclusion of immobilizer systems in new vehicles, especially in Europe and North America. Additionally, Immobilizers have a tamper-resistant design makes them a an ideal choice among automobile manufacturers. Furthermore, as vehicle security threats evolve with digital hacking, immobilizers are also advancing with encrypted and code-rolling technology, further driving the market demand.

By Vehicle Type

By vehicle type the car security systems market trends is segregated into passenger vehicles and commercial vehicles. The passenger vehicle segment dominated the global market share in 2024, owing to growing demand for safety systems in passenger vehicles due to increasing consumer awareness, stricter government regulations, and a rising number of road accidents. Moreover, modern consumers are actively looking for vehicles with advanced safety features such as airbags, lane departure warning, automatic emergency braking (AEB), and blind-spot monitoring. For instance, in Europe and North America, several of these features have become mandatory in new vehicles. Automakers are also using safety technology as a major selling point in advertisements, especially for family-oriented vehicles like SUVs.

By Sales Channel

On the basis of sales channel the global car security systems market growth is segmented into OEM and Aftermarket. The OEM segment dominated the global market share in 2024 owing to, increasing consumer expectations, and the growing competition among automobile manufactures to offer cutting-edge safety features in vehicles. Moreover, governments around the globe are enforcing stricter safety norms, for instance, mandates regarding the inclusion of emergency braking and lane-keeping assist in new vehicles in the European Union and U.S. are driving the market demand. Likewise, OEMs are also investing heavily in integrated systems like radar, lidar, and AI-based driver monitoring, further driving the growth of the segment.

By Region

On the basis of region the global car security systems market size is analyzed into North America, Europe, Asia-Pacific, and LAMEA. The Asia-Pacific segment accounted for a dominant market share in 2024, owing to rise in vehicle ownership, due to increased availability of financing options and easier access to loans resulted in surge in both new and used car ownership. As more individuals are investing in personal transportation solutions, there is growing demand for effective car security solutions. Moreover, the increasing rate of urbanization, along with the rise of smart city projects, has further accelerated the demand for intelligent vehicle security technologies. Moreover, technological advancements and the decreasing cost of high-end security systems has further resulted in market growth.

Increase in vehicle theft

In recent years, vehicle theft has been steadily increasing around the world. Criminals are now using advanced methods to steal cars, making security a top priority for both car owners and automakers. As a result, modern consumers and automobile companies are investing in high-tech security solutions like GPS tracking, biometric authentication, remote immobilizers, and AI-powered surveillance to protect vehicles from theft.

For example, in the U.S., according to a data from the National Insurance Crime Bureau showed that over 1 million vehicles were stolen in 2023. In the UK, cars like Range Rovers are among the most commonly stolen, and some insurance companies even refuse to cover them because they are often targeted using keyless entry hacking methods. In India, major cities like Delhi and Bengaluru saw a sharp rise in vehicle thefts between 2022 and 2023, as they are easier to resell.

The growing risk of car theft has led both automobile manufacturers and aftermarket companies to invest in more advanced security systems. Similarly, modern car security systems are integrated with features such as biometric authentication, smart keys, GPS tracking, real-time geofencing alerts, and remote immobilization to reduce car theft. For instance, Tesla cars are implementing Sentry Mode, which uses cameras to continuously monitor the area around the car and alert the owner if something suspicious happens. Similarly, aftermarket brands like Viper and LoJack are offering GPS-enabled alarm and tracking systems. These technologies help stop vehicle theft and also make it easier to locate and recover stolen vehicles quickly.

Growing trends towards electric and autonomous vehicles

The growing trend toward electric and autonomous vehicles are anticipated to offer lucrative opportunity for the growth of car security system market during the forecast period. As electric and autonomous vehicles are becoming more advanced, they are reliant on software, connectivity, and artificial intelligence.

In comparison to traditional cars, electric and autonomous vehicles are more exposed to cybersecurity threats, such as hacking, data theft, or system manipulation, due to their dependence on internet connectivity and digital control systems. This creates a huge demand for advanced and next-generation security features, which offers more vehicle security in comparison to basic anti-theft in traditional vehicles.

To tackle the growing demand for security features in electric and autonomous vehicles, companies are developing advanced security tools such as intrusion detection systems, encryption technologies, secure cloud platforms, and AI-powered threat monitoring. Moreover, as governments and regulatory bodies are introducing cybersecurity standards for autonomous and electric vehicles, the demand for robust security systems in electric vehicle will grow further. Hence, the growing consumer preference towards electric and autonomous vehicles along with strengthening regulatory standards are anticipated to offer lucrative growth opportunity for the car security system market during the review period

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the car security systems market forecast, segments, current trends, estimations, and dynamics of the car security system market analysis from 2023 to 2034 to identify the prevailing car security systems market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global car security systems market demand trends, key players, market segments, application areas, and market growth strategies.

Car Security Systems Market Report Highlights

| Aspects | Details |

| Market Size By 2034 | USD 15.4 billion |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2024 - 2034 |

| Report Pages | 279 |

| By Vehicle Type |

|

| By Sales Channel |

|

| By Type |

|

| By Region |

|

| Key Market Players | Cautio, HELLA GmbH & Co. KGaA, BorgWarner Inc., ZF Friedrichshafen AG, Valeo S.A., Robert Bosch GmbH, Meta System spa, Continental AG, DENSO Corporation, Kiramek |

The car security systems market was valued at $8,230.0 million in 2024 and is estimated to reach $15,367.6 million by 2034, exhibiting a CAGR of 6.6% from 2025 to 2034.

The integration of AI and ML technology are the upcoming trends in the car security system industry.

Asia-Pacific is the largest regional market for car security systems.

Factors such as stringent security regulations, increase in vehicle theft, and growth in advancements in connected vehicle technology drive the growth of the market. However, factors such as high cost of premium security features and potential failure of electronic components used in vehicle security hamper the growth of the market. On the contrary, factors such as growth in electric and autonomous vehicles and integration with smart homes & IoT technology offer lucrative market growth opportunities for the global car security systems market.

HELLA GmbH & Co. KGaA, Robert Bosch GmbH, ZF Friedrichshafen AG, BorgWarner Inc., Continental AG are some of the major companies operating in the market.

Loading Table Of Content...

Loading Research Methodology...