Cheese Crumbles Market Research, 2033

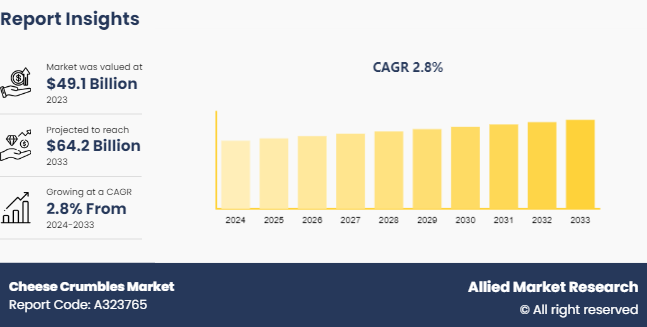

The global cheese crumbles market was valued at $49.1 billion in 2023, and is projected to reach $64.2 billion by 2033, growing at a CAGR of 2.8% from 2024 to 2033.

Market Introduction and Definition

Cheese crumbles are small, crumbled pieces of cheese, often used as toppings or ingredients in various culinary applications, adding flavor, texture, and visual appeal to dishes such as salads, soups, pizzas, and baked goods. These crumbles can be derived from a variety of cheese types, including blue cheese, feta, goat cheese, and more, catering to diverse taste preferences. The cheese crumbles market is driven by their convenience, versatility, and alignment with current food trends highlighting gourmet and health-conscious eating. As an easily incorporable ingredient, cheese crumbles meet the growing demand for ready-to-use and time-saving food options, making them popular among both home cooks and foodservice providers. The rising consumer interest in artisanal and organic products, along with innovations in flavor and packaging, further enhances the cheese crumbles market growth.

Key Takeaways

The cheese crumbles market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major cheese crumbles industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The health and wellness trends significantly surge the cheese crumbles market demand by aligning with the increasing consumer preference for nutritious and convenient food options. As more individuals adopt health-conscious lifestyles, there is an increased awareness of the nutritional benefits of cheese, such as its high protein, calcium, and essential vitamin content. Cheese crumbles, often perceived as a versatile and easy-to-use ingredient, fit seamlessly into various dietary menu, including low-carb, ketogenic, and high-protein diets. This versatility makes them an attractive addition to salads, soups, and snacks, providing both flavor and nutrition without the need for extensive preparation. Additionally, as per the cheese crumbles market forecast, trend towards clean eating and organic foods has led to a surge in demand for natural and minimally processed cheese products, including organic cheese crumbles. Consumers are increasingly seeking products that are free from artificial additives and preservatives, and cheese crumbles that meet these criteria are gaining popularity. Moreover, the importance of portion control in modern dietary practices supports the use of pre-portioned cheese crumbles, allowing consumers to manage their intake effectively. These health and wellness trends collectively drive the demand for cheese crumbles, positioning them as a favored choice among health-conscious consumers seeking both convenience and nutritional benefits.

However, cheese crumbles often come with a higher price tag due to factors such as the quality of ingredients, artisanal production methods, and brand positioning. This cost barrier can warn a substantial portion of the consumer base, particularly those with limited disposable incomes or those who prioritize budget-friendly food options. In competitive markets, where numerous alternatives exist, the higher cost of cheese crumbles can push consumers towards more affordable substitutes, such as block cheese or non-dairy alternatives, which offer similar culinary benefits at a lower price. Additionally, price sensitivity is pronounced in emerging markets where the overall spending power is lower, further constraining the cheese crumblesmarket growth. Even health-conscious consumers, who are typically willing to spend more on nutritious products, might reconsider their purchasing decisions when faced with the high costs of premium cheese crumbles. Retailers and foodservice providers may also hesitate to stock expensive cheese crumbles in large quantities owing to the risk of slower turnover and potential waste, thereby limiting cheese crumbles market penetration. Consequently, the high-cost acts as a significant restraint, reducing the broader adoption and growth potential of the cheese crumbles market size.

Moreover, as busy lifestyles drive demand for time-saving food options, cheese crumbles emerge as a versatile ingredient that can enhance a wide range of ready-to-eat and convenience foods. These pre-portioned, easy-to-use crumbles can be quickly sprinkled on salads, soups, pizzas, and various dishes, adding rich flavor and texture without additional preparation time. This convenience appeals to both home cooks looking to simplify meal preparation and foodservice providers aiming to streamline kitchen operations. Moreover, the growing popularity of meal kits and pre-packaged salads offers a natural fit for cheese crumbles, providing consumers with gourmet-quality ingredients that are ready to use straight from the package. The ability to incorporate cheese crumbles into these products meets the demand for high-quality, convenient food solutions, enhancing their appeal. Additionally, as consumers seek healthier convenience foods, the nutritional benefits of cheese crumbles—such as high protein and calcium content—make them an attractive addition to health-focused ready-to-eat products. This trend not only boosts the demand for cheese crumbles but also increases cheese crumbles market share.

Parent Market Overview

Cheese Importer-Exporter Trade Statistics of 2023

In the arena of global trade, one commodity that has constantly held a unique area is cheese. Whether it's the wealthy and creamy French brie or the pointy and tangy cheddar from England, cheese is a staple in cuisines around the globe. In 2023, the worldwide cheese enterprise is experiencing considerable shifts in import and export patterns. The HS Code for Cheese is 0406. The international cheese market in 2023 stood at $163.81 billion and its miles are expected to go $213.72 billion by 2032, developing at a fee of 3% according to year from 2023 to 2032. As we flow similarly, let's take a closer look at the cheese import-export trade statistics for 2023, the pinnacle of the top 10 cheese importers, cheese exporters, and producers, and what the future holds for this cherished dairy product.

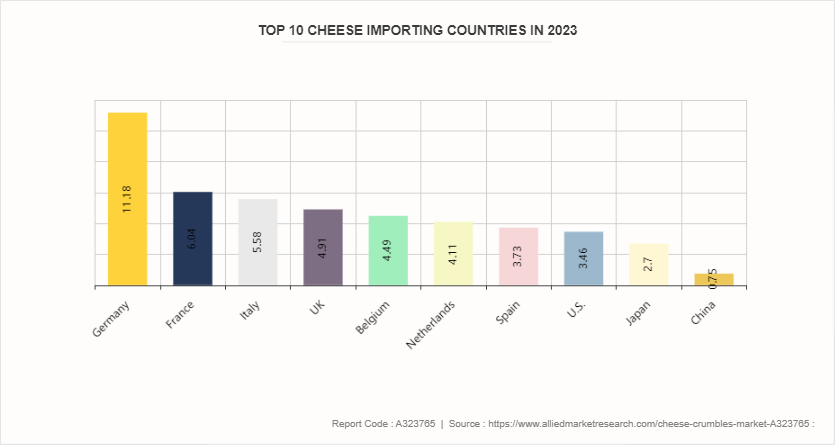

Top 10 Cheese-Importing Countries in 2023

The total fee of cheese imported in 2023 is around $79.87 billion. Germany emerged as the largest cheese importer in 2023 with a value of $11.18 billion. The pinnacle 10 cheese importers in 2023 are mentioned below in graph.

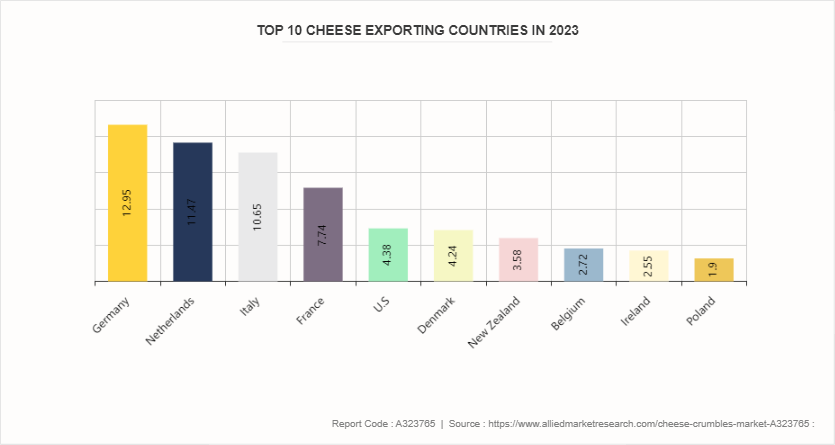

Top 10 Cheese-Exporting Countries in 2023

The worldwide cheese exports in 2023 accounted for $80.43 billion. Germany is the biggest cheese exporter with cheese exports accounting for $12.95 billion in 2023. The top 10 cheese exporters in 2023 are mentioned below in graph.

Market Segmentation

The cheese crumbles market is segmented into type, packaging, application, distribution channel, and region. On the basis of type, the market is divided into blue cheese crumbles, feta cheese crumbles, cheddar cheese crumbles, and others. As per packaging, the market is segregated into bags, tubes, trays, and others. On the basis of application, the market is classified into salad, pasta, pizza and others. According to distribution channel, the market is divided into supermarkets/hypermarkets, convenience stores, online retail, and others. Region wise, the cheese crumbles market share is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

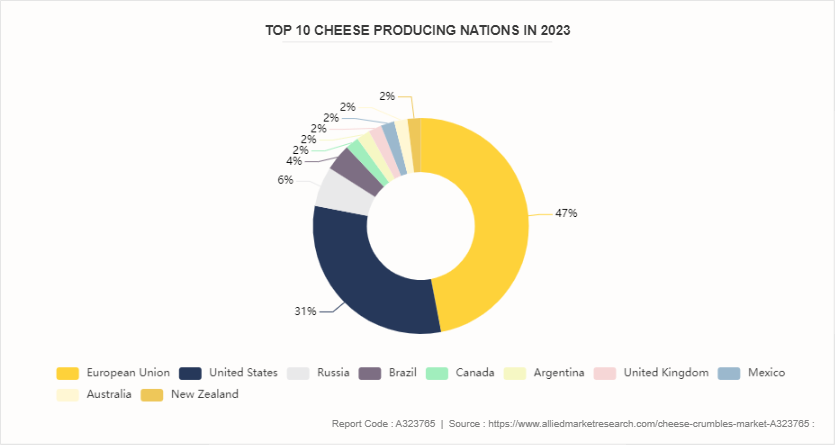

Europe remains a significant player in the global cheese crumbles market. For instance, in 2023, around 22.15 billion metric tons of cheese were produced with an increase of 0.74% from the preceding 12 months. There has been a small increase in cheese production. Approximately 50% of the cheese produced in 2023 comes from the European Union. Germany became the pinnacle producer of cheese within the EU-27, with almost 2.25 billion metric tons produced. In 2023, the United States ranked as the top producer of cheese outdoors in the EU-27. The pinnacle 10 cheese producers in 2023 consist of:

Industry Trends

Artisanal and specialty cheese markets are expanding, with the American Cheese Society reporting a 25% increase in artisan cheese production over the past 5 years. Cheese crumbles from premium and unique cheeses are in high demand.

The plant-based cheese market has been growing, with sales increasing by 18% in 2020 according to the Good Food Institute. Vegan cheese crumbles cater to the rising number of consumers adopting plant-based diets.

The global influence on cuisine is bringing international cheese varieties into mainstream markets. Imports of specialty cheeses, including those used for crumbles, increased by 7% in 2020 according to the International Dairy Foods Association.

Competitive Landscape

The major players operating in the cheese crumbles market include DeJong Cheese, Saputo Cheese, Litehouse, Kraft Heinz (Churny) , President Cheese, Arla Foods, Montchevre, Salemville, and Boar's Head.

Recent Key Strategies and Developments

In April 2023, DeJong Cheese introduced their new Goat Cheese Crumbles, designed to be versatile and easy to use in various dishes such as salads, pastas, pizzas, and even desserts. The product is available in different packaging sizes, catering to retail, foodservice, and industrial needs?.

In January 2023, Saputo introduced new products under its Montchevre brand, including a Hibiscus Berry Goat Cheese Log and two topped goat cheeses. The Hibiscus Berry Goat Cheese, with its bright, tart, and sweet flavor, is available nationwide in 4-ounce, easy-to-peel log-shaped packaging.

In March 2023, DeJong Cheese's retail products, including Goat Cheese Crumbles, gained recognition for their innovative packaging and flavors. The company continues to expand its presence in specialty cheese shops, catering wholesalers, and supermarkets under the Alphenaer brand.

Key Sources Referred

TradeImeX

Tridge

Ambassador

Dairy Foods

American Cheese Society

The Good Food Institute

International Dairy Foods Association

Body Hampers

British Dietetic Association (BDA)

America's Test Kitchen

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cheese crumbles market analysis from 2024 to 2033 to identify the prevailing cheese crumbles market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cheese crumbles market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global cheese crumbles market size.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cheese crumbles market trends, key players, market segments, application areas, and market growth strategies.

Cheese Crumbles Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 64.2 Billion |

| Growth Rate | CAGR of 2.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 200 |

| By Type |

|

| By Packaging |

|

| By Application |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | President Cheese, Salemville, The Kraft Heinz Company, Arla Foods, Litehouse, Inc., Saputo Cheese, Boar's Head Brand, Cartwright & Butler, Montchevre, DeJong Cheese |

The global cheese crumbles market size was valued at USD 49.1 billion in 2023, and is projected to reach USD 64.2 billion by 2033.

The global cheese crumbles market is projected to grow at a compound annual growth rate of 2.8% from 2024-2033 to reach USD 64.2 billion by 2033.

The key players profiled in the reports includes DeJong Cheese, Saputo Cheese, Litehouse, Kraft Heinz (Churny) , President Cheese, Arla Foods, Montchevre, Salemville, and Boar's Head.

Europe dominated in 2023 and is projected to maintain its leading position throughout the forecast period.

Increasing demand for convenience foods, rising popularity of salads and pizza toppings, and growing interest in gourmet and artisanal cheese products. There's also a trend towards healthier options, with low-fat and organic cheese crumbles gaining traction majorly contribute toward the growth of the market.

Loading Table Of Content...