Digital Therapeutics Market Research, 2031

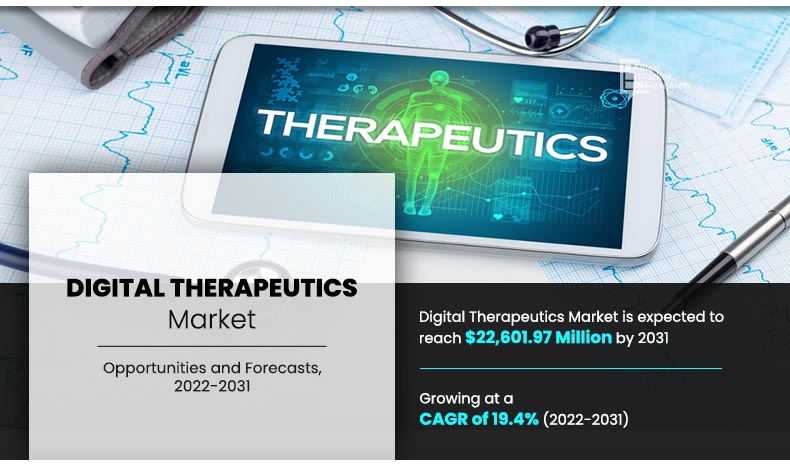

The global digital therapeutics market size was valued at $3,845.74 Million in 2021, and is projected to reach $22,601.97 Million by 2031, registering a CAGR of 19.4% from 2022 to 2031.Digital therapy provides patients with evidence-based therapeutic interventions. It is provided through software and devices to prevent manage or treat medical conditions. The digital therapy software application can be used alone or in conjunction with another device, medication, or therapy to provide patient care and health outcomes. The design, clinical validation, usability, and data security of digital therapeutics are all based on cutting-edge technology at best practices. These products are reviewed and approved by regulatory agencies prior to use. In addition, digital therapies provide patients, healthcare providers, and payers with smart, accessible tools to treat a wide range of conditions through interventions such as high quality, safe and effective evidence-based cards.

Digital therapeutics such as Pear-001, CT-152, MR-001, Bluestar and Propeller Health are some of the products offered by the topmost companies. Digital therapeutics solutions help improve medication adherence with personalized incentives to encourage long-term behavior change in patients and for people with chronic conditions like diabetes and COPD, digital therapeutics can play an important role in the treatment.

Market Dynamics

The increase in the use of smartphones and tablets, along with healthcare applications, the rise in need to control healthcare costs, significant benefits to the entire process healthcare and surge in incidence of chronic diseases fuel the growth of the global digital therapeutics market. Rise in the incidence of preventable chronic diseases, and increase in government funding on healthcare are the major factors expected to accelerate the market growth. Also emerging markets are predicted to provide significant growth opportunities for companies in the coming years. Besides this, strong potential products expected to be launched during the forecast period will also be profitable to the market players. Factors such as the cost effectiveness of digital health technologies for providers and patients, and the rise in need for integrated health systems and patient-centered care are expected to drive market growth during the forecast period.

However, lack of understanding about digital therapies in developing countries and patient data privacy issues are hindering the growth of the market. The developers or manufacturers of digital therapeutics do not guarantee the security of patient data. Consumers fear that these apps will not be able to protect the confidentiality of their health data. Fears about the privacy of patients are hindering the adoption of digital therapeutics. In addition, the fear that the data will be compromised or that the technology will expose it to unwanted personal surveillance further hinders the growth of the digital therapeutics market.

Digital therapeutics has become an important treatment option for patients with medical conditions, mainly due to personalized treatment programs and different strategies adopted by key players. The strategies adopted by the key players mainly include the acquisition, product approval, product launch, and partnership. Furthermore, the rise of chronic diseases such as heart disease, diabetes, anxiety disorders and others has prompted major players in the market to pursue digital treatments. Currently, a number of manufacturers are developing products to treat anxiety disorders, and several products are being developed at different stages of development which serves as the great opportunity for the growth of the market.

What is the Impact of COVID-19 Pandemic on the Digital Therapeutics Market?

In addition, the COVID-19 has a greater impact on the digital therapeutics market. There is a huge potential in the digital therapeutics market and investors are investing more in this industry. Investments in digital-therapeutics companies in the U.S. have increased, on an average by 40% a year over the past seven years. Furthermore, billions of dollars have been invested in digital health in the past decade and the market is growing at a very good pace. As per the Rock Health report, the U.S. digital health sector had its second-highest year of investment of $14.1 billion in 2020.

The digital therapeutics market, which is a subset of digital health, has also gained significant traction in the recent years. The COVID-19 pandemic disrupted the healthcare system all over the world and as health responses to the pandemic are strengthened, a need for a substantial shift to apps and hardware capable for lifestyle enhancement and medical intervention, with potentially life-saving functionalities has emerged.

The digital therapeutics market is expected to be positively impacted by the COVID-19 pandemic, owing to awareness regarding importance of digital health, rise in prevalence of mental illness, and increase in rate of drug abuse globally. Moreover, during this pandemic, people had to stay at home, which led to less physical activity, unhealthy lifestyle, and mental stress and, in turn, increasing the prevalence of chronic diseases. Hence, there is a rise in demand for DTx devices and software across the globe. Recent easing of regulatory approvals for DTx based treatments further drives the growth of the market. For instance, the U.S. FDA issued temporary guidance for Pear Therapeutics products for mental health amidst the COVID-19 pandemic. Furthermore, it suggests that regulatory agencies acknowledge the importance of digital therapeutics products.

Segments Overview

The digital therapeutics market is segmented into product, sales channel, application, and region. On the basis of product segment, the market is categorized into software and devices. On the basis of sales channel, the market is bifurcated into business-to-business and business-to-consumers. On the basis of applications the market is segmented into diabetes, obesity, cardiovascular disease (CVD), diseases of the actually central nervous system (CNS), respiratory conditions, quitting smoking, gastrointestinal problems, and others. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, India, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Turkey, Saudi Arabia, South Africa, and rest of LAMEA).

By Product

By product, the software segment is the largest and the fastest growing segment, which dominated the market in 2021, and is expected to continue this trend during the forecast period owing to perpetual improvements happening in device software.

By Product

Software holds a dominant position in 2021 and would continue to maintain the lead over the forecast period.

By Sales Channel

By sales channel, the business-to-consumers segment is the largest and the fastest growing segment which exhibited the highest growth in 2021, and is expected to continue this trend during the forecast period.

By Sales Channel

Business-to-Consumers segment is projected as one of the most lucrative segment.

By Region

North America accounted for a majority of the digital therapeutics market share in 2021, and is anticipated to remain dominant during the forecast period. Europe is the fastest growing market. This is attributed to increase in the usage of smartphones and digital devices, increasing chronic diseases, presence of key players, and rise healthcare expenditure in the region. However, Asia-Pacific is anticipated to witness notable growth, owing to increase in digitalization, unmet medical demands, and increase in investments in the healthcare sector in the region.

By Region

North America is expected to experience growth at the highest rate, registering a CAGR of 18.3% during the forecast period.

The key players operating in the global digital therapeutics market are 2MORROW Inc., Akili Interactive Labs Inc., Click Therapeutics Inc., Fitbit Inc. (Twine Health, Inc.), Happify Inc., Kaia Health, Livongo Health Inc., Medtronic Plc., Omada Health Inc., Pear Therapeutics Inc., Proteus Digital Health Inc., Resmed Inc. (Propeller Health), Voluntis Inc., Welldoc Inc.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the global digital therapeutics market with current trends and future estimations to elucidate the imminent investment pockets.

- Comprehensive analysis of factors that drive and restrict the market growth is provided.

- Comprehensive quantitative analysis of the industry from 2021 to 2031 is provided to enable the stakeholders to capitalize on the prevailing digital therapeutics market opportunities.

- Extensive analysis of the key segments of the industry helps understand the applications and technologies used globally.

- Key market players and their strategies are provided to understand the competitive outlook of the digital therapeutics market.

Digital Therapeutics Market Report Highlights

| Aspects | Details |

| By product |

|

| By sales channel |

|

| By Region |

|

| Key Market Players | Voluntis, Inc., Pear Therapeutics, Inc., Welldoc, Inc, Akili Interactive Labs, Inc., Fitbit, Inc. (Twine Health, Inc.), Happify, Inc., Livongo Health, Inc., Omada Health, Inc., 2MORROW, Inc., Resmed, Inc. (Propeller Health), Proteus Digital Health, Inc., Medtronic Plc., Click Therapeutics, Inc., Kaia Health |

Analyst Review

Digital Therapeutics Market

This section provides the opinions of the top level CXOs in the digital therapeutics market. According to the insights of CXOs, the field of digital therapeutics is still young and has gained significant attention over the years. The digital therapeutics market has gained the interest of healthcare providers, patients, and medical practitioners, owing to several benefits offered by these devices to reduce healthcare expenditure, improve patient & doctor communication, and manage patient health efficiently. There has been remarkable technological advancements in development of novel digital therapeutics applications to provide advanced management options for chronic disease patients and to maintain healthy lifestyles. As the market is saturated and is growing at a steady rate in developed nations, Asia-Pacific and LAMEA are expected to offer high growth opportunities to key players in this market.

According to the perspectives of CXOs of leading companies in the market, significant advancements in the applications of digital therapeutic products with increase in clinically backed researches and advanced hardware and software are projected to increase the usage rate of digital therapeutics globally. Presently, rapid adoption of digital therapeutics is witnessed around the globe for wellness management such as fitness, diet & nutrition, diabetes, obesity, respiratory disorder, and lifestyle & stress management.

North America is expected to dominate in terms of revenue, owing to rapid rise in incidences of chronic illness, high adoption rate of digital therapeutics, robust R&D infrastructure for life science researches, presence of key players, and advancements in healthcare investments. Europe was the second largest contributor to the market in 2021, due to the continuous government support for pharmaceutical and R&D, increase in public–private investments, and rise in number of research activities in the healthcare sector for improved and efficient treatment. In addition, abundance of pipeline products is anticipated to drive the market growth.

The total market value of digital therapeutics market is $3,845.74 million in 2021.

The forecast period for digital therapeutics market is 2022 to 2031

The market value of digital therapeutics market in 2022 is $4,598.35 million.

The base year is 2021 in digital therapeutics market

Top companies such as 2morrow Inc., Akili interactive labs, Inc., Click therapeutics, Inc., Fitbit, Inc., Kaia health, Livongo health, Inc., Medtronic Plc., Omada health, Pear therapeutics, Inc., Proteus digital health, Inc., Resmed, Inc, Voluntis, Inc and Welldoc, Inc. held a high market position in 2021.

Software segment dominated the global market in 2021, and expected to continue this trend throughout the forecast period due the advancements and digitalization and adoption of the smartphones and various devices.

Increase in adoption of smartphones and tablets, coupled with healthcare apps, rise in need to control healthcare costs, rise in incidences of chronic diseases and significant benefits to the entire healthcare continuum are the key growth factor for the market.

North America is projected to account for a major share of the digital therapeutics market during the forecast period. U.S. dominated the North America digital therapeutics market owing to increased advancements in the digital treatment. Europe is expected to be the fastes growing market in the froecast period.

Loading Table Of Content...