Fitness Equipment Market Summary

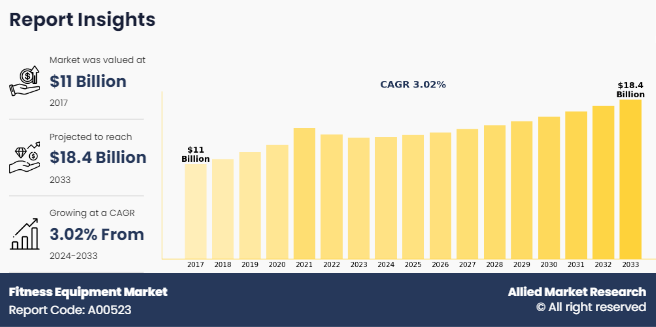

The global Fitness Equipment market size was estimated at $10.9 billion in 2017 and is projected to reach $18.3 billion by 2030, growing at a CAGR of 3.02 % from 2025 to 2030. Rising participation in sports is anticipated to increase the demand for fitness services and expand the consumer base, supporting revenue growth in the industry.

The Fitness Equipment industry in Europe held a significant share of over 30% in 2023.

The Fitness Equipment industry in India is expected to grow significantly at a CAGR of 8.8% from 2024 to 2033.

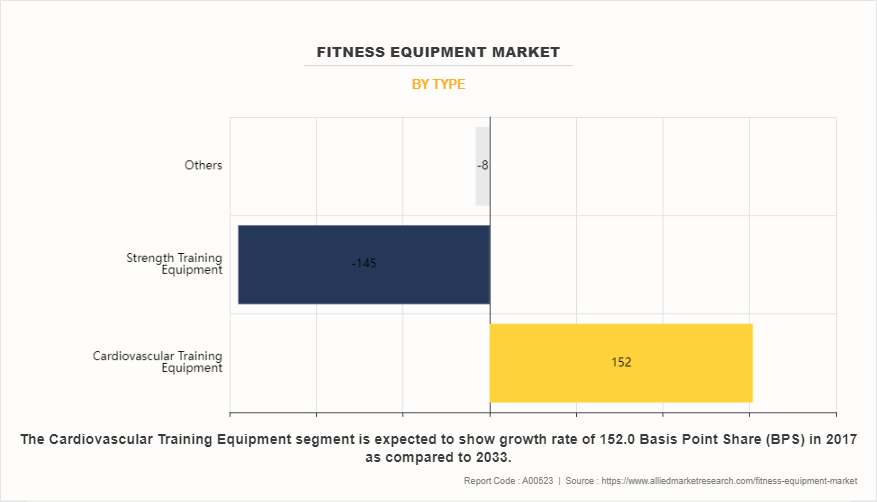

By type, the Strength Training Equipment is one of the dominating segment in the market and accounted for the revenue share of over 33.1% in 2023.

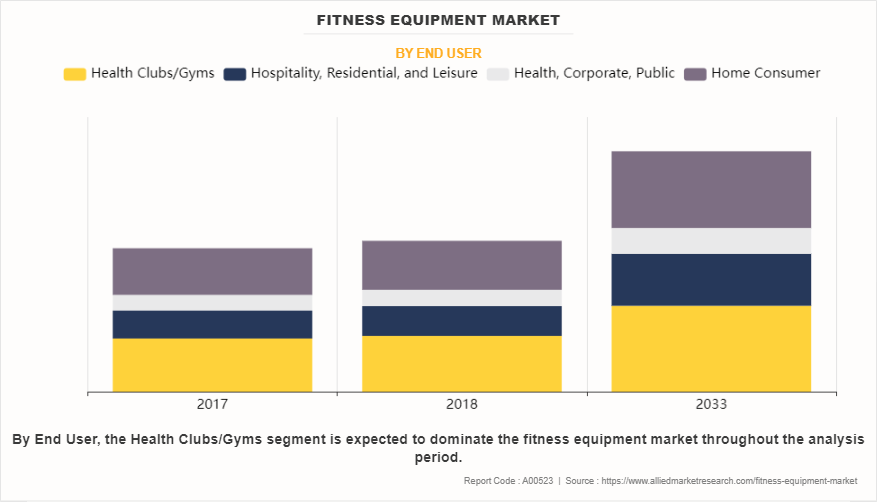

By end user, the Home Consumer segment is the second dominant segment in the market in 2023 .

Market Size & Forecast

2017 Market Size: $10.9 Billion

2033 Projected Market Size: $18.4 Billion

CAGR (2024-2033): 3.02%

North America: Largest market in 2023

Asia Pacific: Fastest growing market

Through IoT connectivity, users can conveniently access their training history across various devices and machines, facilitating easy tracking of gym sessions. This heightened connectivity encourages increased user engagement and a deeper understanding of fitness progression.

In addition, anticipated growth in sports participation over the coming years is confident to yield a dual positive effect. As individuals increasingly involve themselves in sports and recreational activity, there arises a increasing demand for fitness equipment geared towards facilitating training, conditioning, and performance enhancement.

Athletes and enthusiasts alike necessitate specialized equipment tailored to their specific sports or activities, encompassing cardio machines, strength training gear, agility tools, and recovery devices. Furthermore, this surge in sports involvement is expected to drive up the demand for fitness services and expand the potential pool of consumers, thereby contributing to industry revenue growth.

Key Takeaways

In 2023, on the basis of type, the cardiovascular training equipment segment was the highest contributor to the fitness equipment industry.

According to end user, the health club/gym segment generated the highest revenue in 2023 and is likely to grow at a substantial rate during the forecast period.

Based on price point, the health club/gym segment generated the highest revenue in 2023 and is likely to grow at a substantial rate during the forecast period.

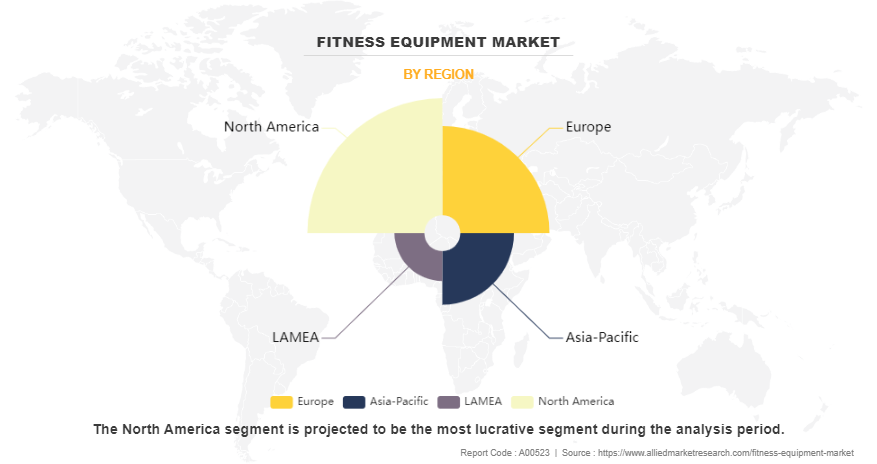

By region, North America was the major revenue contributor in 2023 and is estimated to grow at a significant CAGR during the forecast period.

Market Dynamics

Fitness equipment is widely used for physical fitness, weight management, and improving body stamina & muscular strength. The commonly used fitness equipment are treadmills, stationary bicycles, stair climbers, and weightlifting machines. Rise in awareness regarding health & fitness, increase in obese population, government initiatives to promote healthy lifestyle, and increase in youth population are the major factors that drive the growth of the global fitness equipment market.

Rise in fitness and wellness trends at the working place of employees is propelling the fitness equipment market demand across the world. A corporate wellness program is a structured initiative established by a company to promote and facilitate employee physical activity and general well-being.

By integrating physical activity into the workplace environment, these programs make it convenient for employees to participate in gym sessions, exercise classes, or other wellness activities. Highlighting the fact that approximately 90% of large U.S. companies have adopted workplace wellness programs, which underscores the growing awareness and emphasis on employee health in the corporate world.

The primary goal of corporate fitness programs is to prevent the harmful effects of sedentary work habits and cultivate a healthier, more active workforce. Typically, these programs offer access to fitness facilities, exercise classes, and wellness activities focused on health and fitness. Through these initiatives, corporate fitness programs foster a culture of well-being within the organization that leads to an increased demand for fitness equipment in workplace gyms and wellness facilities, driving growth in the commercial fitness equipment segment.

In 2020, the number of people aged 60 or older will pass the one billion marks, which is one in every seven people. By 2045, approximately one generation later, this number is expected to reach one in every five people. As this demographic shift unfolds, many industries should embrace the concept of "active aging" to meet the needs of this aging population.

Perhaps the most common goal among seniors of all backgrounds, cultures, interests, and walks of life, is to remain healthy and independent right up to the time of death. This means that senior living communities offering access to experienced trainers and wellness professionals, age-friendly fitness equipment, and an active aging culture, is naturally going to be attractive to many seniors.

Today’s seniors are also embracing technology to support their health goals. However, there is a strong social element to how they want to utilize that technology in fitness equipment. Even though new fitness trackers, online programs and mobile apps pop up every day, most of today’s seniors prefer brick and mortar wellness facilities staffed with professionals and fitness equipment designed for aging population, such as low-impact cardio machines and balance training equipment, which is experiencing increased demand as a result.

Families and parents are continuing to become more conscious of health, wellness, and fitness, especially with the growing concern over childhood obesity. Obesity prevalence was 12.7% among 2- to 5-year-olds, 20.7% among 6- to 11-year-olds, and 22.2% among 12- to 19- year-olds. Childhood obesity is also more common among certain populations.

According to The Physical Activity Guidelines for Americans, 2nd edition, children aged 6 to 17 years are recommended to perform 60 minutes or more of moderate-to-vigorous physical activity daily, but the CDC states that less than a quarter of children in that age range meet that recommendation. Thus, there will be an increase in gym memberships from consumers 17 years and younger who will invest more in fitness classes and private training sessions.

Segments Overview

The fitness equipment industry is segmented into type, end user, price point and region. Depending on type, the fitness equipment market is categorized into cardiovascular training equipment, strength training equipment, and other equipment. The cardiovascular training equipment segment is sub-segmented into treadmill, elliptical, stationary bike, rowing machine, and others. By end user, the market segregated into, health club/gym, hospitality, residential, & leisure, health, corporate, public, and home consumer.

Region-wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (UK, France, Germany, Italy, Spain, Portugal, Benelux, Ireland, Denmark, Nordics, Estonia, Austria, Switzerland, Poland, Turkey, Russia, and Rest of Europe), Asia-Pacific (Japan, Korea, China, India, Hong Kong, Indonesia, Viet Nam, Australia, Malaysia, Thailand, Philippines, Singapore, New Zealand, and Rest of Asia-Pacific), and Latin America (Brazil, Argentina, Chile, Colombia, Peru, UAE, Saudi Arabia, Qatar, Israel, South Africa, Egypt, Morocco, and Rest of LAMEA).

By Type

By type, the fitness equipment market overview is segmented into cardiovascular training equipment, strength training equipment, and other equipment. The cardiovascular training equipment segment accounts for the major fitness equipment market share and is poised to grow with the highest CAGR during the analysis period.

In addition, cardiovascular equipment dominates the market which propells the global fitness equipment market growth, owing to higher value and increase in popularity among obese population. Moreover, cardiovascular training equipment also gains adoption among geriatric population, who desire to stay physically fit while exercising in the comfort of their home.

By End User

By end user, the global fitness equipment market, is categorized into health clubs/gyms, hospitality, residential, & leisure, health, corporate, public, and home consumer. Home consumers purchase different fitness equipment for their personal use. Health clubs/gyms/fitness centers purchase fitness equipment for commercial purposes.

Fitness equipment is an essential prerequisite for their core business. The pandemic caused the closure of gyms and health clubs all over the world and negatively impacted the overall business. However, other commercial users, such as hotels, hospitals & medical centers, public institutions, and corporate offices, purchase fitness equipment to improve their business offerings.

By Price Point

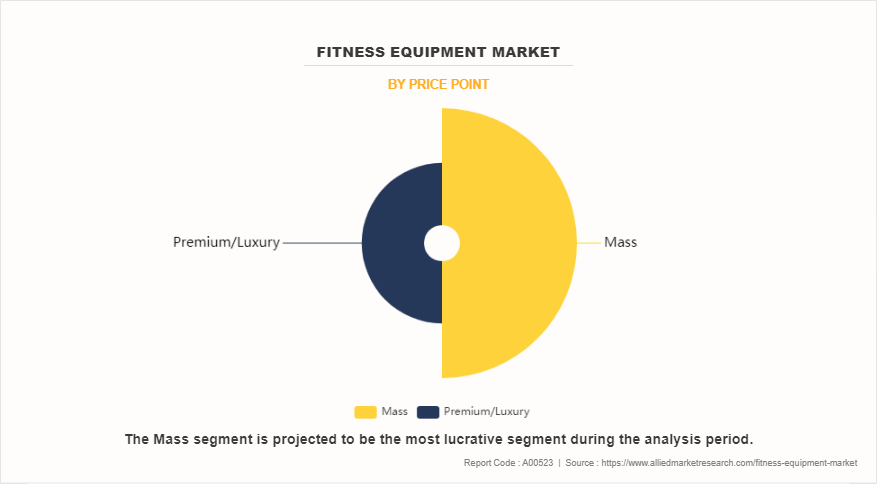

By price point, the mass segment dominated the market, owing to the higher preferences for affordable fitness equipment among most of the consumers. Moreover, the presence of huge number of small commercial gyms across the developed and developing nations has boosted the growth of this segment in the past few years.

By Region

Based on region, North America held the highest market share in term of revenue in 2023, accounting for nearly half of the global fitness equipment market. North America is the largest market for fitness equipment across the globe. A larger base of obese population in the region leads to higher adoption of fitness equipment.

Obesity has long-term negative effects on health including but not limited to heart disease, stroke, type 2 diabetes, high blood pressure, cancer, and other bone & joint diseases. The Centers for Disease Control and Prevention (CDC) reports that the prevalence of obesity among adults in the U.S. was 41.9% in 2020, highlighting the need for accessible and convenient fitness solutions.

Competitive Analysis

Some of the key players in the fitness equipment market analysis includes ICON Health & Fitness, Inc., Brunswick Corporation, Johnson Health Tech Co., Ltd., Technogym S.p.A, Amer Sports Corporation, Nautilus, Inc., Core Health and Fitness, LLC, TRUE Fitness Technology, Inc., Impulse (Qingdao) Health Tech Co., Ltd., and Torque Fitness, LLC.

The fitness equipment market is moderately fragmented with the top ten players accounting for approx. 60% of the market share. Peloton Interactive, Inc. garnered the leading position across the global fitness equipment market 2023. Brand image across the market and wide distribution network of above players have contributed toward the growth of its overall business in fitness equipment manufacturing.

Recent Developments

- In February 2022, ICON Health and Fitness, Inc.(iFIT) launched a new NordicTrack Commercial X22i Incline Trainer, treadmill; it is based on iFit technology that allows users to run with certified trainers in beautiful locales around the world on a massive built-in flatscreen display.

- In August 2022, Peloton Interactive, Inc. announced the Peloton Bike, Guide, and selected accessories and apparel are now available for purchase in Amazon's U.S. stores, with Bike delivery available to most of the U.S.

Key Benefits for Stakefolders

This report provides a quantitative analysis of the market segments, current fitness equipment market trends, estimations, and dynamics of the fitness equipment market analysis from 2017 to 2033 to identify the prevailing fitness equipment market opportunity.

Market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier–buyer network.

In-depth analysis of the screen printed glass segmentation assists to determine the prevailing market opportunities. Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

Fitness Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 18.4 billion |

| Growth Rate | CAGR of 3% |

| Forecast period | 2017 - 2033 |

| Report Pages | 2398 |

| By Type |

|

| By End User |

|

| By Price Point |

|

| By Region |

|

| Key Market Players | Peloton Interactive, Inc., Nautilus Inc., iFIT, ANTA SPORTS PRODUCTS LIMITED, Johnson Health Tech. Co., Ltd., IMPULSE HEALTH TECHNOLOGY CO., LTD., Core Health & Fitness, LLC, Torque Fitness, Inc., Technogym S.p.A., TRUE FITNESS TECHNOLOGY, INC. |

Analyst Review

To cater to the changing trends for physical activity and exercises across the globe, the fitness equipment industry is continuously developing innovative exercise products for both home use and commercial gym environments. The aim is to maximize fitness results while enhancing overall workout experience. For instance, earlier, fitness equipment had a standard user interface; however, these user interfaces are now evolving to include more sophisticated smartphone-like features. In addition, to allow users to customize and monitor individual workouts, fitness machines provide advanced entertainment functionality, such as the ability to watch live TV, listen to music, and access the internet during workout.

Major manufacturers of fitness equipment are exploring options to improve overall user satisfaction and machine equipment effectiveness (OEE) by developing a next-generation fitness machine product line that has reduced machine down time and improved user engagement. In addition, they are seeking a reliable and durable touch solution, which can withstand rigors of a typical commercial gym environment, while maintaining consistent optical clarity of the LCD and touch interface. To meet this requirement, OEMs have selected microtech system based on 3M Surface Capacitive Technology (3M SCT).

This robust touch interface can withstand the rigors of commercial environment and offers easy cleaning after use. Along with developing innovative products, OEMs have adopted acquisition, partnership, and expansion as their key growth strategies to access other geographies, extend product lines, and garner maximum market share.

Rise in fitness and wellness trends at the working place of employees is propelling the fitness equipment market demand across the world. A corporate wellness program is a structured initiative established by a company to promote and facilitate employee physical activity and general well-being.

The North America region held the highest market share in term of revenue in 2023.

ANTA SPORTS PRODUCTS LIMITED, Peloton Interactive, Inc., TRUE FITNESS TECHNOLOGY, INC., Johnson Health Tech. Co., Ltd., IMPULSE HEALTH TECHNOLOGY CO., LTD., Nautilus Inc., Torque Fitness, Inc., Technogym S.p.A., Core Health & Fitness, LLC, iFIT are the key players in the fitness equipment market.

The global fitness equipment market to grow at a CAGR of 3.02% from 2024 to 2033.

The global fitness equipment market size was valued at $11.0 billion in 2017, and is projected to reach $18.4 billion by 2033, growing at a CAGR of 3.02% from 2024 to 2033.

Loading Table Of Content...

Loading Research Methodology...