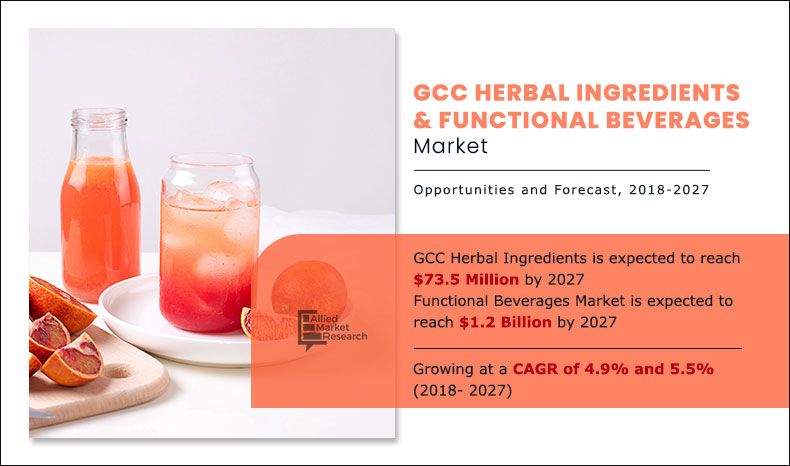

The herbal ingredients market was valued at $46.4 million in 2017 and is projected to reach $73.5 million by 2027, registering a CAGR of 4.9% from 2018 to 2027. The functional beverages market revenue was valued at $750.2 million in 2017, and is projected to reach $1,260.1 million by 2027, registering a CAGR of 5.5% from 2018 to 2027.

Herbal ingredients are plant-based ingredients that are used for their medicinal or therapeutic properties. Herbal ingredients can be used in a variety of forms, including as whole herbs, extracts, powders, teas, or capsules, and are commonly used in traditional and alternative medicine practices.

Herbal ingredients have been used for thousands of years in traditional medicine practices around the world, and many modern pharmaceuticals are derived from plant-based compounds. Herbal ingredients are often used to treat a wide range of conditions, including pain, inflammation, anxiety, depression, insomnia, and digestive issues.

Herbal substances can be consumed orally in the form of teas, tinctures, or capsules, or administered topically in the form of creams or oils. While many herbal substances are thought to be harmless, some may mix with pharmaceuticals or have negative effects on some people, so it's advisable to speak with a healthcare provider before taking them.

Beyond their fundamental nutritional composition, functional beverages contain additional substances that have unique health benefits. Vitamins, minerals, antioxidants, probiotics, prebiotics, botanicals, and other bioactive substances are examples of these ingredients.

Since customers have become more health-conscious and interested in goods that offer extra advantages beyond simple hydration, functional beverages have grown in popularity in recent years. It's crucial to remember that not all functional beverages are created equal and that some may contain high concentrations of sugar, caffeine, or other substances that, if consumed in excess, could have harmful effects on one's health. Like with any food or beverage product, it's crucial to read the label and pick items that support your dietary needs and health objectives.

In order to more aggressively achieve their own particular nutritional and personal health goals, customers are looking for personalized food, beverage, and dietary solutions, according to the Institute of Food Technologists. Currently, items for general health and wellbeing are enough to maintain total fitness.

Similar to South Korea and the UAE, residents of other developing nations are now aware of the health advantages of consuming functional beverages, which has increased demand for dairy-based beverages, probiotic drinks, energy drinks, and sports drinks. Also, people are consuming more dairy-based foods and beverages per person. Hence, it is anticipated that developing countries will drive market expansion. These factors suggest the increase in demand for functional beverages in developing nations which encourages the growth of the market.

Customers are actively interested in their health and fitness. Consumers who are active and concerned about their health now prefer natural energy drinks over those that contain caffeine and sugar. Functional beverages are made comprised of specialised nutrients and additives that improve metabolism and athletic performance. For the successful enhancement of athletic performance, conditioning, recovery from exercise-related weariness, and quick injury recovery, proper nutrition is a must. Moreover, it aids in the control of diabetes. Because of their nutritional qualities, functional beverages like natural sports drinks are becoming increasingly popular.

One of the main reasons why herbal components and functional beverages are becoming more and more popular in developing nations is changes in consumer lifestyle. A rise in per capita income in GCC nations has caused consumers' food and beverage preferences to change. The desire and aspiration for a wealthy lifestyle have grown, which has greatly increased the market's size and overall demand. Furthermore, the Middle East's per capita income has grown significantly over the past ten years, which is predicted to quickly raise consumer demand for foods and beverages with high nutritional value and support market expansion.

As a result, more people are developing chronic illnesses like obesity, high blood pressure, diabetes, and cardiovascular conditions. This has raised consumer awareness of health issues throughout the world.

Customers are now focusing on products that can aid in the prevention and treatment of such illnesses as well as provide their bodies with the proper combination of nourishment. Because of this, the demand for herbal nutraceuticals increases, which in turn spurs market expansion.

It has been observed that customers are becoming more inclined to favour alternatives such carbonated soft drinks, unprocessed milk, and all-natural & unprocessed fruits & vegetable juice. This is explained by the fact that these alternatives have less demand because they contain less functional beverages and more proteins, fibre, minerals, vitamins, and carbohydrates. These alternatives are pure, naturally occurring, and easily accessible for less money than functional beverages, which is also anticipated to restrain the market's expansion over the forecast period.

Due to the greater production costs from the need for more labour, organic herbal substances are more expensive than conventional herbal components. Due to the low scale of organic herbal product production, the marketing and supply chain for these items are also highly inefficient and expensive. This in turn is predicted to limit the volume sales growth of the market for herbal components during the anticipated timeframe.

Because the market for functional beverages is niche, there are opportunities for small- and mid-sized businesses to invest. Stakeholders intend to invest and expand their businesses by developing new items because the diversified companies who rule the food and beverage industry have a limited presence.

Hence, small and medium-sized businesses (SMEs) can benefit from premium nutraceuticals and other food and beverage supplements. Additionally, a number of businesses focus only on the manufacturing and marketing of functional beverage products. Also, developing nations like India and China are placing a lot of emphasis on made-in-country initiatives, which promote the expansion of small and mid-sized beverage processing facilities and the market for functional beverages.

A novel idea for addressing food and beverage shortages is a functional beverage, which needs the retail industry for its widespread distribution. While these stores serve to enhance the sales of functional beverage products, the rapidly growing number of major retail outlets, including supermarkets and hypermarkets, in developing nations has made it simpler to access functional beverages. The best distribution points for a variety of functional beverage items have been supermarkets and upscale bakeries. Furthermore, it is anticipated that increased urbanization would foster the expansion of the retail industry, which in turn will increase demand for functional beverages. Also, modifications in consuming and drinking habits have accelerated the retail industry's expansion, which has a substantial positive impact on the market's expansion.

E-commerce, also known as online retailers, is a sizable industry that is expanding rapidly all over the world. Customers of all ages, including members of generation X, millennials, and generation Z, favor shopping at various e-stores. When compared to actual stores, internet retailers are more handy because customers can simply locate anything there without having to be there in person.

Furthermore, it is anticipated that increased digitalization and a rise in the proportion of people who choose to purchase online would create fantastic chances for goods containing herbal substances. This fact is therefore expected to fuel the market for items created using botanical ingredients in the future.

The herbal ingredients and functional beverages market is segmented into herbal ingredients and functional beverages. On the basis of functional beverages, the market is categorized into energy drinks, sports drinks, dairy-based beverages, juices, and others. As per herbal ingredients, it is fragmented into ginger, garlic, rosemary, thyme, ashwagandha, aloe vera, green tea, and others. Country wise, it is analyzed across UAE, Saudi Arabia, Qatar, and rest of GCC.

The players operating in the herbal ingredients industry have adopted various developmental strategies to expand their market share, increase profitability, and remain competitive in the market. The key players profiled in this report are Herbalife Nutrition Ltd., Red Bull GmbH, Monster Beverage Corporation, NOW Health Group, Inc., Himalaya Wellness Company, PepsiCo, Inc., Al Rabie Saudi Foods Co. Ltd., Garden of Life LLC, Almarai Company, and Vitabiotics Ltd.

By Herbal Ingredients

The ginger segment dominates the global market and is expected to retain its dominance throughout the forecast period.

On the basis of herbal ingredients, the ginger segment dominated the GCC market in the year 2017 and is likely to remain dominant during the forecast period. Ginger is helpful in treating various health issues including headaches, sore throat, menstrual pain, fever, muscle pain, and soreness. It also supports cardiovascular system by maintaining healthy leukotriene and thromboxane production. Thus, these health benefits offered by ginger has made it popular among consumers. Therefore, various manufacturers have introduced nutraceuticals made from ginger in the market. These nutraceuticals are available in different forms including capsules, tablets, powder, and liquid. This, in turn, drives growth of the ginger herbal nutraceutical market.

On the basis of functional beverages, the energy drinks segment dominated the GCC market in the year 2017 and is likely to remain dominant during the forecast period. The demand for energy drinks and related products has escalated at a very high rate. This is attributed to benefits that these drinks offer such as increased performance, attention, weight loss, and stamina. Furthermore, consumers, especially male, positively associate risk-taking activities and masculinity with frequency of energy drinks consumption. Moreover, energy drinks contain more caffeine than a cup of coffee and can support attentiveness and alertness. Manufacturers launch various products with different flavors & taste, owing to surge in demand for products that offer instant energy. This, in turn, is anticipated to boost the growth of the functional beverages market through energy drinks segment.

By Functional Beverages

The Energy Drinks segment dominates the global market and is expected to retain its dominance throughout the forecast period.

On the basis of country, Saudi Arabia dominated the GCC market and is likely to remain dominant during the forecast period. Herbal medicine is widely used in Saudi Arabia. For instance, a survey of the literature revealed that between 22.3% and 82.3% of pregnant women in the Middle East take herbal medication. AlGhamdi et al study included 612 participants, of whom 48.9%, 33.7%, and 25.3% said they had used herbal medicine after giving birth, during labor, and while they were pregnant. To clean the womb, hasten and ease labor, and improve overall health were the main reasons for utilizing the medications after birth, during labor, and during pregnancy, respectively. Thus, the nation's demand for herbal substances has increased.

By Countries

The Saudi Arabia dominates the global market and is expected to retain its dominance throughout the forecast period.

Key benefits for stakeholders

- This report presents a quantitative analysis of the current trends, estimations, and dynamics of the market from 2017 to 2027 to identify the prevailing market opportunities.

- The key countries are mapped based on their market share.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier–buyer network.

- In-depth analysis of the market segmentation assists in determining the prevailing market opportunities.

- Major countries are mapped according to their revenue contribution to the industry. Market player positioning segment facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of key players, market segments, and growth strategies.

GCC Herbal Ingredients and Functional Beverages Market Report Highlights

| Aspects | Details |

| By Herbal Ingredients |

|

| By Functional Beverages |

|

| By Country |

|

Analyst Review

According to the insights of the CXOs, functional beverages are gaining high traction in the developing countries such as India and China. This is attributed to the fact that functional beverages contain raw fruits, minerals, herbs, probiotics, and some artificial ingredients, which fortify the nutritional value of beverages. Rise in participation of people in sports-related activities; increase in enrolment for fitness centers & health clubs; and surge in popularity of adventurous tours such as motor biking, trekking, and mountain climbing are likely to encourage people to consume instant energy food and beverages, therefore, it is expected to increase the demand for functional beverages.

Existing challenges such as availability of close substitutes and lack of awareness regarding functional beverages benefits are expected to hamper the growth of the functional beverages market during the forecast period. Furthermore, lack of proper distribution channel in rural & remote areas and increase in inclination of people for fresh, natural, organic, and additives-free beverages are the key challenges faced by functional beverages processing companies.

According to the key market players, changes in lifestyle and rise in health concerns of consumers across the globe boosts growth of the herbal ingredients market. These players are focused on investing in R&D activities to launch improved products for consumers and maintain their position in the market.

According to some key herbal nutraceutical companies, the rise in the trend to improve immunity among people is expected to fuel demand for herbal nutraceuticals across the globe. Thus, this factor is anticipated to offer lucrative opportunities for the growth of the herbal ingredients market.

Moreover, key manufacturers are providing herbal ingredients in different formats including liquid, capsules, soft gels, and powders to make consumption easy and convenient for consumers. However, the high cost associated with these products hampers market growth.

The herbal ingredients market was valued at $46.4 million in 2017 and is projected to reach $73.5 million by 2027

The global GCC Herbal Ingredients and Functional Beverages market is projected to grow at a compound annual growth rate of 4.9% from 2018 to 2027 $73.5 million by 2027

The key players profiled in this report are Herbalife Nutrition Ltd., Red Bull GmbH, Monster Beverage Corporation, NOW Health Group, Inc., Himalaya Wellness Company, PepsiCo, Inc., Al Rabie Saudi Foods Co. Ltd., Garden of Life LLC, Almarai Company, and Vitabiotics Ltd.

On the basis of country, Saudi Arabia dominated the GCC market and is likely to remain dominant during the forecast period

Loading Table Of Content...