Home Insurance Market Overview

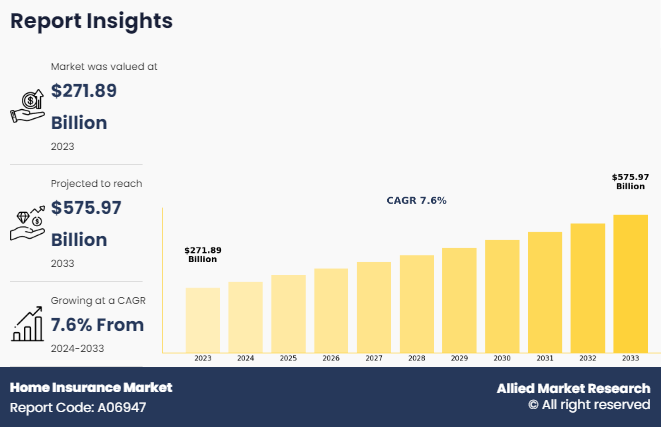

The global home insurance market size was valued at $271.9 billion in 2023, and is projected to reach $576 billion by 2033, growing at a CAGR of 7.6% from 2024 to 2033. Rising climate-related disasters, increasing property values, urbanization, regulatory changes, technological advancements, consumer awareness, digital platforms, and the need for financial risk protection contribute to the growth of the market.

Market Dynamics & Insights

- The home insurance industry in North America held the major share of 42.43% in 2023.

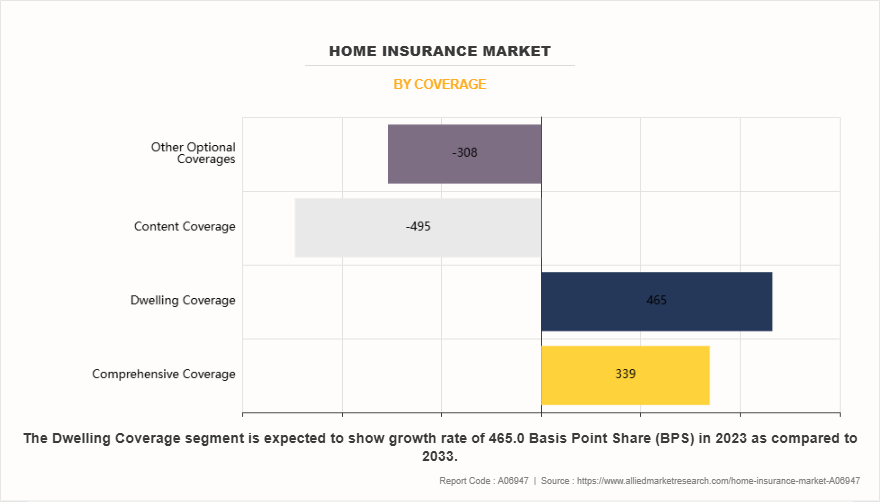

- By coverage, the comprehensive coverage segment held the major share of 38.49% in 2023.

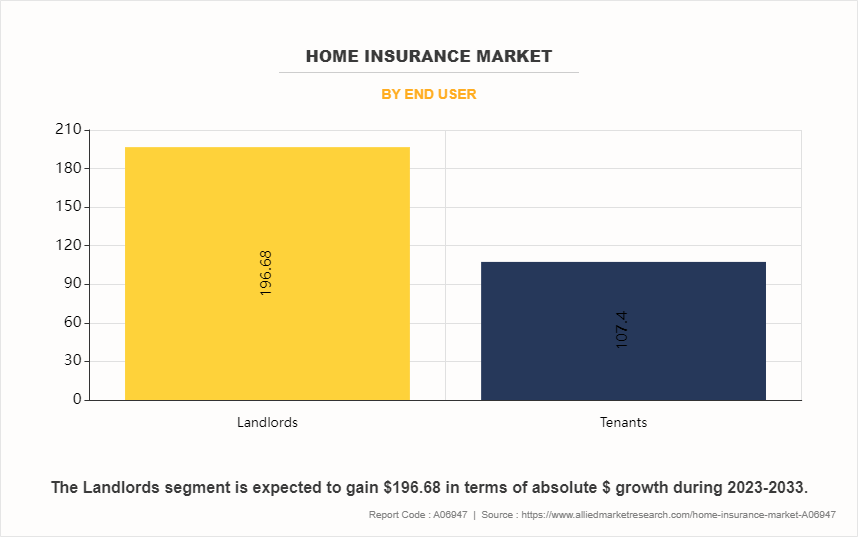

- By end user, the landlords segment held the major share of 76.47% in 2023.

Market Size & Future Outlook

- 2023 Market Size: $271.9 Billion

- 2033 Market Size: $576 Billion

- CAGR (2024-2033): 7.6%

- North America: Dominated market share in 2023

- Asia-Pacific: Highest CAGR during the forecast period

What is Meant by Home Insurance

Home insurance provides coverage to homeowners against potential risks to their property, including damage from natural disasters, theft, fire, and other hazards. It is a critical financial product for individuals to protect their homes, belongings, and liabilities against unexpected events such as theft, natural disasters, accidents, or lawsuits, ensuring financial security. The home insurance market is supported by rise in frequency of natural disasters, which has heightened the awareness of potential risks and the necessity of insurance to mitigate losses from events such as floods, hurricanes, and wildfires.

Home insurance is divided into two main types such as basic policies, which cover common risks like fire, theft, and some weather damage and comprehensive policies, which offer extra protection for things like flooding, earthquakes, or more valuable personal items. As the home insurance market evolves, factors such as climate change, increasing property values, and advancements in smart home technology are shaping its growth, influencing premium rates, and driving demand for more customized and technology-enhanced coverage options.

The home insurance market is growing due to several key factors, such as rise in property values, which leads to higher insurance premiums as homes become more expensive to rebuild or repair. Rise in extreme weather events driven by climate change has made homeowners more aware of the need for comprehensive coverage, especially for natural disasters. The report focuses on growth prospects, restraints, and trends of the home insurance market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the home insurance market.

Key Findings

- By coverage, the comprehensive coverage segment accounted for the largest home insurance market share in 2023.

- By end user, the landlords segment accounted for the largest home insurance market share in 2023.

- Region-wise, North America generated the highest revenue in 2023.

Home Insurance Market Segment Review

The home insurance market is segmented on the basis of coverage, end user, and region. By coverage, the market is segmented into comprehensive coverage, dwelling coverage, content coverage, and other optional coverages. By end user, the market is segmented into landlords and tenants. Region-wise, it is analysed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of coverage, the comprehensive coverage segment dominated the home insurance market in 2023, indicating a strong preference among homeowners for more robust and all-encompassing protection against various risks. Comprehensive coverage typically includes protection for the structure of the home, personal belongings, and liability for accidents that may occur on the property. This type of policy often covers a broader range of perils, such as fire, theft, vandalism, natural disasters, and additional living expenses in the event the home becomes uninhabitable due to damage.

By region, North America dominated the market share in 2023 for the home insurance market. The U.S. witnessed significant rise in demand for home insurance due to a significant rise in home values. and a growing emphasis on protecting assets from climate-related risks, such as wildfires and hurricanes. The region’s well-established mortgage market also contributed to the dominance, as regulatory requirements mandate home insurance for borrowers. In addition, adoption of smart home technologies in North America has increased, allowing insurers to offer customized policies with technology-based incentives, further fueling the home insurance market growth.

Competition Analysis

Competitive analysis and profiles of the major players in the home insurance market include ALLIANZ, Zurich, ADMIRAL, Allstate Insurance Company, Liberty Mutual Insurance Company, Chubb, AXA, PICC, State Farm Mutual Automobile Insurance Company, and American International Group, Inc. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships, which help to drive the growth of the home insurance market globally.

What are the Recent Developments in Home Insurance Industry

- In October 2024, the UK bank, Virgin Money partnered with insurtech company, Uinsure to offer home and landlord insurance products. The coverage is designed to meet the specific needs of homeowners and landlords, providing up to $1 million in building cover and $75,000 million in contents cover as standard.

- In July 2024, Karnataka Bank partnered with ICICI Lombard General Insurance Company, providing customers with a wide range of comprehensive insurance products and services. These offerings include health insurance, motor insurance, travel insurance, home insurance, and more. The partnership aims to cater to the diverse insurance needs of individuals and businesses.

What are the Top Impacting Factors in Home Insurance Market

Rise in Property Values

Rise in property values has become one of the most significant factors driving growth in the home insurance market. As real estate prices surge globally, particularly in urban areas and growing economies, the cost of replacing or repairing homes increases as well. This trend compels homeowners to seek higher insurance coverage to adequately protect their properties. For example, homes that were once valued at a certain level may now require more expensive materials or labour to rebuild, making it crucial for insurance policies to consider these rising costs. As a result, homeowners are opting for more comprehensive dwelling coverage to ensure that, in the event of a loss or damage, their policy cover the full cost of repairs or rebuilding.

Regulatory Requirements

Regulatory requirements play a crucial role in driving the home insurance market growth, particularly in developed economies. In many regions, home insurance is legally required for individuals who are financing their homes through mortgages. Mortgage lenders often mandate that borrowers maintain adequate insurance coverage as a condition for approving loans. This is to safeguard the lender's financial interest in the property, ensuring that, in the event of damage or destruction, the home can be repaired or rebuilt, thus protecting the property that is supported by the mortgage.

Technological Advancements

Technological advancements, particularly rise of smart home technologies, are transforming the home insurance market by reducing risks and offering innovative solutions for both homeowners and insurers. Smart devices such as security systems, motion detectors, water leak sensors, fire alarms, and temperature monitors provide real-time monitoring and alerts, allowing homeowners to prevent or mitigate damage before it escalates. For example, a smart water leak detector can alert homeowners to a potential plumbing issue early on, helping to prevent significant water damage and costly repairs that would follow.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the home insurance market forecast from 2024 to 2033 to identify the prevailing market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities of home insurance market outlook.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the home insurance industry segmentation assists in determining the prevailing home insurance market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as home insurance market trends, key players, market segments, application areas, and market growth strategies.

Home Insurance Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2033 |

| Report Pages | 350 |

| By Coverage |

|

| By End User |

|

| By Region |

|

| Key Market Players | AXA, Chubb, Zurich, Allstate Insurance Company, Liberty Mutual Insurance Company, PICC, Allianz, Admiral, American International Group, Inc., State Farm Mutual Automobile Insurance Company |

Analyst Review

As the home insurances market continues to evolve, CXOs are evaluating the opportunities and challenges regarding this emerging technology. Enterprises recognize the importance of current advances in the finance sector, and the home insurances market growth is expected to be impacted by these advances in networking solutions and wireless communication protocols.

Businesses are considering the benefits that home insurances solutions can offer, including the capability to provide an effective means to process the data, preserve legal compliance, and decrease the potential of data breaches and unauthorized access. In addition, implementing effective home insurances solutions help insurance sector to maintain the privacy and authenticity of data, safeguarding their enterprise reputation and avoiding potential legal consequences. Such factors are expected to provide lucrative opportunities for market growth during the forecast period.

Furthermore, the integration of Internet of Things (IoT) and industry 4.0 principles into finance sector is driving the demand for the global market. However, businesses also recognize the challenges associated with home insurances solutions. In addition, home insurances solutions require significant investment in security infrastructure and technological expenses, which can be a major restraint for the global market.

Furthermore, rise in concerns regarding interoperability issues is expected to limit the global market growth. There could be incompatibilities between the regulatory standards and protocols used by various communication solutions, which further hinders the growth of the global home insurances market. Businesses must integrate software or applications by specific standards and protocols. By addressing these challenges, businesses can unlock the full potential of Home insurances solutions to transform their charging operations, create value, and gain a competitive advantage in their industry. For instance, in October 2024, HDFC Bank launched a range of life insurance products on its platform, Tata Neu, in collaboration with Tata AIA Life Insurance. To enhance the customer experience, the insurance buying process has been streamlined to just three clicks.

The home insurance market is experiencing several notable trends as it adapts to shifting consumer needs and technological advancements.

Comprehensive coverage is the leading coverage of the Home Insurance Market.

North America is the largest regional market for Home Insurance.

$576 billion is the estimated industry size of Home Insurance in 2033.

ALLIANZ, Zurich, ADMIRAL, Allstate Insurance Company, Liberty Mutual Insurance Company, Chubb, AXA, PICC, State Farm Mutual Automobile Insurance Company, and American International Group, Inc. are the top companies to hold the market share in Home Insurance.

Loading Table Of Content...

Loading Research Methodology...