North America Gasoline Direct Injection (GDI) System Market Statistics 2031 -

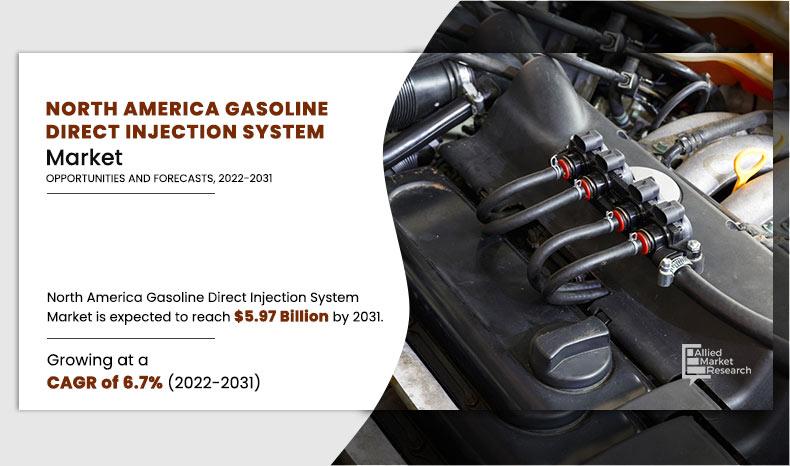

The North America gasoline direct injection (GDI) system market was valued at USD 3.15 billion in 2021 and is projected to reach USD 5.97 billion in 2031, registering a CAGR of 6.7%.

Gasoline direct injection is also referred as petrol direct injection or spark ignited direct injection or direct petrol injection or fuel stratified injection. A GDI system injects fuel directly into the combustion chamber, leading to greater fuel efficiency. The fuel injectors in a GDI engine are situated in the cylinder head to spray the fuel directly into the cylinder, where the air and fuel mixing then occurs. In a GDI engine, fuel is injected at higher pressures to obtain smaller droplets of fuel. Injection pressures are usually in excess of 100 bar as compared to a port fuel injection pressure of 3 to 5 bar.

The growth of North America gasoline direct injection (GDI) system market is propelling due to rise in demand for fuel efficiency, thermal efficiency & greater engine performance, introduction of stringent regulations associated with emissions, and growth in inclination toward engine downsizing & reduced weight of vehicles. However, high cost of GDI engines, and electrification of vehicles are factors restraining the growth of the market. Furthermore, incorporation of GDI systems in hybrid vehicles, and technological advancements are expected to offer growth opportunities during the forecast period.

The North America GDI system market is segmented on the basis of component, engine type, vehicle type, sales channel, and country. Based on component, it is segmented into fuel injectors & rails, fuel pumps, electronic control units, and others. Based on engine type, it is classified into 4 cylinder, 6 cylinder, 8 cylinder, and others. Based on vehicle type, it is bifurcated into passenger cars and commercial vehicles. Based on sales channel, it is fragmented into original equipment manufacturer and aftermarket. By country, the report is analyzed across the U.S., Canada, and Mexico.

Some leading companies profiled in the report comprises BorgWarner Inc., Continental AG, Denso Corporation, Hitachi Ltd., Hyundai Motor Company, Marelli Holdings Co., Ltd., Mitsubishi Electric Corporation, Park-Ohio Holdings Corporation, Robert Bosch GmbH, and Stanadyne LLC.

By Component

Electronic Control Units is projected as the most lucrative segment

Rise in demand for fuel efficiency, thermal efficiency, and greater engine performance

Several regulations have been introduced in North America that require automobile manufacturers to reduce harmful emissions produced by the automobiles as well as to increase the fuel efficiency and engine performance of the vehicles. Automobile manufacturers are adopting GDI technology to reduce emissions from the vehicles. GDI is a key technology in the latest generation of gasoline vehicles that aids in delivering improved engine performance.

In addition, some manufacturers are developing and introducing new vehicles with GDI system based engines to fulfill the demand for enhanced fuel efficiency and reduced emissions. For instance, in August 2020, Kia announced that the upgraded model of Kia Stinger will have a powerful new Smartstream 2.5-liter turbocharged gasoline engine for the North America region.

Henceforth, rise in demand for fuel efficiency, thermal efficiency, and greater engine performance is encouraging vehicle manufacturers in the U.S. to integrate GDI technology in their fleets.

Introduction of stringent regulations associated with emissions

Numerous countries across the globe are introducing stringent regulation in terms of vehicular emissions to defend against increasing level of CO2 emissions. In North America, the U.S. has issued new greenhouse gas emission standards to control the increasing level of CO2 emissions. For instance, in December 2021, the Environmental Protection Agency (EPA) issued new greenhouse gas emission standards for new passenger cars and light-duty trucks with model years 2023-2026. The regulation requires automakers to reach industry-wide target of 161 carbon dioxide grams per mile (g/mi) in 2026, which increases in stringency by 9.8% from model years 2022 to 2023, 5.1% in model year 2024, 6.6% in model year 2025 and 10.3% in model year 2026.

By Engine Type

4 cylinder is projected as the most lucrative segment

Manufacturers producing passenger cars, light-duty trucks, and medium-duty passenger vehicles for sale in the U.S. are required to meet greenhouse gas (GHG) emissions and fuel economy standards. The Environmental Protection Agency regulates GHG emissions through the light-duty GHG program, and the National Highway Traffic Safety Administration (NHTSA) regulates fuel economy through the Corporate Average Fuel Economy (CAFE) program. EPA’s GHG program defines standards for each manufacturer’s car and truck fleets based on the average footprint of the vehicles produced for sale. Each manufacturer fleet generates credits if the fleet average emissions performance is below the standards, or deficits if it is above the standards.

Moreover, automotive manufacturers are utilizing gasoline direct injection technology to reduce emissions and comply with the emission standards. For instance, in April 2019, Hyundai unveiled its all-new 2020 Sonata at the New York International Auto show, marking the North American debut of Hyundai’s longest-standing and most successful model. The 2020 Sonata is expected to offer two Smartstream gasoline powertrains: a 2.5 GDI and a 1.6 T-GDI engine, both with an eight-speed automatic transmission. Thus, introduction of stringent regulations associated with emissions is driving the growth of the market.

By Vehicle Type

Commercial Vehicles is projected as the most lucrative segment

Growth in inclination toward engine downsizing and reduced weight of vehicles

Engine downsizing aids in reducing the emission and fuel consumption of internal combustion engine. It assists in reducing engine displacement volume while keeping the needed output characteristic unchanged. By downsizing the engine, a larger displacement engine is replaced with a smaller one and fewer cylinders, so the volume brushed away by the pistons is significantly reduced, which in turn decreases the friction and thermal losses.

Moreover, several OEMs are introducing small displacement engines instead of larger ones to enhance fuel efficiency and performance of the vehicle. Some automotive companies have also developed engine systems coupled turbocharging and cylinder deactivation technologies to deliver improved fuel economy and reduced emissions. For instance, General Motor HFV6 with Active Fuel Management (AFM) and Chrysler’s Pentaster with Multi Displacement System (MDS) offer cylinder deactivation for enhanced efficiency. Thus, growing inclination toward engine downsizing, and reduced weight of vehicles are driving the growth of the market.

By Sales Channel

Original Equipment Manufacturer is projected as the most lucrative segment

COVID-19 Impact Analysis

The COVID-19 crisis has created uncertainty in the market, massive slowing of supply chain, falling business confidence, and increasing panic among the customer segments. Governments in the region have already announced total lockdown and temporary shutdown of industries, thereby adversely affecting the overall production and sales.

The impact of the COVID-19 pandemic has resulted in supply-chain disruptions causing low sales of passenger cars, shortage of semiconductor components, and temporary suspension of production of vehicles across North America, which in turn resulted in decrease in demand for gasoline direct injection system. For instance, North America recorded a drop of 27% in the sales of passenger cars in 2020 as compared to 2019. Truck and SUV sales were also down by 9.6% in 2020 as compared to 2019.

However, with the easing of lockdown restrictions, rise in the sale of automobiles has been observed in North America. For instance, in 2021, the U.S. automobile sales recorded a growth of 3.4% in 2021 as compared to 2020. This increase in the sale of automobiles is expected to drive the growth of the market during the forecast period.

By Country

Mexico would exhibit the highest CAGR of 8.5% during 2022-2031.

KEY BENEFITS FOR STAKEHOLDERS

- This study presents the analytical depiction of the North America gasoline direct injection system market analysis along with the current trends and future estimations to depict imminent investment pockets.

- The overall North America gasoline direct injection (GDI) system market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the North America gasoline direct injection system market with a detailed impact analysis.

- The current gasoline direct injection system market is quantitatively analyzed from 2022 to 2031 to benchmark financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

North America Gasoline Direct Injection (GDI) System Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Engine Type |

|

| By Vehicle Type |

|

| By Sales Channel |

|

| By Country |

|

| Key Market Players | Hitachi Ltd., Mitsubishi Electric Corporation, Continental AG, Stanadyne LLC, Denso Corporation, Marelli Holdings Co., Ltd., BorgWarner Inc., Robert Bosch GmbH, Hyundai Motor Company, Park-Ohio Holdings Corporation |

Analyst Review

Growth of the North America gasoline direct injection system market is propelled by factors such as introduction of stringent regulations regarding vehicular emissions and enhanced fuel economy. There has been increasing focus on development of new vehicles with new and improved engine features to meet current emission standards. Automotive manufacturers such as Kia and Hyundai have already launched vehicles with improved GDI engines in North America.

Several developments have been carried out by key players operating in the North America gasoline direct injection system industry. For instance, in August 2020, Kia announced that the upgraded model of Kia Stinger will have a powerful new Smartstream 2.5-liter turbocharged gasoline engine for the North America region. Moreover, in April 2019, Hyundai unveiled its all-new 2020 Sonata at the New York International Auto show, marking the North American debut of Hyundai’s longest-standing and most successful model. The 2020 Sonata is expected to offer two Smartstream gasoline powertrains: a 2.5 GDI and a 1.6 T-GDI engine, both with an eight-speed automatic transmission.

The increase in demand for GDI systems from Canada and Mexico coupled with rise in involvement of governments and environmental organizations in the market is expected to supplement the market growth. Collaborations and acquisitions are expected to enable the leading players to enhance their product portfolios and expand into different countries. Major revenue for GDI systems in North America is generated from the U.S., followed by Mexico.

The North America gasoline direct injection (GDI) system market was valued at USD 3.15 billion in 2021 and is projected to reach USD 5.97 billion in 2031,

The global North America gasoline direct injection (GDI) system market is projected to grow at a compound annual growth rate of 6.7%. from 2022-2031.

North America is the highest revenue contributor.

The key players that operate in the North America gasoline direct injection (GDI) system market such as BorgWarner Inc., Marelli Holdings Co., Ltd., Denso Corporation, Park-Ohio Holdings Corporation, Stanadyne LLC, Mitsubishi Electric Corporation, Continental AG, Hyundai Motor Company, Hitachi Ltd., Robert Bosch GmbH

Growth of the North America gasoline direct injection system market is propelled by factors such as introduction of stringent regulations regarding vehicular emissions and enhanced fuel economy. There has been increasing focus on development of new vehicles with new and improved engine features to meet current emission standards.

Loading Table Of Content...